Our heads swivelled in unison.

We stared at the slightly bizarre sight of a bed-headed woman dawdling through the airport departure lounge wearing a tiger print fleecy onesie.

“That’s…” began my son, before trailing off.

“Interesting?” I prompted.

“… not normal” he concluded with an amused shake of his head.

“Maybe she just got off a long haul flight?” I naïvely suggested.

“Maybe she is a plushie?” countered my lady wife.

We looked blankly at her.

“Someone who is into yiffing?” she elaborated with an exasperated sigh.

We wore identical baffled expressions and gave identical synchronised shrugs. Genetics can be funny sometimes.

“Look it up!” she muttered, as she abandoned us in favour of the overpriced duty-free shop.

So we did.

I wish we hadn’t.

Some things cannot be unseen.

I’ll never look at a teddy bear in the same way again.

Half an hour later we were queued up to board the plane, behind a young couple who were in the midst of a blazing row.

By the sounds of things, the fixed term honeymoon rate on their mortgage was coming to an end and they couldn’t afford the variable rate repayments. They had attempted to refinance, but the new lender(s) had valued their house as being worth significantly less than what they had paid for it.

The classic negative equity trap.

“But property prices always go up…” insisted the husband. “… it just isn’t normal!”

“Tell that to the bank. I told you we couldn’t afford such an expensive house!” retorted the wife, on the verge of tears.

That got me thinking: what is “normal”?

What is normal?

Something can be considered normal when it is familiar, as expected and acceptable.

However normal is also intangible and difficult to describe.

Everyone has a different perspective on what could be considered normal, framed by their own unique personal experiences and environment.

Which means the lens you view the world through has been influenced by the sum total of your experience, including:

- where you live

- what you are exposed to

- how you were brought up

- what opinions you listen to

- who you surround yourself with

- what you have experienced

- what you believe

Sometimes we are influenced because of these things: Acceptance. Blend in. Conformity. Don’t stray from the path. Embracing. Follow the script. Present a small target, and don’t draw fire.

Other times we are influenced in spite of these things: Acting out. Being noticed. Confronting. Distinguishing oneself. Escaping. Exploring. Independence. Rebellion. Standing up. Trailblazing.

Perceptions of reality

Events experienced personally, or by those voices who influence you, play a major part in forming how we perceive the world and our attitudes towards risk.

The young couple in the airport had never before experienced interest rate rises, or a decline in property prices. From their perspective, it wasn’t normal.

The recent stock market (late 2018) rollercoaster gave many newer investors the yips, as they had been lulled into a false sense of security by the mistaken belief that markets always go up. In their experience, it wasn’t normal.

Seemingly every second high street publican and coffee shop owner has hung out the “help wanted” signs, yet wages remain low and few applications are received. Many are surprised, having never before encountered an economy experiencing full employment. Viewed through their lens, it isn’t normal.

Property developers in London, who are attempting to sell, are having trouble attracting any interest from prospective buyers. Buy-to-let tax regime changes, visa restrictions, and Brexit uncertainty combining to deflate the previously buoyant market. According to their business plans and projections, it just isn’t normal.

In search of normal

To illustrate how events we experience define and influence our outlook and view of normal, below are a handful of alternative perspectives.

A child of the Great Depression

My evil grandmother grew up during the Great Depression.

This established a scarcity mindset common to many of her generation.

She owned little. What she did buy was intended to last forever, as she was never confident there would be sufficient money available to replace things later.

Normal for her was:

- Be grateful for getting any job.

- Work hard and be loyal to your employer for providing you with a means to eat.

- Own your home outright so they can’t take it away from you.

- Hold the rest of your net worth in readily accessible cash.

Living through two decades of largely negative or neutral inflation rates will do that to you!

Returned service personnel

My other, younger, grandparents didn’t remember much of the depression. The defining event in their lives was serving during the Second World War.

My grandfather decided that having survived several years of people actively trying to kill him, he had experienced enough risk for one lifetime.

My nice grandmother took the opposite view: once you have survived a war, everything else life may throw at you is tame by comparison.

Normal for them was:

- You can only rely on yourself.

- Own your own home outright so you will always have somewhere safe to sleep.

- Hold the rest of your net worth in cash, because cash provides the option of thinking on your feet and reacting quickly when your life depends upon it.

- All forms of social welfare (including the state pension) were a form of last resort for the poor, the stupid, and the freeloading. If you used it, you had failed in life.

They retired in an environment where interest rates had been 10+% for a decade. Their retirement funding model was a ladder of fixed interest term deposits. Which worked out nicely… until base rates reverted to the long term historical average

A baby boomer

My father grew up on a farm.

Farming is a tough way to make a living, involving lots of heaving lifting and working outdoors.

A farmer’s efforts yield annual returns that oscillate wildly between feast and famine, due largely to factors outside the farmer’s control: drought, floods, the forces of supply and demand.

