Lenny readied himself as the pitcher performed his pre-throw ritual. His team was 1-0 down.

The ball streaked in from the mound like a thunderbolt sent down by a vengeful god. An illegal pitch, aimed at Lenny’s body rather than the strike zone.

Not very sporting. Sometimes people feel compelled to show an opponent who is boss.

The pitch narrowly missed, passing behind Lenny’s back. Close enough to ruffle the fabric of his jersey before thudding into the waiting catcher’s mitt.

Unimpressed, Lenny readied himself again.

Bat poised.

Knees bent.

Ready to take an almighty swing.

The pitcher launched once again, a slower delivery this time, right over the plate.

In a single fluid movement, Lenny stepped inside the pitch and gently bunted the ball between the pitcher’s mound and first base. Dropping his bat, Lenny charged down the baseline.

Darting forward, the pitcher anticipated easily gathering the ball and tagging Lenny out.

The pitcher didn’t realise it yet, but he had just made three strategic errors.

His first mistake was aiming at Lenny’s body and missing. If you’re going to hit somebody, then you make damned sure they stay hit. You may not get a second chance.

His second mistake was not knowing that Lenny had represented his college in both baseball and football. Lenny may not have been the most gifted wide receiver to have ever played the game, but he had been tough enough to survive playing college football.

His third mistake was pissing Lenny off.

As he stooped to field the ball, a stampeding Lenny veered off the baseline, dropped his shoulder, and cannoned into the pitcher’s chest!

The pitcher was flattened like he had been hit by a runaway train. The impact sent hats and helmets flying.

Not very sporting. Sometimes people play the man, not the ball.

Lenny sprinted towards first base.

An outraged first baseman tackled him to the ground. The rest of the fielding team quickly piled on.

The pitcher sprang to his feet and dashed towards the melee. He had the presence of mind to show the umpire that he still controlled the ball, before tagging Lenny out and joining the fight.

Both dugouts emptied.

An all-in brawl ensued.

Lenny’s team had been under pressure and the game was getting away from them. He had taken a chance and done the unexpected. Unsettling his opponents. Changing the momentum of the game.

Not very sporting. Sometimes people swim against the tide, knowing they will be roughed up in the process.

Eventually, the umpires managed to restore order. A now closely contested game continued.

That night a local brewery had been running a 10 cent beer promotion at the stadium. It was a publicity stunt. The fans embraced the idea with an unexpected degree of enthusiasm.

With scores were tied 5-5 in the 9th inning, there was everything to play for. Rather than risk an adverse outcome, the local fans rioted.

Away team players were attacked with chairs and metalwork torn from the grandstands.

Home team players used baseball bats to defend their opponents from their own fans.

The umpire ruled the game forfeit to the away team. He was brained with a chair for his trouble.

Having achieved the sort of publicity that money simply cannot buy, the brewery opted to continue the 10 cent beer promotion at the next home game. The only concession made to the dangers of posed by a marauding mob of drunken fans was to impose an unenforceable four drink limit.

And to station a squad of riot police in the stadium car park. Just in case.

Not very sporting. Sometimes people make the wrong decisions and learn the wrong lessons.

Here be dragons

In the late 1990s, the world was in the midst of a panic about the looming threat of the “Y2K bug”.

Doomsayers, politicians, pundits, and technology consultants loudly and regularly proclaimed that the end of the world was nigh.

At the turn of the century command and control systems were predicted to fail. Electricity and gas supplies would cease. Floodgates would open. Planes would fall out of the sky.

For decades, programmers had cut corners by storing four-digit years in two digits worth of space.

Y2K marked the point where those two digits looped, making it impossible to tell whether the year 00 represented 1900 or 2000.

Not very sporting. Short-sighted decision-making by the few are often paid for by the many.

Fearful about business continuity and legal liability, firms collectively opened their wallets to the tune of billions of pounds. Vast armies of consultants gleefully lined up to help them spend it.

