Sometime earlier this week I realised I had misplaced my career.

I searched down the back of the sofa.

Rummaged inside my coat pockets.

Braved the dust mites and spiders inside the vacuum cleaner.

Even checked the fridge, where my car keys had once turned up after a heavy night long ago.

My career was nowhere to be found.

This was annoying. A mild sense of unease building in the pit of my stomach. Invoking long-suppressed memories of childhood home-cooked meals. Easy in, explosive out.

I cast my mind back to the last time I had seen my career. Early summer. Around the time the government was abandoning COVID restrictions in favour of summer vacations and taxpayer subsidised date nights. Neglecting to remind the public that pandemics only end once the majority of the population have been infected, either via vaccine or contact with the contagious.

Perhaps my career had escaped? Made a break for freedom, after three long months of lockdown. Tired of competing with homeschooling. Playing timezone tennis. Participating in an unhealthy number of video calls.

I reached out to my former colleagues, competitors, and industry peers. Perhaps one of them had spotted my missing career?

Roaming the mean streets of the City.

Running the gauntlet in the dystopian wastelands of Canary Wharf.

Playing amidst the tumbleweeds blowing through London’s West End.

Squatting in some soulless commuter town, clustered around a dying shopping centre with empty anchor tenant stores and boarded-up shopfronts. Haunted by the ghosts of Britain’s retail past: Beales, Debenhams, House of Fraser, John Lewis, and Marks & Spencers.

Alas, none had.

Missing careers

The more people I spoke to, the more a curious phenomenon began to emerge.

It wasn’t just my career that had disappeared. The same thing had occurred to many, perhaps even most, former colleagues who were my age or older, and possessed comparable levels of experience.

As none of them subscribed to my “work a little, play a lot” seasonal working pattern, they had discovered the absence of their own careers months ago.

They searched.

Knocked on doors.

Contacted everyone they had ever met in a professional context.

A few created portfolio websites. Monuments to past glories and faded professional achievements.

Some documented their fruitless search on social media. Providing dramatic blow-by-blow accounts of the heartache their missing career was having upon themselves. Their families. Their finances.

Belts tightened.

Discretionary spending cut. First, gym memberships and Netflix. Later, life insurance cancelled. Pets given away. Granny’s aged care costs palmed off onto the state.

Second cars sold.

Kids pulled out of private schools.

Mortgage holidays first obtained, then expired.

Household items liquidated via eBay. Jewellery pawned.

Attempting to let out the family home, while renting somewhere cheaper. Bedrooms traded for bunk beds. Houses for apartments. Comfortable neighbourhoods for rough council housing estates.

Leaping aboard the “pump and dump” property boom. Fuelled by a time-limited stamp duty holiday, and completely divorced from underlying harsh economic realities. Desperate to cash out any accumulated equity before the music stops.

Not the stuff that dreams were made of. A chilling reminder of just how close to the financial cliff edge many people choose to lead their lives, irrespective of income level.

Learning that there had been a spate of careers gone missing was unsettling. My mild unease escalated to feeling troubled.

I was fortunate that for me work is mostly optional. The same could not be said for my former colleagues or industry contacts.

No vacancy

Could my career have been abducted? Lured away by an advertisement promising a nice safe home for its accumulated skills, knowledge, and experience?

The brief searching I had done on the job boards and LinkedIn suggested this was a long shot. There were no adverts for roles with the last few job titles I had held on client projects. Not a single one.

I spoke to a couple of headhunters, who had found me some excellent staff over the years.

They knew the market. Could read the competing forces of supply and demand. Paid keen attention to emerging trends and structural changes.

One recruiter sighed, gave a Gallic shrug, and shook her head.

The other laughed out loud. Normally an infectious musical sound that brightens the day of all who hear it. Today it was a touching combination of sympathy and despair.

They shared a story of woe.

My empty search results had not been a bizarre one-off.

Clients were no longer looking to fill those types of specialist roles. They hadn’t been for months.

A confluence of uncertainties and anticipation of impending economic doom, that had not yet shown up in bankruptcies, loan defaults, purchasing managers indexes, or unemployment statistics. The clients were fearful that economic disaster lurked, like an imaginary monster hiding in the dark beneath an over-imaginative child’s bed.

Firms were not commissioning new projects.

Existing programmes of work were being mothballed. Or cancelled.

They were not backfilling existing roles as they became vacant. Cost-cutting was the new normal.