Farmers who survive over the long term quickly learn to set aside bounty from a good year to smooth out the ride during the inevitable lean years.

Those who don’t face extinction.

Farming was the original case study for “sequence of returns” risk in action.

Encountering a drought or low crop prices early in a farming career was often fatal to the business enterprise. Outliving your capital means failing to have enough money to purchase seed or restock breeding animals for the next year.

Normal for him was:

- Work hard and delay gratification until you are done accumulating.

- Own your own home, because rent is dead money.

- Maintain a large cash buffer to smooth out the ride.

- Hire the best wealth manager you can afford, and follow their advice with half your net worth…

- … but don’t trust them too much, and invest the other half in domestic property. Stock markets may crash, but people will always need somewhere to live.

- Tax minimisation is more important than investment returns.

Once you’re done accumulating, start enjoying. You can’t take it with you!

The big risk in placing enjoyment after everything else is that you can’t predict how much (if any) play time there will be at the end.

A late bloomer

My mother never took much interest in money.

Her defining event didn’t occur until her early 50s, when she went to work for an international development aid organisation.

The next few years were spent globetrotting and sharing her niche expertise with governments the world over. The sights and experiences she witnessed removed her blinkers and made her eternally grateful for her lot in life.

Normal for her was:

- Say yes to the opportunities you encounter, because many people would kill for them.

- Money is an enabler, not a purpose.

- Life is finite and fragile. Make the most of it, you never know how much time you will have.

- Anyone can write a cheque, but if you really care about something donate your time.

- Charity is about helping others. If you need recognition for your giving, your donations are about you not about the cause.

In the words of Naval Ravikant:

“Signalling virtue is a vice”

An entrepreneurial explorer

I have worked for myself for the last 20 years, initially as a freelancer and later running a consultancy business. I am also a serial migrant.

While to date these lifestyle choices have worked out pretty well, they have also resulted in constant change and regular uncertainty. Neither of which come naturally to me.

I have watched and learned from the financial journeys of relatives and close friends.

Normal for me involved cherry-picking the lessons learned by others:

- My evil grandmother’s risk aversion: The rules can and do change. Don’t take things for granted, regulatory risk in particular should not be underestimated. I’m looking at you pensions!

- My father’s time horizon: Play the long game and plan for the future…

- My mother’s time valuation: … but take the time to enjoy the present. If not now, then when?

- My nice grandmother’s embracing of risk: What’s the worst that could happen? Will anyone going to die as a result?

- My grandfather’s management of risk: Once you’ve reached the point of “enough”, consolidate and preserve.

Combined with some lessons learned personally:

- Starting over armed with only your wits, a credit card and a passport is inconvenient but survivable.

- Fearing the unknown is a debilitating and ultimately futile endeavour.

- Stress is self-imposed. Deadlines are arbitrary dates somebody once made up on the spot.

- Understanding the profit motive, and identifying the value chain, means money grows on trees.

experience defines normalcy

The outlooks behind each of these mini case studies were formed at different times, over different durations, and through very different economic conditions.

While some overlap, none fully align or agree with another. Yet each view holder could have put forward a credible argument as to why their worldview was valid. As ever, perspective is a wonderful thing!

When viewed with the necessary context and background, each is understandable in its own way.

Without the benefit of that context, every one of them probably sounds illogical or even downright crazy!

With that in mind, consider the financial messages we frequently receive.

How often do you blindly accept content, without understanding context:

- Charts using carefully selected time frames to prove a point?

“Markets always go up!”

- Conclusions based upon limited, or artificially truncated, data series?

“Our fund managers have consistently outperformed the market” (… in all three months that we have been in business)

- Correlations mistaken for causations?

“Placing the beer next to the nappies resulted in increased sales”

- Crimes against charts, where unrelated datasets are plotted on the same chart, or worse on the same chart using a secondary axis?

“By charting last year’s SpaceX launch frequency against this grocery receipt I just found in my pocket we can conclude from where the lines intersect that…”

Small slices of history

To illustrate how personal experience can influence perspective, consider the following economic indicators when viewed through a 300+ year lens.

A typical individual’s investing experience covers less than 20% of that time period. Their perspective on what is normal is formed over an even shorter period.

The older historical data should be viewed with some healthy skepticism. Some smart academics have valiantly attempted to piece together a picture based on fragments of data and assumptions.

Unfortunately there is nobody still around to ask whether they got the final product correct! However for the purposes of this discussion it will suffice.

