I have a confession to make: one of my guilty pleasures is occasionally watching the tv show Grand Designs.

For those who have never seen it, this is a dramatised reality show about property development.

The basic premise of each episode is a couple with a dream for a “Grand Design”, lots of money, and little sense; decide to become amateur property developers. They typically attempt to save money by doing some/all the work themselves, while living onsite throughout the (often lengthy) build.

Invariably things go off the rails: Planning permission problems. Nimby neighbours. Slipped deadlines. Overrun timescales. Blown budgets.

For added drama often the developers end up pregnant before the build concludes… it appears there isn’t much to do in the evenings when you’re living in an unheated caravan, and house poor!

Eventually the build completes, with the “Grand Design” being presented like a display home.

Anecdotally once the cameras stop rolling more than a few of the marriages break up, with the recently completed “Grand Design” hitting the property market at a significant discount. Unsurprisingly few of those “perfect for us” bespoke design elements and quirky features that so inspired the original owners appeal to the general population.

Juggling knives

It would be fascinating to know the conversion rate between projects started versus episodes aired. Property development is an attritional game at the best of times, without the added dimension of potentially failing in front of a television audience!

There are several reasons I enjoy the show.

Partly it is for the property porn.

There is an element of voyeuristic thrill in watching “car crash television”, providing a strong reminder that perhaps renting isn’t so bad for now, as building a dream house is difficult.

In my experience, successfully getting more than one person to agree on what constitutes a “dream” anything is harder than juggling a dozen Sabatier knives while riding a unicycle that is on fire!

However the main thing I enjoy is how inspiring it is to watch the developers throw caution to the wind and really go for something they are passionate about.

No safety net.

No plan B.

Succeed, or go broke trying.

Occasionally one of the designs is genuinely beautiful. Often they are downright awful. Yet always there is something compelling about the passion the developers exhibit in pursuit of their dream.

Unexpectedly purple

I woke up this morning and discovered I owned a house with purple wall(s)! Who knew?!?

The ownership of the house wasn’t a surprise, I purchased it as an investment several years ago.

However I have another confession to make: I have never set foot inside this property.

Property investment is a numbers game.

In theory it is possible to identify areas with strong capital appreciation prospects via online research.

Determining the market price can be performed from afar.

Google street view makes it possible to virtually “stroll” around the local neighbourhood without getting off the couch.

Building inspections can (and should) be outsourced to somebody who knows what they are doing, and has sufficient professional indemnity insurance coverage for when they make a mistake!

From an investment perspective all of this research worked out nicely. However as any manager can attest, when you staff out things sometimes the unexpected happens.

Like the surprising purple walls, which nobody had previously mentioned. One of those quirky design elements that makes properties harder to sell, but possibly helps to explain why the purchase price I paid was so attractive!

At the risk of letting facts get in the way of a good story, I must disclose that I also happened to own a neighbouring property with an identical floor plan and similar fixtures and fittings.

While I believe in numbers-driven decision-making, I also like to verify what they tell me!

Several readers have requested I write some posts about my property investments, given that direct property accounts for more than half my asset allocation, yet I currently rent where I live.

Today I will use the (unexpectedly) purple-walled house as a case study to walk through my investment process.

Top down research

The first, and in my view most important, step in successful property investing is identifying an area that has the long term potential to appreciate in value faster than the prevailing market.

As per the cliché: the three most important property features are location, location, and location!

Why is this important? When it comes to property it is cash flow that makes you feel rich, but capital growth that actually makes you rich.

Buying a nice property is a shitty location might seem like you are getting a bargain. However when the time comes to sell, unless the area has drastically improved, that nice property will still be located in that same shitty location!

Identify areas that possess strong job opportunities.

Excellent transport links.

Located near good schools and healthcare facilities.

With ready access to shopping and entertainment.

Ideally identify areas that don’t yet enjoy all of these, but soon will do. It is the introduction or improvement to this type of infrastructure that should see property prices rise faster than the rest of the market.

In the case of the purple-walled house, when I bought it the local neighbourhood had a single primary school, a small medical clinic, and a tiny shopping precinct containing just a small grocery store, a newsagent, and a kebab shop.

However zoning and development approvals had been sought, and recently granted, to significantly improve the area.