Resources were being channelled into war chests. Contingency funds earmarked to navigate through stormy waters of bad debts, cancelled orders, and reduced demand. Eyes open to opportunistic mergers or acquisitions, should competitors or suppliers stumble and fall.

We briefly discussed the sorts of roles that they were being asked to recruit for.

Permanent positions.

Offering materially lower salaries than the market had demanded over recent years.

Seeking cost-effective generalists, to keep the lights on and the engines running,

Niche specialists were viewed as a luxury. An expensive indulgence. Affordable during boom times. Not so today.

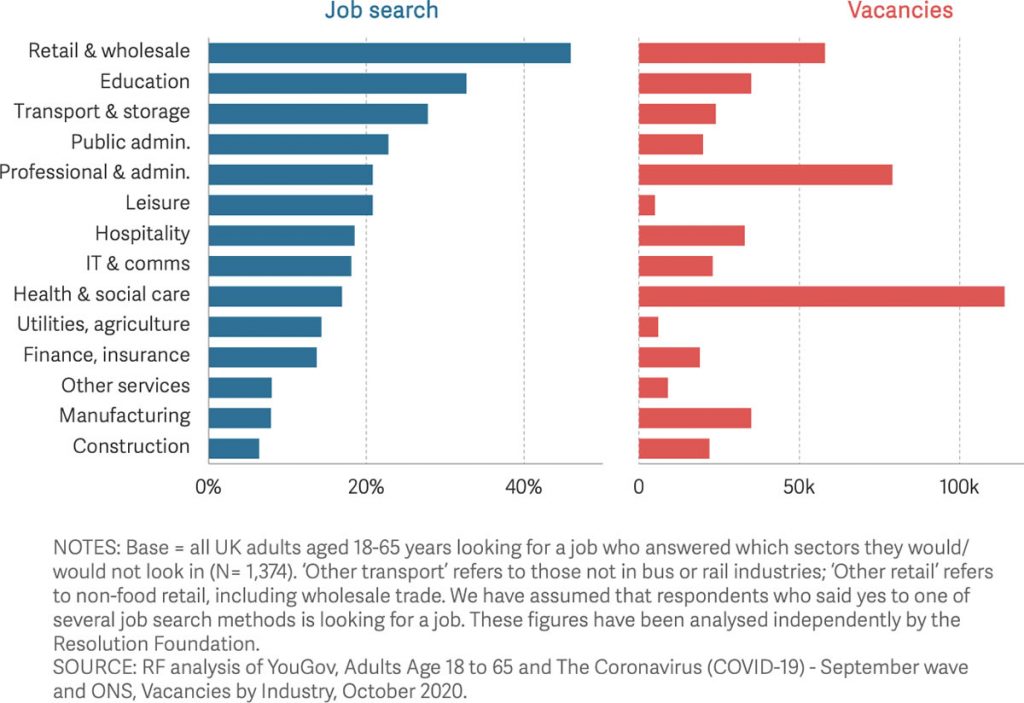

Job searches versus job vacancies. Image source: Resolution Foundation.

The order of the day was quick. Easy. Cheap. Certain. Seldom good, but usually “good enough”.

Accelerating pre-existing trends. Hastening the demise of the dinosaurs.

Cloud-hosted Software-as-a-Service. Not bespoke software developed in-house.

Configure. Not customise.

Built to solve a specific problem for millions of customers around the world. Not the mere handful of folks at a specific site, where inflated egos thought they were special and their needs were unique.

Greatly reducing the demand for in-house techies with job titles ending in architect, designer, developer, modeller, or tester.

These roles were said to be consolidating into a small number of catchall “engineer” positions. Harking back to the difficult market of the early 2000s, when one smart “Analyst Programmer” did a little bit of everything and got the job done.

The recruiter’s margins were under pressure. Their commissions had dried up. Redundancies were rolling through their industry, thinning their ranks.

Echoing a sentiment shared by the hungrier of my former colleagues, they wondered if there was a future in their current profession over the next year or three?

Choose your own recession

My search for my missing career had taken a dark turn. Official unemployment levels remained relatively low, for now. Yet the folks who ply their trade at the top of the work pipeline were unemployed. In normal times they would be busy getting business cases signed off and incepting programmes, work that would subsequently employ tens, hundreds, or thousands of people.

Their unemployment is like a rock being dropped in a pond. The ripples spreading across domains and industries for quite some time to come. With that work not taking place now, few of those tens, hundreds, or thousands of people would have projects to work on in six to twelve months time. Another flashback to the job market of the early 2000s.

