“I read about this ‘FIRE movement’ in the paper. What a bunch of pretentious entitled snowflakes!

‘Life is hard. Boohoo. Woe is me, it isn’t fair. Mum always told me I was special.’

Do these people not realise life has never been so good?

Running away from problems never helped anyone.

Work out what is actually wrong. Figure out how to fix it. Then just fucking do it!

Problem solved.

Now go enjoy their actual life, instead of fantasising about an idealistic dream life that doesn’t exist.”

Big Wal’s inebriated voice boomed across the room, easily drowning out the ambient small talk at the wake.

He was speaking with a bunch of other old guys. Some politely nodded, while others looked puzzled.

“These foolish kids want to retire in their 30s or 40s. They think they can save enough during the first 10 to 15 years of their careers to fund whatever life throws at them over the remainder of theirs.

Imagine how things would have turned out if old Clarrie had retired in his 30s?

Sounds more like a bowel movement to me!”

Big Wal downed the last of his beer as his explanation was greeted with a mixture of disbelieving shakes of the head, knowing smirks, and derisive chuckles.

With a finely honed sense of timing, Big Wal’s long-suffering wife appeared at his side the moment his drink was empty. She herded him towards the door, muttering about letting people mourn Clarrie in peace and not making more of an arse of himself in public.

Mainstream media

The next morning, while battling a hangover and choking down some prehistoric cornflakes, I searched for the article Big Wal had referred to.

The local paper had recently replaced the bulk of their staff journalists with a syndicated news deal.

From what I recall, the gist of the article was some guy spent 10+ years earning megabucks torturing computers, while leading a hermit-like existence somewhere in rural America. He then cashed in his chips, retired to Scotland, and sold his story to a newspaper.

On a slow news day, somehow this unrelatable story was republished as filler content in a struggling regional newspaper half a world away.

Until Big Wal’s drunken protest, I had heard the word fire used in four contexts:

- A destructive force of nature that consumes all available fuel, leaving only ashes in its wake.

- The command that brings forth pain and suffering from the business end of a gun.

- Slang for dramatically and unexpectedly severing a person from their livelihood.

- That burning sensation a super hot curry provides, on the way in and again on the way out.

All of them painful.

None of them good.

According to the article, FIRE was now an acronym for the term Financial Independence, Retire Early.

Interesting.

Financial independence

The idea of financial independence made a lot of sense to me.

Everyone should seek the freedom that comes from conquering the financial imperative. Affording the luxury of separating time investment decisions from how they finance their chosen lifestyle.

The speed and realism of that goal depends upon the individual’s good choices and good fortune.

- Where they live.

- What and where they study.

- Whom they choose to live and socialise with.

- The skills, experience and network they curate.

- Which industry and profession they ply their trade in.

- Whether their efforts generate wealth for themselves or create it for others.

While the term financial independence was new to me, the goal was something I had been working towards my whole life.

Early retirement

The early retirement part was more puzzling.

Early retirement wasn’t unheard of.

Sportspeople retire relatively young. Broken bodies. Lost desire to win. Or simply unable to keep up.

Military personnel can retire early. Survive 20 years risking being shot at or blown up for a living, and receive a well-deserved pension.

Business owners sometimes retire early. Establish a business that is of value to others, sell out to the highest bidder, then head for the nearest exit.

In all three cases, the individual typically retires from one career, then transitions to another.

Retired sportspeople becoming coaches. Commentators. Motivational speakers. Or security guards.

Ex-military often become insurance brokers. Project managers. Real estate agents. Or tradespeople.

Those former entrepreneurs often pop up again as consultants or non-executive directors. Or line up to do it all again with a new venture.

However, those weren’t the style of early retirement the story was selling. The article ended with the memorable final line that left me with more questions than answers:

“He’s currently working on nailing down a new source of motivation — and it’s an ongoing challenge”

The successful young guy appeared to have bailed out of a lucrative career to do… nothing?

