Five year old me took a deep breath and nervously approached the toy store cash register.

I reverently placed the action figure on the counter.

Trap jaw action figure. Image credit: He-man wiki.

I had been dreaming of playing with this toy for months. However as it wasn’t Christmas or my birthday, my parents had firmly refused.

If I wanted it, I would have to pay for it myself.

They thought that would be the end of it.

They were mistaken.

I emptied my money box.

Dropped coins found in the street had been rescued.

I volunteered to do every additional chore I could physically manage, earning a few cents for each.

Painstakingly slowly I accumulated the money I needed.

Today I had finally saved up enough!

A disinterested teenager noisily chomped open-mouthed on her chewing gum as she rang up the sale.

“That is $7.99.”

I swung a heavy drawstring bag onto the counter. My shaking hands carefully withdrew individually wrapped packages of 1¢ and 2¢ coins, each adding up to $1.

“1… 2… 3… 4… 5… 6… 7… 8.”

The girl’s face rapidly cycled through a gamut of emotions.

Boredom. Surprise. Alarm. Frustration. Anger.

“Oh for fuck’s sake! You have got to be kidding me!” she exploded.

I blinked, instinctively taking a step back from the angry adult.

The shop assistant tore open the first package and poured a torrent of copper coins onto the counter.

She started counting. Some time later, she arrived at 100.

The shop assistant shot a death stare at the seven remaining, meticulously hand wrapped, parcels of coins sitting on the counter.

Then she turned it on me.

“Do they all add up to 100?” she demanded suspiciously.

I nodded, remaining out of reach.

She shrugged, threw the remaining unopened parcels into the cash register drawer, and thrust the toy towards me.

I edged forward to take it from her, then bolted for the exit clutching my treasured new possession.

Having just realised my dream and achieved my goal, I should have been elated.

Instead I quietly cried the whole way home, my first experience of “buyer’s remorse”.

I had worked hard for that money, and felt a real sense of achievement when I had saved enough.

Now it was all gone.

In its place, I had an empty money box and a hollow feeling in my stomach.

Beginner level finance

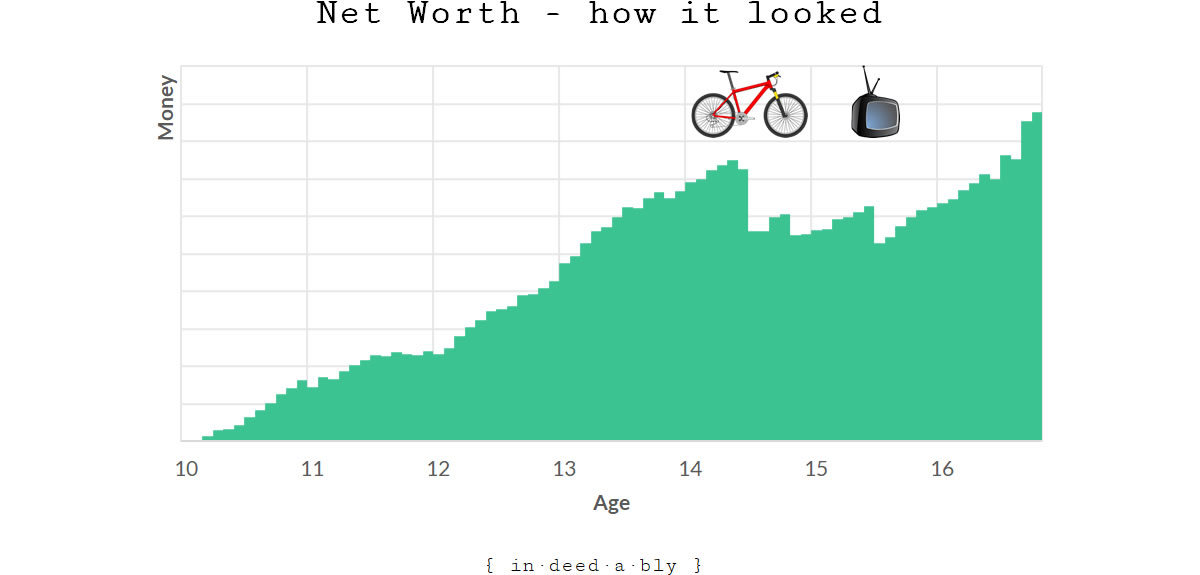

I started tracking my spending when I got my first job as a ten-year-old paperboy.

