What do you think of when you hear the term “millionaire”?

Someone who is rich?

Somewhat wealthy?

Merely comfortable?

Or maybe someone who is doing well enough for themselves, but not quite any of those things yet?

Is your mind filled with images of private jets, luxury yachts, and five star luxury?

Perhaps the ridiculously clichéd balding potbellied middle-aged white guy driving around town in a little red sports car?

The term millionaire was first used to describe someone who had made one million French livres investing in the Compagnie Perpetuelle des Indes. The company synonymous with the infamous “Mississippi bubble” of 1719, and the subsequent collapse of the French central bank.

One million French livres back then would now be worth roughly the equivalent of £14,250,000 today.

25x the average household wealth in the United Kingdom.

Almost 50x the median household wealth.

More than most of us will earn in our lifetimes.

Popular culture retains the association between someone having attained millionaire status and riches. Yet critical analysis quickly reveals that to be an urban myth in many parts of the developed world, harking back to faded glories and nostalgia for the distant past.

GBP£1,000,000 is no longer enough to buy the average house in London’s zone 3, far away from the storied Monopoly streets and postcard monuments that people associate with the nation’s capital.

AUD$1,000,000 won’t buy you the median house in Sydney.

CAD$1,000,000 falls similarly short in Vancouver.

SGD$1,000,000 can’t buy the average property in Singapore.

So much for the misconception that millionaire status is synonymous with feeling rich!

If I had a million dollars…

When I was a kid, I decided I was going to be a millionaire. My father mockingly showed me a photo of a stack of banknotes and told me that was the closest I was ever likely to come to having a million dollars.

History tells us he was wrong about that. I managed to achieve my goal before the age of 30.

Of course, by the time I had one million dollars, it no longer meant what it once had back when I was a child dreaming about the future. Achieving that original purchasing power today would require nearly $2,500,000!

The eye-opening thing about crossing that arbitrary magic number threshold was that I felt no different. In fact, it was several weeks after the event before I realised it had occurred.

Something I had been working towards my whole life proved to be decidedly underwhelming. Meh.

I invested some time pondering how that could be?

Becoming a millionaire was supposed to make me feel safe. Financially secure. Successful.

Financial pressure dispelled.

Daily stresses vanquished.

Control regained.

Happiness bought and paid for.

Yet my day to day living still felt like a struggle. Income barely covering expenditure. Random “life happens” events would cause me to financially stumble, trip, and recover with monotonous regularity.

Eventually, I realised that while I might have been considered asset “rich”, I remained decidedly cash flow poor.

My wealth existed largely on paper, tied up in inaccessible assets.

My business.

Investment properties.

Unrealised capital gains.

Creating a frustrating feeling. Reminiscent of the time as a young child when I discovered my mother had a stash of amazing Hot Wheels cars still in their original packaging. Then not being allowed to play with them because they were “collectables”. What was the point of having toys that nobody could enjoy?

What was the point of this supposed “millionaire” status if it didn’t help me pay for the groceries?

… I’d be rich?

I decided to make some changes to the way I approached money.

I would aim to make another million by the time I was forty. This time however, the goal wasn’t about hitting some arbitrary number on a spreadsheet. It was to feel financially comfortable, the way I had once thought becoming a millionaire would make me feel.

To remove the financial imperative. Separate decisions about how I invested my time from how I funded my lifestyle.

In short: to have enough money that I no longer needed to worry about money.

The first million had been the result of good fortune. Hard work. Having nothing to lose. Selling my life off by the hour.

It had involved sprinting down the road to nowhere, on the hamster wheel of thankless 24×7 technical support. Selling my time and my soul to megacorps, where presentism triumphed over talent, and anyone caught leaving the office before 20:00 was considered to be shirking. Lots of time on the road away from home. Compromising to the point being compromised for work visas.

All choices a young single person might make when they lack the ancestry, experience, network, and skills necessary to have any other viable means of achieving their goals.

By that point, I had become a husband, and father of a baby boy who rarely slept.

My days were spent at client sites. The nights a blur of bottles. Nappies. Seemingly endless tears.

