“What would you do if right at this very instant you got given 1 million great British pounds? This could be from a lottery win, an IPO, a scratch card, you name it. No tax needs to be paid, it’s just been plopped directly into your run of the mill bank account.”

This was the thought experiment proposed by SavingNinja. The one thing he asked of participants was for a stream of consciousness outpouring of thoughts rather than a carefully polished article. Here goes…

If I had a million dollars

Many years ago I found myself on a backpacker coach tour around Europe. One evening the coach wound its way along the spectacular Basse Corniche between Nice and Monaco. Seeing all the little coastal towns and beautiful yachts at sunset was a magnificent experience.

As we approached the border into Monaco the coach driver instructed all us naïve backpackers to hold our passports up against the windows, so they could be read by the world’s first automated immigration checkpoint.

The Basse Corniche is one of the world’s most beautiful drives. Image credit: Ben_Kerckx.

We subsequently discovered he was bullshitting us! I’m man enough to admit that I was one of the many backpackers to fall for the gag.

The driver cackled in delight at having suckered so many of us, and cranked up the stereo to play the classic Bare Naked Ladies song “If I had a million dollars”.

The lyrics of the song are good fun, the band lists out the many and varied things they would spend the money one, including:

- A house with a tree-fort in the yard

- A llama or an emu

- A green dress (but not a real green dress, that’s cruel!)

Interesting choices!

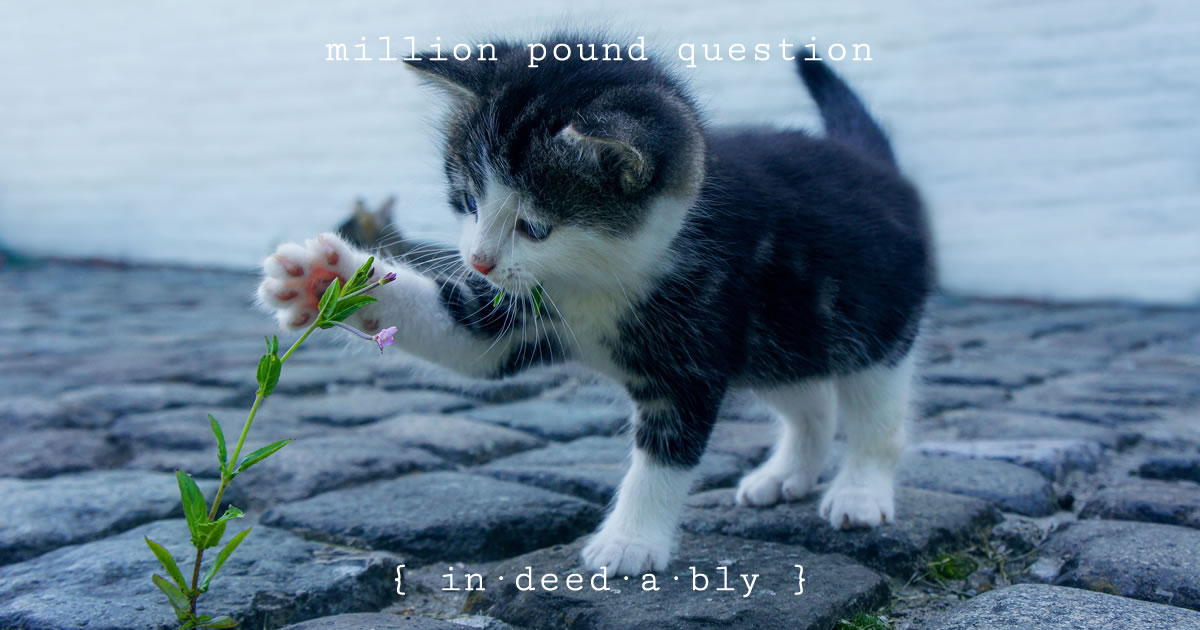

The Million pound question

Receiving a million pound windfall would be a lovely surprise indeed.

I am in the very fortunate position that for me this would not be a life-changing amount of money. I have passed the point of having “enough”, and the passive cash flows from my investment portfolio already reliably cover the majority of my living costs.

That means the entire million would be “fun money”, that I could allocate to endeavours that would bring me pleasure or provide value.

