Mateo’s restful slumber was shattered by the incessant yapping of his neighbour’s hyperactive King Charles spaniel. It was late on a cool overcast Tuesday morning in Buenos Aires, the sort of weather that encourages hitting the snooze button and dozing for a bit longer.

His jet lagged brain took a bewildered moment to orientate itself to its surroundings. He was home. At last!

The long haul flight had been an endurance test. Delayed departing. Turbulent throughout. Late arriving.

He had run the immigration gauntlet on autopilot.

At least customs was quick. The airline conceding they had lost his bag, so he really did have nothing to declare.

Uber drivers were attempting to trigger surge pricing by playing the accept and cancel game. Mateo bypassed the crowd and grabbed a traditional taxi for the ride home.

It cost a small fortune, but he was beyond caring. Sometimes you just have to pay what it costs.

The moment he entered his flat, Mateo had kicked off his shoes, collapsed onto his bed, and fallen into an exhausted sleep.

The barking continued.

Mateo abandoned any hope of returning to sleep. He awkwardly writhed like a drunk who had been stunned by a taser, as he extracted his phone from the trouser pocket he had been lying on.

It was still on airplane mode from the flight the night before.

After reconnecting to the outside world, he idly skimmed through the news headlines.

The incumbent President, who had been running the austerity playbook, had been soundly defeated in the election primary by a fantasy-land populist. “Shit!”

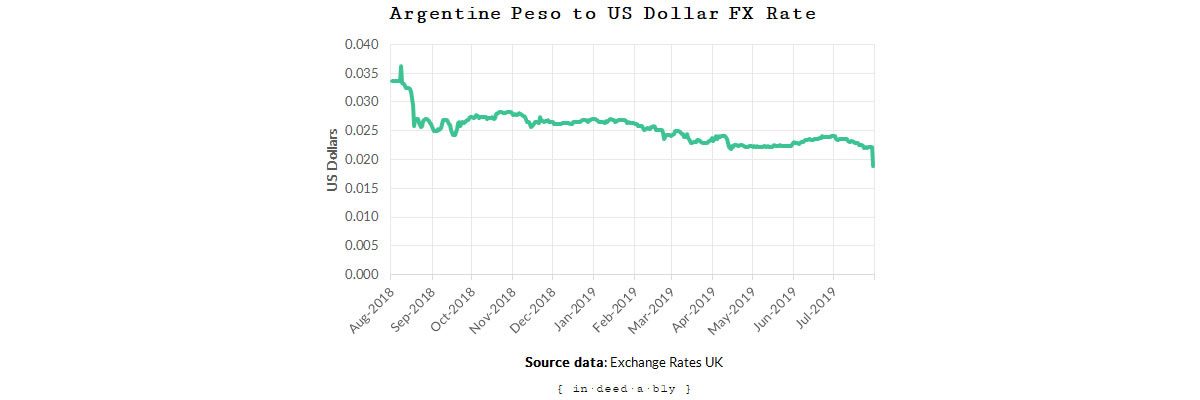

The currency was down over 40% from this time last year. “Bugger!”

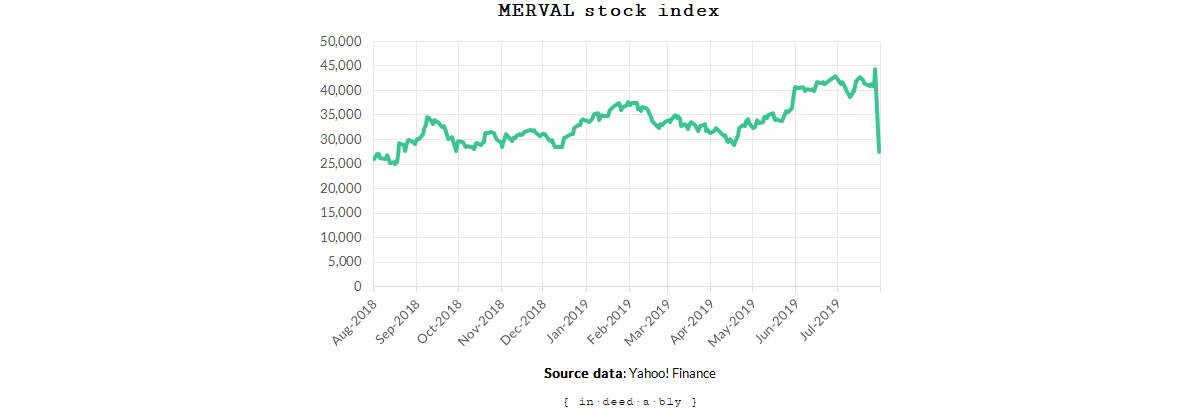

The stock market had crashed 48% previous day. “FUCK!”

