It would be fair to say the second quarter of 2020 was interesting.

Eventful for many. Locked down. Homeschooled. Furloughed. Pay cut. Underemployed. Unemployed. Unemployable.

Short-tailed tragedy for a few. Illness. Sometimes death. For them or their loved ones.

Dramatic headline figures. Small percentages.

Long-tailed misery for some. Bad debts. Bankruptcies. Defaults. Evictions. Repossessions.

A snowball for now. Quietly gathering size and momentum as things go downhill. Soon to be an avalanche.

Many of us have long considered ourselves to be the Kings and Queens of our own castles. Leading a secure existence. A comfortable lifestyle carved out and enjoyed. Seldom wanting for much. Yet rarely satisfied.

A long-running bull market brings with it a sense of complacency. Inevitability. Invincibility.

Investing is easy.

Asset prices can only go up.

Mortgages can be easily refinanced at the end of a honeymoon period.

Everyone is a genius in a rising market.

The last few months demonstrated the fallacy of those beliefs. A tough life lesson to learn or relearn.

Markets will crash.

Asset prices can fall.

Mortgage refinance can be expensive or unobtainable.

Successful investing is large parts character, consistency, and luck.

Those companies we did business with, worked for, invested in, or owned now appearing all too mortal.

The 2020 rollercoaster ride has given the wiser amongst those Kings and Queens good reason to re-examine their castles with a critical eye. How deep is the moat? How solid the walls? How secure the defences?

Passive income pandemonium

Dividend, interest and rent statements have trickled into my inbox this month. Covering the months of April, May, and June 2020. A period when economies the world over went into hibernation. Then recession.

Their populations entering various combinations of lockdown, denial, selfishness, and self-destruction.

I viewed the statement’s arrival with equal parts cautious optimism and foreboding. How bad could it be?

Dividends

The first one I opened was a FTSE All World index tracker. It would be fair to say that the numbers it contained were a tad underwhelming. Like a dividend, only smaller. 41% lower than the comparable period last year.

![]()

