80 days is a long time.

Long enough to form a new habit.

Long enough to break an old one.

Long enough to determine whether a business idea has legs.

Long enough to settle into a new job. To stop feeling like a martian.

Long enough to assess if a long-dormant flame can be rekindled. Or has gone out.

150 years ago, Jules Verne’s fictional character Phileas Fogg sought to circumnavigate the globe within that time frame, hoping to win a wager worth more than £2.2 million in today’s money. An ambitious goal in those days before aeroplanes.

Long ago I foolishly signed up for my first half marathon. Roughly 80 days passed from couch to possessing the stamina required to run the distance. “Comfortably” run would have been a gross overstatement!

A couple of years ago I gave up drinking. 74 days elapsed before the pavlovian “beer o’clock” instinct dissipated. To be able to walk past a pub without experiencing a sense of longing.

Today marks the 80th day of my coronavirus pandemic lockdown. During that time I haven’t travelled around the world. Invented perpetual motion. Performed alchemy. Nor written a novel.

Instead, like many folks, I have been muddling through full-time remote working while concurrently attempting to homeschool my kids. Time management with the difficulty level set to “extreme”.

At the start of those 80 days, I decided to maintain a daily journal of my thoughts and feelings as I experienced this most interesting of times. A life-threatening pandemic sweeping the globe. Governments around the world voluntarily inducing a recession the likes of which hadn’t been experienced within living memory.

Shooting from the hip. Firing blind. With no seasoned experts to ask. No proven playbook to follow.

How did I react to things?

What did I think would happen next?

How adept was I at filtering the facts from the “fake news” and propaganda?

The sorts of thing that we gloss over or forget after the fact, as selective memory and survivorship bias carry us inexorably forwards in a bubble of overconfidence and self-delusion.

The tone of a journal is different to a blog post. Fallible. Raw. Transparent. Unedited.

Random and disjointed. The way real-life feels as it unfolds. Before we know how the story ends.

Discomfort

Truth be told I haven’t enjoyed the daily journaling experience. The uncomfortable exploration of reactions that I would normally gloss over or skip past. Processing feelings to turn them into words.

It has been educational. I have learned a thing or two about myself. Not all of them good.

It turns out I am terrible at predicting outcomes.

Confident. Logical. Plausible sounding. Yet often wrong-headed. Sometimes downright foolish!

Overestimating the present. Taking an immediate issue. Projecting it forwards. Scaling it outwards.

The sky is falling. A plague of Justinian proportions is upon us. Preppers of the world, this is your time to shine. Everybody else, “welcome to dystopia”.

Underestimating the future. Life on Earth has existed for billions of years. Agrarian humans for at least ten thousand of those. When viewed through such a lens, nothing in the daily news really matters.

It took 58 years for humans to go from making the first powered flight to flying amongst the stars. Two generations. A single lifetime. Yet in terms of human history, a mere blink of the eye.

The Pony Express delivered the news of President Lincoln’s inauguration in 1860 to America’s west coast at a bandwidth of roughly 1 byte per second. 160 years later, researchers demonstrated data transmission via fibre optic cable at more than 40,000,000,000,000 times that speed.

The rate of improvement is staggering when you think about it, yet we barely notice each incremental enhancement before swiftly adapting and taking it for granted.

It appears that short term outcomes seldom pan out as we predict. Sporting results. The weather.