Testing, and occasionally fixing, computer systems against Y2K vulnerabilities. Systems that in many cases those same consultants had designed and built in the first place.

History tells us that Y2K turned out to be one of the largest boondoggles of all time.

The forecast cataclysm did not eventuate. The predicted long term hangover failed to appear.

The consultants profited handsomely from all the headlines, mayhem, and misdirection. Much as the brewery behind the 10 cent beer promotion had done.

Those CEOs who invested heavily in preparations where punished for needlessly wasting shareholder funds.

While those who pretended the whole thing wasn’t happening, ostrich-like, were often rewarded for their apathy.

The line between bravery and stupidity can only be drawn in hindsight, determined by the outcome.

Lenny steamrolling the pitcher might have been seen as inspirational standing up to a bully, had he made it to first base. Instead, he got tagged out and found himself on the bottom of an all-in brawl.

Not very sporting. Sometimes those who stand up for themselves or do the right thing get punished.

For the insiders, the only ones qualified to know the truth, Y2K represented a massive gravy train.

Y2K defined a pattern that had been successfully repeated for every large regulatory change that has followed. Basel. FATCA. GDPR. MiFID. Sarbox. Solvency. The list is long and oh so expensive.

An immovable deadline.

A severe imbalance between supply and demand.

Impossible to replicate specialist skills and knowledge.

A textbook seller’s market. Firms having little choice but to pay what it cost. And pay they did!

Not very sporting. If you follow the money, you could be forgiven for wondering if policy and regulation are actually written by lobbyists and consultants working on behalf of those who will ultimately profit from the changes.

Deemed employment

I can’t help but observe many similarities between Y2K and the ongoing palaver that is the United Kingdom’s “deemed employment” tax rules.

An idealistic principle underpinning society is that a fair day’s work deserves a fair day’s pay.

Governments then siphon off a fair amount of tax to pay for those foundation services upon which a smoothly functioning society depends. Education. Emergency services. Healthcare. Police. Roads. Social security.

Civil rights campaigners have fought to universally apply that principle, correctly observing that equal work deserves equal pay.

Like many things in British society, the tax system is seldom fair and rarely equal.

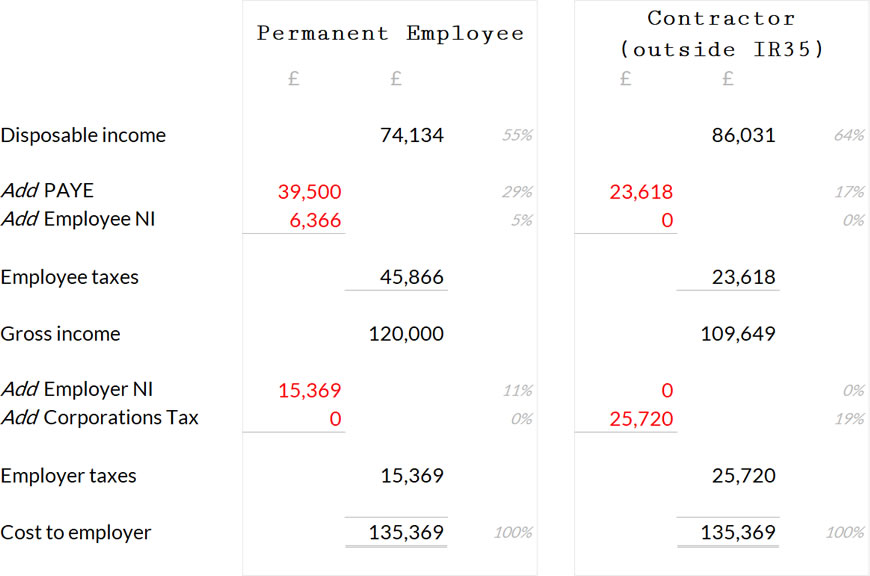

Today, there could be two people sitting side by side in an office, performing identical roles.

