During our daily walk in the Spring sunshine, my elder son was waxing lyrical about how proud he was of his mother. She will soon start a new job. In an entirely new industry. Several rungs higher up the corporate ladder. No longer one of the troops, this time she will be running her own department.

The boy paused for a moment, then asked about how pensions worked? Did an employee receive a different pension for each job they held throughout their career? Or do they all get combined into one single pension?

I explained that it depends.

Some jobs come with pensions. Others do not.

Good employers will generously match the employee’s contributions.

Average employers contribute the bare minimum amounts they can legally get away with.

Shitty employers strong-arm employees into opting out entirely. Not ethical. Not legal. Not uncommon.

Employees have the option of starting a new pension with each new employer. Alternatively, they may be able to consolidate some or all of their pensions into a single pot. This may make sense where a past employer’s pension charges high fees or offers only a limited range of investment options.

He thought that over for a moment, then asked whether I matched pension contributions for my staff?

I nodded.

He paused again, momentarily struck dumb as a pretty lady wearing short shorts gave him a huge smile as she rode past. The boy is growing up! Once his brain re-engaged he asked:

“So Mum might receive lots of different pensions when she is old enough? Regardless of what she is doing, where she might be, or who she is working for?”

I nodded again. Curious as to where this conversation was going.

He looked thoughtful. Mulled it over. Then eventually said, “That’s good.”

Glancing over his shoulder, he lowered his voice and muttered: “It isn’t that far away, you know?”

I nodded a third time. Less than a decade. On the horizon, visible from where we were standing.

Anyone who mentioned that fact out loud would be a dead man.

Scorched Earth. No mercy shown. No prisoners taken. No quarter given. We both knew it.

We walked along in companionable silence for a while.

Finally, the boy asked, “Do you have a pension?”

It was my turn to pause. “Yes… no… sort of…”

He raised an eyebrow. The formerly amicable silence turning decidedly uncomfortable.

Save us from ourselves

The idea behind placing age-restrictions on pension accounts is that we can each contribute towards the cost of our own retirement in the future.

A noble goal, yet the paltry mandatory contribution levels in place today mean this will be little more than a token gesture for many.

By locking the money away, we are prevented from making short term decisions that may jeopardise our long term financial health and well-being.

The government is essentially saying that the average legal adult, who is allowed to vote and to raise children, cannot be trusted to make the right choices regarding the management and prioritisation of their own money.

An uncomfortable truth is that they were almost certainly correct in reaching this conclusion. Don’t believe me? Read any major daily newspaper. Examples of legal adults making poor choices are legion!

The strength of that absolute restriction is also its greatest weakness. Specific rules vary by jurisdiction, but the general principle is that retirement funds are inaccessible until retirement.

What happens if you are wrongly accused of a crime? Now you need to tap into your retirement savings to finance the legal defence required to preserve your liberty and clear your name? Too bad.

Does one of your children need expensive experimental drug treatments to save their life today? Your only means of acquiring it is cashing in your pension assets? So sad.

How about if your once profitable business is now experiencing a temporary cashflow crisis? The lockdown prevents you from plying your trade, yet those fixed recurring costs like rent and equipment leases continue to accrue. Personal loan guarantees mean bankruptcy for you and homelessness for your family are imminent, unless you can tap your pension pot for an emergency cash transfusion? Bye-bye.

Obviously, these are all edge cases. Yet they pose an interesting question: how comfortable are you with the idea of a government telling you how and when you can spend your own money?

That leads us to the question of regulatory risk. How confident are you that goalposts won’t move?