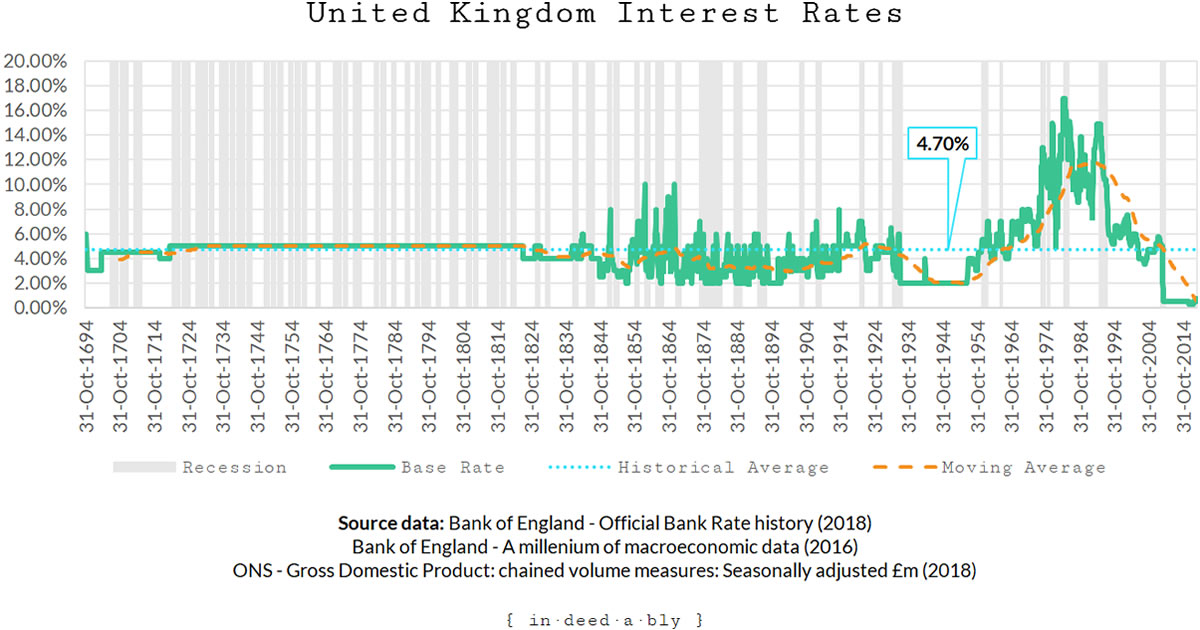

Interest Rates

What is interesting about this data series is how markedly different the pattern is from the mid 1950s onwards compared to the preceding ~250 years.

When viewed through this lens the high interest rates of the 1970s and 1980s were an anomaly. So too are the current extremely low rates!

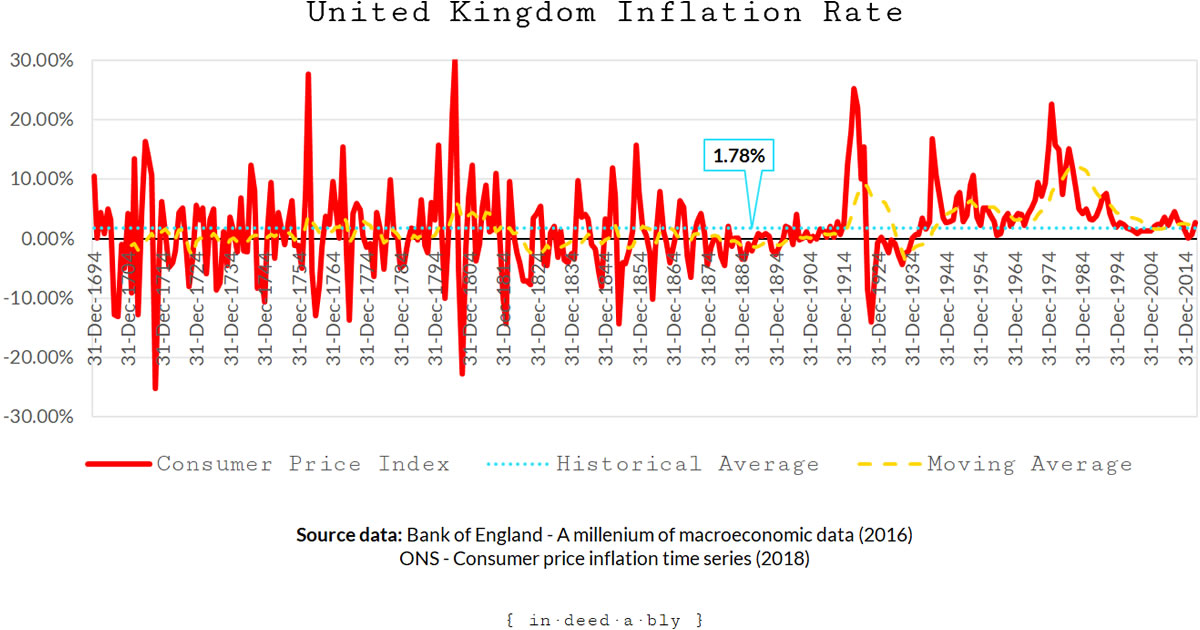

Inflation

The United Kingdom has experienced positive inflation more or less continuously since the end of the Great Depression. When compared to the gyrations of the preceding 200 years that is unprecedented.