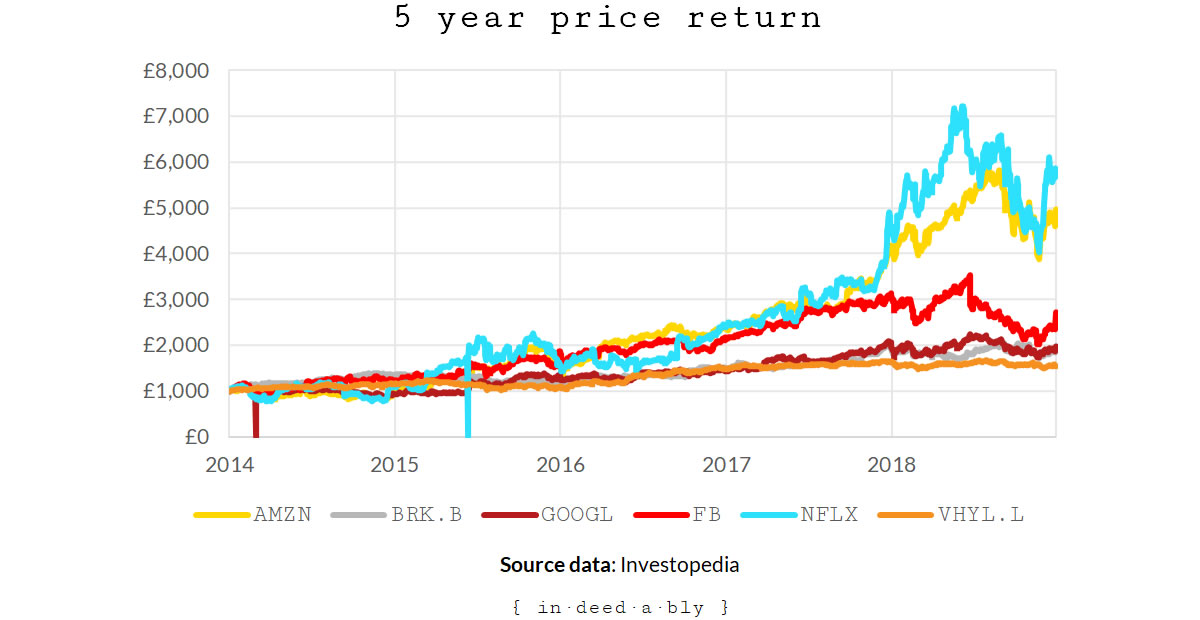

Long term directions of travel can be easier. However, my likelihood of getting both the timing right and backing the eventual winners is vanishingly small. Passive index trackers are as much a salve to my ego as my net worth!

Easily led

It also turns out I am more easily influenced by what I read than I had previously appreciated.

My short term thinking clouded by the chattering voices I had admitted into my consumption bubble.

Talking heads in the media. Misaligned commercials demanding they alarm, exaggerate, or titillate to entice and retain their audience. The more sensational the narrative, the larger the drawcard.

Random strangers on social media. Pithy. Witty. As confidently uninformed as I am. Often more so.

The occasional thoughtful blogger. Sharing rational perspectives and sending well-reasoned arguments out into the void.

Once I became aware that I was so influenced by the information I was consuming, I gave my Feedly and social media feeds a spring clean. Seeking to improve the signal to noise ratio.

The sheer number of RSS subscriptions to dead or long-dormant Personal Finance blogs which had come and gone throughout the two years that { in·deed·a·bly } has existed was disheartening.

Do-It-Yourself lobotomy

Noise reduced, I was left with the first problem I had observed: being piss poor at predicting the future. That one is not so easily dealt with.

While I was writing this post, I was listening to an old band from my university days who had briefly reunited for a virtual fundraising concert. The chorus of their opening song taunted me.

“This life well it’s slipping right through my hands

These days turned out nothing like I had planned

Control well it’s slipping right through my hands

These days turned out nothing like I had planned”

With my crystal ball’s predictive powers having proven to be demonstrably fallible, what did that mean for the carefully laid plans that I had layered upon them?

Do they stand up to scrutiny?

Or were they just as full of faulty assumption, bias, hopes, over-confidence, self-delusion, and wishful thinking?

What would happen if I burned it all down? Started over, completely from scratch?

Sacrifice the sacred cows.

Rip off decades worth of band-aids and duct tape.

Take a wrecking ball to the accumulated baggage.

Abandon the compromises.

Dispense with the matrimonial peacekeeping devices.

Liberate the random assets remaining in non-core jurisdictions.

Take a one-off tax hit on the chin, while performing the mother of all asset allocation rebalances.

The prospect was daunting. Exciting. Liberating. Somewhat scary.

