Life seldom goes to plan.

Cruising down the motorway late on an overcast autumn afternoon, Bev and her best friend Michelle had the top down and the wind in their hair.

Thelma and Louise. Image credit: IMDB.

Feeling like they were acting out the iconic scene from Thelma and Louise, they prepared themselves to carry out the final wishes of Bev’s late husband.

He had wanted his ashes to be scattered from his lovingly hand restored 1968 model MGB Roadster.

Bev closed her eyes, took a deep breath, and said a silent goodbye to her husband of 32 years.

In a single movement, she yanked the top off the urn and shoved it into the car’s blustery slipstream.

“Uhhh, Bev… it’s not working” observed Michelle a few moments later.

Bev cracked open one eye and glanced at the urn.

“Stubborn to the bitter end!”

It had been more than six months since the cremation. Bev had postponed disposing of them, because she hadn’t finished shouting at her husband.

Until today.

Probing inside the urn, Bev discovered her husband’s remains were contained within a heavy plastic bag that had been industrially heat-sealed. Clearly he wasn’t supposed to get away!

As she struggle to tear open the seam, it started to rain.

Once more she thrust the urn out into the car’s slipstream.

A small stream of ashes slowly trickled from the urn, spraying out behind the speeding roadster.

A horn tooted from a vehicle behind them.

Bev gave the urn a vigorous shake.

Then suddenly the urn felt lighter. Much lighter.

Bev glanced over her shoulder in time to witness the bag of ashes arcing gracefully through the air, the plastic serving as a wind-filled sail.

A small portion of the ashes dramatically fanned out from the airborne package.

However the bulk of them remained intact, until the bag exploded into the windshield of a semi-trailer several car lengths behind the roadster.

“Oh shit!” exclaimed Michelle, gunning the accelerator to surge away from the angrily honking truck.

The rain was quickly transformed Bev’s husband into sticky grey mud, which the truck’s wipers struggled valiantly to clear off the windshield.

Bev couldn’t help but laugh. Even In death, as had so often been true in life, her husband’s final grand plan exposed yet another huge difference between dreams versus reality.

Dreams versus reality

The question dreams versus reality is a recurring theme throughout the internet, particularly when the topic of retirement comes up.

The most popular { in·deed·a·bly } post to date touched on this topic. It generating some lively feedback when somebody broke the golden rule, and fed it to the Reddit trolls.

Today I thought I would brave those trolls, and explore this topic in a bit further.

Primary motivators

There are two primary motivators that influence a person’s view on the notion of retirement:

- Money

- Lifestyle choice

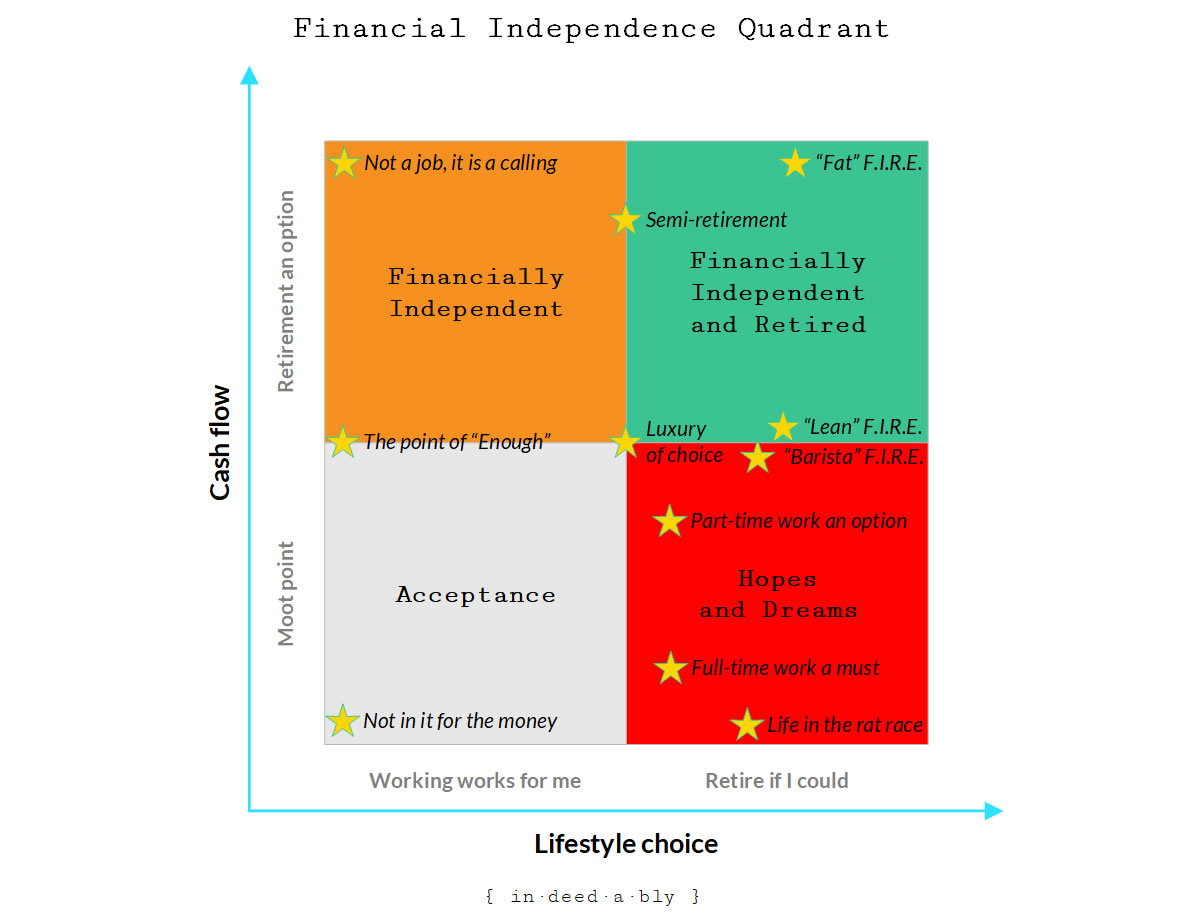

If these factors were to form the axes of a chart, it would look something like the Financial Independence Quadrant shown below.

Financial Independence Quadrant

Each quadrant represents an intersection of those two primary motivators.

- Acceptance: Lacks the money and/or the will to change their circumstances.

- Hopes and Dreams: Desires change, but currently lacks the means to achieve it.

- Financially Independent: Has “enough“, but chooses to continue working.

- Financially Independent and Retired: Accumulated sufficient wealth to take an extended break from the workforce.

Acceptance

The first quadrant contains the vast majority of the population.

Some members of this group generously perform vital roles in society: teachers, nurses, firefighters, and charity workers. They don’t do what they do for the money, which is probably a good thing as they are often outrageously underpaid for the value they provide the community.

Others in this quadrant are content with their lot in life. They do a job they don’t hate, earning enough to lead a comfortable life.

The final group contained in this quadrant are those who live pay cheque to pay cheque, for whom there is little money remaining once their lifestyle costs have been met.

This quadrant (consciously or otherwise) accept their lot in life. An extended break from the workforce is so far beyond their current financial reality that it isn’t worth contemplating, much like winning the lottery.

Hopes and Dreams

The second quadrant contains people who are not content with their current lifestyle, and desire something different.

They view their jobs as a means to an end, somewhere that they go to sell their time for money.

This quadrant recognises that a lack of financial means is restricting their ability to invest their time in pursuits they would find more rewarding.

Those pursuits may include the clichéd dreams of slow travel, writing a novel, or developing those long-suppressed artistic interests from their youth.

Alternative they may be driven by practical realities: a desire to be a stay-at-home-(grand)parent; or to trade an unsatisfying yet well-remunerated profession, for a lower paying but more fulfilling job.

Perhaps they want to adjust their work/life balance, to reduce the proportion of their precious time consumed by externally imposed demands.

The difference between inflows and outflows that determines the rate of change in a person’s net worth.

It is the size of a person’s net worth, relative to their lifestyle costs, that determines their ability to afford to pursue their hopes and dreams.

This group possess dreams larger than their net worth can finance.

Financially Independent

Financial Independence is the term representing that point where the financial imperative no longer determines how we choose to investment our time.

The Financially Independent quadrant contains those people who have past the point of having “enough”.

They are now in the enviable position of being able to invest their time however they like.

Many people in this quadrant happily continue working in their chosen professions.

Business owners.

Entrepreneurs.

People who derive much of their personal identity from their chosen profession; for example C-suite executives and academics.

Some members of this quadrant decide to hang up the tools of their previous trade, choosing instead to invest their time in more rewarding or interesting pursuits.