Whether that represents a long lasting anomaly or represents a permanent change remains to be seen.

Many a commentator has been made to look silly by proclaiming “it is different this time” or “inflation is dead“!

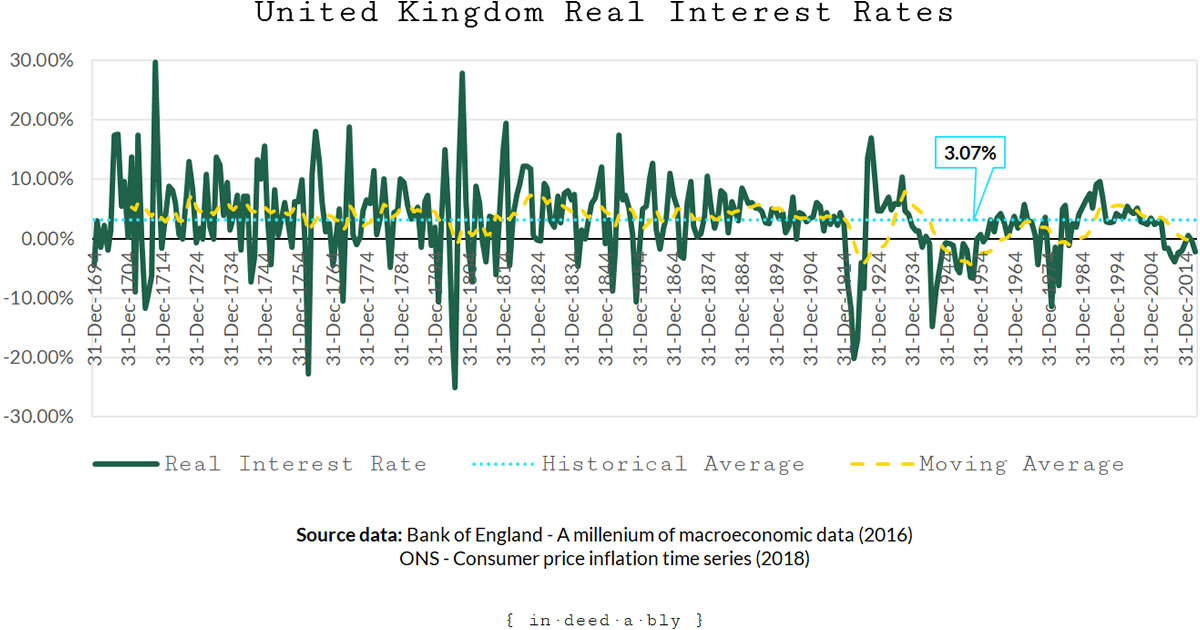

Real interest rates

We like to believe that real interest rates are almost always positive, and that the recent super low base rates are a historical aberration.

While this chart tells us that negative real interest rates are uncommon, they occur frequently enough to not be unusual.