All things considered, the week had gotten off to a sub-optimal start. What else could possibly go wrong?

Mateo’s phone pinged with a news alert: “Leading stockbroking firm experiencing a liquidity crisis”.

Not just any stockbroking firm, the brokerage Mateo used.

Meltdown

With a sinking feeling of impending doom, Mateo checked his email.

Over the course of the previous day, while Mateo had been flying home, his broker had sent him a series of increasingly animated messages.

08:34 – There is a likelihood of election related market volatility, we advise keeping a cool head. Investing is a long term game, ignore the noise and focus on the goal.

12:02 – The magnitude of the volatility is larger than expected, we advise staying the course. Compounding returns become more powerful the longer they are left uninterrupted.

15:27 – There is no doubt that investors have had a tough day at the office today. Only those who sell actually lose money when the market falls.

17:00 – This is an automated margin call. Your brokerage account contains inadequate security to support your margin lending facility. Please credit further security within three business days, or your trading positions may be closed out.

19:35 – Please be advised that due to the unusually high market volatility we will close out inadequately secured margin positions when the market opens tomorrow. We apologise for any inconvenience caused.

21:32 – Please review the revised list of securities that will be accepted as collateral for margin facilities, effective immediately. We apologise for any inconvenience caused.

He skimmed through the list. None of his shareholdings were included. “Oh bother!”

Mateo was a master of procrastination. Delaying the inevitable, he switched to the business section of the national newspaper website and scrolled through the headlines.

- The sky was falling.

- Doomsayers predicting the end of the world.

- Headless chickens executing poorly thought through knee-jerk reactions.

- Lack-wits calling on the government to do “something”.

- Rent seekers demanding bail outs and rescue from their own greed and calamitous misjudgements. Lobbying to pass accountability onto the tax payers.

He quickly closed the browser window. Hope and happiness is seldom to be found in the news!

Wisdom of crowds

The majority of Mateo’s financial knowledge had been self taught. There was a scarcity of accessible and well written financial content in his homeland, so he did what a generation of new investors had done before him: turned to the internet.

Mateo had read about the importance of diversification.

Balancing risk versus reward.

Minimising fees and taxes.

Consistency and patience.

Early on, he had discovered the Boglehead’s three fund portfolio. This spoke of breaking up your portfolio into three discrete buckets: one for bonds, one for domestic equities, and one for international equities.

This sounded like a prudent approach.

Mateo had heard that playing with foreign currencies introduced additional risks. Therefore he thought he would mitigate that risk by holding all his investments in his familiar local currency: the Argentine Peso.

Living in Argentina, Mateo invested a third of his assets in local government bonds. The yields appeared attractive, in the region of 25%. That was a much better return than all those Americans and Europeans wrote of achieving!

He invested a third in the low cost iShares ETF that tracked the domestic Argentinian market index, again denominated in the local currency. The collective wisdom of the internet repeatedly stated that stock-pickers were playing a game they could only lose over the long term.

The final third he invested in a locally listed global index tracker.

Then he waited.

Progress was excruciatingly slow. The Argentinian market made for a more volatile ride than the websites described.

Go big or go home

Mateo was impatient. He was smart and worked hard, his money should work hard too. He read up on margin lending, a way to use leverage to potentially boost his returns.

The broker would not accept the passive tracker funds as security for a margin facility, so he sold them and invested directly in local companies instead.

Mateo’s primary sources of information were business magazines and the finance section of the daily newspaper. There were regular features about some CEOs, where they spoke about how good a job they were doing, and promised great returns ahead for investors.

He didn’t rate the prospects of many of the companies in the index, so he cherry-picked those he believed were well placed to outperform the market. Surely his returns would beat the index if he avoided the companies that were dinosaurs, losers or zombies?

Mateo’s broker established a margin facility that let him borrow up to 25% of his portfolio value, at an interest rate lower than the cost of a standard variable mortgage.

He heeded the advice of some of the wise bloggers he followed, and went all in. “Fear is a limiting belief. Fortune favours the bold. Take massive action, today!”