The first is a permanent employee. They receive a net salary after income tax (PAYE) and social security contributions (Employee’s national insurance) have been deducted. Their employer will have also had to pay the government a payroll tax (Employer’s national insurance) for the privilege of employing the staff member.

The second is a freelance contractor, working through a limited company. Their company invoices the client on a time and materials basis. Eventually, that invoice payment gets distributed to the contractor in the form of dividends.

In the general case, the contractor then (probably) pays income tax on those dividend payments. However, the contractor probably won’t pay need to any social security contributions. Nor will their limited company be charged payroll tax.

These interchangeable providers of professional services receive very different disposable incomes for their efforts.

Same location. Same role performed. Same working hours.

Not very sporting. Most taxes are optional, the system offering arbitrage opportunities to those who seek them out.

On the face of it, this arrangement seems inequitable. Unfair. Unjust.

As is often the case, there is more to this story than there first appears.

The permanent employee receives a benefits package on top of their salary. Paid holidays and sick leave. Pension contribution matches. Health insurance. Training and professional development.

Benefits packages vary based on market conditions, the generosity of the employer, and the negotiating skills of the potential employee. If you don’t ask, you don’t get.

Meanwhile, the contractor receives none of those things. If they want them, they have to buy them. To make the comparison fair, the figures in the table above assume the contractor works only 45 weeks of the year. They take the same five weeks of annual vacation, plus bank holidays. In the contractor’s case, all unpaid.

Entrepreneurial

Next, consider entrepreneurial risk.

An employee takes very little. Their employer is likely owned and run by others. Somebody else worries about keeping the lights on and making the payroll each month.

The contractor takes on a lot. They own and operate a business. All the pressure, responsibility, and uncertainty belong to them alone.

They ride the rollercoaster that is the life of a business owner. Reaping the benefits of profitability during the good times. Warming the bench and earning nothing during the inevitable quiet times when the market is down or their skills are no longer in demand.

At the conclusion of the project, the permanent member of staff will be allocated their next assignment. No friction. No loss of earnings.

The contractor gets thanked for their efforts and shown the door. If they are both well organised and fortunate, they will have another client lined up. More often, they will find themselves on the bench. Earning nothing. Scrambling to find another client willing to pay for their services.

Not very sporting. Simple contract versus permie money comparisons are deceiving.