Our household income had dropped by the equivalent of a wage. Initially due to stay at home parenting and no paid maternity leave. Later, via nursery fees and the cost of an after school nanny.

I wanted to spend time with my son. To be there when he needed a father. To be his friend. All demanding different prioritisation decisions to those my own time-poor parents had made while doing their best to raise me.

The next million required a smarter approach. Selling time doesn’t scale, and only gets you so far.

I realised that while capital gains make you “rich”, it is cashflow that makes you feel rich.

My new plan generated some cognitive dissonance: I wanted to earn more AND work less. Simultaneously, not sequentially.

The way to resolve those inconsistencies was to get smarter about how I approached things.

I began delivering solutions rather than charging day rates. Taking on delivery risk, and profiting from my hard work. Hiring staff to work for me, rather than working as an extra pair of freelance hands.

Performing activities that added value. Outsourcing jobs that were best done by others. Ignoring the meaningless busywork tasks that had previously consumed so much of each working day.

My new way of working was far from perfect. Greater risk in pursuit of greater rewards. Yet inevitably swapping one set of problems for another. Collecting debts. Curating relationships. Rainmaking and sales. Ringmaster of delivery. Staff management, mentoring, recruitment, and retention.

Some fun. Others not. Always challenging.

The most notable change was taking conscious control of my working hours. No more evenings or weekends spent working. Greatly reduced business travel. Starting each day with a leisurely school drop off, rather than battling the peak hour hordes on public transport.

In hindsight, this had been possible all along. It was a matter of choice and self-confidence, rather than empowerment or changed working conditions.

That sparked another realisation. The majority of changes could already be accomplished in some form today. There had been no need to wait until I had crossed an arbitrary self-imposed finishing line. Delaying was the stuff of procrastination and excuse, rather than legitimate reason.

I began to adjust my asset allocation so that my investment portfolio would generate more free cash flow. This was a protracted exercise, no small task.

Purchasing rather than renting where we lived. Maintenance, mortgage interest, and service charges were collectively much lower than the rent we had been previously been paying the landlord.

Reducing leverage. Investment properties now generating cash rather than consuming it. This slowed the pace at which my portfolio expanded, but it made the ride a lot more comfortable.

Shifting away from investing in individual stocks based upon short term bets. I gave up closely following the financial press and reading business magazines. Too much noise, too little substance.

Focussing instead on establishing or extending long term positions in up and coming companies that had strong strategic prospects and should generate good total returns.

Positions I still retain today, though now I subscribe to the low-cost passive index tracker route. Mostly!

Feeling like a millionaire

For a time everything (on the financial front at least) seemed to work like clockwork.

Goals and behaviours aligned.

Work and home life relatively balanced.

I finally escaped from the work visa trap.

For the first time in years, it felt like I had surplus cash flows and control over my time.

Another realisation, that the pressure had always been driven by a lack of control rather than money.

While my business was making reasonable money, it was the compounding of my existing assets that generated far more. As the old saying goes, “money makes money”.

I reached my revised target around the time my second son was born. He didn’t sleep much either!

By that stage, I had realised that shooting for a static magic number was folly. Inflation erodes purchasing power over time, making a long term goal easier to attain, while reducing the significance of the eventual achievement.