I remember the thrill of seeing my bank balance grow with each pay.

There was a tangible relationship between the effort I expended and the rate at which my net worth increased. The more I worked, the faster my wealth appeared to grow.

Beginner level finance: hustle equals money.

I celebrated the doubling of my wealth!

Not long afterwards, I celebrated it happening again!

However the interval between those celebrations lengthened as the size of the numbers increased.

My rate of acceleration slowed.

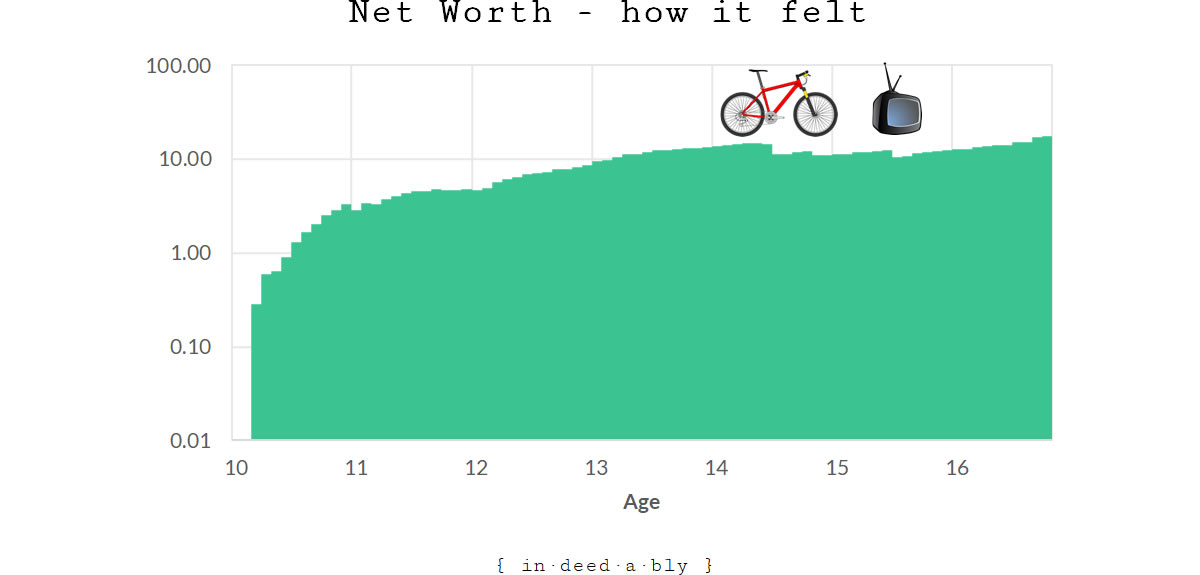

The chart above showed my actual progress, while the chart below illustrates how that progress felt, using a log scale to present the same data.

I next experienced that “buyer’s remorse” sinking feeling after I made two memorable trophy purchases, during my brief period of beginner level finance.

With each of these purchases, my net worth took a noticeable hit.

By this stage I had already started measuring outgoings in terms of the effort expended to earn their purchase price.

A bike to ride to school, cost me 108 laps of my paper route.

A television, so I could avoid parental disapproval while watching the late-night broadcasts of the Formula 1 and Star Trek, required a further 70 rounds of deliveries.

The emptiness of attainment

This strange anticlimactic feeling when attaining goals proved to be a recurring experience throughout my life.

Graduation. Being offered jobs. Landing clients. Completing projects. Getting married. Having children.