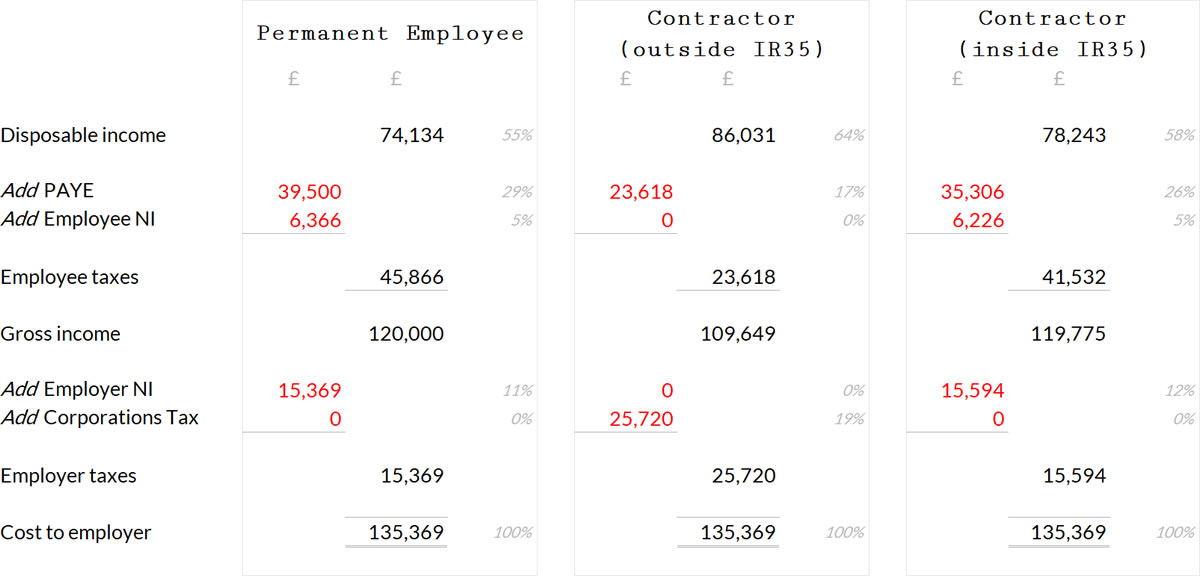

Recently the United Kingdom government decided that the contractor is a “deemed employee”.

What does this mean?

The tax authorities will pretend that the contractor’s limited company does not exist. They are said to fall “inside IR35“.

Instead, they rule that the contractor’s revenue should be taxed at source, consistent with the way the permanent employee is taxed. Now the contractor is both employer and employee, liable for both lots of tax.

On the face of it, the numbers now look much more equitable. The permanent employee and the contractor each receive approximately the same disposable income. While the tax authorities take roughly the same sized bite from each.

Sounds reasonable, no? Fair. Equitable. Arbitrage opportunities removed. Injustice redressed.

Except that the contractor still receives no benefits package. No healthcare. No pension. No paid vacation days.

They experience none of the certainty or risk avoidance enjoyed by the permanent employee.

They must still provide their own equipment and training.

Recalcitrant clients will still need chasing for payment.

Services need to be marketed.

Paying clients found.

To the contractor, this change feels as threatening as Lenny was when faced by a drunken mob armed with pipes and chairs torn from the grandstands.

Not very sporting. Sometimes it isn’t your imagination, the government really is out to get you.

To make matters worse, the tax authorities have decided that if the freelancer does not pay their taxes properly then it is their client who is liable.

Think about that for a second.

That is the equivalent of you being held liable for your plumber, housekeeper, or the mechanic who services your car not filing their taxes properly. You have no control over their financial affairs, yet you are exposed to considerable liability should they cut corners or not do the right thing.

Many clients took one look at the risk of potentially vast penalties blowing their budgets and understandably decided they no longer wanted to engage the services of freelancers any longer.

Instead, they would use consultancies.

Coincidentally those same consultancies are often performing working practice assessments for the clients. Advising them about their risks and exposures under the new rules, should they continue to engage freelancers as opposed to consultants.

Not very sporting. Sometimes conflicts of interest and misaligned commercials intersect in alarming and expensive ways.

Not very sporting

It will be interesting to watch how the “deemed employment” changes ripple throughout the employment market.

How adverse will their impact on projects and programmes prove to be?

What will former contractors do when they realise freelancing is no longer financially viable? Join a consultancy? As a permanent employee?

Contractors will see their day rates decrease by their additional tax burdens. Few will be able to pass those costs onto their clients in the form of higher day rates. In a competitive globalised skills marketplace, the work will simply flow to lower priced alternatives.

Clients will incur increased costs when sourcing interim staff from consultancies, rather than using freelancers. They will have little choice, given the alternative is recruiting ongoing permanent staff.

The government will almost certainly carry on acting like an unruly drunken mob. Making ill-conceived decisions. Giving little thought and even less care about the resulting consequences of their actions.

Meanwhile, the consultancies will do what they do best. Adapt. Evolve. Play the angles. Profit from the change and confusion. Work towards an end game that benefits themselves, often at the expense of their clients, subcontractors, and the government.

Not very sporting.

