As a young child, I was going to grow up to be the captain of the Australian cricket team.

I’d been told it was the second most important job in the country, after the Prime Minister.

There was one minor technical problem with this plan.

While I wasn’t quite as bad as Martin Johnson’s immortal description of the mid-1980s England team “they can’t bat, they can’t bowl, and they can’t field”; I wasn’t far from it!

By age 11 an inability to be in two places at once posed an insurmountable logistical challenge. I retired from cricket to take up a paper route.

My career aspirations also changed direction. I was now going to be a stockbroker.

There was just one problem: my expectations of what a stockbroker did were almost exactly wrong!

On my 18th birthday, I reached the age where I could legally invest in shares. I visited the offices of a local stockbroking firm to open a brokerage account.

A friendly junior stockbroker handled the paperwork, answered my many questions, and quickly dispelled my illusions.

Stockbrokers didn’t run the numbers or analyse annual reports. Financial analysts did that.

Stockbrokers didn’t read tea leaves, divine animal entrails, or seek out patterns in share price charts. Technical analysts did that.

Stockbrokers didn’t do mergers and acquisitions, or venture capital deals.

No, stockbrokers answered the phone to take trade orders from people like the 18-year-old me.

They also cold-called dentists and Rotarians to try and talk them into taking an investing position that the brokerage firm was actively trading against.

That didn’t exactly live up to my expectations of the high flying corporate-financiers that I had built up in my head over the years.

Over the next couple of days, I checked and verified what the stockbroker had told me. It turned out he was telling the truth.

The 18-year-old me commenced my investing career by placing a couple of trade instructions with my tame broker.

At the same time, I quietly crossed out stockbroking as my profession of choice.

I learned to live with the disappointment that holding unrealistically high expectations often brings.

Investor study

I was reminded of how costly having unrealistic expectations can be when I read the 2018 edition of the Schroders Global Investor Study.

The study interviewed more than 20,000 investors across 30 countries, to ask them about their attitudes, outlooks, and expectations about investment income.

The results were fascinating, and often alarming.

Before we jump into the data, some health warnings:

- Without knowing how the survey participants were selected, or the age/geographic distribution of sample size, results should be treated with healthy scepticism unless independently verified.

- The survey write up uses the term “income” inconsistently, sometimes using it to refer to dividend yield and interest, other times appearing to mean total returns.

- To overcome this poor wording choice, I have inferred which “income” context is relevant to each result set, and as such any errors in this context reverse engineering are my own.