Today there are three primary schools and a high school nearby. A Westfield style shopping centre has opened, along with two office buildings. The city’s light rail network has been extended to the shopping centre. A sports stadium is currently being constructed.

These improvements have had a significant positive impact on the land values of nearby properties.

Individual properties

Another property cliché is to try and buy the worst property on the best street.

The idea is that a rundown property may trade at a discount to its nicer looking neighbours. If it is possible to improve the property for less than the discount, then you come out ahead.

When choosing a property, always look for opportunities to create value.

Common examples include:

- subdividing

- extending

- remodelling

- re-zoning

- gaining planning approvals

- consolidating titles

- demolishing and rebuilding

Ensure the numbers, not wishful thinking, prove the viability of each of value-adding option.

Don’t be put off by minor cosmetic problems that could be easily and cheaply remedied. I never cease to be amazed at the number of prospective buyers who walk away from a good deal because they can’t see past hideous 1970s bathroom tiles or the current owner’s dubious decorating choices.

Those purple walls could easily be repainted within a couple of days.

Tread cautiously when considering sinking money into renovations that won’t add value. Decorating in the latest trendy materials may help a property sell faster, but are unlikely to shift the needle on the sales price you ultimately achieve.

Run the numbers

A good property must be capable of being self-funding.

If not, then you will be subsidising the living costs of your tenants. Which is charitable of you, but hardly the route to riches.

You may currently occupy the property yourself. However there is a reasonable chance that at some stage you will wish to move, potentially renting your property out to tenants.

A good investment property is self-funding before any tax offsets or deductions are taken into account. The rules can (and do) change, so if your investment only makes sense due to tax deductions then you’re screwed if they do!

When running the numbers make sure you factor in a reasonable safety margin for interest rate rises, void periods, management fees and maintenance costs.

Margin of safety

Build in a margin of safety so you don’t drown under the unexpected. Image credit: Clker-Free-Vector-Images.

The United Kingdom’s long term bank rate is around 4.7%. Within living memory, it reached as high as 16%.

Occasionally the property gods will smile and you will experience a seamless handover between tenancies.

More often there will be a void period.

During this time you are on the hook for all the ongoing utility bills, mortgage payments, and property related taxes. In addition to those, you also incur the costs associated with seeking and vetting a new tenant.

Even if you are planning to manage the property yourself today, that may not always be the case. It is better to ensure the property can afford professional property managers upfront, rather than getting an expensive shock at a later date when life happens and your plans change.

Properties incur maintenance costs.

Things wear out. Tenants break things. Water mains burst. Showers leak. Mice eat electrics. Fires occur.

You can’t know exactly what will go wrong, but rest assured something will semi-regularly… often on a bank holiday weekend when plumbers charge penalty rates to attend!

Occasionally there may be good exceptions to this general rule.

Personally my approach has been to ensure my property portfolio in aggregate is always self-funding, though at times individual properties have needed to be propped up by the others.

A property undergoing improvement works might be one example.

Another might be while putting together a title consolidation deal, selling a group of neighbouring houses to a property developer so they can be demolished and replaced by an apartment building.