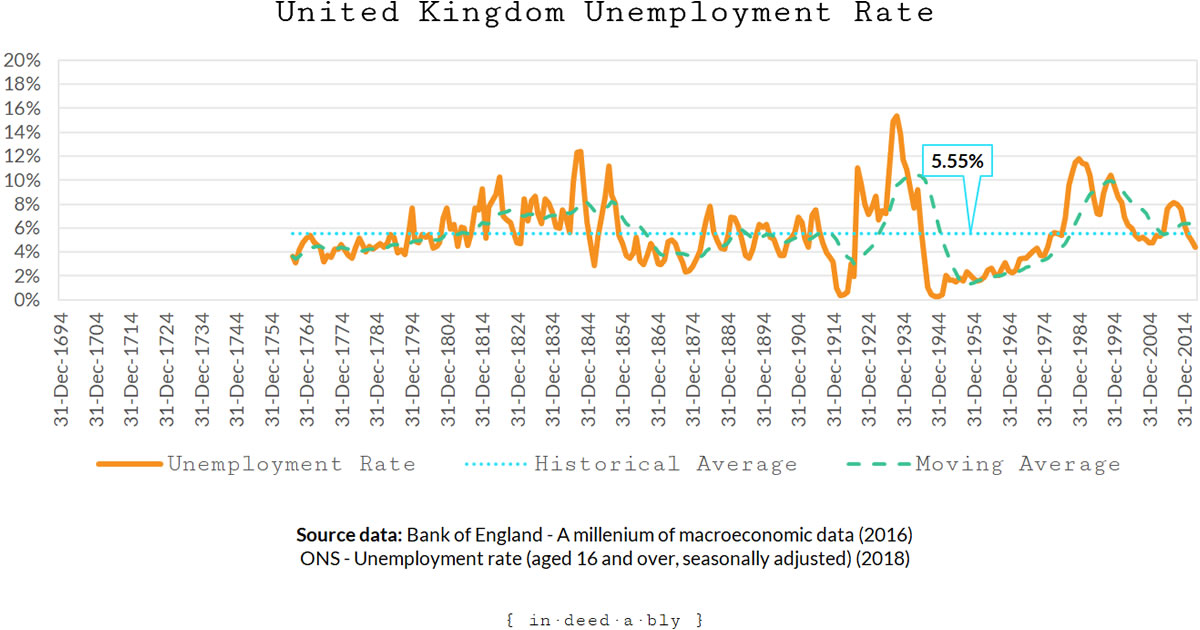

Unemployment

This chart shows a couple of self evident truths: unemployment goes up in times of recession and down in times of war.

The very gradual increase in unemployment from the end of the Second World War through to the mid 1970s was unusually steady, with little oscillation.

During that extended period there were jobs available to virtually anyone who wanted one.

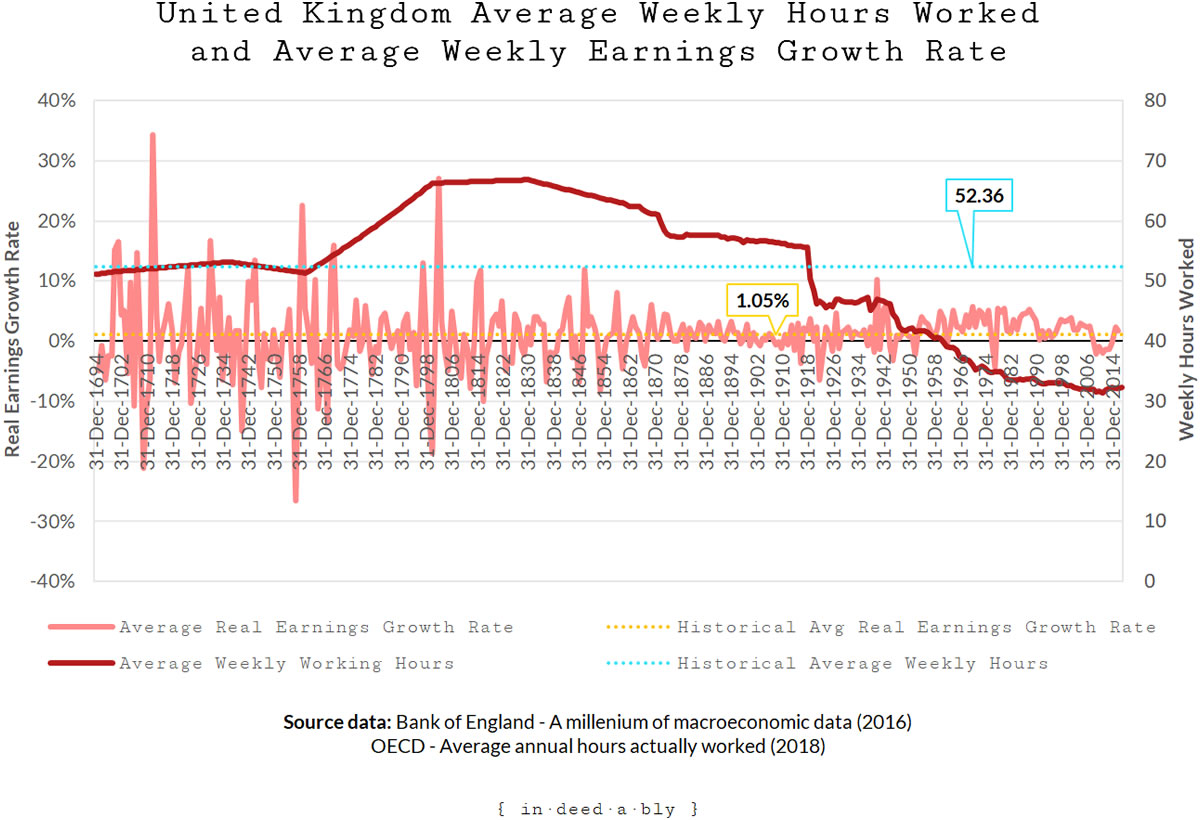

Wage growth and earning

There is a lot of noise in the media about real wages falling, and how hard life is today compared to years past.

Viewed over the longer term, we can see that falls in real wages are not uncommon. However enough time has past since it was last experienced that it is no longer in our collective living memory.

The narrative changes somewhat when average hours worked are plotted alongside real wages however. Real wages may have fallen, but the effort required to earn those wages has also reduced.

The question is, how is that time previously consumed by working being invested?