Investment expectation

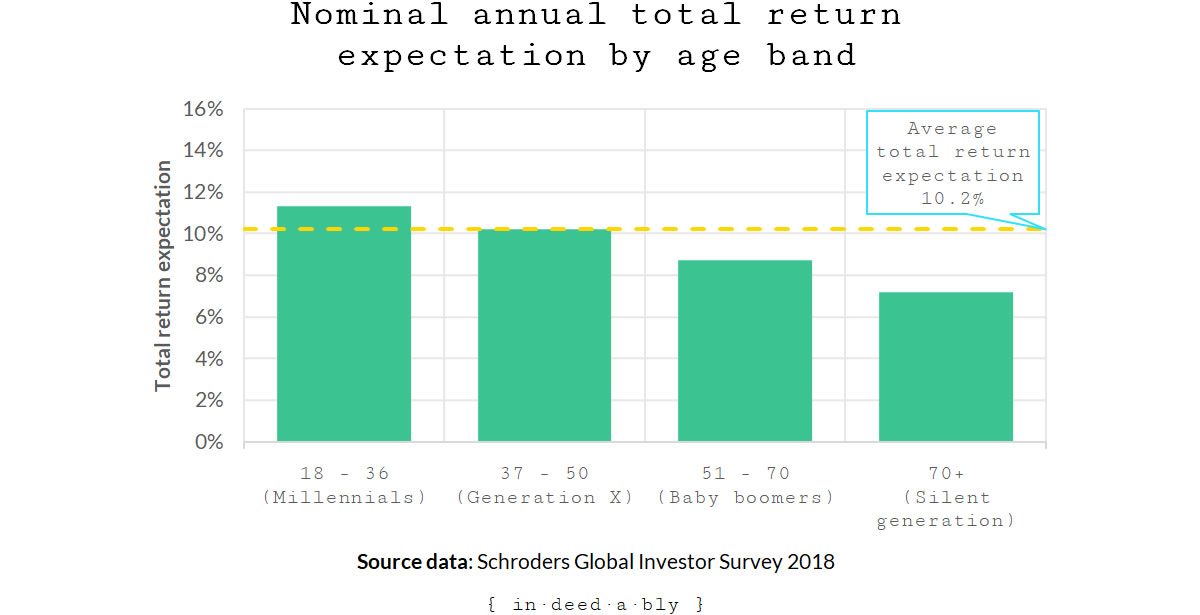

The first chart displays the nominal annual total return expectations of those investors surveyed, roughly grouped into the popular culture “generation” age bands that are so often used to manufacture controversy.

The investment return expectations of the youngest generation in the survey were more than a third higher than those of the eldest generation.

Age and hard-won experience appear to temper investment return expectations.

The greater the exposure an investor has to the vagaries of real life, the less inclined they are to trust that “average” returns are what they will personally experience in the next calendar year.

Random chaos and disaster fill out the daily news cycle. Wars, natural disasters, stock market crashes, bankruptcies, fraud, corruption, and civil unrest all highlight that to a large extent our lives are constantly buffeted and influenced by external events beyond our control.

In the long run, these events average out.

Confusing short term spikes smooth out over time to produce nice understandable (in hindsight) trends.

Diversification is the tool we deploy to combat all this random noise. Spreading our bets, hedging our risk, and consequently sleeping better at night.

Across asset classes. Industries. Currencies. Jurisdictions.

This approach mitigates risks associated with individual firms or specific locales; but is of limited help when risks are systemic in nature such as Brexit, climate change, and the long term funding of the social security safety net.