Those who were in work had dug in, hunkered down, and done their best to appear indispensable.

Those who weren’t, worried. Desperately hoping to find a way they could jump on board the pandemic healthcare and pharmaceutical gravy train. Unable to see where else their next job might come from.

All were daunted by uncertainty. Scared of the unknown.

Business confidence was down.

Consumer confidence down also.

These things become self-fulfilling, the way recessions are made.

Hearing the anecdotes and sentiments from my former colleagues was troubling. I wouldn’t wish what they were going through on anyone. Finding their careers had been interrupted was humbling. Learning there was little they could do about it was a brutal hit to their confidence.

In time, many will reinvent themselves and recover in a different guise.

For some, their missing careers would prove permanent. Discovering that the world had moved on. Their skills and experience qualifying them to fight the last war, but leaving them ill-equipped and unsuited for the next one. Their skills as relevant as chimney sweeps, coal miners, nightsoil collectors, and wheelwrights. Joining the ranks of the “left behind”.

Several emergent structural changes were evident from the experiences of my former colleagues.

Those who had been independent freelancers suddenly discovered that clients were no longer buying what they were selling.

Partly basic supply and demand. Renting an extra pair of hands only makes sense when there are additional productive tasks to do beyond the capabilities of the recurring workforce.

Partly a new tax regime had instilled uncertainty amongst clients. They feared finding themselves liable for unpaid taxes and penalties, should a freelancer be deemed to be a “disguised employee”.

Those who had been consultants suddenly discovered the utilisation trap.

Large consultancies subcontracted to smaller specialist consultancies on a project by project basis.

This way the big firm retained control of the client relationships and used their dominant market position to influence market rates. Meanwhile, the smaller firms assumed the hiring risk.

Employing professionals with niche skills as permanent employees, then betting they could string together sufficient engagements to cover their payroll.

A business plan that works until it doesn’t.

Consultancies no longer maintain much in the way of bench depth, so any consultant who is unable to get themselves assigned to billable projects tends to perish.

New beginnings

Some of my former colleagues had exhausted their options and run out of time.

A few had signed on as pre-sales consultants with software vendors.

Working for peanuts, their remuneration tied to sales performance. A herculean task in the current market, demanding skills and experience that they don’t possess. I wish them luck, they are going to need it.

A couple had taken huge leaps down the career ladder to join startups.

Dubious business plans and poor product-market fit meant these engagements would likely be shortlived. Confronted by their advancing years like never before, as they realised they were old enough to be the parents of many of their new co-workers.

Even worse, they had trouble keeping up with those bright youngsters! Kids who instinctively approached problems with an “at scale”, API based, cloud-native, iterative agile, mobile-first, open-sourced mindset. The polar opposite of the traditional megacorp “Big IT” approach, where they had learned their trade.

These gigs should provide my former colleagues with somewhere to re-skill and rebuild their market value.

Hopefully, those out of work are successful in reinventing themselves. Evolving a skillset that the market values and demands.

For the rest, the choices are not much different to those faced by the generations which preceded us.

Buying a job via a franchise or taking on a business based upon the sale of their time.

Joining the non-profit sector.

Taking early retirement.

Volunteering.

My search for my missing career proved unsuccessful. It may come home when it gets hungry. Or perhaps not at all.

Which poses some interesting questions.

What I do instead of a winter working hibernation this year? Amidst recurring lockdowns and long-running travel bans.

The break with my established seasonal working routine presents an opportunity of sorts.

Whatever I end up doing, five years of leading a “work a little, play a lot” semi-retired lifestyle was a good run. While it lasted!

References

- Brewer, M., Cominetti, N., Henehan, K., McCurdy, C., Sehmi, R. and

Slaughter, H. (2020), ‘Jobs, jobs, jobs’, Resolution Foundation - Centre for Retail Research (2020), ‘Who’s Gone Bust in UK Retailing in 2019-2020?‘

- Jones, C. (2020), ‘The jobs market is far bleaker than the headline stats show’, Financial Times

- Strauss, D. (2020), ‘London a recruiting black spot as rest of UK recovers‘, Financial Times

Carolyn 2 November 2020

I guess few of those you describe in your piece will have signed on, either out of shame or because they have not yet reached that rung on the ladder, desperately trying any and all other options first. This means they won’t appear in the unemployment stats, and perhaps many never will, leading to a distortion of the picture of how truly awful things are.