Whatever the goal or milestone, they followed a similar pattern:

- a sense of anticipation and build up while chasing the goal

- a brief and fleeting sense of achievement and pride when attaining it

- followed almost instantly by a sense of restlessness and the thought “what’s next?”

It turns out I love the thrill of the chase far more than realising the goal. Perhaps there is some truth to the urban myth that greyhounds won’t race anymore once they catch the electronic rabbit!

Just as the acceleration rate of my wealth accumulation had slowed over time, so too did the frequency with which I experienced this anticlimactic “buyer’s remorse” feeling.

I thought about this for a while. Why had the instances of this feeling become fewer and further apart?

Eventually I realised it was because the point at which I ceased caring was getting ever lower.

As a 5 year old, buying a toy was the biggest thing in the world. Getting shouted at by an adult was terrifying.

By the time I was 14, anything smaller than acquiring a bike or television didn’t really matter. Adults were people to be wary of, but no longer scary.

In my early 20s my noise threshold had shifted further. Graduating university and getting a job were my whole world, but buying a car or couch barely registered. Only people with the direct power to adversely impact my life, such as my employer or the police, were daunting.

By the time I was 30 getting married and having kids were mountain-esque, yet qualifying as a financial planner or being sued were merely minor bumps in the road. Everyone was just a person much like me, regardless of how big or important they thought themselves to be.

I’d gradually learned to follow my old rugby coach’s advice:

“don’t sweat the small stuff”

intermediate level finance

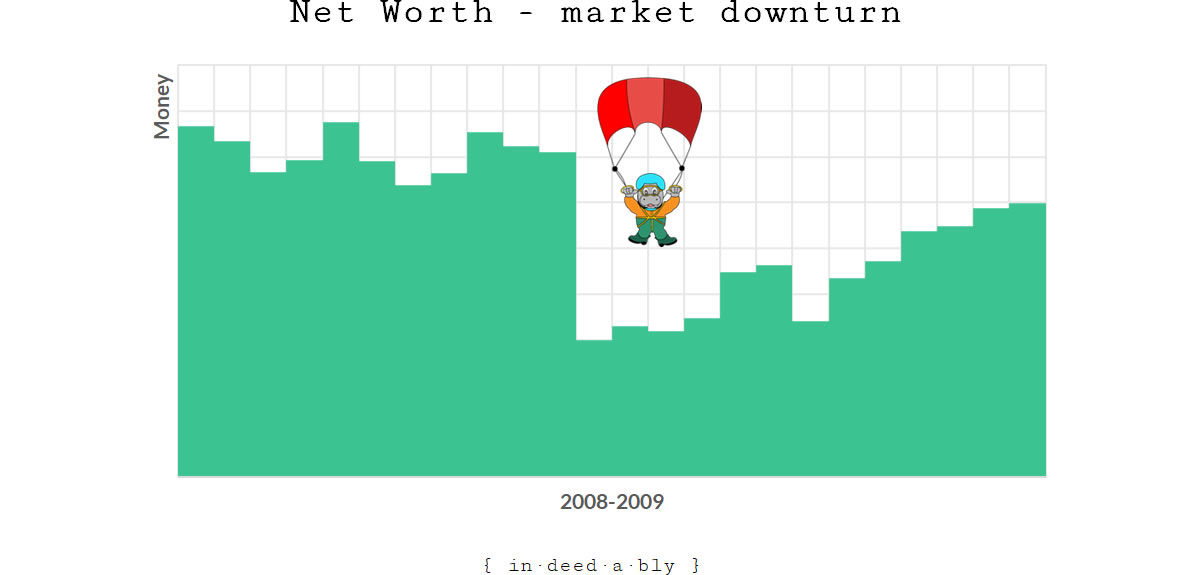

One day in my late teens I started investing the money I earned but hadn’t spent. An interesting thing happened.

Before long, the day’s share price movements would have a greater impact on my net worth than my wages did. This probably says more about my meagre income than the volatility of the markets!

If the market went up I was rewarded regardless of whether I had worked that day.