Unsustainable outcomes

To my simple mind, that seemed like a curious, and likely unsustainable outcome.

The mind is like a muscle, it atrophies. Use it or lose it.

Clarrie’s wake was attended by a host of retirees who once led accomplished careers. Now they while away their time doing nothing more intellectually taxing than babysitting grandkids, caravan holidays, and pottering around the garden. They were constantly being preyed upon by unscrupulous wealth managers.

Idleness leads to boredom. Boredom is stressful in its own way.

Bored people are often unhappy, and make trouble to keep themselves entertained.

Disruptive kids in class.

Difficult to manage staff at the office.

Machiavellian manipulators who play people off against one another just for sport.

I remember concluding the story was most likely a fabrication. The retiree an unlikely figment of the writer’s imagination.

Or perhaps the early retired guy was an avatar designed to lure readers into a sales pitch? I couldn’t figure out what he might be selling from the article, and wasn’t tempted to seek out more information.

Or maybe the story was genuine?

A selectively edited recounting of the experiences of a real person. In which case I figured that such an obviously intelligent person would soon stumble onto a productive use for their time and talents. A new job or business venture to keep boredom at bay.

Never had it so good?

Recently I learned that Big Wal had passed away from a broken heart. He had outlived his long-suffering wife by just a couple of months.

This sad news reminded me of his outburst, from which I first learned of the FIRE movement.

Since that time I have read a great deal of content by aspirational bloggers. Many of them seek the same outcome as the guy from the newspaper article. An escape from their everyday lives today, with only the vaguest of notions about how they will occupy their time tomorrow.

I have often wondered why that might be?

Is modern everyday life really so awful? Or was Big Wal right when he said people had never had it so good?