We’ll see the effects of this all the same – how many of this subset of the workforce employ cleaners, gardeners, nannies? How many kids are we going to see yanked out of private school? Weekly shopping done in Lidl not Waitrose?

The trickledown effect on the economy will be huge.

{in·deed·a·bly} 2 November 2020 — Post author

Thanks Carolyn.

Most of those I spoke to without jobs had already registered for unemployment benefits. I was actually surprised how quickly some of them had gotten over their pride to do so, that wouldn’t have been easy for them.

Unfortunately however, lifestyle costs often matched former earnings, so the benefits available didn’t come close to bridging the gap between income and expenditure. Once mortgage holidays come to an end and savings are exhausted, they will face a major cash flow problem.

Firetheemployeemindset 2 November 2020

alas you will find it again

{in·deed·a·bly} 2 November 2020 — Post author

Perhaps. Or perhaps some reinvention is overdue for me also. It will be fascinating to see how things play out.

Firetheemployeemindset 2 November 2020

all part of life’s rich tapestry

FullTimeFinance 2 November 2020

You could always follow the secondary path of the internal consultant path. Pays less but fairly cushy. That’s where I sit these days, and baring the end of my employer I’m relatively safe. Someone has to tell the overpriced consultants what config is needed for legal and process reasons in good times. ;). In bad someone had to tell the company where they can trim the fat.

{in·deed·a·bly} 2 November 2020 — Post author

Thanks FullTimeFinance, that is a good suggestion. I’ve performed similar sounding roles as the “independent” outsider, playing bad cop to deliver news that boards usually already know but feel better about acting on once they have purchased an outside opinion.

Q-FI 3 November 2020

I really enjoyed this post. Well written and hilarious witty humor. That’s a great blog name as well.

Good stuff and best of luck in your next adventure.

{in·deed·a·bly} 3 November 2020 — Post author

Thanks for the kind words Q-FI.

David Andrews 3 November 2020

Your post parallels the experiences of some of my former colleagues. Many will get a shock when they see what awaits them in the area of state benefits.

Savings, redundancy money, investments etc will need to be deleted before any help can be obtained beyond JSA. Over the past few months I’ve seen much wailing about the perceived unfairness of that and many may wonder why they bother saving if others who didn’t can access benefits sooner.

My partner is a contractor and she was laid off about 5 months ago. She has gone in to full on mega frugality mode, even though she is financially independent. I remain employed as I’m one of those IT generalists who is mostly able to keep the lights on.

I’m pretty certain my household will weather this latest storm. Mortgages are paid, debts at zero and a decent emergency fund gently depreciating. Many households will not be so fortunate.

When I was made redundant 6 years ago I had no pride issues when claiming JSA, my infant son and I dutifully attended the signing on sessions which also helped with my NI record.

I fear this is just the start of a very bumpy time. The borrowed money both government and household will need to be repaid.

{in·deed·a·bly} 3 November 2020 — Post author

Thanks David.

Hopefully your partner finds a rewarding gig before too long, good luck with the search.

The government debt is likely to remain on the books for quite some time, and gradually be inflated away. Germany paid off the last of its World War I loans in 2010. In 2015, the United Kingdom was still paying off government borrowings from the 1720s (though they had been refinanced a couple of times along the way).

Household debt has shorter timescales, but the public has been conditioned to kick the can ever further down the road via remortgaging once honeymoon periods have expired. In theory the borrower (or their beneficiaries) will clear the debt upon disposal of the asset, highlighting yet another reason the government does all in its power to keep property prices rising.

David Andrews 3 November 2020

Thanks for your response. I’ve been through a couple of recessions already so I’ve previously learned to live below my income and plan for earnings disruption.

The recent announcements of extending mortgage holidays and credit card freezes confirms that the can has been kicked a little further down the road for now.

Quite what the next few years hold are anybody’s guess – as you say it should be “interesting”

Bob 3 November 2020

Bizarrely the first few paragraphs brought to mind James Blish, Cities in Flight. On reflection he used a lot of Great Depression analogies in a sci-fi setting. Okie communities scouring the galaxy for work being lured into cheap labour.

I’ll let you get back to the point now

{in·deed·a·bly} 3 November 2020 — Post author

Thanks Bob, that is high praise indeed.

weenie 6 November 2020

A good sombre read – good luck with finding your career again, or some other alternative which suits your lifestyle.

