The battered old fake Christmas tree has been assembled. A seasoned campaigner, it has outlasted the attentions of a decade’s worth of marauding toddlers and mischievous kittens. Tilting precariously, the arboreal equivalent of the dopefiend lean. Carefully balanced via an eclectic collection of baubles, ranging from the traditional to random primary school art projects and happy meal toys. Held together with threadbare tinsel and an epilepsy-inducing string of erratically flashing coloured lights.

My younger son proudly stood back to admire his decorating handiwork. This year a bright yellow minion soft toy topped the tree, where a long-lost glitter-covered star ornament once traditionally resided.

My inner saboteur applauded the honesty of symbolism in replacing a discount store seasonal tribute, said to have once guided a trio of lost Babylonian astronomers and part-time perfume purveyors, with a modern-day beacon of merchandising capitalism.

In recent years, the floor beneath the tree would have contained a mountain of gift-wrapped presents. All waiting to be torn open by excited young children at stupid o’clock on Christmas morning.

Today, the offerings are sparse by comparison. Gift vouchers, subscriptions, and money have replaced the books, games, toys, and various surprises that were often more miss than hit as presents of choice for my family.

There was one surprise I was confident would be well received this year. A new Xbox, after the old one had issued a chilling death rattle that sounded like a bag of marbles being dropped into a blender. Almost impossible to find amidst the great semi-conductor shortage of 2021. Christmas was rescued by a free service called StockInformer, which deploys an army of robots to continually monitor retailer stock availability and instantly alert subscribers the moment shelves have been replenished.

While observing the teetering tree and its scarcity of presents, I was struck by the thought that it probably needed replacing. Time to move on. Our changing attitudes and constantly evolving experience meant things that had once seemed magical would eventually be no longer fit for purpose.

Illusions deciphered.

Misconceptions dispelled.

Outgrown. Used up. Worn out.

Occasionally traded in for something better. More often, just something different.

Charting the course

My collection of pretty charts taken from my financial tracking spreadsheet is another example. Does the tale they tell still reflect a narrative consistent with my current thinking and worldview?

I wasn’t sure that they did.

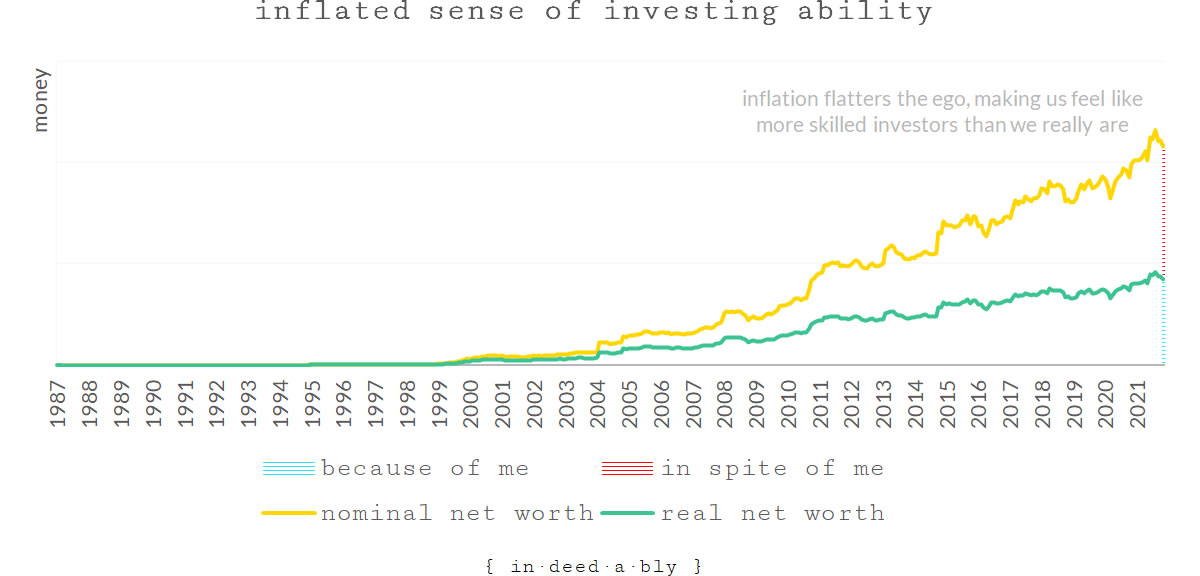

A year or two ago, I wrote a couple of posts highlighting common gaps and shortcomings in the way FIRE bloggers chart their progress. Several of those applied equally to my own bookkeeping as to those I had observed in the wild. Simple things like ignoring the purchasing power eroding effects of inflation. Not accounting for taxes accrued on capital appreciating taxable assets. Failing to consider the impact of age restrictions on private pensions or ignoring social security benefits.