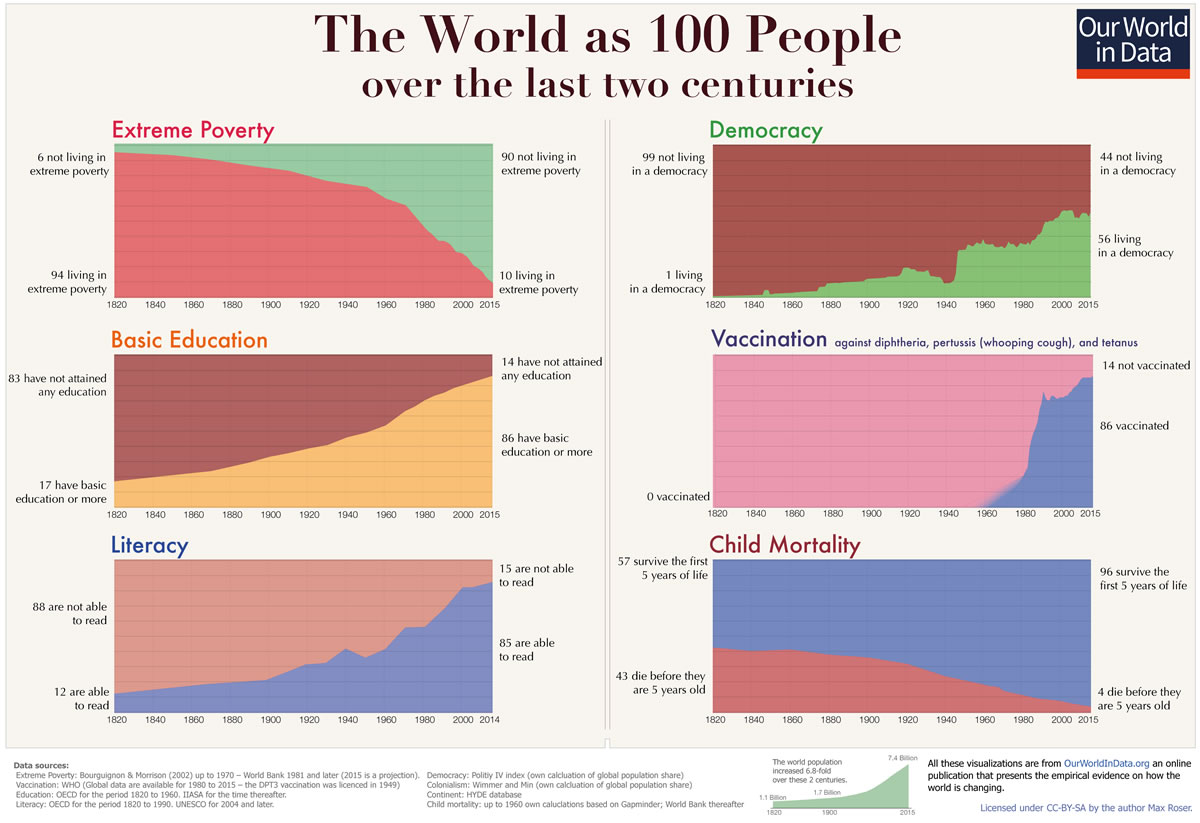

At a macro level, things look positive (except for climate change). Extreme poverty and infant mortality are down. Literacy, education levels, and life expectancy are up.

Macro level indicators. Image credit: Our World in Data.

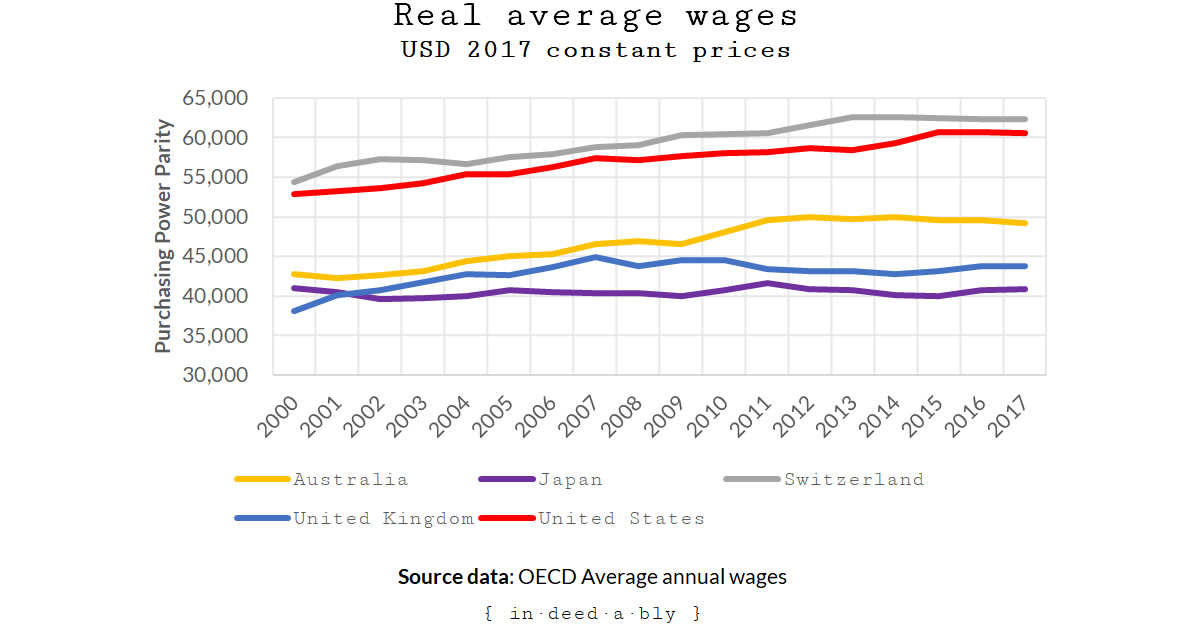

Real average wages have been slowly but surely increasing in many places.