Conversely, when the market gods crapped on me from a great height, I could have worked all day and still be worth less than I had been when I woke up that morning!

That previously tangible relationship between effort and wealth had been severed.

Intermediate level finance: hustle does not equal money.

The larger my portfolio grew, the less impact my day to day earnings had.

For example, the stock market wobbles during the Global Financial Crisis “cost*” me more than a decade’s worth of earnings. Or to apply the effort scale I used earlier, the drop was roughly the equivalent of 200,000 laps around my old paper route!

That made it through my noise filter and captured my attention!

Conversely on several occasions, rising property values have “increased*” my net wealth by more than I have ever earned in a year.

* you only actually make or lose real money when you sell, in-between times it is all just pretend money.

Financial junk food

That got me thinking.

The vast majority of personal finance content published these days is like junk food.

Quick.

Unhealthy.

Unsatisfying.

Ultimately harmful.

We’ve all seen the breathless click-bait headlines in large newspapers and award winning blogs:

- “6 ways to save money this Valentine’s Day”

- “How to save £20 on your next grocery shop”

- “The ultimate guide to travel hacking your way to a free holiday”

Variants of these types of shouty low-value articles are forever being recycled in the personal finance media.

At face value the individual tips presented appear to make sense.

Yet when you step back and look at the bigger picture it becomes apparent they are steering people towards spending their money on things they often don’t need… usually via affiliate links or referrer codes.

These practices are remarkably similar to those deployed by the much-maligned wealth management industry. Fee chasing financial planners steering their clients into and out of a multitude of expensive actively managed funds, collecting commissions on the churn.

In many cases, the client would achieve a more favourable financial outcome by doing none of that.

A preferable approach would have been to park cash in a low cost index tracker, and leave it alone.

It is challenging to make money as a financial advisor using this approach however!

Similarly, personal finance authors only make money if their audience returns for their next junk food binge, before being sales funnelled towards a product purchase they generally don’t need to make.

Don’t sweat the small stuff

So why does this low quality content keep getting republished on a seemingly endless loop?

A little while ago I looked into household asset allocation and wealth distribution. This showed a significant portion of the population own few assets beyond their home, bank accounts, and workplace pension.

It occurred to me that this group’s finances resembled the beginner level setup of my childhood self.

Earned income in, raises the bank balance.

Spent money out, lowers the bank balance.

Hustle still equals income.

To this audience, the prospect of saving £20 on their groceries will capture their attention.

The idea of buying something on special feels like winning.

Any prospect of getting something for free is like Christmas.

These easy answers provide the illusion of progress. They satiate the reader’s desire to take action, and receive immediate gratification. A short, yet briefly rewarding, positive feedback loop.

The audience gets stuck in a loop of endlessly focussing on the small things. None of which will individually make a material difference to the overall outcome.

They are sweating the small stuff.

The problem with this approach is that it treats the symptoms, but will never cure the disease.

Focus on what matters

Stepping back, adjusting the noise threshold, and making fewer but more strategic decisions will improve their lot in life.

Any of the following decisions will demonstrably have a material long term impact on a person’s finances:

- Choosing a field of study based on aptitude and earning potential.

- Selecting a profession offering remuneration compatible with their desired lifestyle.

- Skipping un/lowly paid internships and graduate programmes in favour of gaining reasonably paid experience at smaller firms.

- Managing their own trajectory up the career ladder, moving when they are ready rather than waiting for permission or approval.

- Spending money on essentials or things that will genuinely make them happy. Not spending money on anything that doesn’t tick at least one of those boxes.

- Investing what they don’t spend, as early as possible, in self-funding low-fee investments. Then leaving it alone.

- Viewing tax the same as any other manageable expense.

- Carefully using leverage where appropriate to boost investment returns, providing they have the cash flow and financial security necessary to manage the potential downsides.

Once a person has made the right strategic decisions for themselves, they too can graduate to the intermediate level.

No longer needing to chase those empty promises and easy answers offered by all that greasy financial junk food content.

They have escaped the hustle equals income trap.