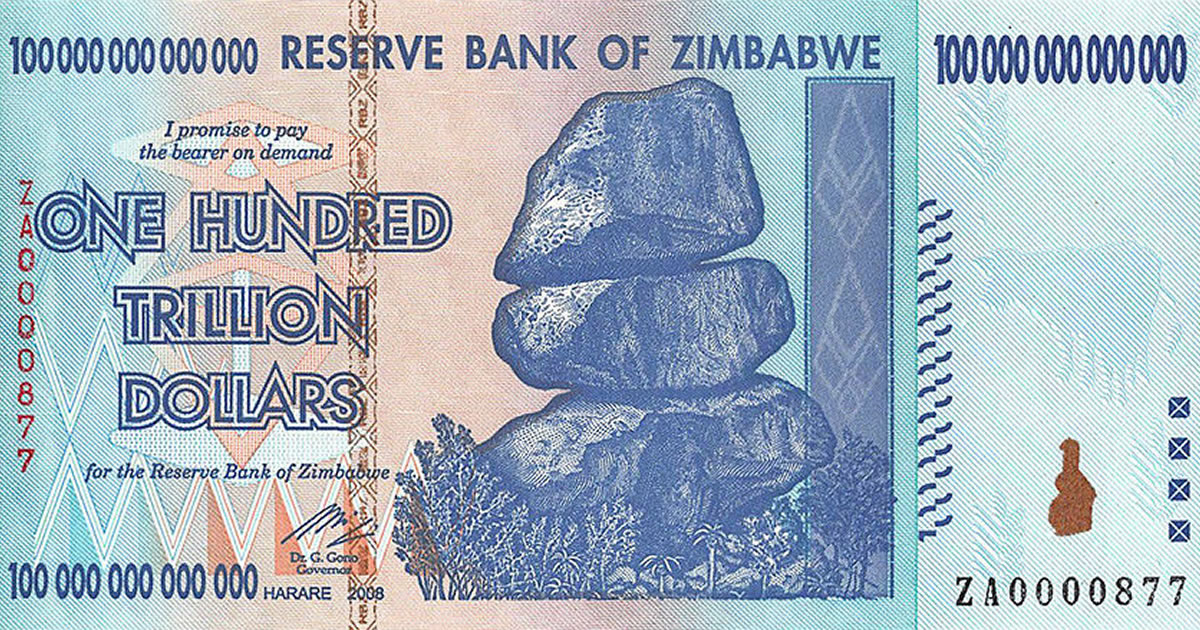

Inflation makes hitting magic numbers easier, but erodes purchasing power. Image credit: BankNoteWorld.

If all those mortgage-free owners of those average houses in London, Singapore, Sydney, and Vancouver are millionaires, then surely that means being a “millionaire” is no longer extraordinary?

It is not even that remarkable, given all they had to do was buy their own home twenty years ago, pay down the mortgage, and wait.

Watching my net worth number go up and down each month had been mildly entertaining, but it was seeing the free cash flows hitting my bank account, and having money remaining at the end of the month that left me feeling relieved.

Reduced stress.

Less pressure.

More freedom.

Beginning to feel like the “millionaire” I had envisaged as a child all those years ago.

I had reached the point where I had enough money to no longer worry about money. A mindset, not a bank balance.

Time investment decisions made (mostly) because I wanted to rather than because I had to.

A brush with mortality led to some introspection and further changes in priorities. I had long since fallen out of love with my chosen profession, and had two entertaining kids at home whom I wanted to spend more time with.

After a bit of experimentation, and plenty of trial and error, I adopted a semi-retired lifestyle following a seasonal working pattern. My financial goals are now focused on building and maintaining those passive income streams.

Something that should largely take care of itself, with or without my help.

Leaving me plenty of time to explore the great unanswered question of the FIRE movement: what comes next?

References

- BankNoteWorld (2020), ‘Zimbabwe 100 Trillion Dollars Banknote‘

- Bare Naked Ladies (1988), ‘If I had a million dollars‘

- Beattie, A. (2019), ‘What burst the Mississippi bubble?’, Investopedia

- Boynton, S. (2020), ‘Home prices in Metro Vancouver continue to fall, but average still sits over $1M: report’, Global News

- Domain (2020), ‘Domain House Report – June 2020‘

- Edvinsson, R. (2016), ‘Historical Currency Converter’, HistoricalStatistics.org

- Gold Price (2020), ‘Price of gold‘

- Office of National Statistics (2019), ‘Total wealth in Great Britain: April 2016 to March 2018‘

- Reserve Bank of Australia (2020), ‘Inflation Calculator‘

- Rightmove (2020), ‘House Prices in Zone 3‘

- Seah, S. (2019), ‘S’pore’s private property second-most expensive in the world: CBRE report’, Today

Fire And Wide 9 October 2020

Love it. For us it was always about cash-flow. The net-worth/millionaire status being meaningless. It’s what you can do with it that makes a difference. Having ‘enough’ – whatever that means to you, as it’s so personal to each of us.