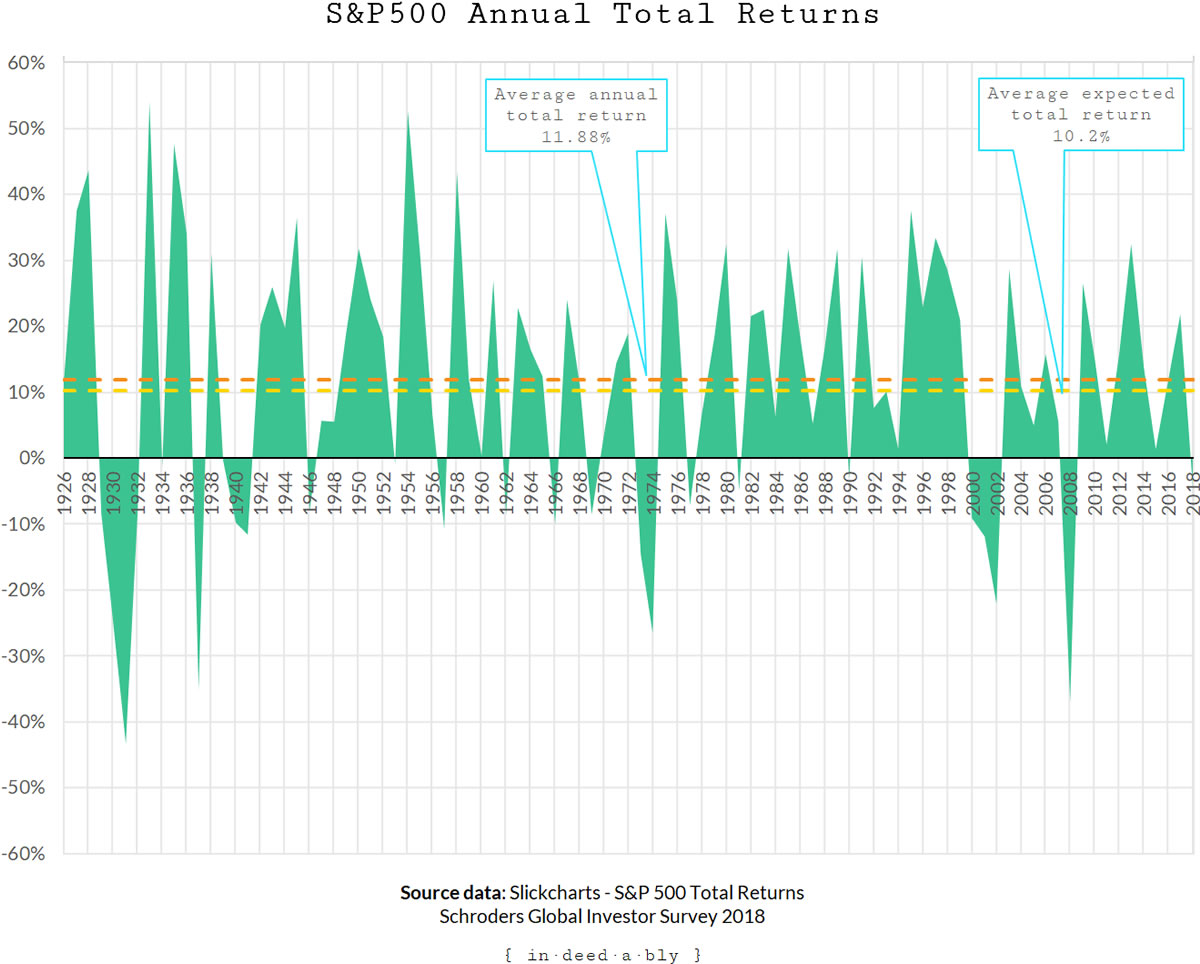

To highlight this rollercoaster ride, consider the annual total returns of the S&P500 since it was created in 1926. The actual and expected average returns mask a huge amount of volatility.