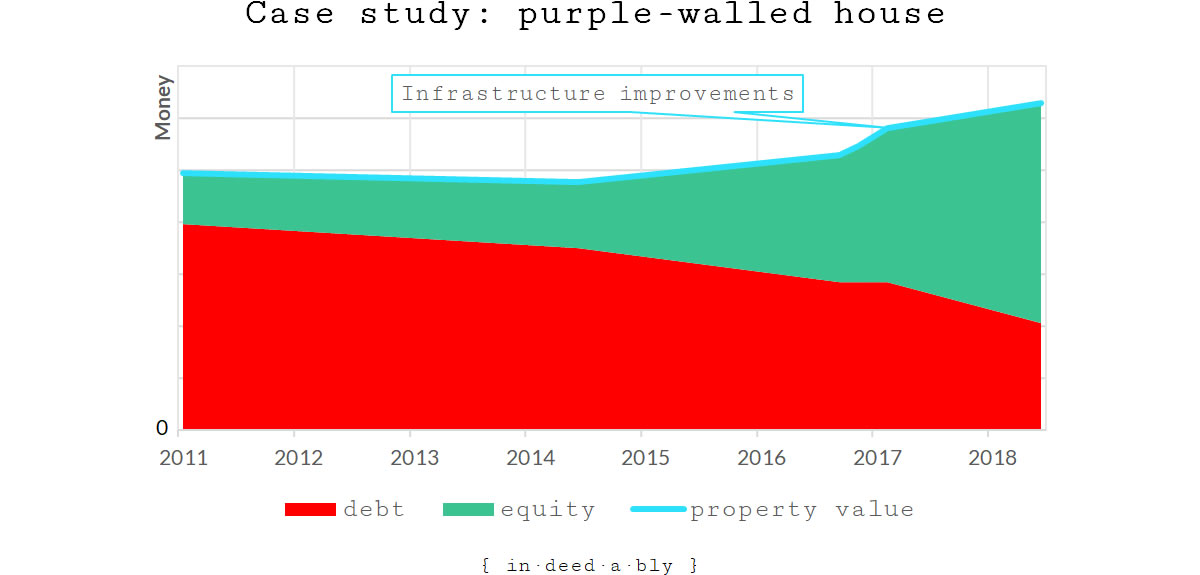

Case study: the purple walled house

For the purple-walled house I factored in a 4 week void period per year, which in my experience is the upper end of average. This meant my income figures were based on a 48 week rental year, rather than the 52 week calendar year.

Property management fees vary considerably by location. The purple-walled house is managed for 5%. I’ve had a property manager in London try and charge me as much as 15%.

Maintenance is a tricky one. I budget on maintenance costs being 10% of the gross rent. That more than covers most properties most years, but has proven insufficient to cover larger irregular jobs like repainting a whole house or replacing the flooring.

When combined, these figures give me a conservative view of what the property should earn, and what it will cost to own.

This provides an initial triage point, whether the total investment return (before financing costs and taxes) warrants further investigation. Would it make sense to invest capital into the property, or would it perform better elsewhere?

In this case the purple-walled house passed that test.

First the finding, then the financing

Next I ran a multitude of “what if” financing scenarios, looking at permutations of Loan-To-Valuation percentages, loan terms, and interest rates.

To ensure I don’t miss anything, I test all the options ranging from risk-averse owning the property outright through to a very risky 100% interest only mortgage.

I then stress tested those numbers assuming using an 8% interest rate. This is a lot higher than rates currently are, but I’m old enough to remember interest rates in the mid-teens!

In this case I contributed a 20% deposit, and financed the remainder with a flexible Home Equity Line Of Credit.

For this particular property I didn’t invest any cash at all, preferring to use accumulated equity from another investment property as the deposit. This meant my out of pocket expenditure on the purchase was limited to the conveyancing costs and loan establishment fees.

I did the victory dance when I discovered the jurisdiction covering the property’s location had recently abolished stamp duty, replacing it with a far more equitable value driven land tax!

Grand design

Returning to the present day, the property has performed largely as expected.

The neighbourhood improved, resulting in a one-off surge in property values. This took longer to complete than I had initially expected, an economic slowdown resulted in several of the infrastructure projects being mothballed for a couple of years.

Since then values of grown roughly in line with the prevailing market.

For the duration of my ownership, the property has been strongly cash flow positive.

The excess cash flow thrown off by the investment has been channelled into paying down the loan, reducing the gearing levels from an initial 80% to just over 40%.

Nobody would ever accuse this uninspiring suburban property of being a thing of beauty. The grand design lies in the financials.

All going well, within a few years the tenants will have successfully paid off the mortgage in full. The extracted equity I used as the deposit has been similarly repaid.

Should this occur, the purple-walled house will have be a good example of “making your money work for you” in action.

I would be in the fortunate position of owning outright an income producing asset, that has financed itself fully (once the initial buying costs were paid).

Nick @ TotalBalance.blog 11 January 2019

I must say, I hadn’t imagined you as a property porn consumer 😛

I too enjoy Grand Designs. And like you, I’d like to know how many episodes fail to actually air. I’m fairly sure it must be a significant number…

Anyway, great to get some tangible insight in your intricate mind 😉

Thanks for sharing – I already knew the gist of it, but I’ve yet to put that knowledge to good use…I’m agressively awaiting another property downturn here in DK.

I wrote a little about it here. I’d love to get your opinion on my “analysis” 😉

{in·deed·a·bly} 11 January 2019 — Post author

Thanks Nick. If you like property porn, take a look around Wowhaus. They curate some amazing property listings from around the world.