In some ways we occasionally miss the FIRE journey stage – it’s always a fun feeling to achieve a goal. But not for long though. I can defn say the next part of FIRE is even more fun.

We’re setting ourselves new challenges, new goals – but ones determined by everything and anything apart from the need for money. It’s so freeing, it’s unreal at times tbh. I can see why some people find it scary, it’s very much a mind-set thing to make the most of life.

{in·deed·a·bly} 9 October 2020 — Post author

Thanks Fire And Wide. Well done on progressing to the next phase, a fantastic achievement.

The importance of cash flow is obvious in hindsight. Often gets lost in the targeting of arbitrary magic net worth figures though.

Accumulation funds, age-restricted pensions, home equity, and tax policies that favour buybacks over dividends as the preferred form of capital distribution mechanism for shares all easily divert us from focussing on maximising positive cash flows.

I agree that the earlier parts of the journey, where progress is tangible, are fun to watch and in some ways are missed when they are gone. These days I target the lengths of my winter working hibernation based on how much (little) cash I need to make to bridge the gap between lifestyle costs and passive income. Which in turn means that for over the course of a year inflows and outflows tend to pretty much match. Long gone are the days where my bank account reliably contained more cash at the end of the month than the beginning!

GentlemansFamilyFinances 9 October 2020

As someone who is just on the cusp of 7-Os, I firmly believe in what you write here.

I suppose it all depends on your mentality and for some millionaires they’ll feel poor compared to the multi-millonnaires. There will always be richer Joneses to envy.

Maybe the best way to live is to be rich enough to be happy, maintain the freedom you can have and make those around you happy too. For us, I can’t ever imagine going back to working full time plus a commute – you opt for seasonal employment which is something that I might try.

Of course freedom comes at a price and choices (particularly with kids) must be made .

Money gives you the options but doesn’t make the decisions – whereas making the money requires some sacrifice and dedication to get there. What comes next as you say – a question few can ask and only you can answer.

{in·deed·a·bly} 9 October 2020 — Post author

7 x zeros is impressive GFF, £10,000,000. No wonder you’re done with the full time daily grind! ?

For me chasing a magic number was a placeholder while I figured out what I wanted to be when I grow up, and what made me happy. 30+ years on, I’ve concluded both are moving targets and transient states of being.

I suspect what comes next will similarly evolve, that has certainly been my experience after five years of living a seasonal “work a little, play a lot” lifestyle choice.

As those renowned Canadian philosophers, The Bare Naked Ladies, once pondered: “If I had a million dollars…”

David Andrews 9 October 2020

Totally agree about that “meh” moment when you realise you’ve hit that magic number. Some also talk about the magic day when the mortgage balance drops to 0. We’ve always lived below our means and sought value in our purchases. I don’t feel we’ve missed out on anything so far. I’ll probably hit the £2 million mark in a couple of years if I can cope with the prospect of working for a couple more years. It would probably take a few more years than that if I follow my heart and quit at year end. Just beware of the upcoming potential of “wealth taxes” as I think those in the millionaire club will be prime targets

{in·deed·a·bly} 9 October 2020 — Post author

Thanks David. Sounds like you have adopted a sound approach there.

When the mortgage disappears there should be corresponding tangible increase in cash flow, as the monthly payments no longer leave our bank account. That was my experience anyway, back in my days as an owner-occupier.

It will be interesting to see which way the authorities jump when it comes to wealth taxes.

A “soft” form would be rolling back some forms of middle class welfare and raising taxes on investment income. For example, aligning tax rates across PAYE income, capital gains, dividends, etc. Possibly also removing some of the exemptions, such as tax free pension contributions and capital gains tax exemptions on owner occupied property.

Some countries have sought to discourage property investment by non-residents via wealth taxes, (unsuccessfully) hoping to avoid driving up the property prices and avoid pricing out the locals. In those instances a recurring percentage based “wealth tax” has applied.