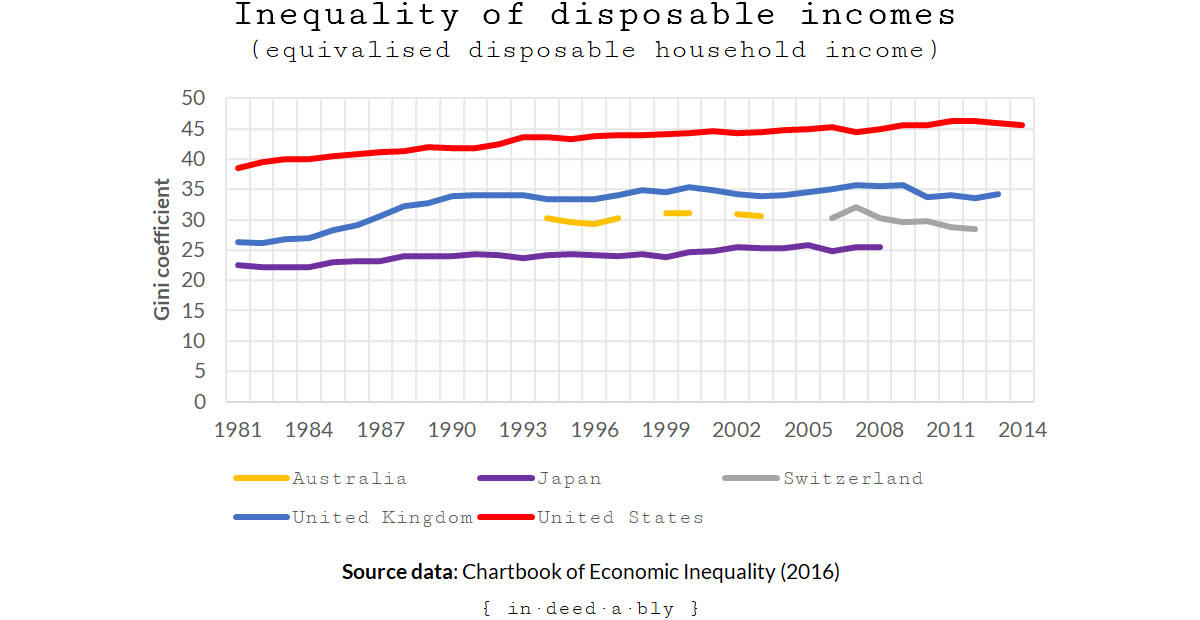

Though not everyone has shared in that growth equally.

If people are generally benefiting from more education, better health, and longer lives then what is driving this group of people to seek an exit from the workforce at a young age?

Why are thousands of people sufficiently dissatisfied with their lives that they would choose to invest vast quantities of their scarce precious time blogging about their desire to escape?

Common gripes appear to include:

- High housing and childcare costs.

- Lengthy commutes and limited opportunities.

- Lacking enough time free to invest in doing pleasurable things.

- The desire for “more”. A feeling of missing out. That life is passing them by.

- An absence of meaning or fulfilment in the work they are paid to perform.

Ennui

There is an old French word that aptly describes this malaise: ennui.

The Oxford dictionary defines ennui as:

“noun: a feeling of listlessness and dissatisfaction arising from a lack of occupation or excitement.”

The urban dictionary expresses that more bluntly:

“A very deep and generalised boredom with one’s life.”

Early retirement is one potential, if extreme, option for addressing that sense of dissatisfaction.

It can take years to achieve.

Some folks naïvely view early retirement as a magic elixir that will cure all that ails them.

It may end that lengthy commute, and provide an escape from the pointy-headed boss.

Time previously spent working and commuting will be freed up to invest in other endeavours.

However, early retirement will not spontaneously resolve issues that aren’t directly caused by an underwhelming job.

Boredom.

Disappointment.

Disillusionment.

Dissatisfaction.

Loneliness.