What if I discovered that I had been wrong, about everything? Potentially humbling, but better to know now and start doing something about it.

What if I discovered that I had been overly conservative? Too much resilience. Too many redundancies. My risk tolerance placing me at the tin-foil hat end of the paranoia spectrum.

What if I discovered that when viewed through a fresh pair of eyes, I had already crossed the finishing line? Overshot the runway. Enduring conference call hell and playing time zone tennis for no good reason whatsoever.

An uneasy feeling of impending doom settled in the pit of my stomach.

Questions raised and curiosity piqued I… procrastinated mightily. Finished watching the concert. Put my younger son to bed with three bedtime stories. Shopped around for a better deal on a landlord insurance policy renewal. I even defrosted the freezer!

Introspection

Eventually, I admitted to myself that impersonating an ostrich wasn’t going to make those questions go away. With a heavy sigh, I hunkered down and started torturing some numbers.

- STEP 1: Establish an approximate valuation for each asset.

- STEP 2: Determine a quick residual equity estimate after accounting for clearing debts, selling costs, and capital gains taxes.

- STEP 3: Convert to a common currency, after accounting for foreign exchange and international money transfer charges.

- STEP 4: The resulting total figure represented my realisable accessible net worth.

That number proved to be larger than I had expected.

My faulty mental accounting for capital gains tax had overestimated the financial friction involved in selling some assets.

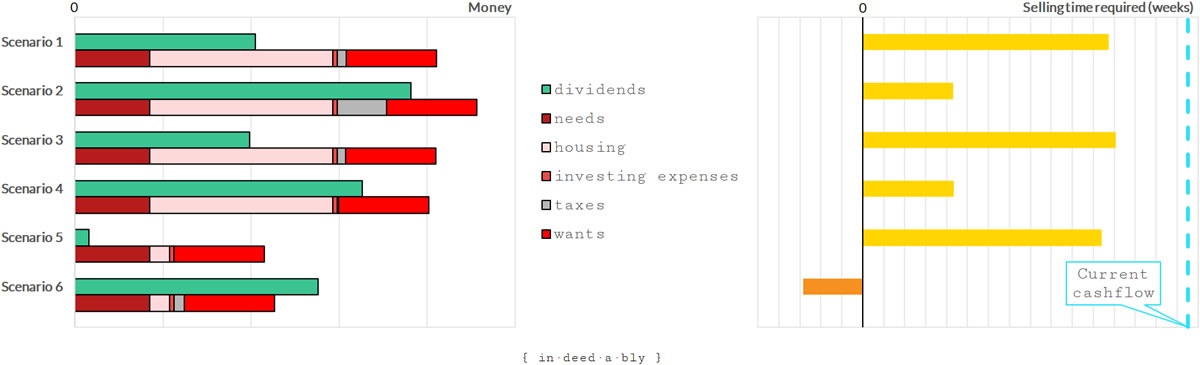

Next, I ran a few simple “what if?” scenarios.

Scenario 1: Invest 100% in a low cost passive global index tracker ETF?

Removing the leverage creates a better passive cash flow picture than my portfolio generates today.

There would be a corresponding loss of potential capital growth, as the absence of leverage would also mean I owned fewer assets.

Scenario 2: Invest 100% in a low cost passive global dividend yield chasing tracker ETF?

The after-tax cash flow position improves considerably, driven by the higher yield.

This additional yield comes at a high price in terms of forgone total returns however, as many growing companies reinvest profits rather than distributing them as dividends.

This is magnified by the inherent arbitrage favouring capital gains over dividend income that is present in the tax code.

Scenario 3: Invest 100% in a Bogleheads “3 fund portfolio”?

This option trails Scenario 1 in terms of cash flow, while providing a side serving of bonds to facilitate “buying stocks when they are on sale” via rebalancing asset allocations. The difference was closer to rounding error than material however.

Scenario 4: Substitute natural yield for total return on that global index tracker?

My natural inclination is to seek to live off the natural yield of my portfolio while preserving the capital.