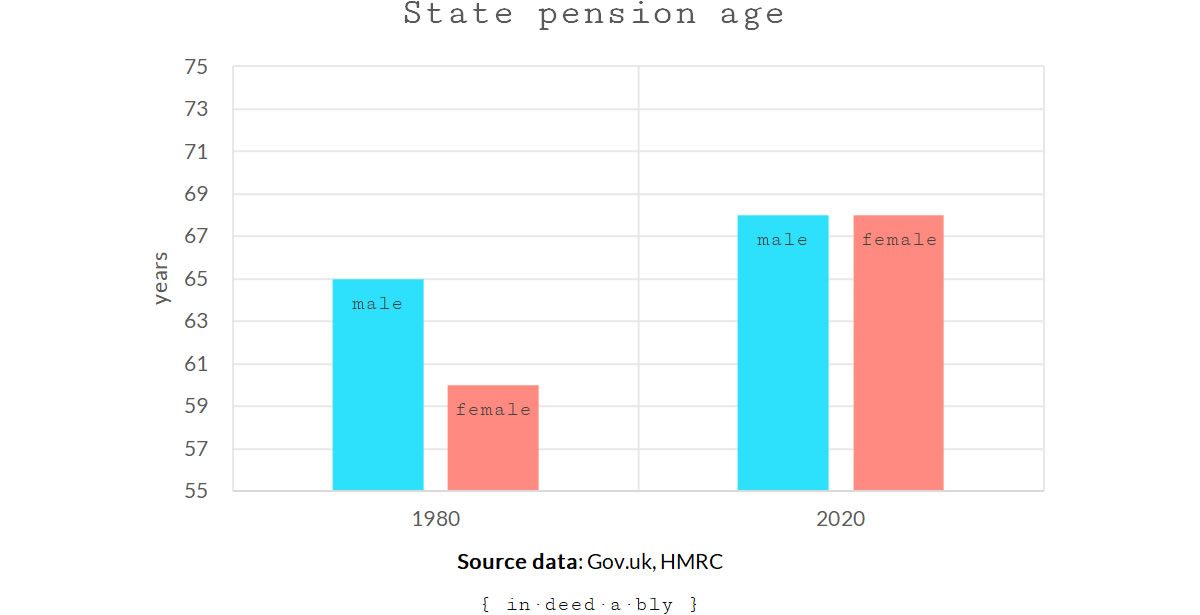

Maybe the age at which you can access those pension funds changes.

Perhaps the tax advantages that make pension contributions attractive today are reduced or removed. Capital gains tax exemptions. Employer contribution matches. Tax-free lump sum withdrawals.

A twenty-year-old making a pension contribution today is taking a punt. They are betting that between now and the age they can access their pension, currently 35-40 years in the future, the rules will not change in an adverse manner that materially harms their financial wellbeing.

That may prove to be a reasonable bet. Yet it is important to recognise it as such. The future is uncertain. Our decisions should consciously factor in foreseeable risk and anticipated reward.