What does that look like?

This may disappoint some readers to discover but, for mine, that isn’t an epic first-class Las Vegas week long gambling binge fuelled by cocaine and hookers.

I would divide the million up into five endeavours.

Endeavour 1: University

University graduates.

I would set aside enough money to fund both my kids through university, (within reason) leaving them debt-free upon graduation.

Adult life should start with a clean slate, offering the promise of climbing as high as an individual’s abilities can take them.

Student debt positions freshly minted graduates at the bottom of a very deep hole. To simply get to ground level, they must first struggle to claw their way out. By the time they eventually reach the top, many are already burnt out, jaded and cynical. It shouldn’t be this way.

This is not a blank cheque. I would be more than happy for them to go off to study in the United Kingdom, or Australia, or Singapore, or Switzerland, or wherever.

However I would not be willing to fund them to attend a university with eye-wateringly high tuition fees, like many in the United States, as I don’t believe they provide good value for money.

The daughter of a family friend is hoping to study at Georgetown University next year. As a foreign student, and should she not win a scholarship or bursary, that is going to cost her (or more likely her parents) in the region of £40,000 per year!

I would allocate £200,000 to the tertiary education of my children, investing it in a low-cost global index tracker until it is needed.

Endeavour 2: Breakfast club

Breakfast club. Image credit: rawpixel.

One the big challenges facing working parents in London is before-school care.

Overcoming this challenge often results in the kind of temporal shenanigans that only a Star Trek scriptwriter could enjoy!

Harried parents need to be arriving at work on time for the start of the business day; while simultaneously dropping off their progeny at nursery or primary schools, typically located at the other end of their daily commute, that often don’t open their doors until 09:00.

Unfortunately, the days of free-range primary school children have long since past. The government rules essentially say that any child under the age of 11 caught roaming the streets unsupervised clearly has neglectful parents who must be prosecuted, and the child taken into care. The enforcement of these rules vary considerably, but I doubt having to go rescue my kids from the clutches of children’s services would be the highlight of my day.

The provision of before-school care is haphazard and inconsistent, varying markedly from one school to the next. The value for money and reliability of those services (where offered at all) also varies considerably.

I would allocate £200,000 to establishing a well run and reliable commercial before-school care organisation servicing London’s state schools. It would offer a professional service for a fair price to harried parents, allowing them to have their children fed and entertained until school starts, while allowing them to make it to work on time.

This would operate on a cooperative model along the lines of Vanguard, ensuring service provision is both high standard and cost-effective. To be successful the business model must be self-funding, so it would start with a handful of schools and gradually expand based on the needs of the owners.

Endeavour 3: Financial literacy

Financial literacy lessons in schools. Image credit: OpenClipart-Vectors.

Basic money skills are not adequately included in the primary school curriculum.

Simple concepts should be taught to every Key Stage 2 child (ages 7-11), including:

- opportunity cost (“you can’t have your cake, and eat it too”)

- earning more than you spend

- the perils of consumer debt

- the huge costs of mobile phone plans and gym memberships

Visit any supermarket between 15:00 and 16:00 and you’ll witness hordes of children wasting money on junk food, day after day.

The few financial literacy programmes aimed at children that do exist are mostly sponsored and operated by retail banks or financial services companies. These act as a sales funnel for future customers, having children open bank accounts as youngsters, while paving the way to credit card and personal loan offerings when the children reach the required minimum age.

I would allocate £200,000 to establishing a fun financial literacy programme that teaches these lessons via exercises and games that keep the children engaged. I would then look to partner with consumer advice services like Which? Or MoneySavingExpert to have the programme introduced to state schools.

The long-term aim would be to have it included in the school curriculum, and taught by the same teachers who educate the students in other core life skills like reading and mathematics.

Endeavour 4: Financial Software

If you ask any Personal Finance blogger what system they use to organise and manage their finances, almost all of them will admit to using hand-rolled spreadsheets for some parts of their answer.

It has been my experience that there is almost nothing Excel can’t do, but there is a great deal it should not be made to do.

… there is almost nothing Excel can’t do, but there is a great deal it should not be made to do.

Software that works.