Many of the points people make about not trying to time the stock market could be just as applicable to the property market. There does tend to be a more tangible boom and bust cycle as supply and demand get out of balance, but there should always be good deals out there if you have the patience, knowledge and contacts required to find them.

Your post is interesting, but I fear you’re looking at physical property too much like a financial asset. The transaction costs for property purchases tend to be vast by comparison (e.g. in the London stamp duty on a purchase often runs into the mid five figure range), and the conveyancing process can take months compared to the few days settlement timescales for share dealing.

We all have a bias that makes property prices feel expensive at the time, then look “cheap” in hindsight.

Instead for directly owned property you need to determine what you believe it is worth, and what opportunities exist for creating value (something you can’t do with shares). If you can do that reasonably accurately then you will be able to identify successful investment candidates. The financing element and interest rates are important, but only factor in once you’ve found those reasonably priced properties with potential.

For those who aren’t interested in creating value themselves, REITs might be an easier way to go. Invest in the folks who are, less hassle and spreads the risk over a larger number of property investments. Peer-to-peer/crowdsourced lending may be another option, though a riskier one with a higher default rate.

Nick @ TotalBalance.blog 11 January 2019

You’re right, the entrance-fee to the property market is a lot higher, than that of the stock market 😉

I have been looking at REITs too – also in form of REIT-like local non-publically traded fonds.

However, since I started dabbling in crowdlending, I’ve become quite fond of the monthly dividends/interest payouts. And that’s obviously also one of the traits of rental properties. You have a monthly cashflow, which I really like.

I’m not dead-set on reaching FIRE slow and steady like most people. I’m still fairly young, and should I lose my FIRE pot – I’ll have time to start a new one, so I think I’m a little more risk willing than most FIRE seekers 😉

Obviously, I’m trying to be smart about it. – And posts like this one just encourage me even more to pursue that (first) property investment. Of all the people who have FIRED, properties tend to be an integral part of their wealth, and I believe it to be the most safe and stable “asset” – provided that you select the good/right ones, obviously…

{in·deed·a·bly} 11 January 2019 — Post author

“Of all the people who have FIRED, properties tend to be an integral part of their wealth”

Of all the people who have FIRED,

propertiesbusiness ownership tend to be an integral part of their wealth creation.Most people who successfully retire early have never heard of the FIRE movement. They were small (or large) business owners like plumbers, dentists, property developers, or farmers.

Property prices still rise and fall like the stock market, but at a much slower rate. If you get the numbers right they may throw off excess cash flow more regularly than listed company dividends. However receiving £2,000 a month or £24,000 once a year ends up being exactly the same amount of money, so pursuit of regular cashflow can be a bit of a red herring. You can always create yourself a regular “pay cheque” if that is a goal, indeed this is what the FIRE movement’s “safe” withdrawal rate approach seeks to do.

The main difference between directly owned property and most other asset classes is the ability to use leverage (without much risk of margin calls).

Using other people’s money to grow your own equity.

That isn’t without risk, but again if you get your research and numbers right, then it may help get you to the finishing line faster than using entirely your own money.

Nick @ TotalBalance.blog 11 January 2019

As always, you make some excellent points 😉

Thanks for challenging my perception of property ownership.

Whether you retire as a business owner or not, if you’re wealthy (and intend to stay so) you’ll eventually end up investing in real estate (is my experience). I just prefer to invest in real estate (in some form) now rather than later 😛

About the cashflow “hunting”, this is also an interesting observation. I agree to some degree that $2000/month or $24000/year almost amounts to the same – but the monthly cashflow will allow you to diversify a lot quicker – and also (in the case for crowdlending for example), having the benefit of monthly compounding should allow me to reach my goal faster, than if I “settle” on yearly “dividend” payouts. I do however agree that some of the great deals probably wont necessarily offer a monthly payout, so I won’t say it’s a hard requirement for me – it’s just preferred 😉

{in·deed·a·bly} 12 January 2019 — Post author

I applaud your enthusiasm.

For mine, owning investment property is a business, and it is important to treat it as one.

It can be profitable when done well, or ruinous if done badly.

You have the ability to improve and create value in a way that just isn’t possible with listed shares or bonds.

There is also the risk of being sued or prosecuted if you provide an unsafe product to your customers, the tenants.

As you know, I’m a big fan of collecting investments that throw off excess cash flow. Today these passive income streams fund my family’s food, utilities and rent bills.