Market dividend yields

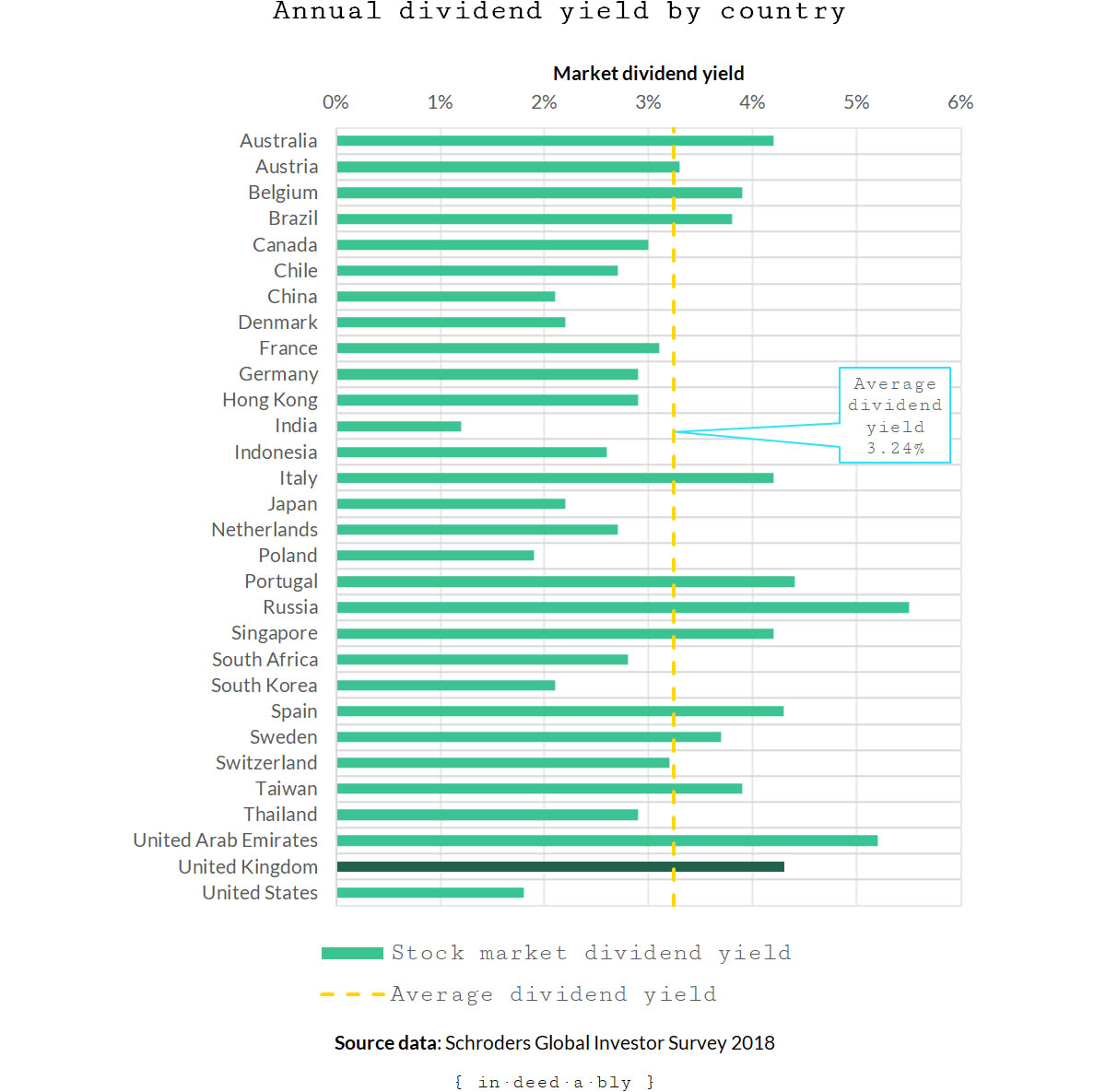

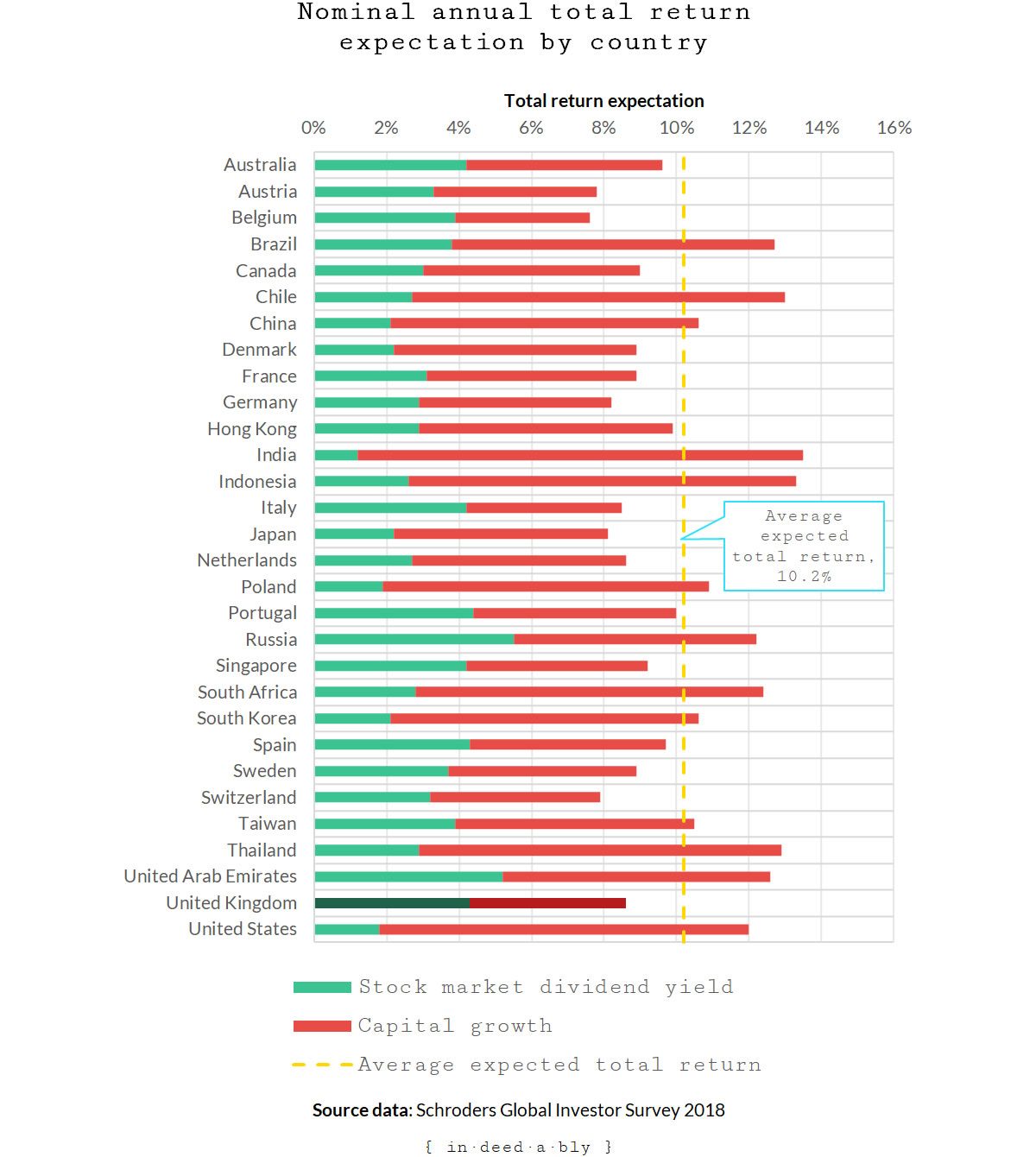

The next chart displays the dividend yield of the 30 markets the survey covered. This is a tangible, verifiable, element of expected total returns. The yields ranged from 1% to 5%, with the average market dividend yield across all these markets being 3.24% at the end of August 2018.

The United Kingdom had an above average dividend yield, trailing only Russia, the UAE and Portugal. This reflects the underwhelming market performance since the massive ongoing economic own goal that is Brexit.