Overcoming “buyer’s remorse”

My mother recently found the action figure in a box of old junk in her garage. Before she donated it to the charity shop, she kindly asked if I wanted it.

I vividly remember the buying experience like it was yesterday, yet strangely I didn’t remember ever playing with the toy.

When I asked my mother about that, she said that shortly after we arrived home that day I had given it to my younger brother. He had been upset that I had a new toy and he didn’t get one.

Apparently he never played with it either. It was set aside, and soon forgotten.

Out of curiosity I looked up what that action figure would fetch on eBay today.

The value of the toy had increased by over 9000%, an annualised return on investment exceeding 13%.

That easily tops the performance of any share or property investment I have ever made.

It appears a “buy and hold” approach works just as well for toys as stocks, providing you don’t play with either. Apathy wins again!

[HCF] 9 March 2019

This post made a perfect ending for a productive day spent with my family working in the garden. Caused a warm feeling around my heart and put a smile on my face.

I also have some memories of shopping as a kid but cannot dig up any big lessons. The first thing I remember saving (for years) and buying was my first PC which I don’t regret the least. There’s a chance it was the most important purchase of my lifetime.

These listicles and quick advise type posts are popping up over and over again. I think I developed immunity against them pretty soon. I could not come up with anything more accurate than the “don’t sweat the small things” statement.

I don’t really believe in these small hacks. Ok, some of them comes handy every now and then but if you spend a significant amount of time on finding out how not to spend 3 bucks on a single item you already lost the war.

What works, in my opinion, is making changes in your habits. These changes could be even small ones but as time goes they add up. Just to bring up an example that’s why I don’t do diets. “Starving” for a month could make some kilograms go away but once the diet is over the cycle will start again and those will return faster than they disappeared.

Instead, if you make a permanent change in your eating habits, you eat a little bit less and change some meals for healthier ones the results will come slower but will be long-lasting. I think this approach work for pretty much everything. Maybe that’s what they call butterfly effect? 😀

Thanks for the thought food as always 😉

{in·deed·a·bly} 9 March 2019 — Post author

Thanks HCF.

You make an astute observation about small habits, both good and bad, compounding over the long term.

Somebody might only have a cake on Monday, and a cookie on Tuesday, and ice cream on Wednesday… but cumulatively by the end of the week they’ve still eaten a load of junk food.

It comes down to making good choices. Getting the big ones right, like profession or living location, means the little ones matter a great deal less.

Caveman 10 March 2019

You’re right that there is a lot of personal advice out there that focusses on immediate needs and small wins and you’re also right that there are things that people can do that will have large long term impacts. I’m not sure though that we live in a world of either/or in this do we?

As you point out in your post you’re at the point in your life where small-ish things like buying a TV don’t register. It’s a version of hedonic adaptation I guess. I’m largely in the same place. But is that a reflection of having finances under control?

For a lot of people I wonder if the small benefits are the gateway drug to getting into improving their finances as they get an immediate hit (just like junk food). Once they have a few of those they adapt and need to move on to stronger things like ISAs, pensions etc. Eventually those stop working as well so they get sucked into those strategic things that you talk about, career advancement and side hustles, tax, and leverage…the journey of thousand miles and all that.

{in·deed·a·bly} 10 March 2019 — Post author

Thanks Caveman.

You pose an interesting challenge.

It is true the financial journey is a lifelong one.

However I’m not sure that chasing 3 for 2 specials or a coupon clipping to get 5p off your next trip to the service station does naturally lead on to career choice, maximising earning potential or investing.

That certainly isn’t the product many of the award winning personal finance blogs package and sell at any rate, and is probably the most fundamental difference between them and the financial independence lens.

An author would struggle to make any sales off talking up savings rates, conscious consumption and the like. Funnelling punters in coupon codes and their next discount fix does pay however.

That is why so many FIRE blogs sell the business of blogging (web hosting, email list building software, and so on). The matched betting blogs selling odds guides operate a similar business model in a different niche.