There are already loads of personal finance software products on the market: tracking, budgeting, planning, analysing, calculating taxes, robo-advising, and so on. Most of them do one or perhaps two things well, while the remaining coverage is either poor or missing entirely.

The truth is the many of them just aren’t that helpful.

When using many of these applications users are left facing the “so what?” question. What do these numbers mean? What are the implications? What should I do next?

The level of financial literacy in the general populous is alarmingly low. The misinformation and conditioning we are constantly bombarded with, via advertising and sensationalist clickbait media coverage, reinforces many poor financial behaviours.

Simple, intuitive software can help address this. It can’t force people to make good choices, but it can readily demonstrate various “what if?” scenarios to aid well-informed decision making.

I would allocate £200,000 to hiring a small team to produce a viable proof of concept solution that resolves that problem. The product would then be opened to a limited number of subscribers, to be refined and developed based upon subscriber feedback and identified needs. Once fit for purpose, the product would be opened up to the general market under an affordable yet for-profit subscription model.

Endeavour 5: Financial guidance

Financial Review. Image credit: GraphicMama-team.

The vast majority of people do not require the ongoing services of a financial planner or tax accountant. Their affairs are too simple and straightforward to warrant the cost of these often expensive professional services.

However the vast majority of people are also largely financially illiterate, not knowing when they should be seeking guidance. Life events such as marriage, divorce, redundancy, children, and inheritance can have major implications for a person’s financial well being over the long term.

These may require an adjusted approach, some forward planning, different products or tools, and so on.

I would allocate the final £200,000 to establishing a not-for-profit financial advisory service. This would not provide personal financial planning or accounting advice.

Instead it would provide a capability to the general public to have a suitably qualified reviewer cast their eye over the punter’s financial setup on a one-off basis, and offer general feedback and guidance.

This would essentially provide a means to the public of “phoning a friend” who can check their homework and offer suggestions. Where professional advice is warranted the service would refer the punter to the appropriate professional organisation.

The service would be targeted at low to medium income earners with relatively straightforward affairs.

I would seek to partner with university business schools to source a stream of low cost but financially literate students to perform the reviews in return for some work experience or potentially extra credit.

This may be expanded to include financial planners willing to donate professional time on a pro-bono basis, but the arrangement would need to have sufficient controls in place to ensure it does not become a sales funnel similar to the school banking setup.

The ongoing service operation would be funded using the profits from the financial software described above.

Perspective is a wonderful thing

That is what I would do with a million pound if it miraculously fell in my lap.

Post-Brexit Britain. Image credit: Mad Max Wikia.

The alternative would be to buy a private island somewhere sunny and warm, then wait out the Mad Max style post-apocalyptic aftermath of Brexit!

If you ask a million people what they would do with an unexpected windfall, you will inevitably receive a million different answers. To hear some alternative points of view check out the other responses to SavingNinja’s thought experiment:

- Corinna @ InspiringLifeDesign

- Dr FIRE

- Iain @ GoodPersonalFinance

- Marc @ EarlyRetirementPlanning

- Ms ZiYou

- Mr RIP @ RetireInProgress

- SavingNinja

- SteelKitten

- TheFireStarter

- Weenie @ QuietlySaving

What would you do with a £1,000,000 windfall?

weenie 11 October 2018

Wow, your answers blew me away with all the good that you will do with what you are calling ‘fun money’! Absoulutely brilliant!

I now secretly hope that you will come upon this fortune in some way, if only to read about how you go about these endeavours on your blog!

{in·deed·a·bly} 12 October 2018 — Post author

Thanks very much weenie.

Each endeavour is a problem that I have personally tripped over recently, or have been puzzling about for a little while. The “steam of consciousness” instruction provided an outlet to give some form to the random thoughts that had been buzzing around in my head.

I hope we all hit the jackpot! Would be amazing to see all my imaginary internet friends action their grand plans.

Ms Zi You 12 October 2018

I love your answers there in-deed-a-bly, some good philanthropic causes.

{in·deed·a·bly} 12 October 2018 — Post author

Thanks Ms Zi You.

earlyretirement 12 October 2018

Loved reading your ideas! You have given this quite some thought and you point out some fundamental issues that need improvement. Your money would be so well spent!

My favourite one is the software idea… i am a software engineer… that’s why 😉

{in·deed·a·bly} 12 October 2018 — Post author

Thanks Marc.