Finally, some countries go the “hard” form. A percentage based wealth tax over a given limit. Those are the ones that scare me. Chases the high earners abroad to more favourable locales, and herds the rest into tax avoidance vehicles like offshore companies and trusts.

David Andrews 12 October 2020

I’ll be keeping a close eye on any new proposals and their potential impact. I’m aware that I’ve been lucky by being born at a time when University fees were mostly free, housing was relatively affordable and I really got lucky by having 14 years of stable employment and a final salary pension scheme, sadly taht ended in 2014.

I’m sure some would look at my net worth and instantly classify me as rich, but at times it doesn’t feel like I’m rich.

About 66% of my wealth is tied into pension schemes that will be subject to tax when I start to access them. Oh, and If I save too much I’ll be potentially subject to additional tax if I breach the AA and or LTA.

The remainder is split between property and ISA holdings.

The property element was subject to tax when I bought them, tax on the rental income and potentially CGT if and when I sell my rental property. The ISA holdings were accumulated from taxed income.

I also pay VAT when I (occasionally) buy things.

Life definitely isn’t fair and I accept this. However, the handling of so many decisions recently but those in authority has been sufficiently woeful to demonstrate that “my” tax money is not being well spent. If I ran my household in the same manner we’d be in deep trouble.

We already have a number of wealth taxes, loss of Child Benefit if you earn too much, tapering of thresholds if you earn too much, exclusion from state support because you saved too much.

As you mentioned, I suspect “they” will try the soft form initially. Trying to perform a hard wealth tax will be tricky – especially if they target property wealth.

One month your house could be worth 750k and the next month it could be worth considerably less. Who would come up with the valuations ? Would you be compelled to sell if you could not pay the wealth tax ?

As a notorious American once said “Mo Money Mo Problems”

{in·deed·a·bly} 12 October 2020 — Post author

Careful not to confuse “enough” with rich. We’re all so influenced by the images we see portrayed in the media that rich is the lifestyles of those shown on tv shows like Billions or Succession.

United Kingdom Inc. is not a well not organisation. If it were a business, it wouldn’t remain in business all that long. That said, there are many other countries that levy a higher tax burden on their citizens and corporations. Possibly a sign of things to come, time will tell.

There are a few different models in use around the world. I wrote about one such model here.

That is not uncommon in the United States for example, as neighbourhoods gentrify the original residents get priced out and forced to move on.

weenie 9 October 2020

Well done on reaching your revised target.

My idea of a millionaire is still very much the image of Scrooge McDuck diving into his pile of gold coins, ie someone with a million in the bank or in liquid assets, which I guess aligns with the importance of cash flow you mention.

Aside from winning the top Premium Bond prize or the lottery, I’m never going to be a millionaire but I’m ok with that, it was never an aspiration of mine (though a nice dream!). In any event, if I did win a million, I’d give a lot of it away – who needs that much money? 😉

{in·deed·a·bly} 9 October 2020 — Post author

Thanks weenie, it was a few years ago now.

One thing that has evolved over the years is the currency in which I did my mental accounting. When these goals were set it was still the currency I grew up with, but over time I’ve gradually found myself defaulting to the British Pound. Made the numbers in the revised goal a bit of a nonsense by the time I reached them I guess, but I figured that was the target I had set myself so that is what I should aim for.

One thing I’ve always wondered about Scrooge McDuck is how he didn’t knock himself senseless doing a face plant into that mountain of coins? A bully at my high school used to beat people up using a sports sock full of 50p shaped coins, I can only imagine what diving face first into a swimming pool full of them must have felt like!

fatbritabroad 10 October 2020

Not quite cash flow but this is why the penny dropped about Isas a couple of years ago. It’s a not all about tax.

Not a millionaire but had decent equity in house and pension and felt poor. Fast forward to today and now have a decent amount in Isas which being readily accessible make me feel far wealthier

{in·deed·a·bly} 10 October 2020 — Post author

Thanks fatbritabroad.

That feeling you speak of is a keep part of it. The mindset. Knowing you could access/use the funds if required. You sleep better as a result, free from much of the money angst you might experience without those funds or if they were locked away in an age-restricted pension or illiquid business interest.