My approach differed from most Personal Finance bloggers, in that I actively led a hybrid lifestyle of semi-retirement long before I reached the point I consider to be financial independence.

My motivation was simple: I was consciously aware that time is finite, longevity unknowable, and my children would only be young once.

Rather than pursuing the traditional “hustle till you drop” FIRE model upfront, while fervently hoping to have enough time, money, and health remaining to do the enjoying later in life, I instead chose to alternate between summer stints of semi-retirement and full-time winter working hibernations.

My passive income streams reliably afforded a “Lean FI” existence where my family’s basic needs and housing costs were met whether I was working or idling. The durations of my stints back in the workforce were determined by how much supplemental income my desired “Fat FI” lifestyle demanded. A juggling act between aligning financial means and expectations to enjoy the feeling of “enough”.

That overarching goal of balancing enjoyment today with investing for tomorrow remains unchanged.

However, my thinking about the levers involved in sustainably achieving that outcome has evolved.

One change is my understanding that externalities beyond my control have played a far larger role in my progress to date, and will continue to play in my future plans, than I would have been comfortable admitting in times past. Life experience grudgingly causing my ego to make way for self-awareness.

Foreign exchange rates. I live on an island that is reliant upon importing just about everything.

Health and well-being. Debilitating maladies like cancer and depression neither discriminate nor play fair.

Inflation. Friend of those in debt. Foe to anyone trying to live off savings, or the natural yields of assets with inflated prices.

Interest rates. Reversion to the mean will expose a whole new generation to scary monsters thought to be long dead, like negative equity and being “house poor”.

Taxation policy. How would your retirement plans be impacted by “user pays” aged and health care systems? Means-testing and tax residency applied to social security? Eliminating concessional tax treatment on pension contributions and withdrawals? Levying recurring “wealth taxes” on the value of land and capital gains on owner-occupied property? None are impossible. All occur elsewhere, including jurisdictions operating economic systems readily comparable to the United Kingdom.

Underemployment. Being willing and able to work doesn’t mean work will be readily available when and where we want it. Nor is there is any guarantee the available work will pay us what we thought we were worth. The older we get, the greater the likelihood this shifts from perceived risk to real issue.

Voter behaviours. When the “everyman” is so easily manipulated, self-destructive, and short-sighted then society elects the government it deserves. Each one seemingly more captive and less effective than the one it replaced.

All these things are beyond my control, so not worth losing sleep over.

Yet each exerts significant influence over the outcome of my financial plan. Some providing a helpful tailwind propelling me towards success, others a weighty anchor impeding my progress.

It was humbling to overlay the effect of inflation on my trusty net worth over time chart. It turns out I’m not nearly as smart as I once thought I was!

Four dimensional chess

Something else I have become more conscious of is that we are concurrently playing the game over multiple time horizons, each with vastly differing tax regimes at work.

When our kids are young, we want to live within catchment areas for good schools. Once they age out, we swiftly lose interest in schools altogether.

While we are working, we desire strong employment opportunities within short commutes. As our skills and interests evolve, those opportunities may lose relevance or be found elsewhere.

In our dotage, ready access to good healthcare and age support services becomes essential. Factors we give scant consideration to when we buy property while in the prime of our lives.

Few locations affordably offer all those things, no matter how much we may wish it were otherwise.

Owner-occupier home equity can be grown, for now, capital gains tax-free. Purchased with the ultimate “buy now, pay later” arrangement, that (hopefully) gets paid off over a lifetime. For many, this will prove to be their single largest asset. For some, their only asset of note.