Capital growth expectation

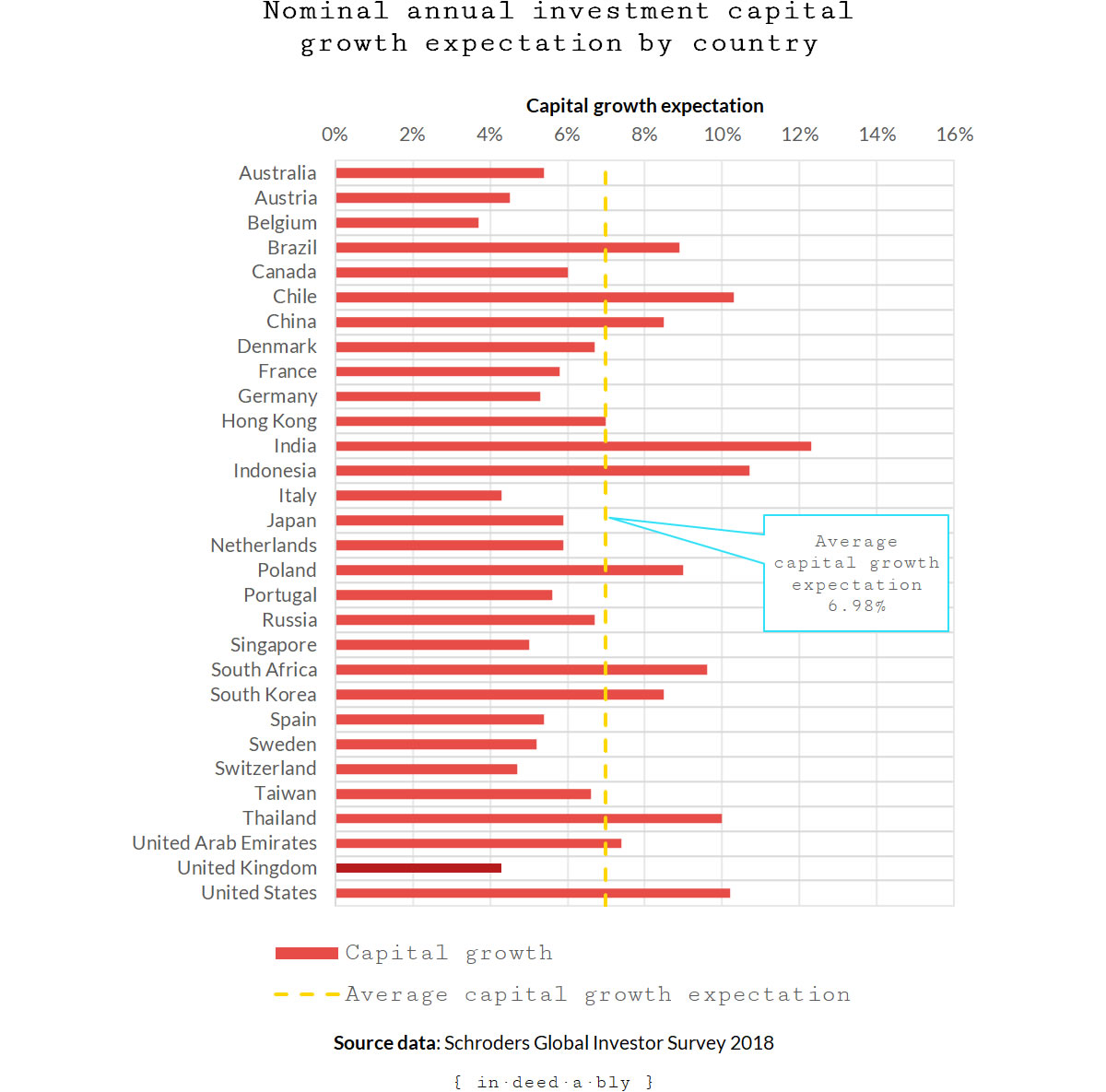

Stripping dividend yield from the expected total returns leaves the levels of capital growth that investors were anticipating.

There was a surprisingly broad spread.

The British and Italians were understandably pessimistic about their respective country’s economic prospects.

At the other end of the spectrum, the Indians are more upbeat than the incurably optimistic Americans!

Anticipated total returns

Combining the dividend yield and capital growth expectations into a single chart paints a fascinating picture of investor expectations around the world.

The expectations between locales vary by up to a third. The top end of the annual total expected return range, at nearly 14%, was India. By contrast, the Belgians anticipated more modest total returns of less than 8%.