Unfulfillment.

Those all come from within. No matter how hard you may try, it is impossible to run away for yourself.

Big Wal had suggested there was an alternative approach, that could improve things immediately. It wouldn’t preclude retiring, and would certainly make for a more enjoyable journey.

My high school psychology teacher once taught us about a self-evaluation exercise called the “Wheel of Life”. A person scored their satisfaction levels across a wide variety of life aspects. Once these scores were visualised, it quickly became apparent what the problem areas were.

The exercise is often used by life coaches, and those financial “life” planners who have realised that there is more to a well-balanced life than financial success alone.

You can try a variant of the exercise for yourself below. Assign a score out of ten with how satisfied you are with each aspect of your life, then study the results.

Which life aspects are the most important to you?

What areas were you most satisfied with?

Which areas could do with some work?

How closely does your satisfaction levels reflect the relative importance of each aspect to you?

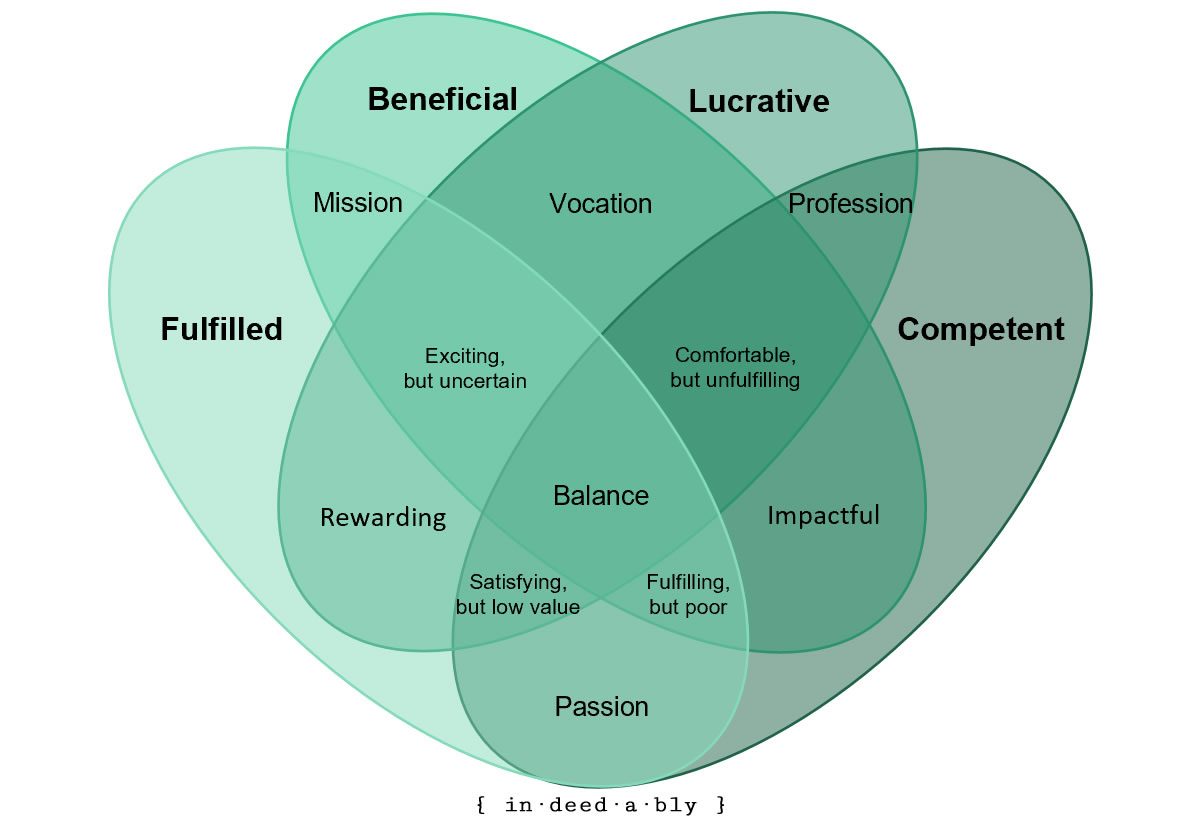

Another reflection exercise that does the rounds of the internet every so often is the Ikigai diagram.