Once a person is financially independent, they can even afford to pursue employment in those lowly paid yet vitally important professions mentioned earlier: teaching, healthcare, and charity work.

Financially Independent and Retired

The final quadrant represents those folks who can afford to take an extended break from the workforce, and elect to do so.

That break may be temporary, such as a sabbatical or a gap year.

It may represent adopting a semi-retired or seasonal working pattern, choosing to invest some of their time working, while enjoying a leisurely existence for the remainder.

For many people retirement becomes a permanent arrangement, such as that pursued by many older folks once they reach pension eligibility age.

They may choose to join the migratory herds of grey nomads, taking cruises and coaches and caravans to all those places they never had the time or the money to visit previously.

Or they may pursue a simple life at home, pottering around the garden, or becoming a “lady who lunches“.

A key thing to note about the Financially Independent and Retired quadrant is the admissions criteria are determined solely by the perspective of the individual.

An unemployed high-school dropout, who is content to live in council housing and exist on social security benefits, belongs in this quadrant.

Their financial approach is similar to folks pursuing a “Lean” FIRE strategy, in that they are pursuing a modest lifestyle and comfortable living very close to the financial edge.

The need to retire

In the “Lessons from retirement” post, the most contentious point turned out to be the conclusion:

There are very few things you want to do in retirement, that you couldn’t already be doing in some form today.

This statement appeared to trigger many people.

On the reddit thread, the top upvoted response was from a person who described their perfect day: waking without the alarm, walk the dog, surf, tinker with personal projects, eat BBQ, drink beer, and have sex.

They concluded with the line:

Yeah, I’m pretty sure I need early retirement for this.

Several folks then observed that sounded like any weekend, rather than something that needed to wait until retirement.

The conclusion the commenter reached was wrong, there was nothing in their perfect day that needed to wait until retirement.

However the comment did highlight the importance of having control over time investment decisions.

If the commenter had more control over their time, then they would be able to enjoy more days like the one described.

Our level of control is largely determined by how close we are to reaching Financial Independence. The higher our net worth relative to our lifestyle costs, the more control we have.

The desire for retirement

The thread also contained several responses like the following:

I do not expect retirement to make me happy. I expect retirement to free me from a continual and constant source of unhappiness.

I’m already content with my life, except for the part where I have to get up and go to work 5 days a week. Retirement will definitely fix that.

These commenters sought to escape the daily grind, conflating early retirement with an end to being unhappy.

Unfortunately this logic is flawed.

The removal of unhappiness may indeed help improve a person’s general outlook and demeanour.

However an absence of unhappiness does not automatically result in happiness.

Nor is an endless weekend the same thing as a fulfilling and rewarding use of your time, generating value for yourself and others.

The solution to working in a job that makes you miserable may well be leaving that job.

However the decision to retire, with all that entails, should not be taken lightly.

If you don’t have a clear idea of how you will occupy the hours once consumed by work, then you probably aren’t ready to retire.

To misquote Jordan Peterson, a holiday brochure is not the same thing as a rich full life!

In search of meaning

A recurring theme in the Personal Finance blogosphere is that some people struggle to find meaning and motivation once they leave their former professions.

This is particularly true for those with immediate family who continue to follow their existing day-to-day routine: a spouse who continues to work, kids who continue attending school, and so on.

A reader named Jim generously provided a heartfelt and very honest comment that does an excellent job of summarising first hand what this experience can feel like.

I have paraphrased it here for brevity, the emphasis is mine.

I recently left work and … have savings so can comfortably sit it out for 6 months or much longer if I needed to.

I was really looking forward to this break but it has not turned out to be as enjoyable as I had hoped.

My day is defined by my kids school run drop off and pick up times. I have found myself going to the gym everyday, working out to business audiobooks then spending my afternoon watching Netflix or playing computer games.

I seem to have constant guilt about the amount of time I have and the fact I am not working. My motivation levels are low. When I tell people I know that am currently not working, they look at me with pity ….

In this scenario the early retiree is free to pursue anything in the world… providing they are back in time to do the school pickup run!

Most workplaces provide a ready made social circle, that no worker can evade.

The only social interaction an early retiree need participates in are those they instigate themselves. That requires energy and the making of a conscious effort.

This can be quite a confronting change!

There is a disconnect between the dream versus reality.

“What do you do?”

A huge part of a person’s identity is tied to their vocation.

A doctor saves lives. An account helps with finances. A teacher educates.

