“Life is good. You finally did it! You pulled the plug on your day job after reaching financial independence. You never have to work for money ever again. But, you’re bored. You need something to do… You need a project! You grab a piece of paper and a pen and start thinking. Now that you’re financially free, what projects do you want to complete? However ambitious, however small, you now have the time to pursue anything that you like, what will you accomplish?”

This was the thought experiment proposed by SavingNinja. The one thing he asked of participants was for a stream of consciousness outpouring of thoughts rather than a carefully polished article. Here goes…

Celebrate, then move on

One of my all-time favourite television shows was The West Wing.

Through a blend of fantastic storytelling and witty dialogue, the show imagined how the idealistic senior staff of a presidential administration might attempt to change the country for the better.

The President, played by Martin Sheen, encouraged his staff to celebrate their wins, large or small.

Briefly.

He would then quickly focus their attention back to the job at hand with a gruff “What’s next?”.

Recently I have been asking myself that same question.

School’s out

This week I submitted the final assessment piece towards my “just for fun” post-graduate studies.

Providing I haven’t got that spectacularly wrong, in due course I should be awarded another expensive piece of paper to add to my collection of things that seemed like a good idea at the time!

The vast quantity of time I had been investing in deciphering turgid academic prose will be liberated.

Sun’s out

My annual winter working hibernation has just a handful of billable days remaining.

The solution to the client’s tricky problem has been found and articulated.

This engagement could be eloquently summarised by the old consultancy maxim:

“you can provide the client with the best advice in the world, but you can’t make them listen”

Based on their recently released budget for the next financial year, it appears the leadership team subscribes to the Big Pharma motto:

“there is more money to be made from treating disease than curing it”.

Decompression will commence.

Control over my time investment decisions will be restored.

Aged out

Young children place their parents on a pedestal and look upon them with hero worship.

These all-conquering superheroes banish imaginary monsters.

Perform amazing feats of dexterity and strength.

Provide an endless supply of batteries.

Find lost toys.

Unfortunately school cures them of those illusions.

Magic traded for fact.

Unquestioning acceptance swapped out for healthy scepticism.

The fall from that pedestal is swift, and the landing bruising to the ego!

Around that same age, most kids have also outgrown the need for constant entertaining, stimulation, Peppa Pig, and Fireman Sam.

While my volume of “free” time is far from those halcyon days before children, a comfortable balance is slowly being restored.

What’s next?

At the start of the year I called out three things I wanted to do during 2019.

The first was finishing up my studies, which is hopefully now done.

The second was reconfiguring my asset allocation to turn up the free cash flow.

This sounded simple in concept, but quickly became a minefield when my lady wife listened to “improved cash flow” but chose to hear “avoid paying rent by buying a house”. Here be dragons!

The third was a project:

“Combining my accounting knowledge, financial planning training, professional expertise in reporting and analysis; and applying them to design and build a personal finance application that actually helps solve real-world problems in a usable way.”

What does that actually mean?

I’ve tracked my finances for more than 30 years using an evolving collection of personal finance software products. These products have been mostly good for tracking, but I’ve found them wanting when it comes to analysing and forecasting.

Consequently, I have maintained a suite of handcrafted spreadsheets alongside those applications.

The software generally takes care of the low-value grunt work: tracking, categorising and persisting. The spreadsheets are where the magic happens.

Anecdotally many in the Personal Finance blogging community appear to adopt a similar approach.

I pondered why this might be the case?

Were my financial affairs so incredibly complicated no software could hope to make sense of them?

Not really.

Am I such a control freak that answers had to be produced and presented my way to have validity?

Not so much.

Was I simply doing it wrong?

Maybe… but unlikely.

Could my lifetime’s worth of accountancy, financial planning, business ownership and consulting experience mean I am overthinking things?

Possibly.

Is it possible that the potential customer base for personal finance software is just too small to bother with?

Potentially.

Microsoft gave up on their Money product a decade ago for this reason.

Meanwhile Moneydance discovered the folly of selling commercial software, where key functionality was dependent upon the continued benevolence of strangers providing datasets for free. Oops!

I briefly explored, then discarded, this hypothesis.

- Personal Capital claims to have more than 2,000,000 registered users.

- Intuit (the company behind Mint, Quicken, Quickbooks and TurboTax) reported nearly 4,500,000 actively paying subscribers in its latest quarterly filings.