While there is no science behind the meme, evaluating your current role across the four dimensions can help identify if something is missing.

You can try a variant of the exercise for yourself using the modified Ikigai diagram below. Interested readers can play with an interactive version of the diagram here.

Where does your current job land? Are any dimensions missing?

If so, how closely do those missing segments reconcile with your feelings towards the job?

The goal of these exercises is to explore why a person might be experiencing that ennui feeling.

Big Wal had a valid point when he suggested problems should be managed or dealt with today, rather than suffering until some arbitrary number has been reached in the future.

Life throws a curve ball

Big Wal asked the question about how things might have turned out differently had Clarrie retired early. The same question could be asked of himself.

Neither Clarrie nor Big Wal lived extraordinary lives. Both experienced many random “life happens” events over the years, that altered their plans and timescales.

Between them, they had:

- Been conscripted into the army and spent several years unexpectedly fighting in a war.

- A shotgun wedding, after a one night stand resulted in a pregnant future wife.

- Taken in and raised two young grandchildren, when aged in their 60s.

- Paid for a daughter to go to rehab for heroin addiction. Three times.

- Been made redundant a couple of years short of retirement age.

- Lost an underinsured rural dream home to a bush fire.

- Bailed out a son when his business went bankrupt.

- Paid for an experimental drug treatment. It failed.

- Relocated for work. Several times.

- Got divorced.

None of these events had been expected nor planned for.

Each of them had been a financial setback at the time. They adapted and managed because they had to.

Having a reliable income and a reasonable financial cushion helped them absorb some of those shocks and smooth out the ride. The smaller the financial buffer a person has, the more vulnerable their existence is to “life happens” shocks.

Risk tolerance not certainty

The lure of early retirement would deliver a great outcome for some. For others, it is trying to solve the wrong problem.

How much is “enough” is a subjective judgement, that differs for every individual.

It is a question of risk tolerance, rather than false certainty offered by spreadsheets or calculators.

Hopes and dreams are a powerful motivator, by all means imagine what a utopian retired existence might look like.

But also ensure you take the time to argue the other side of the equation.

- What doors will close as a result?

- Which options will no longer be available?

- How fragile, and vulnerable to shocks will life become?

- Are you content with reducing your ability to financially assist loved ones?

- How about potentially leaving yourself dependent upon the generosity of others, should things go wrong for you?

Ultimately each person must make their own choice about what is best for them and their family. They are the ones who must live with the consequences of that decision.

Big Wal’s delivery lacked subtlety and tact, but his point about identifying and resolving issues as they occur was well made. The pursuit of early retirement should be a well-informed lifestyle choice, not an attempt to escape from ennui.

References

- Atkinson, A., Morelli, S. and Roser, M. (2016) ‘Chartbook of Economic Inequality‘

- Barrett, S. (2016), ‘The lowdown on Armed Forces pensions’, Moneywise

- García, H. and Miralles, F. (2017), ‘Ikigai – The Japanese secret to a long and happy life‘, Penguin Random House

- Investopedia (2018), ‘Financial Independence, Retire Early (FIRE)‘

- Organisation for Economic Co-operation and Development (2019), ‘Average Annual Wages‘

- Roser, M. (2019), ‘The short history of global living conditions and why it matters that we know it’, Our World in Data