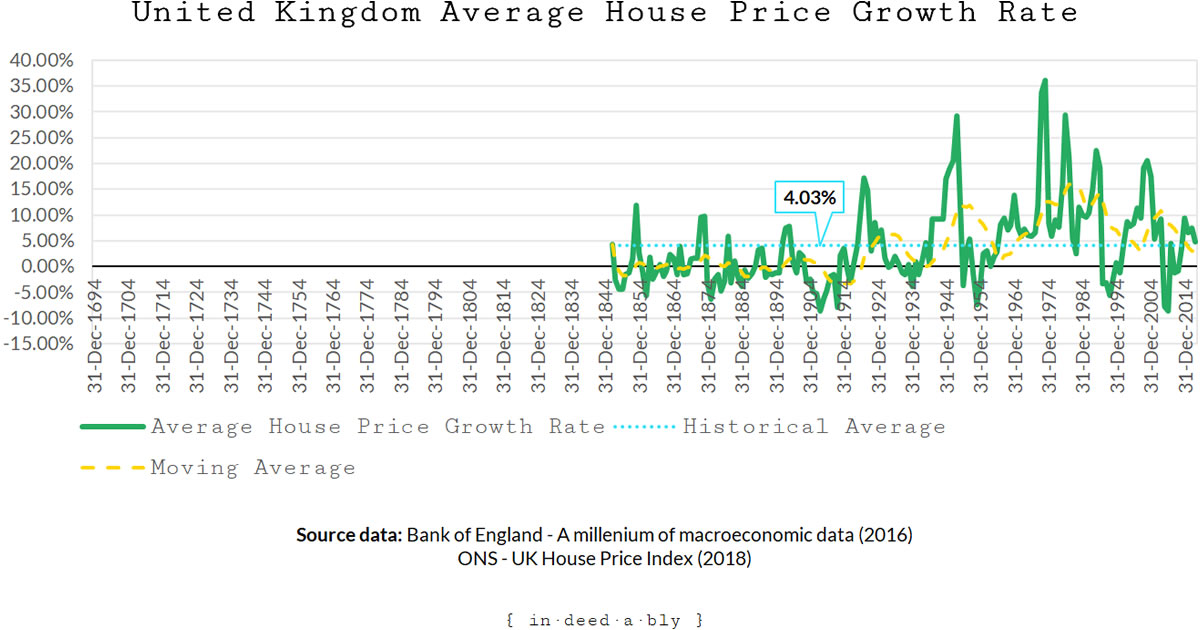

House Prices

House prices are an intriguing trend. The populous generally feels more prosperous when they are rising, though in many cases this is irrational as the next house most people may look at buying will likely also have risen in price.

The neutral or falling house prices currently being experienced across much of the country are far from unusual, though certainly inconvenient for those seeking to refinance or sell.

Is it a time for an eye test?

A common narrative running through much of the Financial Independence discussion is that market timing and market forces don’t really matter.

Invest for the long term, ignore the noise, and live happily ever after.

One thing these longer time horizon charts highlight is that economic conditions can fluctuate markedly over an investor’s time horizon.

It is true that over the very long term returns and growth rates average out to a nice palatable smooth figure.

But what if your personal journey coincides with a depression, war, coup d’état, deflationary period, or some looney tunes economic policies?

Or conversely, begins with a trip down the yellow brick road full of unicorns and rainbows, only for the wheels to fall off later?

These events certainly affect your investment outcomes at the time.

More significantly, they will also colour your judgement and perspective of everything that follows after.

Perhaps making you overly risk averse, like my grandparents.

Or overly complacent, like some of the more vocal cheerleaders in the FIRE movement.

Challenge your own perceptions.

Why do you believe what you believe?

Is it backed up by the data?

Or is it more of a (possibly irrational) belief based on how you would like to see the world?

References

- Bank of England (2016), ‘A millennium of macroeconomic data‘

- Bank of England (2018), ‘Official Bank Rate history‘

- Bank of England (2018), ‘Official Bank Rate history Data from 1694‘

- Broadberry, S.; Campbell, B.M.S.; Klein, A.; Overton, M.; and van Leeuwen, B. (2015), ‘British Economic Growth, 1270-1870‘, Cambridge: Cambridge University Press.

- Crafts, N.F.R and Mills, T.C. (1994), ‘Trends in real wages in Britain, 1750-1913’, Explorations in Economic History, Vol. 31 (2).

- Feinstein, C.H. (1972), ‘National income, output and expenditure of the United Kingdom 1855-1965‘, Cambridge: Cambridge University Press.

Feinstein, C.H. (1989), ‘Wages and the paradox of the 1880s’, Explorations in Economic History, Vol. . 26. - Mitchell, B.R. (1988), ‘British Historical Statistics‘, Cambridge University Press.