That left me with two possible outcomes.

If it wasn’t me, then the software applications weren’t solving my problem.

Or I had overlooked something.

Or quite possibly, some combination of both.

An unhealthy number of consultancy engagements has taught me that when in doubt, act confident and fake it. You will often carry the day!

I decided to squeeze back into my recently discarded parental superhero costume, to see if I could succeed where so many who have gone before me have failed.

The project: to craft some software that scratches my itch.

Beginning with the end

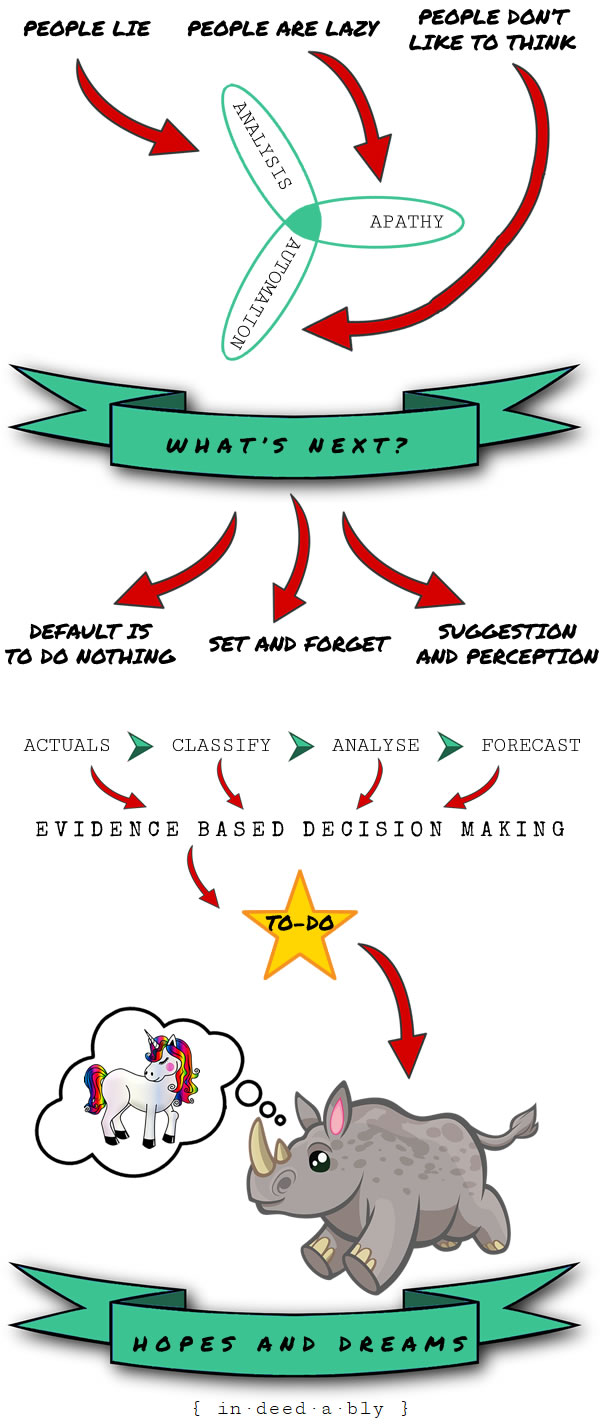

I got out my crayons and sketched out what Personal Finance should do for me.

Then I analysed why the existing products fail to deliver my desired outcome.

Personal Finance software

Personal finance software falls short because it is backwards looking.

What money did I make?

Where did that money go?

It can provide a perfectly accurate accounting of where things went wrong. However that isn’t the same as helping figure out how to get things right in the future.

Driving forwards, while focussing on the rearview mirror, is likely to end in tears!

Budgeting software

Meanwhile, budgeting software falls down because it depends upon the budgeter’s honesty and ability to follow through.

Budgets are the comforting lies we tell ourselves about how the future might unfold.

Providing nothing unexpected happens.

The gods smile.

The stars align.

And we aren’t led astray by all those tempting distractions.

There is another way

Neither approach addresses the all-important questions, including:

- Why do I care where my money comes from, and where it goes?

- What am I working towards? What are my hopes? My dreams?

