Risk-taking never disappears, it just changes shape, often to slip past the institutional and psychological defences erected after the last crisis.

Recently wrote Greg Ip in his fascinating 10-year anniversary retrospective on the Global Financial Crisis for the Wall Street Journal.

During that 10 year period, we have seen regulators ramp up requirements for governance and capital adequacy… then roll back many of those protections under a revised “time to let business do business again” mandate.

time to let business do business again

Borrowers can once again obtain self-certified “liar loans”. High street lenders are once again offering 100% (or even 120%) LTV mortgages.

As much as life seems to change quickly, many things don’t change at all.

That got me reflecting over my own life. What risks had I taken? Did anything change? What remained the same?

10 years ago

10 years ago I migrated to the United Kingdom, with a (then) dependent spouse and noisy energetic toddler in tow.

This began an epic 6+ year quest to string together working and/or skilled migrant visas required to eventually qualify for a British passport. It became a race against time, as the authorities steadily closed off many of the routes towards residency, and raised the bar ever higher for those few that remained.

Residency in the United Kingdom is a moving target. Image credit: Medienservice.

I could have bought a very nice new car for the money spent on visa applications and legal fees.

The real killer was the earning criteria for the visas. If income didn’t accrue PAYE tax then for visa application purposes it did not exist. Needing to arrange my financial affairs in such a tax inefficient manner greatly offended my inner accountant!

However much it irked me, I sucked it up and played the game in order to win the prize: a British passport.

Then Brexit happened, slashing the value of that hard-won passport by 27/28ths. You can’t win them all!

20 years ago

Suck it up for 2 years and buy a house. Image credit: Images Money.

20 years ago Viagra was repurposed to promote happy endings, a couple of smart geeks founded a little company called Google, the US enjoyed its first budget surplus for a generation, and the Asian financial crisis occurred.

I was submitting my resignation from a secure permanent job as a management accountant, to follow a pretty girl halfway around the world. It seemed like a good idea at the time.

On the first morning of my first proper job overseas, the CxO addressed an all-staff town hall meeting and proudly declared: “I don’t like foreigners. I don’t like freelancers. Most of all I don’t like foreign freelancers. I wish you parasitic leeches would all just f*ck off back to your own countries.”

Given I ticked both boxes, that made me feel very welcome indeed!

I worked at that company for 2 years, earning enough to pay cash for a house back home. Every invoice they paid served as my own little f*ck you to the multiculturally enlightened CxO.

I don’t like foreigners. I don’t like freelancers. Most of all I don’t like foreign freelancers. I wish you parasitic leeches would all just f*ck off back to your own countries.

30 years ago

30 years ago saw the introduction of Prozac, stealth bombers, transatlantic fibre optic cables… quickly followed by the first major virus to hit networked computers.

At the time I was delivering newspapers, in the rain, from a second-hand BMX bike with a milk crate strapped to the front.

The guy who took great delight siccing his dogs on paper boys would have complained to my boss that he didn’t receive his newspaper. Inevitably a couple of other customers would have complained their paper was soggy.

Delivering newspapers in the rain was almost nothing like this. Image credit: geralt.

How much is your time worth?

The market value of something is determined by whatever a willing buyer is prepared to pay for it.

It turns out the time of an 11-year-old paper boy isn’t all that valuable, 4 hours of my time was worth roughly the price of a Big Mac. Definitely not enough to be worth being bitten by a dog!