Probably not quite as much thought as you may imagine, sometimes when I start writing I am almost as surprised by what comes out as the audience! Certainly keeps things interesting.

I think the software would certainly be the most fun (for me anyway… my kids may disagree!).

Red kite 13 October 2018

These are really interesting ideas that tackle real problems. My first thought is though that setting up any one of these projects and making it a success would take a non-trivial amount of time and effort. It’s not just the money that is required.

{in·deed·a·bly} 13 October 2018 — Post author

Thanks Red kite, you’re absolutely correct.

My time is a precious commodity, and definitely would not scale across so many additional endeavours concurrently.

My role would be an enabler for each activity, providing oversight and impetus to drive their successful execution. In each case I would hire people smarter and better suited to carrying out the day-to-day operations of each endeavour. My role would be to provide them with guidance, motivation, or a swift kick up the backside as required.

That is the approach I have taken with my existing business interests, and (for the most part) it has worked pretty well.

Red kite 13 October 2018

That’s what I would have assumed, but even that role is pretty time consuming and requires a certain skill set.

I’m kind of stuck on this issue myself, being in the position where I could give away, if not a million pounds, enough to make an impact. I don’t have much experience in enabling roles, so the task boils down to identifying existing organisations which are already making progress and supporting them.

Coming up with the problems that are close to your heart is definitely the easy part!

{in·deed·a·bly} 13 October 2018 — Post author

Indeed!

For what it is worth, my (unsolicited) advice would be to pick an issue you feel strongly about, and make what difference you are able.

Apart from the software venture, the issues I have cited here all boil down to the provision of a basic financial education. Get that right, and the student you have helped is equipped to make a lifetime of well informed (and hopefully good) financial decisions. Helping even one person achieve that outcome certainly provides a warm fuzzy feeling.

That Guy, Nick @ TotalBalance.blog 7 November 2018

I follow a few “international” FIRE bloggers (like yourself), and reading your thoughts on the million dollar/pound question got me thinking about my childhood.

I was born in Denmark – the most socialistic and highly taxed country in the world (depending on who you ask), and for unknown reasons (it might be related to the former?) The Danes are also among the happiest people in the world (according to The UN World Happiness Report).

Growing up in Denmark, I didn’t really feel like we were more happy than other people.

My parents/grandparents would always play the lottery, because if they won a little – we could go on a (nice) vacation. If they won alot, they could quit their jobs. As a young kid in school, I didn’t understand this paradox. I had to spend 20+ years in school (education is free in Denmark, FYI – paid via the high taxes obviously – so technically, it’s not free, it’s just that nobody ever has to worry about not being able to afford an education, which I believe is worth the high taxes) to get a job, hoping to win the lottery eventually (I don’t play the lottery – I’m not stupid) so I could quit my job!?

Then a while back, I stumbled on The Venus Project (and the Zeitgeist movement). Granted, some of the followers of these movements I would put into the same category as the people who play the lottery, but alot of the ideas really resonated with me. If Education can be free, why shouldnt LIFE itself be free?

Imagining that blew my mind. The sceptics would say: “But people will get lazy, if they have no incentives to work for anything in life”. – I think the FIRE “movement” is proving these sceptics wrong. We need purpose. Whenever I see lists like you’ve made here, it becomes pretty obvious to me – when you take away the weight of “the daily grind”, people tend to gravitade towards helping others, to achieve/find their purpose or maximizing their potential…

I realize that some of these ideas are highly controversial, and we’re never going to get there (because the needs/wants of the few outweigh the needs of the many in our society today) – but I think I would sink a million into trying to put some of those thoughts/ideas into the heads of the next generation(s)…

{in·deed·a·bly} 7 November 2018 — Post author

Thanks Nick.

Your comment reminds me of Star Trek (the one with Captain Picard), where the writers did a pretty good job of bringing the concept you describe to life.

In the show somebody came up with a technological way to eliminate scarcity, which instantly would have rendered money valueless.

After than people seemed to do what they wanted, constrained only by the limits of their own abilities (and office politics!).

The show only focussed on characters valiantly exploring and extending themselves, however the legions of wastrels such an event would also have likely created probably wouldn’t have made for such good television!