Intellectually, I recognise this is irrational.

A dividend is a capital distribution, fundamentally little different to a share buyback. The only difference between a buyback and an investor selling a share is who chooses the timing of the sale.

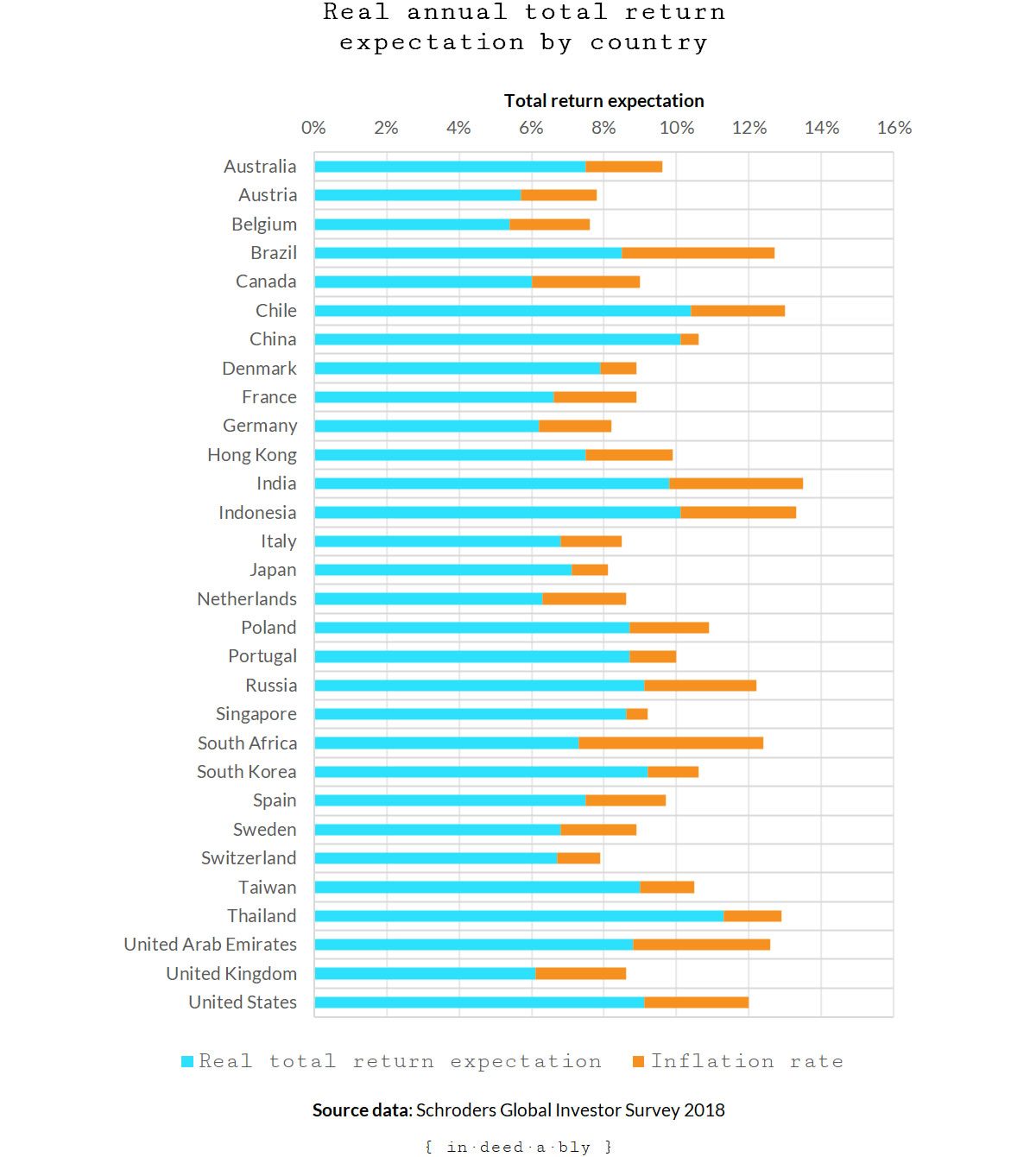

What does this scenario look like? It involves making some assumptions about average total returns.