References

- Baseball Reference (1974), ‘Texas Rangers at Cleveland Indians Box Score, June 4, 1974‘

- Bleacher Report (2009), ‘Cleveland Indians’ Ten Cent Beer Night: The Worst Idea Ever‘

- Contractor Calculator (2020), ‘Financial Profile – Contractor – Inside IR35‘

- Contractor Calculator (2020), ‘Financial Profile – Contractor – Outside IR35‘

- Contractor Calculator (2020), ‘Financial Profile – Permanent Employee‘

- HM Revenue & Customs (2020), ‘Off-payroll working (IR35)‘

- Meyer, R. (2013), ‘No Old Maps Actually Say “Here Be Dragons”‘, The Atlantic

- NC State University (2006), ‘A Brief History of Outsourcing‘

- SMU Jones Film (1974), ‘WFAA Film of A Great Baseball Fight – Rangers vs Indians 1974‘

- Sports Reference (2020), ‘Lenny Randle‘

GentlemansFamilyFinances 12 February 2020

in my industry, everyone is waiting for an announcement to be made soon.

As a contractor who has missed 4 days in 4 months that would have been covered under “sick leave” if I was an employee – the risk of being a contractor are well felt by me.

If it’s a question of tax – then there are easier ways to do it than make everyone employees without benefits.

{in·deed·a·bly} 12 February 2020 — Post author

What industry wide announcement are you waiting for, GFF?

The laws have been on the books for years.

The policy announcement about interpretation was made long ago.

The changes have been live in the public sector for a while now.

The effective date has been set for the private sector, though they wobbled a little bit last week by pretending the new rules won’t be applied retrospectively.

The only action the government now needs take for it all to go ahead is to wait until the end of March.

GentlemansFamilyFinances 12 February 2020

Contractors in my position don’t think that we fall within IR35 and it’s that uncertainty that is present. The company I contract for’s clients haven’t voiced their opinion on whether IR35 will apply or not to us.

According to the government’s own IR35 checklist I’m not affected but the decision is not made by myself.

weenie 12 February 2020

Interesting take on this, indeedably. I’ve just attended an IR35 seminar run by HMRC (I’m in the recruittment industry) and it’s evident that all they’re interested in is scooping up the extra £3bn (their number) they think they will get from extra taxes. They don’t really care who pays, as long as someone does.

I see where you are coming from but your numbers are rather off, the consultants are often on vastly inflated pay compared to the permies; the benefit packages are nowhere near as generous as that pay. Yes, you provide your own equipment but that would often just slip through on company expenses, no?

My ex was on more than 3 times my salary yet paid less tax than I did – that wasn’t very sporting! 😉

There are contractors who have been raking it in (and why not, if they can?), working for the same client on ‘different projects’ for many years. (of course, not saying you are one of these).

One such client of ours has deemed (after independent consultation) that all 50 of their contractors are inside IR35, so huge shocks all round when their new estimated pay was revealed. By the way, under AWR (agency workers rights) after a period of time, there should be holiday and sick pay entitlements, so worth reading up on that if that applies. And don’t forget auto-enrolment into pensions.

It’s looks like the huge majority of these guys will be signing their new PAYE contracts (whilst crying probably), with a few of them looking to get gigs overseas which are still lucrative.

This extreme stance hasn’t been taken by the majority of our clients I might add but it’ll be interesting to see how it turns out in the long run. Personally, I can’t see them sticking to it.

{in·deed·a·bly} 12 February 2020 — Post author

Thanks weenie.

The comparison is designed to illustrate how an identical cost to the business plays out under each resourcing model. The numbers were arbitrary, representative of a “typical” white collar professional.

The goal was simply to highlight the impact and potential ramifications of the pending changes.

I would expect many contractors who are offered the chance of remaining at their current clients will eat the effective cut in take home pay and stay put.

The alternative is to jump ship, then compete in a flooded market for the small pool of gigs remaining “outside IR35”. They will likely incur some bench time, and probably settle for a lower day rate if they do manage to find a suitable role.