I guess I must mix in very different circles – none of my friends (or ex-colleagues I still keep in touch with) have lost their jobs (thus far) and they’re all merrily/grimly (delete as applicable) working from home. One has just started a new job, same role, different industry, higher pay – she has no idea when she’ll be meeting her team face-to-face.

Also, is it not a ‘Gallic’ shrug – something the French would do, not something the Scots/Irish would do?

{in·deed·a·bly} 6 November 2020 — Post author

Thanks weenie. Sounds like your social circle is navigating the pandemic with aplomb!

You’re quite right, Gallic like the French, as opposed to Gaelic like the Celts. In the recruiter’s case it could go either way, based in Glasgow but originally from somewhere near Marseille. I meant the former however, have updated accordingly.

greencat66 6 November 2020

I mislaid my career a few years ago.

A mixture of becoming FI and toxic internal politics meant I decided to cut my hours, moved sideways into a more obscure bit of the company and became a remote worker.

I don’t imagine I’ll be scrabbling around hunting for it in my death bedside cabinet.

{in·deed·a·bly} 6 November 2020 — Post author

Sounds like a cunning plan greencat66, kill two birds with one stone by sidestepping the politics while improving your work/life balance.

You do raise an astute point: observing an absence isn’t the same thing as wishing for its return.

sparklebee 6 November 2020

An apt read for me.

I worked in IT project management and left my job in December thinking I would have some time off then pick up a new job when the new budgets came out in April 2020….

How wrong I was… I am now searching for my career. It has gone missing too and is unlikely to return in the near future. The market has dried up for me. No one is hiring for what I do. They are making do with existing staff or laying off. My last project colleagues have been laid off and I just keep seeing more and more people being let go as projects are mothballed and companies move into survival mode.

So this all rings true for me…

I meanwhile sit it out on my savings, can’t claim anything but JSA and then it will only pay out for 6 months, so hanging on before looking to claim to make the most of it.

The plus point of FI is that I have my emergency fund and investments to keep me going….

I am sitting it out and wondering what I will do next as I think a reinvention is required.

{in·deed·a·bly} 7 November 2020 — Post author

Sorry to hear you’re having a challenging job search sparklebee.

The approach being successfully adopted by several of my former colleagues who had been freelance IT project managers was to take a step back down the career ladder and apply for permanent business analyst roles in an industry where they possessed domain experience.

Their reasoning was they possessed good stakeholder management skills, and experienced BAs were being given the tasks that would have previously have gone to a junior PM. Another example of generalists surviving.

A second aspect here was their belief that being close to the client made it harder for their roles to be offshored or outsourced. In pre-COVID days this was a common line of reasoning, but now that everyone has been working from home for most of the year I suspect it is a more tenuous conclusion than it may once have been.

Good luck with the job hunt, I hope you find something soon.

Ben 7 November 2020

It’s strange times. To mix some metaphors, the pandemic has been like pouring lighter fluid on a barbecue, accelerating the changes that were already lurking. If you fail to catch the wave, you are drowning.

Internal projects in large corporates that aren’t essential to a future path are being dropped or culled. But tech in general seems strong. So far, there is a lot of cash around and the baselines for return on investments are low. If you are one of the kids that can deploy at scale using agile methods you have a chance (these kids often being in their 30s/40s). The FANGs are still making money hand-over-fist. Currency fluctuations and cheap debt make M&A still a viable exit (if the same world exists in 3-5 years time).

It is scary though. It’s becoming a more Randian world and everyone is so nervous there is little compassion or thought for saving others. Everyone screams they need project managers and scrum masters but few are willing to invest money and time training their own people to get there. Freelancers and consultants have always been on the sharp end of risk, and after 10 years of cyclical spluttering growth will be the first to feel the contractions. Those with tight margins will feel the pain more.

The Internet both helps and hinders. Retrain! There are courses out there! But where to start? Who to trust? Any old cowboy can build a website. How do you know your chosen “future-proof” skill isn’t going to be last years fad?

I guess this has always been a perennial problem with IT. Rapid change has been inherent for 70-odd years. For me, I’ve tried to purposely keep at a low capacity to play with the new toys at the fringe, those toys have often become tomorrow’s essential infrastructure. It’s difficult when agile approaches legitimise 12-hour+ work days and squeeze any redundancy out of any system.

Just some mixed bag rambles today!

{in·deed·a·bly} 7 November 2020 — Post author

Drowning in waves of lighter fluid near a barbecue, now there is a troubling mental image. Thanks Ben, best not play with matches!