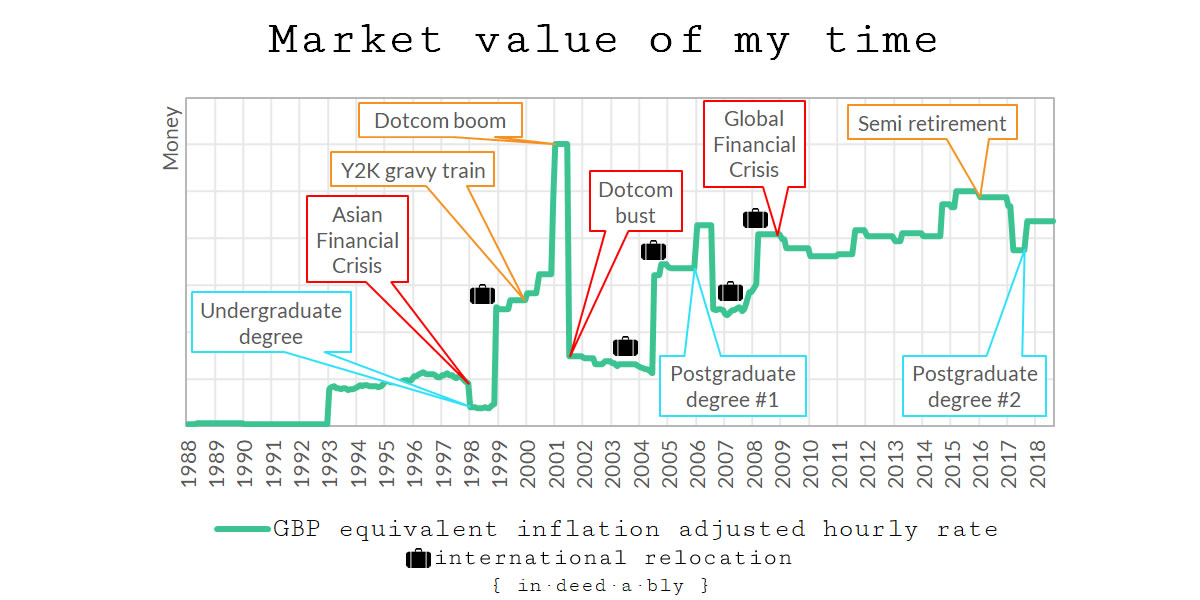

As a closet idealist, I would love to believe that the market value of my time will grow to reflect my accumulated knowledge and wisdom.

But it doesn’t always.

The reality is that the forces of supply and demand have had a much greater say in determining the market value of my time.

The goal should always to be positioning yourself to acquire those skills that will soon be in great demand, while concurrently earning a good living. There is a lot of luck involved in getting this right however, it is very much an art rather than a science.

Possessing rare skills that are required by an in-demand niche is a great way to ride the gravy train.

Unfortunately, in-demand skills will inevitably fall out of fashion. Telegraph operators were highly paid and in great demand towards the end of the 19th century. You don’t see too many job adverts for them these days.

Possess commodity skills in a niche that has declining relevance? Expect to see your market value fall.

Dinosaurs of London

Dinosaurs of London. Image credit: tomakuma.

There is a certain breed in the city of London, a tribe of 50+-year-old white male commuters in grey suits who reek of quiet desperation. They bounce from one legacy support programmer role to the next, fearful that the music will stop and leave them without a chair before they reach retirement age.

Too old/institutionalised/lazy/slow to learn the skills required to remain relevant. Too broke to step away from the tools and take the risk of pursuing alternative career options.

Many an interviewer are fearful of these poor wretches, in part because they can see their own potential futures playing out before their eyes, like Dickens’ ghost of Christmas future.

Darwinism: adapt or die

Adapt to remain useful, or fade away into irrelevance. This is a brutal lesson those plying their trade in IT must learn early on to survive. Needing to re-skill every 3-5 years is not unusual.

Structural and technical redundancy don’t care what we believe our time should be worth. It doesn’t matter how much hard-won experience we may have gained doing something, if nobody will pay for that something to be done any longer.

I believe that the fastest route towards having control over your time is by investing in yourself.

It is much easier to save a high proportion of your income when your income itself is high, there is a reason so many early retirement evangelists have a white collar or technical background.

The surest way to attain that high income is to possess in-demand skills and experience.

Education increases earnings… to a point

University graduates generally have higher earning potential than non-graduates.

The field of study matters less than you may expect, there are many in the junior cannon fodder ranks of management consulting who possess liberal arts backgrounds.

An important caveat however: there is a limit to how much investing in ourselves makes sense.

Postgraduate qualifications may increase your marketability, though depending on your industry this is far from certain.