- Oxford Dictionary (2019), ‘ennui‘

- Urban Dictionary (2003), ‘ennui‘

Renae 19 May 2019

From the description, the newspaper article may be about the guy from Mad Fientist, who gives his own account of his journey on his blog. There are many others out there who have accomplished the same thing, some have written blogs about their journeys. The whole point of it is, to be able to choose how to spend one’s time without reference to the requirement to make money from how one’s time is spent. Some people, having reached financial independence, choose to never trade their time for another dollar again. They may still be involved in very valuable work that our society relies upon, for example, caring for children/elderly parents/ill relatives, growing food, charity work, cooking for elderly neighbours, volunteering in the canteen or as a reader at schools, or hospitals… the list of these necessary and important tasks is endless! Some people, being of an entrepreneurial nature, continue to trade time for money, but only on those projects that interest and excite them. The very nature of the pursuit of financial independence leads to understanding about how to make and invest money efficiently, so that when life happens, and things go wrong, the person is well-equipped with skills and knowledge to bounce back from financial setbacks. The pursuit of FIRE also leads to a deep pondering of values… how shall I spend my short time on earth? What is of more value to me, that particular item I am considering purchasing, or the time I have to trade to get it? Not everyone who pursues FIRE miserably hates their job, but many like to be able to choose how many hours they work and have a better life balance. For paid work to be optional is a good thing, I think!

{in·deed·a·bly} 19 May 2019 — Post author

Thanks Renae.

The article may well have been the Mad Fientist. It was a few years ago now, and at the time that name wouldn’t have meant anything to me.

You’ve eloquently articulated the case for financial independence there: affording the luxury to choose how we invest time.

I think many folks who pursue FIRE are really just after the FI part. Like the examples I listed above, if they are capable enough to achieve financial independence then they’ll most likely transition from one productive thing to another, more akin to changing jobs than retiring in the “old age” sense of the term where they spend the rest of their days bumming around.

I totally agree with you about the examination of values, and questioning how we invest our scarce time. The purpose of the exercises above were to encourage exactly that. Early retirement is one answer, but neither the only answer nor often the most accessible one.

Cashflow Cop 19 May 2019

Thank you for writing about this. It has been on my mind for some time but couldn’t quite get it down in a way I liked.

I think FI and RE is great in the sense that it has allowed many more to know about what is possible even if the ideas themselves are nothing new. If I didn’t happen to stumble upon MMM all those years ago, I would have most likely accepted the traditional path. There is nothing wrong with that of course, but to be able to decide is in itself empowering.

I do worry that as FIRE continues to gain traction, there will be more who have not properly thought about both sides of the equitation. Whilst I accept that life is far too short and time with family is more valuable to me than time at work, I think a cautious approach is needed. “We” tend to discourage the “one more year” syndrome but I am actually coming around to the idea. I may not have the option of returning to Policing once I leave. If I decide to return due to “life happens”, it could be very difficult.

The other thing is that the drive for FIRE could make some people overly optimistic with their numbers. Perhaps those who have only lived in this period is sustained growth, low interest rates and relative world peace (myself included) are more susceptible. We can put any number we want into our spreadsheets and calculators. Manipulate them in a way which would make us feel better. This is why, for me, we are willing to pay for professional advice when we decide to pull the trigger. Inject a bit a realism if I needed it and to challenge my own assumptions.

{in·deed·a·bly} 19 May 2019 — Post author

Thanks Cashflow Cop.

If I can offer some unsolicited advice, seek the professional guidance now rather than waiting until you believe yourself to be at the end of your journey. They may have ideas or approaches for achieving your goals faster or more tax effectively, once they understand what you hope to accomplish.

A good professional advisor will also share insights into related areas that you may not have considered yet, for example the use of trusts to minimise inheritance tax.

“One more year” is a confidence/risk tolerance question. The bigger the financial cushion, the less fragile their future. As ever there is an opportunity cost decision to be made between time and money.

Cashflow Cop 19 May 2019

That’s a good point about professional guidance now. We had looked into getting a professional to look at our plans when we got some advice for inheritance tax planning. We were quoted about £2k for someone to look at our numbers. It was more than we wanted to pay at the time. There is also the issue of finding someone we trust. We’ll definitely look into this.

thefirestartercouk 19 May 2019

Big Wal was spot on as you say!