David Andrews 12 February 2020

It’s going to be a bumpy ride. My contracting partner has been advised she’ll be inside IR35 and there will be no increase to her day rate. She’s rather unhappy about this and has sufficient financial backing to take an extended break in the hope she can secure an outside IR35 role somewhere else or that her soon to be former employer will implode and have a change of heart. I’ve always been a PAYE worker drone but recently I’ve been making aggressive pension contributions that have effectively taken me out of income tax and mostly out of NI (I am a terrible person and I’m gaming the Salary Sacrifice scheme). So in my case I get all the benefits of secure employment ( annual leave, sickness, pension etc) but I’ve been able to avoid ( definitely not evade, in case HMRC are reading this) a significant amount of tax. Life isn’t fair – especially considering many of these rule changes are made by those in secure public sector employment, many of whom have unfunded generous DB pension schemes. As for the next budget, there are also rumours of changes to the tax relief on pensions that are causing quite a stir. The general feeling I get is that there’s just not enough money to meet the current and future commitments so lots of people are going to get squeezed. This may change my potential early retirement into a very early retirement. .

{in·deed·a·bly} 12 February 2020 — Post author

Thanks David. Good luck to your contracting partner, sounds like she faces an uncertain couple of months ahead.

Serious question: when has there ever been enough money to meet the government’s current and future commitments?

I agree about the squeezing part. When one side of politics demonstrably doesn’t wish to be in power, while the other has a sizeable majority and a rusted on grey vote, the government of the day can do pretty much whatever they want providing they don’t upset the current crop of pensioners.

GentlemansFamilyFinances 13 February 2020

I’m waiting until the budget is announced before getting too worked up about any changes.

As usual you must learn the rules of the game if you are going to play (and win).

David Andrews 13 February 2020

Definitely agree with your statement of ” you must learn the rules of the game if you are going to play (and win).” Over on the Telegraph forum there’s howling outrage at the whispers about changes to pension tax relief. That particular change comes up prior to every budget but nobody has been brave or foolhardy enough to rock that boat.

GentlemansFamilyFinances 13 February 2020

I often think that the “always changing the rules” wingers wouldn’t be able to tell you exactly what changes have been made to pensions over the years – other than it’s made their life worse and it’s too complex.

And they’ll never have actually read the budget just read the headlines and comments at the Telegraph.

PendleWitch 15 February 2020

Aww, a bit unfair on ancient programmers – they weren’t cutting corners: those 2 digits for the century would have used up vital space, no? Plus Y2K was carried out and no badness ensued. We don’t have any evidence that not doing the work would have made no difference.

But yes, I feel there is a tendency to hammer the small person and funnel big bucks to the global companies. (Is it a conspiracy if that is the actual effect?!)

(I started programming in ForTran 77, but managed to avoid Y2K work. Phew.)

Good luck on the freelancer stuff, everyone. Stay nimble!

{in·deed·a·bly} 15 February 2020 — Post author

Thanks PendleWitch.

I remember facing a similar space problem with CDR records coming off telecoms switches back in the late 90s. We needed to store a full datetime value, but the very space constrained record only had capacity for a couple of characters. We came up with a scheme to work around the limitation by using base 57 numbers to squeeze a lot of information into a small amount of space. It wasn’t particularly elegant, trading storage for processing cycles to encode/decode, but it got the job done.

My point here is to highlight there were many ways to solve the problem, and many smart engineers who did just that. Not all of them required vast amounts of expensive remedial action to mop up afterwards. But enough did to create the fear necessary to get that gravy train rolling.

Years ago at university, several of my friends studying accounting and economics dreamed of writing policy and “making a difference“. They joined various civil service departments, but after a couple of years most had jumped ship to the large consultancies.

A cynic would argue they were chasing the money (that was certainly part of the motivation), but the main factor was they simply went where that difference was actually being made. Clients would sponsor the consultancies to write opinion papers and draft policies. Under-resourced government departments would accept policy submissions, along with the usual minor graft and corruption that is corporate hospitality, and the promise of being “looked after” later on. Sometimes those policy submissions helped inform or influence the government’s approach to a given issue. Dishearteningly often the consultancy letterhead was simply replaced with the department’s own, and rubber stamped as official policy.