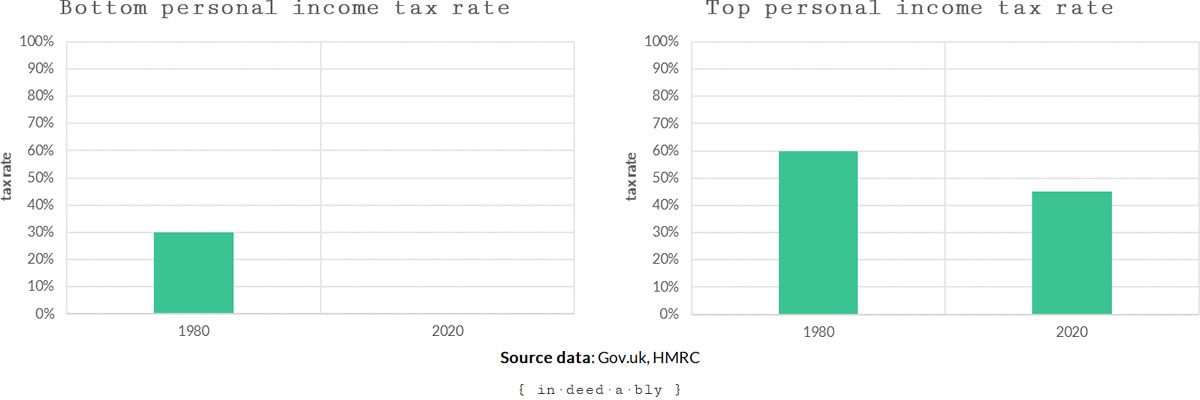

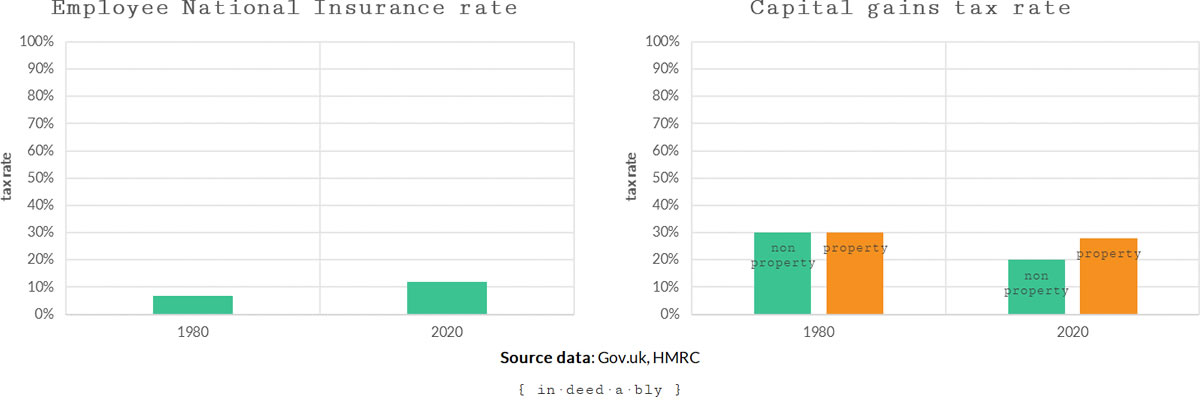

To superficially illustrate that things do change, consider how the world looked to a comparable twenty-year-old some 40 years ago, when they dreamed of accessing their private pension today.

The takeaway here is that significant changes to the rules will occur over an extended period of time.

Yes…

I have several traditional workplace pension accounts scattered around the globe. A byproduct of having led a somewhat nomadic existence back when I was young and responsibility-free.

None are worth a great deal.

Unlike American pension accounts, there is almost no way to access the contents of these age-restricted pensions before “early” retirement age, which for my accounts range between 55 and 60.

One challenge with pensions is that the rules and regulations governing them vary markedly from one jurisdiction to the next. This means one government seldom recognises the rules of another as having equivalency. Attempting to transfer or consolidate international pension pots is always a bureaucratic nightmare, and often proves to be an impossible dream.

Even within a single jurisdiction, the rules of an individual pension provider may preclude consolidating in or transferring out balances from another pension account. For example, additional contributions might only be accepted while the pension holder remains actively working in a given industry, for a specific employer, or as a member of a particular trade union.

Another challenge is that pension contributions can easily become trapped in an undesirable investment vehicle.

Often it is the employer who decides which pension options are offered to their staff. This creates a conflict of interest, what is good for the employer is seldom the optimal outcome for the employee.

That can result in employees having to choose the least bad option amongst a range of poor choices.

High fee products.

Expensive actively managed funds.

Sometimes even high fee wrappers that in turn invest in high fee active funds!

Years ago, the default option offered by one former employer was a single market passive index tracker with an ongoing management fee of 500 basis points. By comparison, at the time of writing that was more than 22x what Vanguard charge for their VWRL global index tracker.

Another of my pensions automatically enrolled members in an additional fee life insurance product. However, only those who remained actively working for the employer at the time of their death were eligible to claim upon it. The pension provider levied a monthly fee for an inappropriate product that the vast majority of members could not use.

No…

When I originally departed my country of birth, I thought I would only be gone for a year.

Each place that I lived was temporary. A short-term adventure, before I would eventually return home.

One year became two. Two became three. And so on.

Before I knew it, a decade has passed.

When you lead a nomadic lifestyle, making pension contributions makes little sense. It would be decades before that pension became accessible, while I would have moved on within the year.

Eventually, I found myself in London. Without realising it at the time, I started down the long and expensive road towards permanent residency and a British passport.

But here is the thing.