Tough questions should be asked about Return On Investment, both in terms of your money and your time, before undertaking further study. An MBA obtained from an also-ran business school may as well have been found inside a cornflakes packet for all the value it will add to your earnings potential.

A PhD may earn more than somebody holding a masters in the same discipline. Holding two masters degrees is unlikely to earn you double what somebody with a single masters degree makes.

Lies we tell our children

We sell our children the myth that they can achieve anything their heart desires, providing they work hard enough for it.

The reality is this simply is not true.

The vast majority of us would never be competent to run Berkshire Hathaway. Or win a tennis match against Serena Williams. Or successfully lead the United Nations. Many incumbents of senior management positions aren’t competent either, as they so frequently demonstrate!

Truth is some people simply aren’t capable of being more than a dental hygienist, a childcare worker, a security guard, or a barista. All these are noble professions, but unfortunately none are well-remunerated.

Better to be good than lucky

Looking at my own 30-year earnings history, I think my father was right when he said: “It is better to be good than lucky, but sometimes being lucky is enough”.

It is better to be good than lucky, but sometimes being lucky is enough.

My early investing in myself paid clear financial dividends. The outcome from my later investing in myself is less definitive.

Some of my increase in earnings has been down to my experience, knowledge, skill and wisdom.

However if I’m brutally honest: much of it has been down to putting myself in the right place at the right time with the right skills.

That Guy, Nick @ TotalBalance.blog 7 November 2018

Life is lived forwards, but understood backwards, right? 😉

I think your father was a very wise man.

I try to live by a similar motto; Luck favors the bold/brave.

I think you are absolutely right that being at the right place at the right time – with the right skillset, is what makes the difference. Sometimes, being at the right place at the right time require you to make certain sacrifices along the way.

I’ve found that most successful people (the definition of success in this case is subjective I guess) are the ones who understand that great achievements often require great sacrifices.

What puzzles me is that most people today fail to realize that what they are sacrificing (their time) isn’t really “worth the achievement”. – In this case, recognition in a 9:5 job. I struggle myself to truly understand this, but I believe I’m getting there.

The problem that I have right now, is that I’m nowhere near where I need to be, to retire early yet. Finding meaning in your 9:5 job (that I desperately need in order to RE) is becoming increasingly more difficult, the more I realize that my time isn’t worth it. And I still have 10-15 years to go 🙁

In your Lessons from retirement you describe how hard it is, to return to your part-time job after 8 months off. I honestly don’t think that I would be able to go back, had I left my job for more than 6 months.

How do you do it? 😉

I have to say, I got a little bummed out when I read those lessons from retirement. Up until now, RE had really been my nirvana goal, but I realize now that retirement doesn’t “fix” anything as you said, unless you know what it is you really want to do with your time in retirement. Right now, I want to retire! But I know that if I retired now I would not only run out of money after about 1 year, I would also squander away my time on the couch most of the time.

What are your plans to keep active, once you retire full time, and your kids get old enough to take care of them self? 😉

Thanks!

{in·deed·a·bly} 7 November 2018 — Post author

Thanks Nick, my father would have enjoyed a wry smile at being referred to as wise by one of my “imaginary internet friends“!

Try looking at the problem another way:

Remember when you were a little kid, and somebody asked “what do you want to be when you grow up“? You probably said something exciting like an astronaut, a fairy princess, a firefighter or a racing car driver.

Few would have said a consultant or complex solutions manager.

No kid ever answered “retired“.

If being retired wasn’t the tangible goal then, why would it represent the finishing line now?

It doesn’t. At best retirement represents a milestone along the way towards something else.

The things you escape by retiring (e.g. the commuting, meaningless meetings, performance appraisals, and office politics) won’t be what makes you happy. Rather it will be the things you choose to invest the time in afterwards, time those undesirable things previously consumed.

The novelty of waking up without an alarm, or not having to wear a suit and tie any more, wears off pretty quickly!

Now that you’ve thought a bit about what you’d be doing with your time instead, figure out how to incorporate that (in some form) into your life today.

The only person who can make the changes required to find your happy is you.