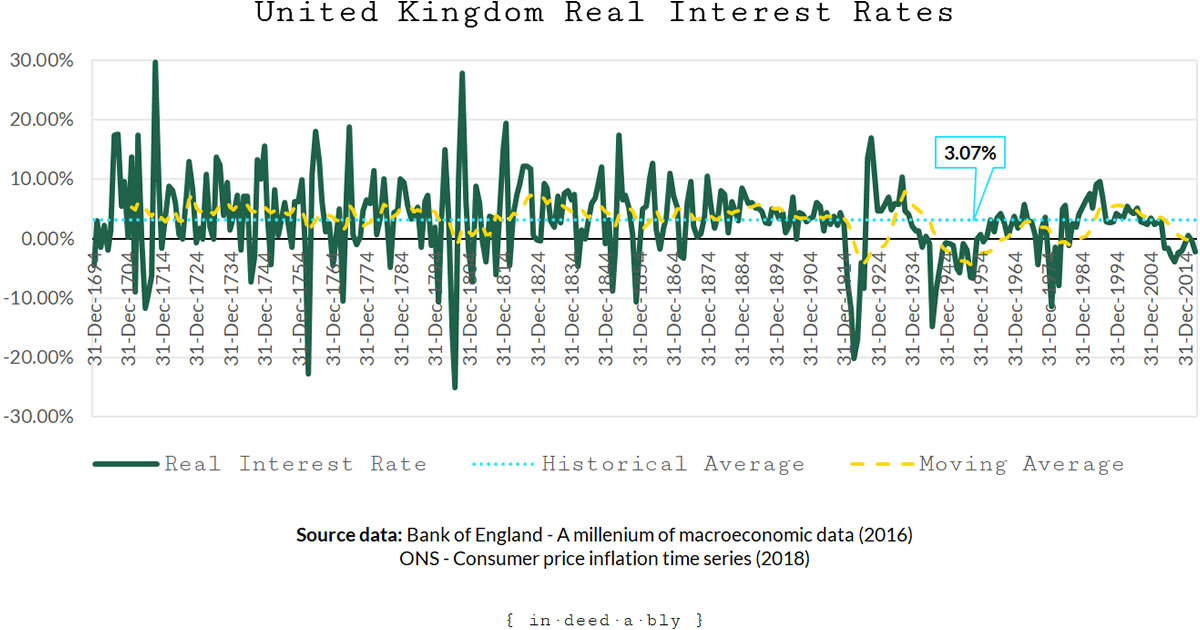

300 years worth of United Kingdom historical data tells us that real interest rates average about 3%.

The stock market offers a risk premium above that.

The Americans argue that this premium averages about 4%.

My experience suggests this real risk premium tends to be more like 2%. Different countries. Different economies. Different markets.

Your mileage may vary.

Add the two together and my average real total return assumption is 5%.

Now give that figure a hair cut to account for all the things that water down our investment returns. Brokerage. Ongoing charge figures. Platform fees. Taxes. User error.

Depending on your level of conservatism, that likely shakes out somewhere between 2.5% and 3.5%.

Which is what the more grounded end of the FIRE movement adopt as their withdrawal rate.

Scenario 5: Purchase my lady wife’s “dream” house and invest the rest in a high yielding ETF?

Capitulate in the epic battle between the powers of homeownership and financial independence. Buy outright the equivalent of the house we currently rent, in the neighbourhood we currently live in.

Scenario 6: Purchase a more reasonably priced house and invest the rest in a high yielding ETF?

Purchase a more moderately priced home in a lower cost locale. Possibly near the beach!

Passive income exceeding lifestyle costs, meaning I would have won the game.

It wouldn’t be all unicorns and rainbows however, the likelihood of a divorce would be high.

Changing gears

After double-checking my formulae and figures, I sat back and felt somewhat bewildered.