- O’Donoghue J., Goulding L. and Allen G. (2004), ‘Consumer Price Inflation since 1750’, ONS Economic Trends 604

- Office of National Statistics (2018), ‘Average actual weekly hours of work for full-time workers (seasonally adjusted)‘

- Office of National Statistics (2018), ‘Consumer price inflation time series (MM23)‘

- Office of National Statistics (2018), ‘Gross Domestic Product: chained volume measures: Seasonally adjusted £m‘

- Office of National Statistics (2018), ‘Unemployment rate (aged 16 and over, seasonally adjusted)‘

- Office of National Statistics (2018), ‘UK House Price Index‘

- Organisation for Economic Co-operation and Development (2018), ‘Average annual hours actually worked‘

Notes

Base rate sources:

- Year end bank rate 1694-1972 (Broadberry et al., 2015).

- Year end minimum lending rate 1972-1975 (Broadberry et al., 2015).

- Official bank rate 1976 onwards (Bank of England).

Recession sources:

- Nominal GDP 1694-1995 (Broadberry et al., 2015). Rule applied: Recession = Negative annual growth.

- Seasonally adjusted gross domestic product: chained volume measures 1995 onwards (ONS). Rule applied: Recession = 2+ consecutive quarters of negative growth.

Base rate historical average calculation:

- Average of month end base rates.

Consumer Price Index sources:

- Mitchell: Schumpeter-Gilboy index 1661-1750 (Broadberry et al., 2015).

- Crafts and Mills: 1750-1770 (Broadberry et al., 2015).

- Feinstein: 1770-1882 (Broadberry et al., 2015).

- Feinstein 1882-1914 (Broadberry et al., 2015).

- O’Donoghue: 1914-1949 (Broadberry et al., 2015).

- Consumer price inflation time series (MM23) 1949 onwards (ONS).

Consumer Price Index historical average calculation:

- Average of annual inflation rates as at year end.

Real Interest Rate calculation:

- Rule applied: Year end base rate – Year end annual inflation rate.

Real Interest Rate historical average calculation:

- Average of year end Real Interest Rates.

Unemployment rate sources:

- Break adjusted unemployment rate 1760-1971 (Broadberry et al., 2015).

- Unemployment rate (aged 16 and over, seasonally adjusted) 1972-2017 (ONS)

Historical Average Unemployment rate calculation:

- Average of year end unemployment rates.

Average weekly working hours:

- Composite series of Average Weekly Hours worked adjusted for part time work, sickness, holidays, and stoppages 1694-2009 (Broadberry et al., 2015).

- Average weekly hours worked 2010-2017 (OECD)

Average House Price growth:

- Composite house price growth measure 1846-2009 (Broadberry et al., 2015).

- Annual house price rates of change, UK all dwellings 2010-2018 (ONS)

Historical Average House Price growth calculation:

- Average of annual house price growth rates to December each year.

green monkey 2 December 2018

Of course market timing matters. The question is, can you do anything about it? The best plan of action may well be to invest for the long term and ignore the noise.

There is not much we can do about the time period we are born into. But it is good to remember that it has an enormous influence on how we live and how we view the world.

{in·deed·a·bly} 2 December 2018 — Post author

Thanks green monkey.

We can’t avoid the ups and downs, it is true.

What is important however is we don’t allow our perspective to be unduly biased as a result of them.

For example the folks who lost money during the dotcom bust, and consequently sat out the long bull market that followed the Global Financial Crisis.

[HCF] 3 December 2018

Why is that when someone tells you ‘don’t look this up on Goggle’ you do? I was suspicious that it could be something NSFW… I only dared to click on the Wikipedia link. It wasn’t until the ancestor case studies that I was able to forget about it. 🙂

It is interesting how you describe your parents’ and grandparents’ mindset especially when I match them with the general thinking in my country (Serbia). The common wisdom over here is still halfway between post depression/WW2 and the boomer/bloomer era. The conservation effect of long years of socialism, the damage of a not so distant dictatorship and the economic status quo as the result doesn’t help to adapt to the next level. At least these days they don’t start sharpening the scythe when you mention “investing” to someone (but in the back of their minds they are suspicious if you want to rob their money).

I got comfortable with the idea of investing a long time ago despite I didn’t know a single investor in my lifetime. Until roughly a year ago I was in the belief that we don’t even have access to a market which we could try to time… Now I know that the possibility is granted, however, it is tricky and don’t really accessible to everyone easily.

It is true that your experiences deeply affect your beliefs. I discover every now and then that I adopted some views of my parents’ generation which aren’t right for the nowadays and even these are coming from an era when I have never really lived. What is more interesting that I see many folks who are not realizing this and still chase the same carrots which aren’t really there anymore. I am deeply grateful that I discovered the FIRE movement and started to shift my mindset towards the reality 🙂

{in·deed·a·bly} 3 December 2018 — Post author

What a perceptive comment HCF, thank you for sharing your experience.