Northern Lad 12 October 2020

I think it’s easy to get desensitised to X level of wealth – esp. if you get into ‘runaway mode’. But for someone who is a similar age to when you became a millionaire, sitting on around £40k new worth + some home equity, £1m still seems an unfathomably large pot. I haven’t looked it up recently, but it’d put you in, what, top 10% of all households across all ages, never mind the fact you were in your 20s and inflation has continued since then? I agree cashflow > net worth when it comes to how it feels, but you’re far from typical and it *is* an achievement. For most people, I dare say accumulating £1m is still hard to imagine. That’s almost 30 years of post-tax salary for me, and I’m in the top 5% of my profession (public sector) so not even a career slouch.

{in·deed·a·bly} 12 October 2020 — Post author

Thanks Northern Lad, congratulations on having a positive net worth! You’re doing better than many, once student loans and mortgages are factored in.

I’d go a step further, I think it is inevitable that we become desensitised to X level of wealth. For example, your current net worth would no doubt have seemed like a princely sum to your former college aged self. In 20 years time you will look back and marvel at just how much it was possible to purchase with that sum of money.

How “rich” a person feels is determined by the relative size of the gap between their income and living costs. Your public sector wage would put allow you to live like a king in Cambodia, but would likely struggle to make ends meet in Chelsea.

Your net worth would put you in the top 1% in Laos. However, it couldn’t purchase a car parking space in central London.

The amounts are the same, the difference is the lens we view them through.

Wherever we choose to live, we maximise our contentment with our lot in life by living within our means and maximise the value of our marketable skills. Getting those two right is half the battle.

David Andrews 13 October 2020

Living within your means and deciding to invest any pay rise / bonus you get has the potential to accelerate you journey. Many people see extra incoming funds as an opportunity to upgrade their lifestyle even if they may not really need to. I’ve probably gone a little extreme in my frugality and that supercharged my savings.

Build an emergency fund, pay down expensive debt, invest in yourself and keep your skills marketable.

Keep up to date with the financial landscape and make investments that you are comfortable with. That might be ISA’s, additional pension contributions, salary sacrifice etc. I’m pretty much at the point where my investments meet my household’s day to day expenses which allows me to allocate almost my entire salary into investments.

southwalesfi 17 October 2020

Seems like it might be time to change the cashflow (up) to start spending some of the assets- or least the return that they produce, otherwise, what’s the point- as you say, of continuing to aim for a greater and greater number.

{in·deed·a·bly} 17 October 2020 — Post author

Thanks southwalesfi.

That is relatively simple for shares or funds. However it is easier said than done for interests in unlisted businesses or directly owned property, as you can’t readily sell off just a small portion of the asset.

United Kingdom based folks who chase the tax advantages of investing via age-restricted pensions may face similar constraints before they reach the age of pension accessibility.

GFF provided a convenient case study of this in action with his post today. 57% of his net worth is currently trapped in home equity or pensions he can’t access for at least another 20 years (based on current rules).

So while becoming a paper millionaire is an awesome achievement, were he to down tools and declare financial independence today, that remaining 43% would need to fund all his family’s living costs for the next 20 years. With young kids in nursery and a mortgage to pay that may be doable, but I suspect it leaves less margin for error than he may be comfortable with.

GentlemansFamilyFinances 18 October 2020

Absolutely right.

In general the mismatch between assets and cashflow can make people do silly things (investing in crypto through scammers, shipping containers or car park spaces or just taking out an equity release mortgage).

The benefits of investing in pensions are obvious and you can work out which is best for you but if you can’t touch them for 20 years (in my case) you run the very real risk of being desperately poor until retirement age and then you are too old to enjoy the fruits of your labour (discount life flow I call it).

For us personally; based on our pre-pension assets and current cashflow requirements, we are not out of the woods yet. Especially since the house is still mortgaged (£8k cashflow drain per annum).

Based on these things we might run out of money before 58 but at least LISAs offer some protection. Also no one really spends all their money – andnif they do the generous state will.grant us cushy benefits to tide us over.

There’s always work as well but let’s not worry about that nust yet.