At the time, the British government didn’t want migrants. They had closed off many of the traditional routes towards United Kingdom citizenship for non-European nationals.

In the economic headwinds leading into the Global Financial Crisis, the only route remaining open to me was that of a “highly skilled” migrant. Which required being able to demonstrate a correspondingly high level of net earnings.

That earning threshold increased with the age of the visa holder, a policy aimed at discouraging older migrants. Each dependent further increased the earnings threshold that the visa holder must satisfy.

To complicate things further, the immigration authorities would not recognise “unearned” income when evidencing that earnings requirement.

Dividends? Interest? Rent? Royalties? Computer says no.

If I wanted to stay in the country, I needed to demonstrate that I held a high paying permanent job.

Except that I owned and operated my own business.

I had little option but the “employ” myself as a high salary earning permanent member of staff. With a correspondingly high PAYE income tax bill.

In what would provide a sneak peek into the post-IR35 “disguised employment” world, I also had to pay both the employee’s and employer’s share of National Insurance contributions on that income.

An “idiot tax” is the opposite of tax avoidance. It means voluntarily paying more tax than is required. Having to pay National Insurance meant my idiot tax was levied at an additional rate of 16.5%.

Compounding that problem was the fact that to satisfy the visa earning requirements, I had to extract more cash from my business than I needed to cover my lifestyle. This pushed me ever higher up the marginal tax rate table, at the cost of paying a further 40% in tax on each additional pound earned.

Unfortunately, I couldn’t salary sacrifice any of that amount into a private pension. The immigration authorities reconciled payslips to bank statements, verifying that net earnings had actually been received by the visa applicant.

Cue the tiny violins.

The total fees to obtain British passports for myself and my family cost in the low five figures.

Add in the amount consumed by all the additional taxes, and the total cost would have paid for an average terrace house.

I don’t even want to think about the opportunity costs!

Sort of…

By that stage, my old passport was full of stamps, while my pension pot was correspondingly empty.

I wasn’t too concerned, however.

I owned a profitable business.

Had established a share portfolio.

Purchased several investment properties.

After spending years dancing to the tune of onerous and ever-changing visa conditions, I find myself risk-averse when it comes to relying on a government to not change the rules or move the goalposts. The subsequent removal of a private landlord’s ability to offset their financing costs against rental property income certainly did not dissuade me from this view!

The incentives and tax benefits baked into the United Kingdom tax system are undeniable.

Yet, for me, they come with too many strings attached.

Income from my investments is flowing in. Now. Accessible today.

With no age lock-in or government imposed restriction.

If I play my cards right, those same income flows should continue once I retire, wherever and whenever that happens to be.

Indefensible

Some may say that I have adopted an indefensible position.

Passing up the “free money” that comes from employer pension matches would be widely viewed as heresy in personal finance and financial planning circles.

The benefit of my approach is that I have no income gap to bridge between today and some arbitrary pension eligibility age.

The absence of an age lock-in has allowed my passive income streams to help finance my lifestyle costs today, which in turn allows me to live the semi-retired working pattern I enjoy.

It is a personal choice. I am consciously paying the price for that flexibility. Indefensible position or no, for me buying that freedom was worth it.

As I said to my elder son, “it’s complicated”.

As always, what is right for me may not be what is right for you. Do your own research. Then choose your own adventure!

References

- Chen, J. (2020), ‘Basis Points (BPS)’, Investopedia

- Gov.uk (2020), ‘Capital Gains Tax rates‘

- Gov.uk (2020), ‘Check your State Pension age‘

- Gov.uk (2020), ‘Early retirement, your pension and benefits‘

- Gov.uk (2020), ‘Income Tax rates and Personal Allowances‘

- Gov.uk (2020), ‘National Insurance rates and categories‘

- HM Revenue & Customs (2010), ‘Capital Gains Tax‘

- HM Revenue & Customs (2009), ‘Main features of NICs (Table A4) – 6 April 1975 to October 1985‘

- HM Revenue & Customs (2009), ‘Rates of income tax (Table A2) – 1973-74 to 1989-90‘