That said, there can be a trap (particularly for new real estate investors) of chasing cash flow at the expense of total investment return. You see this with people buying lots of low cost “doors” in shitty neighbourhoods or rural locations.

In my experience a more optimal outcome is to evaluate both the capital growth and cash flow prospects of an investment, then choose those that offer the highest total combination that also meets the needs of the investor.

It will be the capital growth aspect that generates the real wealth.

Decisionsdecisions 13 January 2019

Hi, thanks for another insightful post, it’s great for me to hear from someone who has been there, done it and is reaping the benefits. Few specific questions I’d be grateful for some further clarity on…

Do you care in what part of the country the property is located? I.e. Will you literally look anywhere for value or do you prefer to have personal knowledge of the area / ability to travel there yourself?

Which mortgage lenders have you found helpful? Do you try and source financing directly or use a broker?

Have the gov changes in stamp duty and attempts to discourage BTL landlords changed your approach? if you were starting out from scratch would you still see value?

sorry hope you don’t mind the questions, although I’ve done some analysis into BTL, I’ve never had the confidence to just go for it so really helpful reading your approach and experiences

{in·deed·a·bly} 13 January 2019 — Post author

Thanks for the kind words Decisionsdecisions.

I do care a great deal about where a property is located, as it needs to be somewhere with strong growth prospects!

I’m open to considering anywhere meeting that profile, providing the local rules are understandable, the taxes are manageable, there is a strong rule of law, and there are no capital controls that may make extracting funds at a future date difficult.

It is certainly easier to invest somewhere you know, or where you have a reliable network of trusted folks who can be press ganged into helping out when things go wrong. A good example of this is when an amazing property manager departs, and you end up with a suboptimal replacement. Diagnosing and remedying that scenario from afar is no fun at all!

Lender and product choice vary greatly by location. My personal preference are for flexible HELOC style loans, that are often open ended and have no minimum repayment requirements (providing you don’t exceed the agreed maximum loan balance). These type of loans generally cost a bit more than your standard fixed term or tracker style mortgages, but to me the flexibility is worth the price.

Unfortunately these lending arrangements appear to be a dying breed in the UK. Here I always use a specialist mortgage broker, as being a semi-retired business owner means I would generally tick the “it’s complicated” box for employment status on a lending application.

A good broker will have the contacts required to bypass the automated “computer says no” initial application processing. In my experience the savings made on the lending products they help source more than pay for their fees.

The UK government appears to be executing social policy via the punitive taxes and increasingly burdensome regulations being imposed on private landlords. Being hit with a huge stamp duty bill, combined with the inability to offset financing costs against rental income, mean the business case for being a private BTL landlord no longer adds up in much of the country.

The trendy approach recently is to purchase BTL property via a limited company. However given the policy goal appears to be helping solve the (manufactured) “housing crisis” by increasing supply, this would appear to be a short term work around that I would expect will be closed off before long.

I think real estate as an asset class remains an effective way to utilise leverage to generate growth in a person’s net worth. However given the current UK tax and regulatory climate, I’m not convinced that the investment returns enjoyed by past generations of “buy and hold” (often accidental) landlords will be experienced by the current generation. If I were starting out, and my investment horizons were limited to just the United Kingdom, then I would be looking at shorter term property development projects rather than being a longer term traditional BTL landlord.

Hope that helps! As always, do your own research, and be careful acting upon advice provided by random strangers on the internet!

Decisionsdecisions 13 January 2019

Your last paragraph made me laugh out loud! ??

Thanks for the thorough response, in my area I think the boat may have sailed on BTL, and I don’t have the “homes under the hammer” trades people contacts to take on a massive renovation and complete it for minimal cost. Having said that, I think opportunities do and will still exist.

For now il keep on the lookout. Thanks again for sharing your experiences and knowledge.

{in·deed·a·bly} 13 January 2019 — Post author

If you haven’t stumbled upon it already, take a look around ThePropertyHub.

The forum there is full of folks similar to yourself, with an interest in UK investment property. Maintain a healthy skepticism, as there is a strong selection bias at work given those discussing things are for the most part already bullish on BTL as an investment approach. Also ensure you distinguish between those who are actually participating in the gold rush, and those who are profiting from selling them shovels.

Good luck with the property hunt.