Remove that professional identity, and it can become difficult to define or articulate what motivates you.

What are your hopes, dreams, and desires?

What is important to you?

What drives you?

The question most dreaded by early retirees is: “what do you do?”

This is a loaded question, as the inquirer seeks to identify where the subject fits in society.

- Are they important?

- Do they matter?

- Should I fear them?

- Can they help me?

- Am I wasting my time speaking with them?

Whether real or imagined, what many early retirees hear when asked that question is the unspoken challenge: “justify your existence!”

A member of the workforce can easily fend that off with a socially accepted role description: student, engineer, bus driver, or senior executive vice-president.

The titles of pensioner or retiree are reserved for old folks. Definitely not unemployed, able-bodied, working aged folks!

Don’t believe me? Reflect for a second on how you feel when someone tells you they are unemployed, homeless, or a drug addict. Think about your instinctive reaction when you see a teenager with a neck or facial tattoo.

Chances are there will be a mixture of feelings including disapproval, judgement, and pity.

This is how the early retiree is perceived by much of society, with measures of disbelief and jealousy thrown in!

The dirty secret of the FIRE movement

The truth is some early-retirees experience a mixture of loneliness, depression, lack of motivation, and boredom to varying degrees.

They struggle for purpose.

They lack the sense of identity.

This is one of the seldom discussed experiences amongst the FIRE movement.

It doesn’t fit the highly polished narrative of the young go-getting overachiever, who after a few short years of working somehow managed to save enough to last them a lifetime. Now they spend their days living an Instagram life jet-setting around exotic locations, while their former coworkers slowly rot in a soulless office cubicle.

Nobody wants to hear about the folks who conquered the mountain, won the trophy… and now are complaining that early retirement isn’t all that it is made out to be.

There must be something wrong with them!

“Only boring people get bored, right?”

“How can anyone be unhappy when they don’t have to endure a commute, dance to the tune called by a pointy headed boss, and suffer the company of annoying co-workers?”

“How dare they suggest FIRE doesn’t provide the most ultimate guide to awesomeness in the whole entire universe ever?”

In my experience the FIRE movement is generally very positive and supportive group (providing you stay away from Reddit!).

Early retirement does work out wonderfully for many people who try it.

And yet… some share the experiences of Jim, or CheesyFinance, or the blogger behind SexMoneyHealthDeath. For whatever reason the dream differs from the reality.

Mind the gap

Do you have a clear idea of how you would invest your time in retirement?

Not a holiday.

Not a project that will be complete inside of 3 months.

A plan for how you will be deriving meaning and value from all those hours that have been freed up by your no longer working.

- 40 hours a week.

- 52 weeks a year.

- Year after year.

- Decade after decade.

If you don’t have a good plan, then the right solution to a unenjoyable job is probably moving to a different job, rather than retiring.

A more enjoyable job.

A new challenge.

With different co-workers.

And a shorter commute.

A job nonetheless, with all the motivation and structure and social interaction that provides.

No U turns? Bollocks to that!

To those early-retiree who feel adrift, lonely, or lacking purpose; consider all the options.

Maybe, just maybe, the right answer may be returning to the workforce in some capacity.

Many people thrive on the structure, routine, and social interaction provided by a job.

There is no law that says retirement has to be a one-way trip.

There is no shame in trying retirement on for size, and reaching a well-informed decision that it doesn’t work for you.

At this time.

Your loved ones, and those former colleagues who genuinely cared about your well-being, will likely support whatever would make you happy.

Or failing that, whatever may make you less unhappy.

The important thing is to choose the right option for you.

youngfiguy 14 November 2018

Cracking post Indeedably.

I’m very much of the view that it’s best to make decisions for positive reasons and not negative ones. That’s because once you’ve ‘escaped’ from the bad thing you need to find a new purpose or direction.

Applying this to FI: pursuing FI to escape work is a valid reason. However, what happens when you reach the goal and quit? Your purpose has gone. Are you the type of grumpy sod that finds other things to moan about? Or a worrier with new problems to find? You’ll find a new thing to hate. Or you might drift aimlessly.

Instead, flip it on its head. Say you want to spend more quality time with your family. That may lead you to come to the decision that full-time work isn’t compatible with spending the amount of quality time you want. But when you jack the 9 to 5 in, everyday you’ll be reminded of why you did what you did. And you’ll be immensely grateful for it. Everyday is a reinforcement of your purpose.