Accounting for inflation

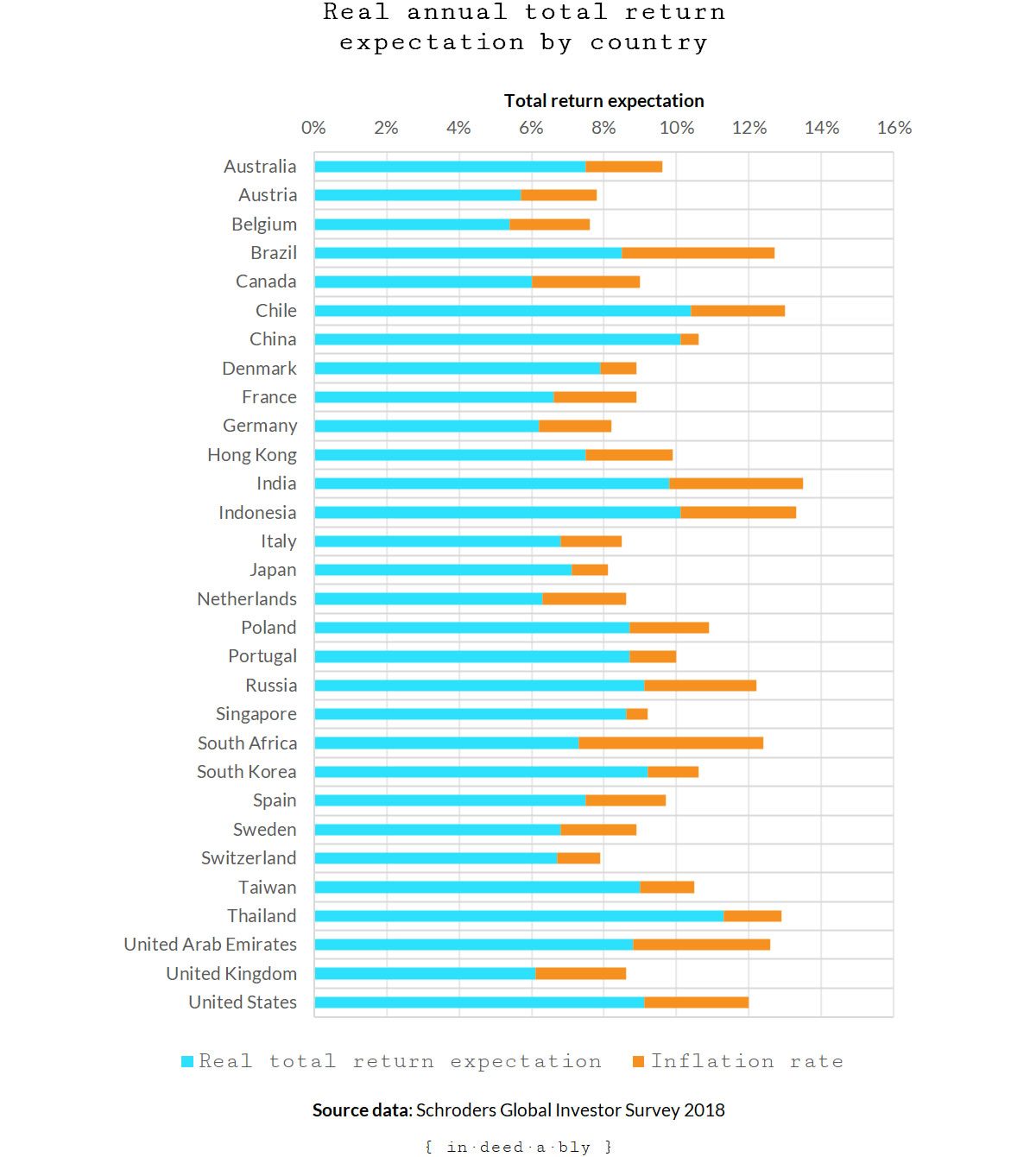

One constant throughout the world is that inflation works to erode the purchasing power of investment returns. There was an interesting correlation between inflation rates and total return expectations across the various countries. Higher expectations tended to go hand in hand with higher rates of inflation.

The chart below showcases the real total return expectations in blue, with the inflation rate of each country displayed alongside in orange. Combined these two figures equate to the nominal expected returns displayed above.

Rose coloured glasses?

How would you respond if somebody told you they were basing their investment return forecasts on a 10% annual return?

I suspect many of us would raise an eyebrow, and inwardly conclude the investor was being overly optimistic.

It is interesting how varied the investment return expectations were across countries and age groups.

One major limitation of these types of surveys is they assume investors only invest in their home markets and currencies. This is a common, though shortsighted, approach.

A globally diversified portfolio would better manage risk, though at a cost of far less interesting survey results!

References

- Miller, A. and Williamson, M. (2006), ‘Can’t bat, can’t bowl, can’t field’, ESPNCricinfo

- Schroders (2018), ‘Investors seek “minimum income” of 10.1%’, Schroders Global Investor Study

- Slickcharts (2019), ‘S&P 500 Total Returns‘

Dr FIRE 19 April 2019

I’m anticipating/hoping that the money I have invested in my global index tracker returns 3% above inflation. Anything more than that will be a very welcome bonus. I’m hoping to temper my expectations, but appreciate that even a 3% gain (~6% if including inflation) is not guaranteed!

{in·deed·a·bly} 19 April 2019 — Post author

That is a modest expectation indeed Dr FIRE.

Hopefully you enjoy a pleasant surprise on the upside!