- What does the future look like if I keep doing what I’m doing?

- Will taking a given action get me closer to my goal?

Nor does any of the software help the user figure out: what’s next?

But they should!

Ending at the beginning

So there you have it, the very early beginnings of my next project.

Now it is ask the audience time!

Complete the form below to have a say in what capabilities this project should consider, or share your thoughts in the comments below.

Check out the other responses to SavingNinja’s thought experiment, to learn about other exciting plans being hatched by the Personal Finance blogging community:

- A Way To Less

- Cashflow Cop

- Caveman @ Ditch The Cave

- Dr FIRE

- Eat Save Live

- Fretful Finance

- Gentleman’s Family Finances

- Marc @ Finance Your Fire

- MerelyCurious

- Sam @ A Simple Life

- SavingNinja

- Sonia @ Money For The Modern Girl

- The FIRE Shrink

- TheFIREstarter

- What Life Could Be

- Young FI Guy

References

- Intuit (2019), ‘Business Metrics‘

- Microsoft (2009), ‘Microsoft Money Plus will not be available for purchase after June 30, 2009‘

- Personal Capital (2019), ‘2+ million planning their financial lives‘

- Rockstar Finance (2017), ‘Rockstar 360 Stats: Apps‘

SavingNinja 15 April 2019

Very exciting stuff! I for one would love to use software like this. I think Andy over at liberate.life is going in a similar direction with his new software project you could team up 🙂

Thanks for taking part, brilliant post (as always).

{in·deed·a·bly} 15 April 2019 — Post author

Thanks SavingNinja.

I’ll volunteer you to be a beta tester at some point.

GentlemansFamilyFinances 16 April 2019

I’ve been keeping my expenses or accoubts in full for 17 years – so as a nubie feel free to ignore – modelling future asset values is difficult and a bit pointless.

From what I get about your finances, they are quite complex.

I find that the easiest method is to look at free cashflow – income plus dividends / asset sales less outgoings, investment purchases and taxes.

Put that into a month by month plan and you can predict maybe 3-5 years out.

Of course things change and all models are just simplifications of truth.

For long run predictions- a crystal ball is about as good as the fanciest model.

Over 30+ years even a small difference of 1% can be huge.

{in·deed·a·bly} 16 April 2019 — Post author

Thanks for sharing your thoughts GFF.

I commend your book keeping persistence, 17 years is a long time to stick with anything!

GentlemansFamilyFinances 16 April 2019

the original intent was to find out where my student loan was disappearing to!

Since earning work it was to work towards FIRE (although that term didn’t exist back then).

Running a monthly summary of all of your income/outgoings/assets doesn’t seem overly obsessive in my view but I don’t think that that many people do the same.

30 years though! You deserve a medal.

{in·deed·a·bly} 17 April 2019 — Post author

I’d argue that keeping a monthly eye on what you earn and where it goes is entirely sensible, rather than obsessive.

The story our figures tell are in the changes and trends, more so than the absolute numbers.

How are the proportions changing?

Does one spending area grow at a much faster rate than the others?

Is lifestyle inflation running away from us… and are we consciously ok with that?

I find the patterns displayed in my pretty charts regularly tell me things I wasn’t cognisant of, often uncomfortable truths that influence my evidence based well-informed decision making going forward.

GentlemansFamilyFinances 17 April 2019

I agree that the numbers don’t like – and patterns can be picked up, like how when we go for a swim in the pool we often have a £20 shopping bill from nearby M&S the same day.

And how having kids actually SAVED us money (even with the Nanny) since we didn’t travel as much.

As I say, the trend is your friend.

The Rhino 16 April 2019

Maybe you should give liberate-life a call? ‘Synergies’ I think they call it in management-consultant circles?

The Rhino 16 April 2019

PS – nice use of the rhino!

{in·deed·a·bly} 16 April 2019 — Post author

Thanks Rhino, you’re an inspiration to us all!

Sas 25 April 2019

Hi there I spend my evenings when I cannot sleep designing a financial planning dashboard in my head, if you want to get in touch I would enjoy comparing thoughts. I reached out to Andy at liberate but his product was more on investment mix and I am a real novice at that stuff.

{in·deed·a·bly} 26 April 2019 — Post author

Thanks for the kind offer Sas, I may just take you up on that when I’m designing the user interface.