{in·deed·a·bly} 14 November 2018 — Post author

Well said Mr YFG.

Or as my ex-military grandfather used to say: “heroes run towards a challenge, cowards run away from them”.

Nick @ TotalBalance.blog 15 November 2018

Another round of striking observations, there 😉

Well done!

Just curious, how long did it take you to write this post? Do you start at the begnning of the week(month?), and then work on it during the week(month?), or do you just finish it all in one go? There’s an awful lot of insights, packed into one post 😉

If you don’t have a good plan, then the right solution to a unenjoyable job is probably moving to a different job, rather than retiring.

A more enjoyable job.

A new challenge.

With different co-workers.

And a shorter commute.

I do not recommend this. For some people, this might be a solution. But to me, this really feel like running from your problems (I’ve done it), and we all know that’s not really a way to solve them. I’m still searching for a better way for me, and posts like this just emphasize what I already know – and it saddens me, as I continue to search for solutions that can work for me. I’m painfully aware that FI is not a solution to my problem(s), but for now, it seems to be a more tangible goal than going out into the world, and find the (my) meaning of life 😛

{in·deed·a·bly} 15 November 2018 — Post author

Thanks Nick.

The main point behind my challenge is that if a person is unhappy about something, then they owe it to themselves to do something about it.

Take action!

Make a change.

That change may be dramatic and life changing like relocating or changing careers, or it might be something far simpler like adjusting their mindset or attitude. One thing is for certain, adopting an ostrich approach of burying their head in the sand and hoping the problem goes away by itself seldom achieves the desired outcome.

You’re absolutely correct that Financial Independence isn’t a solution. It is one hell of an enabler though!

[HCF] 29 November 2018

Shame on me that I just discovered this post of yours, checking the publishing date it could have been a perfect birthday present for me 🙂

That chart is genius, it helps so much positioning your situation visually. Also you can draw a path line about where did you start your journey, where are you now and where are you heading. I could connect the stars starting from the bottom left corner, going through the bottom right (“Life in the rat race”) and reaching the “Full-time work a must”. The route should continue towards the “Part-time work an option” & “Barista FIRE” which are not so different IMO. This would be a good area to dwell in but jumping to the top left corner, reaching the star of “Not a job, it is a calling” would be my ultimate goal and going on to the “Semi-retirement” star or jumping on the FI&R area would be something I would keep for older age or if some circumstances would prevent me from remain on the top left.

I wrote a post about the folks who are naysayers to FIRE just because they are afraid of the things you mentioned. While I accept that it is an option I don’t think it should be a serious problem. My assumption is that if someone is smart enough to reach FIRE then that person should be smart enough to engineer his/her after FIRE life. Anyway it would be a problem I would really like to face one day 🙂

Thanks for the thought food, it really started my brain engine 🙂

{in·deed·a·bly} 29 November 2018 — Post author

Thanks HCF, and happy (belated) birthday!

I like your approach, sounds like a sensible way to plan out your journey.

To my simple mind, the main difference between the “Part-time work an option” and “Barista FIRE” is actually making the change.

As for the naysayers, there is certainly a lot of ignorance out there… but also an element of healthy caution that is worth reflecting upon.

When most people hear the word “retire” they associate it with the one way trip those clichéd old folks take, once they are past their prime and are put out to pasture.

People wonder how somebody in their 20s or 30s or 40s could possibly have accumulated a sufficiently large net worth, to provide for what could realistically be a 70-80 year long retirement. Short of a lottery win, massive inheritance, or founding a unicorn startup it is beyond comprehension!

In many respects they are right to challenge the premise, as it differs so markedly from the standard script of life. When things sound too good to be true, usually they are.

For this reason I think the FIRE community is a bit disingenuous in their use of the term “retire“. It sounds impressive, and certainly flatters the ego. Some folks really do put their feet up and spend the rest of their days watching daytime television, or drinking beer with their cornflakes just because they can. A few actually do spend endless years “slow travelling” their way around the world.

Most however are simply “retiring” from one profession, and moving on to another role (or roles) that is more fulfilling yet (likely) less pressured and/or less financially rewarding.

By that definition I am a retired accountant, a retired computer programmer, and a soon to be retired student (again). Doesn’t really make me “retired” in the traditional sense however!

Ultimately everyone needs to make their own decisions and choose their own path, based on their own risk tolerance and perception of what the future may hold.

We will only be able to tell who was right in hindsight after all.