I would hope that ER is the hook that catches most people into reading further, but upon reading more il they realise that it’s more about optimising and sorting out your life for maximal happiness right now. That’s certainly the mental process that I went through at least.

No one is going to embark on a huge 10 year financial plan on the back of reading one article so I think the chances of people “doing it wrong” is quite slim, although there are bloggers out there that did/do the grind it out route so maybe I’m wrong on that one. I would imagine people will gravitate to whatever bloggers they feel are doing what FI plan suits them the best anyway.

And yeah I thought that sounded like the MadFIentist as well in the article! 🙂

{in·deed·a·bly} 19 May 2019 — Post author

Thanks for reading TFS.

That’s an interesting way of looking at it, the lure of early retirement being bait to gain people’s attention. Hard to argue with that line of reasoning.

Every journey starts with a first step. How many FIRE bloggers have described a backstory that included a variant of “read the ‘Shockingly Simple Math‘ article by Mr Money Moustache“? That post is credited with launching more than a few FIRE bloggers down their direction of travel.

I think where some folks will come unstuck is getting impatient. A long commute, a pointy headed boss, a soul-destroying job. They get fed up and rather than find a better role they hit the eject button into early retirement too soon.

Things would probably be fine while interest rates are low, employment full, and the stock market bullish.

At some point there will probably be a reversal, where some or all those elements no longer hold true.

When the early retiree loses the faith and decides they need to return to work, the chances are that unemployment will be high, competition for jobs fierce, and returning to reasonably paid gainful employment more challenging than they may have imagined.

The longer they’ve been out of work, the more dated their skills, knowledge and network. The harder that challenge becomes.

Of course it is possible that history doesn’t repeat, and the bull market surges on forever. I wouldn’t bet my future on it personally, but ultimately it comes down to risk tolerance and personal preference.

gettingminted.com 20 May 2019

I think you would need to consider where you are in your working life, your financial life and in life more generally. I didn’t leave my job when I hit a financial target, I left it when I didn’t want to do that job any more, and after a thirty-year career. If I’d studied the numbers more maybe I could have gone earlier but I think it was better to go when the work had run its’ course.

I think this is the article you refer to.

At age 34 and after presumably no more than thirteen years in work, but in a position of financial independence, would suggest that his financial life and working life were somewhat out of sync.

{in·deed·a·bly} 20 May 2019 — Post author

Thanks for sharing your experiences gettingminted.

Great detective work, the story you link to sounds familiar and ends with the same line.

Odysseus 20 May 2019

Hi Indeedably,

Great post as usual. I did not know the Our World in Data website. It is really interesting and I could easily spend some time there going through the data.

Concerning the topic of the post, as always, different points of view about. For myself I would say that the reason behind my seeking for FIRE is to have the chance to work/do other things that I may like or not, probably part time, (in order to have more time with the family) without the concern of making money to pay the bills by the end of the month.

I can even have a scenario that, after a couple of months, I will miss my current work and wish to go back to what I do nowadays. Who knows?

All the best.

Cheers!

{in·deed·a·bly} 20 May 2019 — Post author

Thanks for the kind words Odysseus.

Good luck with your journey.

weenie 21 May 2019

Looking at the common gripes, there’s only one on my own list, that is ‘lacking enough time free to invest in doing pleasurable things’. That’s not to say that I don’t have any time, just that I would like more time. So essentially, that’s what FIRE will let me have, more time.

I’m not running away from any of the issues caused by an underwhelming job – I like my job and I like working. But who knows if I’ll still like it in a few years’ time, especially as restructuring is likely on the cards either later in the year or next year.

{in·deed·a·bly} 21 May 2019 — Post author

Thanks weenie, it sounds like you’re in it for all the right reasons.