All six scenarios produced a more advantageous cashflow outcome than my current financial arrangement. Was I really doing it wrong?

Closer inspection revealed the additional cashflow came from liberating equity “trapped” in capital growth orientated real estate holdings. Over time, the anticipated capital appreciation should materially exceed the cashflows displayed here. That was the theory, but wishful thinking is not a financial plan!

It is a pattern I had successfully applied many times in the past. Buy. Create value. Ride the wave as the carefully chosen neighbourhood appreciates or gentrifies. Each investment is sufficiently cashflow positive to be self-funding, but in several cases not much more than that.

This thought experiment raised an interesting question: when is it time to change gears?

To flip the switch from capital accumulation to cashflow generation?

A capital growth mindset has gotten me to this point, but my semi-retired lifestyle demands a certain level of cashflow to sustain it.

The greater that cashflow, the briefer my winter working hibernations need to be.

The final scenario nicely illustrated how significant living location is to achieving financial independence.

The higher the property prices, the longer the journey. An obvious statement, yet one that is often overlooked during the pursuit of side hustles and career advancement.

In my case, these scenarios demonstrated that financial independence would be instantly attainable by relocating just half an hour further away from the centre of London.

Simple, but certainly not easy!

References

- Bank of England (2016), ‘A millennium of macroeconomic data‘

- Bank of England (2020), ‘Inflation Calculator‘

- Bank of England (2018), ‘Official Bank Rate history‘

- Bank of England (2018), ‘Official Bank Rate history Data from 1694‘

- Bloom, Z. (2020), ‘A Quick History of Digital Communication Before the Internet‘

- Larimore, T. (2012), ‘The Three-Fund Portfolio’, Bogleheads

- Coghill, J., Collins, J., Fanning, B., Haug, I., and Middleton, D. (1999), ‘These Days‘, Powderfinger

- ContractorCalculator.co.uk (2020), ‘Dividend Tax Calculator‘

- Corcoran, B., Tan, M., Xu, X. et al. (2020), ‘Ultra-dense optical data transmission over standard fibre with a single chip source’, Nature Communications

- Gov.uk (2020), ‘Calculator your Capital Gains Tax‘

- Hamm, T. (2020), ‘Average Stock Market Return: Where Does 7% Come From?’, The Simple Dollar

- Investopedia (2019), ‘Price history API‘

- Money Advice Service (2020), ‘Mortgage Calculator‘

- Money.com.au (2020), ‘Capital Gains Tax Calculator‘

- National Geographic (2020), ‘Early Manned Spaceflight‘

- Office of National Statistics (2018), ‘Consumer price inflation time series (MM23)‘

- Richardson, D. (2020), ‘Stamp duty calculator’, Which?

- Schroders (2018), ‘Investors seek “minimum income” of 10.1%’, Schroders Global Investor Study

- Smithsonian National Air and Space Museum (2020), ‘The first successful airplane‘

- Vanguard (2020), ‘FTSE All-World High Dividend Yield UCITS ETF (VHYL)‘

- Vanguard (2020), ‘FTSE All-World UCITS ETF (VWRL)‘

- Vanguard (2020), ‘Global Bond Index Fund – Hedged Income‘

- Verne, J. (1872), ‘Around the World in Eighty Days‘

- Wikipedia (2020), ‘Human‘

Nick @ TotalBalance.blog 29 May 2020

Certainly an interesting read there, Sir! 😉

So, which scenario are you leaning towards, and forgive me for asking, but what are “the matrimonial peacekeeping devices”?…I assume we’re not talking about adult toys here, but those are the only things that came to mind (ha!) 😛

{in·deed·a·bly} 29 May 2020 — Post author

Lol! Thanks Nick, that made my day.

I liked the look of Scenario 6, making my winter working hibernations unnecessary. Scenarios 2 and 4 are worth looking at further also.

Families are complicated. Compromises are often necessary. Sometimes a survival skill. Peacekeeping devices in this instance aren’t nearly as exciting as a Hitachi magic wand!