Your link to Ayn Rand is an apt one. A disheartening number of projects (dare I say most?) are ego projects. Driven by politics and personality, rather than compelling business case or return on shareholder investment. In down times, the volume of projects greatly reduce, but unfortunately that seldom results in the important ones surviving the belt tightening.

A survival skill is learning to understand the value proposition and being able to follow the money. The winners are able to successfully attach themselves to something that has legs within the organisation, and allows them to learn/preserve skills which the market will pay a premium for once the project has concluded.

This can sometimes be challenging for workers at megacorps, where generations of legacy investment and technical debt constrain their ability and willingness to remain “current“.

To some degree this is a sunk cost fallacy, meaning that few but newly appointed executives or expensive management consultants are able to get away with writing off the old and innovating with something new. “If it ain’t broke…”

By the time long term workers exit the site, some will discover the world has moved on without them. A common end for ageing techies, particularly in financial services.

Freelancers and consultants are by definition disposable staff, providing organisations with the ability to rapidly flex as demand requires. During boom times that leads to high day rates even for commodity skills, but during downturns it tends to leave many without a seat once the music stops.

I applaud you keeping your hand in. It is great to explore new innovations, if for no other reason than to understand the true strengths and limitations beneath all the marketing hype. Often times those innovations will fade into the background, becoming baked into the products we already use rather than remaining discrete products in their own right, but by then we’ll be playing with the next shiny thing so we can bluff our way through job interviews!

Dave 9 November 2020

This is my great fear Indeedably. I think we’re very bad about thinking about risk, particularly the risk that grows steadily and imperceptibly over time. The illusion of “it’s been safe before, it will continue to be safe” is a pernicious illusion and one that has led to environmental disaster (such as Deepwater Horizon) as well as personal disaster, as you point out.

As time progresses, your career, salary, benefits and compensation become more vulnerable – and security is an elusive thing. A pandemic sharpens the mind, but I’ve always been concerned about the “downsized in my 50s phenomenon”, where you are the most vulnerable for cuts. Risk is growing slowly, progressively, over time. Each passing year you are more dispensable and apt to be replaced by someone younger or taken out of the workforce all together. Just because the salary, benefits and bonus have rolled in progressively each year before is not a cast iron guarantee that it will arrive in the next year. The failure risk is growing even if you cannot see it.

It seems to me that the only sensible approach is to cut your cloth accordingly so that you have greater optionality at this point. Perhaps it is still not your ideal retirement age and perhaps you still need to earn for a while longer but you have the financial flexibility to take a backwards step in compensation without the humiliating climbdown you describe. This is the basic risk management principle that we are wise to follow.

I’m still in my 30s and have the advantage of time and (relative) youth on my side but I’m also equally at the stage where lifestyle inflation is becoming rampant all around as people desperately stretch budgets to create a certain lifestyle and the gap between the “haves” and “have nots” is widening year on year. It becomes harder to keep saying “no” when those around us continue to live more attractive lifestyles, seemingly free of consequence. Right up until the point when the music stops.

So I continue to bide my time and do the boring work of constructing a robust safety net that can hold my family’s weight and makes work optional when I get the bullet myself. Because it’s only when the tide goes out you can see who has been swimming naked.

{in·deed·a·bly} 9 November 2020 — Post author

Thanks for sharing that well-articulated comment, Dave.

I think a key aspect of recognising the difference between risk management versus risk avoidance. The former recognises the risk is a real possibility, and gets on with life anyway.

As you correctly observe, we all age. Our ability to weather a financial setback should strengthen as we get older and richer, however our ability to recover from a career setback tends to drop off as we accumulate more grey hair.

My view of the concept of a career is that it resembles a game of “snakes and ladders” rather than a linear progression towards an imagined finishing line.

Sometimes a life happens event sends us tumbling backwards, a setback, but also an opportunity to change direction or reprioritise.

A good example of this might be the experience of migrants, where their qualification or skills are not recognised in their new home. Doctor becomes hospital orderly. Architect is now a bus driver. Humbling. Tough on the ego. But their new reality, for a time.

Those who adapt to their new circumstances will survive. Live within their current means. Invest in themselves to increase the marketable value of their time. Rinse and repeat.

For most of us, it is society that eventually decides we have run our race. That it is time for someone younger to have a turn. A natural evolution, if an uncomfortable reality.

For the rest, ageing, human frailty, and mortality will get us in the end. Even those who seek to mitigate those career risks via owning their own businesses.