- Land Registry (2020), ‘Average price by type of property in United Kingdom‘

- ListenToTaxMan.com (2020), ‘UK Tax Calculator 2008/2009‘

- Pension Wise (2020), ‘Taking your pension before 55‘

- Portafina (2019), ‘The Pension Timeline‘

- The Money Advise Service (2020), ‘Pension release or pension unlocking‘

- Vanguard (2020), ‘FTSE All-World UCITS ETF (VWRL)‘

bsdb3 10 May 2020

I think there’s a gulf between public sector employees with solid, guaranteed final salary pensions, and the private sector. For a start the private sector employee have no safety knowing where the markets will be when they come to retire whereas the public sector employee is backed by the Government.

I feel lucky in that I’ve been able to so some pension savings through Lifetime ISAs (my wife + my own). It feels like a middle ground – in an emergency the pot can be accessed (albeit with a hefty fee) but we still get the basic tax relief up front and can invest in stocks and shares. The funds are effectively locked away until we’re 60, but we can continue top-ups of £4K each (before the Government bonus) until we’re 50, but I do have concerns the rules could change.

In terms of the inappropriate pensions chosen by the employer with higher-fees, I guess there is increasing freedom now to transfer the balance of the funds as/when to one of your choice and leave the employer paying in. I think many platforms charge a fee to move funds but equally some offer a bonus to receive the funds. I’ve got a stakeholder pension which has grown over the last 10 years from an employer and am considering moving the funds to a SIPP to save on the fees.

{in·deed·a·bly} 10 May 2020 — Post author

Thanks bsdb3.

I agree that the LISA is a good compromise for those who are eligible. Alas, I had aged out of qualifying by the time they were introduced.

You’re also correct that the UK pension holders have more options than many to move away from bad deals. Unfortunately few realise those options exist, instead blindly signing the paperwork issued by the HR department along with their employment offer letter. Truth is, the HR person probably doesn’t understand the strengths and weaknesses of the pension plans either. It is well outside their lane.

Phrases like “solid, guaranteed final salary pensions” give me chills. We should be able to assume they will be there when required. We should be able to trust that the rules won’t change and the benefits won’t be watered down. And yet…

Actually a bigger risk is probably the unscrupulous commission chasing vultures advising folks to transfer out. Watch that space for a PPI style miss-selling scandal in the making.

John Smith 10 May 2020

I hit the meanders of UK bureaucracy, 1K+ for citizenship/person, work permit (even for a EU citizen), pay 40% tax for living 1/4 of my life in UK (useless for 3/4 rest of the life). Those versus a native on state benefits..fair play. Ah, UK old age pension less than [1/4 .. 1/2] of Austria for the same wage? Complicated work pension transfer rules, aggravated by Brexit. Covid-19 pandemic management, a joke.

Right, indefensive personal position. I think MOBILITY (planting flags in many country, geo-arbitraj) is the future “insurance” in this fast evolving world (forward not so good things).

John Smith 10 May 2020

Sorry, I do not want to polute the topic, just a sample demo, UK vs, Austria, if readers are not aware about OLD AGE pension. Ex: wage 52K euros/year gross.

UK: 175/week * 52 weeks / 35 years = 260 gpb/worked_year

AT: 52,000 eur/year * 80% / 40 years = 1,040 eur/worked_year (~4x UK)

dearieme 15 May 2020

Bogus comparison: some countries encourage pension saving, some encourage reliance on a state pension. Britain is in the first category.

I knew a German who turned down a bloody good job in Britain because he didn’t understand our pension system and thought that he’d end up in penury.

{in·deed·a·bly} 10 May 2020 — Post author

Thanks John Smith.

Having multiple options is certainly better than having none, though it can create a new set of problems!

I think the UK age pension may be even lower than you outline, £134.25 per week according to the government’s website.

John Smith 10 May 2020

I will not be pensionable in the near future, just retired 🙂

So NPV=175x52/35 for me if I will survive.

How much beans I could buy is another story.

Boltt 11 May 2020

I value the state pension at over £250k – how much does it cost to buy an indexed linked annuity of £8pa?