An owner-occupied house is an asset capable of helping support the desired retirement lifestyle of those who are not too proud or too stubborn to view it as such. A house is just a building, we bring the sense of “home” with us, no matter the sunk cost investment in memories made or experiences enjoyed within. Releasing accumulated equity via downsizing or home equity loans are obvious yet seldom discussed options that receive less enthusiasm than visiting the dentist or drafting a legal will.

Age-restricted pensions fall into the ultimate tease category for those not yet eligible to access them. Shimmering tantalisingly like a mirage on the distant horizon. Alluring and out of reach, similar to a discretionary annual performance bonus or a potential inheritance. Subject to uncertainty and regulatory risk, as politicians and providers randomly change the rules and shift the goalposts with monotonous yet life-changing regularity.

In those years before pension eligibility age, we must make alternative arrangements to finance our desired lifestyle choices. Working is the default option, selling our time to pay the bills. Gradually we might buy control of our time, using savings to purchase investments, which in turn compound and grow to create alternative income streams. When successfully combined with aligning expectations to financial means, working can become optional. A choice, free from the financial imperative.

This too shall pass

Next, I have become more attuned to various finite lifecycles of expenditure.

Nursery fees and nanny wages feel both eye-watering and endless while they are being paid for. Then one day those expenditures are no more, our kids ageing out of them.

Homeowners may eventually pay off their mortgages, bringing an end to a significant recurring bill.

Ceasing work reduces income. However, it also generates a chain reaction of cost savings. Income taxes incurred during the daily grind vanish. Causing the level of taxes paid on passive income to reduce in turn. Work-related expenses, such as commuting costs, dry cleaning bills, and store-bought sandwiches similarly come to an end. Collectively these amount to a material reduction of outgoings.

People of a certain age may experience a magical influx of recurring pension income. Initially from private pensions. Possibly supplemented a decade or so later, in the form of the state pension.

Each example follows a relatively predictable arc, with a defined beginning and natural end. Yet our simple linear charts that project the future as a continuation of the present often fail to account for them adequately. Were they to do so, we would likely discover our future lifestyles could be sustained off a far lower number than it may initially appear.

Deprecated

Finally, I became more cognisant of the need to mentally account for risks that have a high probability of materialising.

Maintaining a running provision for capital gains tax that would be due were taxable assets to be sold. The actual tax would typically be covered by the proceeds of the sale. However, from a mental accounting perspective it is important to remember that a material chunk of those taxable assets on our personal balance sheet will be donated to the tax authorities upon their disposal.

Figuring out how to ensure my children emerge from university starting at zero, rather than commencing adult life anchored to a mortgage sized student debt. I’ve witnessed all too many starry eyed graduates who are financially hamstrung by the vast liabilities that their shiny new diplomas were anchored to.

Doing the thinking on how the next few years and beyond are likely to play out on the home front, given the brutal learnings experienced and endured throughout assorted covid lockdowns.

Over the holiday break I will be overhauling my financial tracking spreadsheet and pretty charts. Deprecating those no longer fit for purpose, or which project a path I no longer expect to follow. Adding or modifying the logic to ensure what I’m measuring and monitoring remain consistent with my current direction of travel.

An evolution rather than a revolution, but educational nonetheless.

David Andrews 28 December 2021

Congratulations on snagging an xbox. There seemed to be quite a few retailers finding stock of series x rather close to Christmas. Perhaps some of the scalpers will be stuck holding expensive stock.

Half of my team have deprecated their current employer which will make the next few months a little tricky. Luckily I’m neither accountable nor responsible. However my manager will have a “fun time” conjuring up suitable replacements.

{in·deed·a·bly} 28 December 2021 — Post author

Thanks David. Good luck with the next few months, sounds like you’re destined to be both busy and in high demand.

The online gaming focussed white Xboxes seemed to be readily available, it was the black ones with the DVD drive that were hard to find. Until Microsoft recently introduced their subscription based gaming model, buying discounted physical gaming disks had been much cheaper than purchasing the downloadable versions via the Xbox marketplace. My kids have a considerable sunk cost investment in many games, both in terms of their time and my money. For want of a DVD drive, I didn’t fancy being endlessly pestered into buying those same games again electronically (not to mention fear there may not be a path to migrate all their saved games!).