naked in public

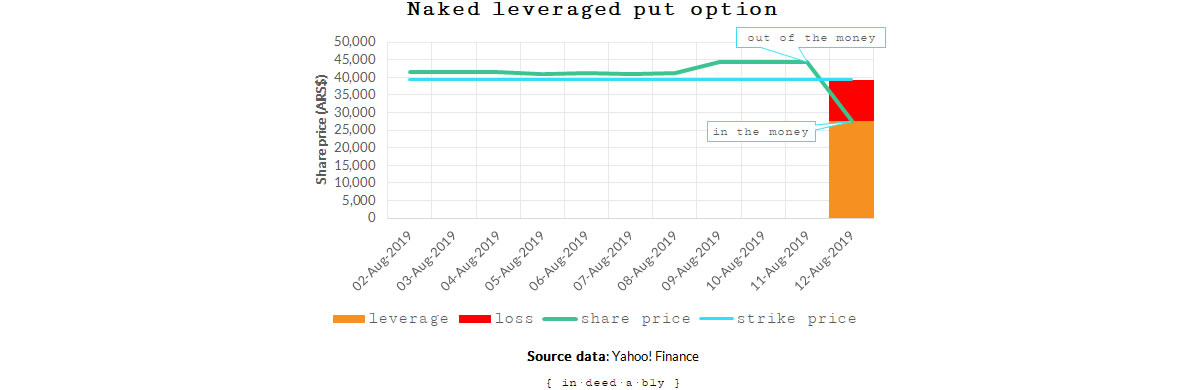

Next Mateo had learned of a way to boost the yield on his bond holdings.

A blogger had written about using selling leveraged short term “out of the money” naked put options, secured by bond holdings. There was a bunch of stuff about standard deviations that Mateo didn’t really understand, but anything involving nudity was alright by him.

The blogger had described the approach as being like running a casino. Mateo thought this sounded like a great idea. “The house always wins.”

A put option meant Mateo was selling insurance to investors who were worried about market falls. Many of the early retirement bloggers he had been reading described the inevitability of market rises. “The market always goes up over the long term, it is almost guaranteed.”

Every time the market closed higher, Mateo would pocket the sale price of the options. A small win, but a win nonetheless!

The naked part meant Mateo would incur all the downside risk if the market dipped.

The leveraged part meant his potential downside exceeded the security of his bond investments. Several times over.

Mateo fancied himself a stoic. Any losses were merely cost of doing business. If there was no chance of winning a prize then nobody would play the lottery. As the life coaching bloggers write about their power lifting: “no pain, no gain”.

Falling with style

Able to stall no longer, Mateo took a deep breath and logged into his brokerage account.

It wasn’t good.

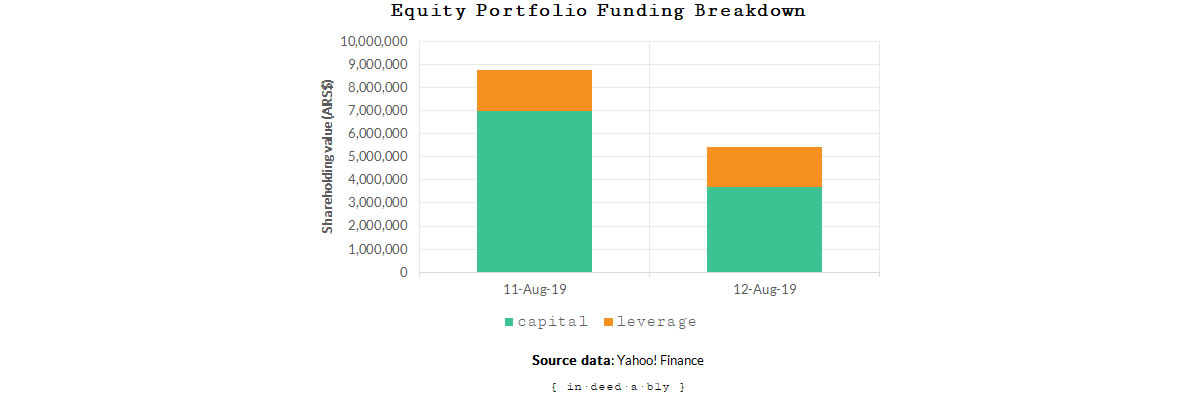

The stockbroker had closed out all his equity positions, his holdings no longer acceptable security for his margin facility. The sale locked in his losses, at the end of a day when the market’s value had halved.

His short term naked put options were now definitely “in the money”. Those punters playing in his casino had all hit the jackpot at once.

They had purchased the right, but not the obligation, to sell their holdings at a price slightly lower than where the market had been trading a week ago. Given the market values of those holdings had just been cut in half, you bet they wanted to exercise that option!

Mateo was scared. His portfolio was worth a mere fraction of what it had been the day before.

He recognised the same options and leverage that stood to boost his gains during good times had blown up on him. However he didn’t understand just how bad the picture was, or what to do next.

DIY is fun, when it works, but there comes a time to call in an expert.

Reluctantly Mateo swallowed his pride and phoned his stockbroker. He was more than a little relieved to discover a living, breathing person existed behind the brokerage app and website.