GentlemansFamilyFinances 29 May 2020

That made me think – I am wrestling with the same ideas in my head.

I appreciate that we all live under different conditions but there’s something that we can all learn from each other.

My conclusion from the lockdown is that we are probably already FI and that’s taken a lot of weight off my shoulders – but then again we do live 6 hours from London.

{in·deed·a·bly} 29 May 2020 — Post author

Thanks GFF. I agree, it is good to learn from the experiences of others, if for no other reason than to avoid making all the mistakes ourselves!

Lockdown has been enlightening in some respects. Appreciation of a backyard and outdoor seating area has been reconfirmed.

The value of having enough space and bedrooms to spread out, escape, or send warring parties to neutral corners has been priceless.

The trampoline I bought my kids several years ago has proven to be one of the most worthwhile purchases ever.

Congratulations on reaching FI (or thereabouts). Once the financial imperative is removed, it leads to some very different time investment prioritisation decisions.

David Andrews 29 May 2020

I suspect many will have recently taken stock of their positions, updated their spreadsheets and evaluated their options. The current global uncertainties make future planning a tricky beast and as per one of your previous posts, I’m sure many of us have run our war games and evaluated their outcomes. The spreadsheet indicates I’m FI and if I sold my rental property I’d comfortably be able to bridge the gap until my pensions (hopefully) become payable. However, should I continue to work which would allow me some extra liquid funds to take advantage of market opportunities ? How much is enough ? My current thinking it to decide once I know a little more about how the chancellor is planning to pay for all the current liabilities. I have a feeling it’s going to be a massive disincentive to continued employment and I’ll then be seeking reduced hours or an exit from the gainfully employed.

{in·deed·a·bly} 29 May 2020 — Post author

Congratulations David, it sounds like you’re in the enviable position of having lots of options open to you. The luxury of choice.

The one constant about the future is it is constantly changing, and rarely plays out exactly how we expect. Whatever the Chancellor may decide next week or next month shouldn’t form the basis for whether the time is right to stop working. That is more of a lifestyle choice, the old cliché about retiring to something rather than from something.

Ryan Gibson 29 May 2020

Great post!

What do you think stops you from making a decision and do you think you will actually do any of the 6 scenarios or should there be a 7th which is ‘do nothing’.

Be interesting to see which decision you take.

Personally we are in a similar position to you but i’ve taken the plunge on the family home. Younger children mind. We’ll be here for 15 years and then decide where next. To be honest though I do love it.

I do find it surprising that you are your wife have such differing opinions. Do you think yours is the ‘exciting unknown’ as opposed to actually going through with it?

Be good to hear what you decide!

{in·deed·a·bly} 29 May 2020 — Post author

Thanks Ryan. Fantastic to hear you and and your family are happily housed for the long term.

Cowardice mostly!

A fair question. Assuming the looming recession doesn’t crater property prices, I can see myself reducing my property holdings as tenancies naturally conclude. In some cases this is strategic, the capital growth outperformance has already occurred. In other cases it will be seeking an easy life, exiting properties that are approaching the age where they require larger maintenance items.

The proceeds I would use to either reduce my own housing costs, or investing with a stronger tilt towards cashflow to better support my lifestyle costs.

Not so surprising. Over time aspirations, dreams, goals, and priorities naturally evolve. Some couples grow together. Others grow apart. It happens.

More a case of being able to have anything, but not everything.

FatFire 16 June 2020

Have you considered scenario 5, but with a fixed long term (e.g. 25-30 years) mortgage?

I’ve been going through similar scenarios and that’s where I’m landing (maintaining some leverage and locking in a very low rate – I can get a 1.5% fixed mortgage right now).

Great post and good luck with whatever decision end up making.

{in·deed·a·bly} 17 June 2020 — Post author

Thanks for the suggestion FatFire, I like your thinking.

The United Kingdom mortgage market works a bit different to that of the United States. The longest fixed term typically available is 10 years, currently with a fixed rate of around 2.07%. Certainly not expensive by historical standards, almost “free” money when considered in real terms.