I can only imagine the sense of change and dislocation your parents must have experienced in their lifetimes. Starting out in an environment where a person has little control over their own destiny, and everything is provided… then finding themselves in a scary new world of having options and needing to fend for themselves. It would be enough to make my head spin!

The internet is certainly a wonderful thing for finding and learning about alternative perspectives and approaches. If only it made it was as easy to figure out who to listen to!

Dr FIRE 3 December 2018

Firstly, that is probably the funniest picture for a financial blog post yet.

Secondly, next time someone says not to search for something, I should listen. I did not need to find out what “yiffing” is, or that a word for such a thing exists!

Thirdly, great article. It’s easy to think that investing everything in the stock markets (e.g. a global index tracker, as is the usual advice) is a recipe for guaranteed success when looking at the previous ten years, but obviously past performance is no indication of the future! As ever, I think diversifying as much as possible is probably the safest way forward, and only invest (whether in the markets or in your own business, etc) that which you can afford to lose / don’t need immediate access to.

{in·deed·a·bly} 3 December 2018 — Post author

Sage advice all around Dr FIRE!

Thanks for reading.

Nick @ TotalBalance.blog 3 December 2018

I love the way you put things in perspective!

A week ago, I got into “an argument” on the Internet (stupid, right?) with an elderly woman (she was 60). She was arguing that debt was absolutely stupid, unless you used it to buy a house or start a company – and you should always aim to be debt-free by the time you retire(d).

It was obvious to me that her opinion was colored by her experience with the interest rate. I bought my first house in 2009 and I was paying around 3% interest if I recall correctly. Last year, I traded that house in for a bigger one (yes – it was stupid, but it was before I discovered FI) and I’m now paying 0.50% interest. I have no doubts that the interest rates are going to go up eventually, but I still have a hard time adjusting to that fact.

So, a while ago I sat down and graphed how our budget would actually look, if our current interest rate doubled – and then doubled again. It was pretty devastating actually! – And yet, I’ve made no adjustments or no plans to try and govern our future from that scenario…It’s strange.

I’m apparently overly optimistic, and I’m fully aware that I’m basically gambling with the future. I think though that I have an expectation that we will be able to adapt to whatever reality we face in the future, should the interest rates suddenly spike. We would most likely have to sell the house, and move into a smaller one. We have enough equity in our home, so it’s unlikely we would have to sell the house with a loss – but even writing this, I sense the dangers of my optimism 😉

Oh well, I guess you can count me as one of the “vocal cheerleaders” (I really loved that label! HA!) in the community. Don’t be blind to the future – but be prepared to adapt to it, should “the shit hit the fan”…

And btw, I didnt have to google yiffing. I’ve watched CSI… 😉

{in·deed·a·bly} 3 December 2018 — Post author

Thanks Nick.

It has been my experience that the path to happiness does not involve arguing with keyboard warriors from the internet!

If your new home makes you and your family happy, then you shouldn’t beat yourself up about purchasing it. It might be worth investigating locking in that super low interest rate mortgage for a fixed term, to provide some insulation (for the fixed term anyway) against rate rises.

I think you are correct, people are remarkably adaptable when they need to be. It is easy to forget that back in the late 1970s and early 1980s, when interest rates were eye-wateringly high, that folks used to spend a significantly larger proportion of their after tax incomes on housing than they do today.

They survived.

Most probably you will too, if the need arises.

Nick @ TotalBalance.blog 3 December 2018

My wife will be like: ARE YOU ARGUING WITH SOMEONE ON THE INTERNET AGAIN!?! When she hear my “angry typing” 😛

We are very happy with our new home – albeit we are well aware that it might not be our permanent residence. I think the important thing is just to be open with eachother about it.

We are here now – but in two years from now, we might not be. When our daughter starts school (summer 2020) there will be a natural shift in our transport patterns, so we are keeping this in mind as a preliminary “finish line”, and are open to maybe moving again in the future (closer to her school – in a cheaper house…).

We currently have a variable loan with a fixed interest rate for 3 years. If we convert to a fixed rate loan, our interest rate would rise to close to 3%. That’s a difference of 2.5% , which is pretty substantial in my opinion.

PendleWitch 4 December 2018

Nick, 60 isn’t elderly! 😉

Before taking out my first solo mortgage in ’96, I stress tested my repayments to 12%. So yes, what’s normal is definitely subjective.

Time scales matter a lot too. After all, over centuries, glass is a fluid; over microseconds, water is a solid.

Nick @ TotalBalance.blog 5 December 2018

Sorry! English is not my first language 😛

I did sense she got upset that I called her “old” (in my own language), so I should have learned my lesson by now!

What would be the correct term for a woman in her sixties? 😉