Sound pretty generous to me, especially since there’s no means testing – and how much we pay in.

B

John Smith 14 June 2020

Extremely generosity, even better if you pay voluntary NIC class 2 [2-3 gbp/week] so recovered in 2 years at 67 old age until 95.

Or pay nothing all the life (but qualify for NIC because children etc) and get the full state pension, without working a day in life. because pension credit etc

One small thing: to do not change the rules later, and eliminate state pension, because auto private pension.

David Andrews 11 May 2020

I agree that pension planning is exceptionally tricky when the rules keep changing. I’m extremely fortunate as I have a deferred DB pension scheme acquired from my 18 years working within the UK Electricity sector, mainly in many of their IT functions.

I vaguely recall that sector had such a beneficial pension scheme as it was judged to be an essential industry. Many of my older colleagues were Electricity sector lifers. When the downsizing / rightsizing / offshoring / best shoring outsourcing / started they took their generous voluntary severance packages and went off into early retirement – I couldn’t blame them. During the outsourcing phase our DB pensions were maintained but after the TUPE protection period ended the redundancies started again and those expensive employees with their DB pensions appeared to be top of the list. Of course it was all explained away in a different manner but the jobs were slowly shifted to lower cost environments. I got “chosen” in 2014 and my pension got deferred.

Fast forward to today and I’m gainfully employed and I have a defined contribution pension – the employer contributions are significantly smaller and the investment risk is mine. My personal outgoings are low and I’m using my employer’s salary sacrifice to make aggressive pension contributions. This approach brings my Net Adjusted Income under the tax free threshold. I’ll only be able to sustain this level of pension saving until the end of this tax year as I’ll have used up all my pension carryover. If I didn’t make this level of pension saving we’d lose our child benefit entitlement and I’d be paying 40% on my income and also my property rental income. However, saving so much is likely to get me very close to the pension LTA. By making personal salary sacrifice my employer saves some of their NI contribution and they put half of that saving into my pension contributions.

If I cashed out my DB scheme I’d probably have to stop making pension contributions as I’d be at 90% of LTA at 48 years old. Anyway, playing this particular game is really tough as the goals keep moving constantly. My deferred DB scheme could go bust and get rolled into the PPF which would be extremely painful, the Government could remove pension freedoms or bring the age I can access my pensions to 57 which would also be painful.

In my case transferring out “may” be a good option. I have other income streams and my dependants are already taken care of. However, I’ll still have to pay for the advice and they’ll most likely cover themselves by advising against a transfer.

JD 11 May 2020

AFAIK, the tax rules don’t allow you to sacrifice income to such an extreme level that would mean you’re receiving a salary equal to less than the national minimum wage.

David Andrews 11 May 2020

I initially thought the same. However, my employer is enabling my current extreme salary sacrifice levels. Whether I’d be blamed for asking them to do it or whether they’ll be blamed for letting me do it would make for an interesting situation.

{in·deed·a·bly} 11 May 2020 — Post author

Certainly sounds like you’ve figured out how to play the tax and benefits systems to your advantage, David.

Hopefully your defined benefits pension has the legs to fund you safely through your retirement. The Pension Protection Fund’s annual Purple Book could be marketed as a horror story!

David Andrews 12 May 2020

The viability of my deferred DB scheme is the principal thing that keeps me awake at nights. Last year my CETV jumped by six figures. With the current financial issues and annuity rates being at a new historic low I expect the CETV will jump again when I next request it. I have a feeling that there will come a point when the PPF “lifeboat” becomes unsustainable.

Damian 16 May 2020

I really enjoyed reading that, thank you. Well-written and well thought through; and great to get a glimpse of the fascinating life story lurking in the background.

Unfortunately very few people have been able / willing to design the kind of life you are living. For them, a workplace pension likely represents the best option, even accounting for the shifting sands of government policy.

{in·deed·a·bly} 16 May 2020 — Post author

Thanks for the kind words Damian.

Leading a lifestyle outside of the defaults requires some effort and a little imagination. Possible for many, not desirable for most. In their case, if they wish to stick to the script then the standard options like workplace pensions are likely a good option.