After being put on hold, and transferred between several departments, Mateo eventually spoke to a nice lady who grasped the magnitude of his problem. She formulated a plan to extricate him from the deep financial hole he found himself in. It wouldn’t be cheap, but she thought it was doable.

A few days later, the last of the trades required to exit Mateo’s positions had been settled. He hadn’t been bankrupted, but his net worth was greatly reduced.

Careful who you listen to

Mateo’s ego was bruised, and his finances were battered.

He had lost faith in the wisdom of bloggers. The real world bore little resemblance to the calm, certain, quick and easy place they so often described it to be.

Mateo recognised that he hadn’t understood many of the finer points about investing, leverage, and risk mitigation. He was certain that many of the bloggers didn’t understand them any better than he did.

He had also lost faith in the sanity of his homeland’s voters, the competency of its leaders, and the future prospects for its economy. A plummeting currency, and wishful thinking thinly disguised as government policy, provide a poor foundation for the future.

Mateo decided to move overseas in search of stability and opportunity.

He briefly considered the locations where many of those bloggers lived.

America? Guns, healthcare, trade wars, and Trump.

Britain? Boris, Brexit, and Corbyn as the alternative government.

With a wry chuckle he reflected that if he wanted to continue riding in a clown car of uncertainty he may as well stay home!

Instead, Mateo started to research how much it would cost to buy a European passport.

He remembered reading somewhere that it was possible to purchase EU residency in Bulgaria simply by purchasing a €40,000 property and living in it for six months.

After that he would go to Denmark, where he had read that a bank was offering negative interest rate mortgages where they paid you to borrow money!

References

- Amadao, K. (2019), ‘Put Options With Examples of Long, Short, Buy, Sell’, The Balance

- Collinson, P. (2019), ‘Danish bank launches world’s first negative interest rate mortgage’, The Guardian

- Exchange Rates UK (2019), ‘Argentine Peso (ARS) to US Dollar (USD) exchange rate history‘

- Financial Industry Regulatory Authority (2019), ‘Understanding Margin Accounts, Why Brokers Do What They Do’

- iShares (2019), ‘iShares MSCI Argentina and Global Exposure ETF‘

- Kellett, T. (2018), ‘Bankso’, The Buying Agent

- Kuepper, J. (2019), ‘Margin Call Definition’, Investopedia

- Larimore, T. (2018), ‘The Bogleheads’ Guide to the Three-Fund Portfolio‘

- Politi, D. (2019), ‘Argentina’s Macri Trounced in Primary by Voters Angry Over Economy’, New York Times

- Ponczek, S. (2019), ‘Argentina’s 48% Stock Rout Second-Biggest in Past 70 Years’, Bloomberg

- World Government Bonds (2019), ‘Argentina Government Bonds – Yields Curve‘

- Yahoo! Finance (2019), ‘ARS / USD‘

- Yahoo! Finance (2019), ‘Historical Data – MERVAL‘

Odysseus 17 August 2019

Hi Indeedably,

I had a very strange feeling reading the post. Couple days ago, after reading the “On the margin” post I requested to my broker to change my account from cash to margin and, for the first time ever, I used the margin to buy equities.

How I’m risk-averse, I’m using an amount that can be easily paid by my dividends in a short period of time. It was more to see “how it works”.

The history of Mateo is scary and see how volatile the investments can be.

Thank you for sharing the link about the Danish bank. Interesting from the buyer point of view.

Have a nice week.

Regards.

{in·deed·a·bly} 17 August 2019 — Post author

Thanks Odysseus.

Margin lending can certainly boost your investment returns, but the constant “marked to market” means a drop in share price can see you scrambling for additional security with little notice. A sustained drop may see that happen multiple times.

If you haven’t already I would encourage you to read ZXSpectrum’s insightful comment on the “On the margin” post discussing those risks.

As always, do your own homework and seek professional guidance if you need help figuring out what is right for you.

Good luck with your investing, I hope the market gods are kinder to you than they were to Mateo.

Odysseus 18 August 2019

Hi Indeedably,

Thank you for your answer and wishes. I had a look into the ZXSpectrum and it was a good point on top of what was discussed on both posts.

I have been reading about the topic for a while, and the amount that it represent on my actual investment portfolio (~2%) make it manageable.I would not have stomach (and I currently do not have the knowledge) to leverage 20%, 30%.

Nevertheless, I’m going to continue reading and trying to better manage it. 🙂

Best regards.

DossersDiary.com 19 August 2019

Good timing on this one. I’m currently in the middle of reading The Mandibles, a novel by Lionel Shriver, that’s in a similar vein (set in the future in the US). I’d recommend it. A good read – entertaining but strangely unsettling at the same time…

{in·deed·a·bly} 19 August 2019 — Post author

Thanks DossersDiary, I’ll check that one out.