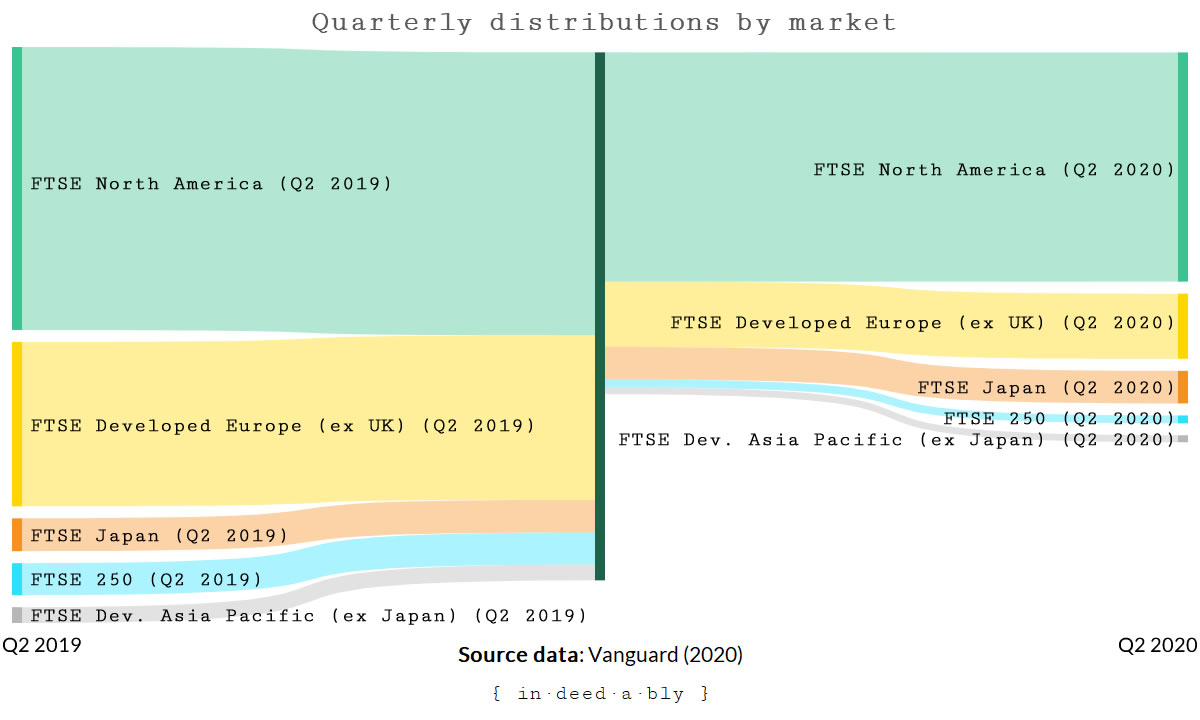

Delving into those numbers, it was interesting to see how different markets I invest in have weathered the pandemic induced economic storm. The chart below illustrates how distributions have been impacted across a range of market indices.

European companies felt the impact of the pandemic faster than the United States, as the European Union banned firms who had received bailouts from paying dividends or making share buybacks for as long as the state retains a significant ownership stake. Meanwhile, the United Kingdom has experienced an eye-watering proportional drop in dividends, keenly felt like a swift kick to the home market bias for many patriotic British investors.

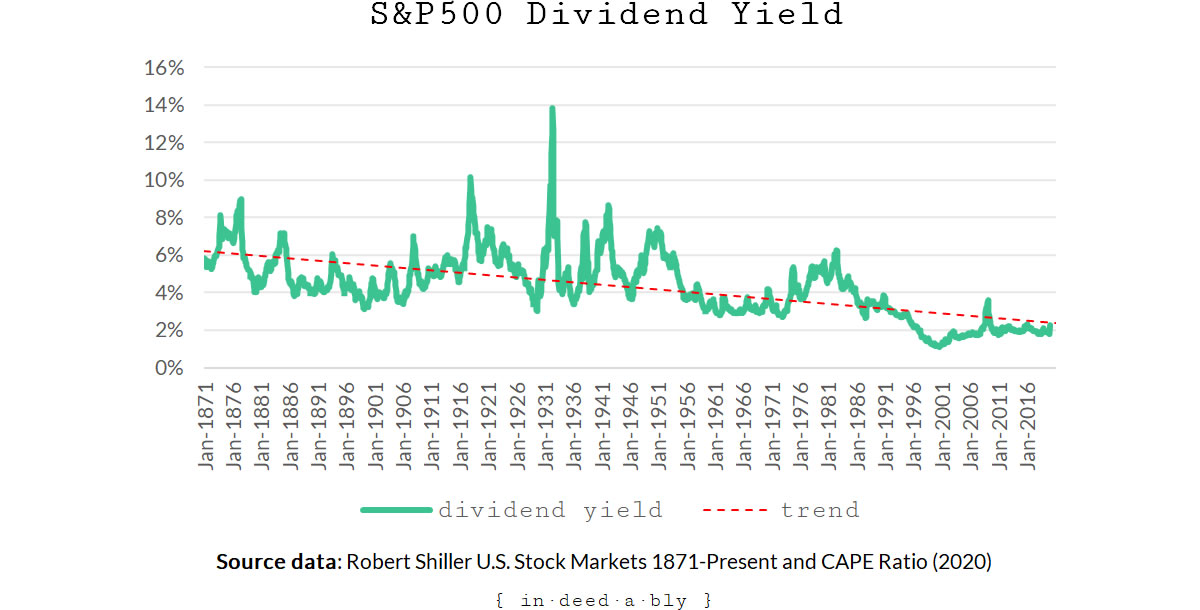

The US markets accounted for over 66% of the global market capitalisation at the time of writing. That is a lot. Out of curiosity, I called up Robert Shiller’s historical dividend yield data for the S&P500 index to see how the current dip in distributions compared to events of the past.

Unfortunately, the Q2 2020 figures had not yet been added to the dataset. I plotted the available data going back to 1871, and observed a clearly defined trend.

Over the 150 years of available market data, the S&P500 dividend yield has steadily declined from around 6% back then to today’s 1.5%. The size of the recent dip in yields might have been unusual, but the general direction of travel wasn’t.

Did that mean that listed companies have become valued at ever greater multiples to the profits they distribute? Or was there a simpler explanation?

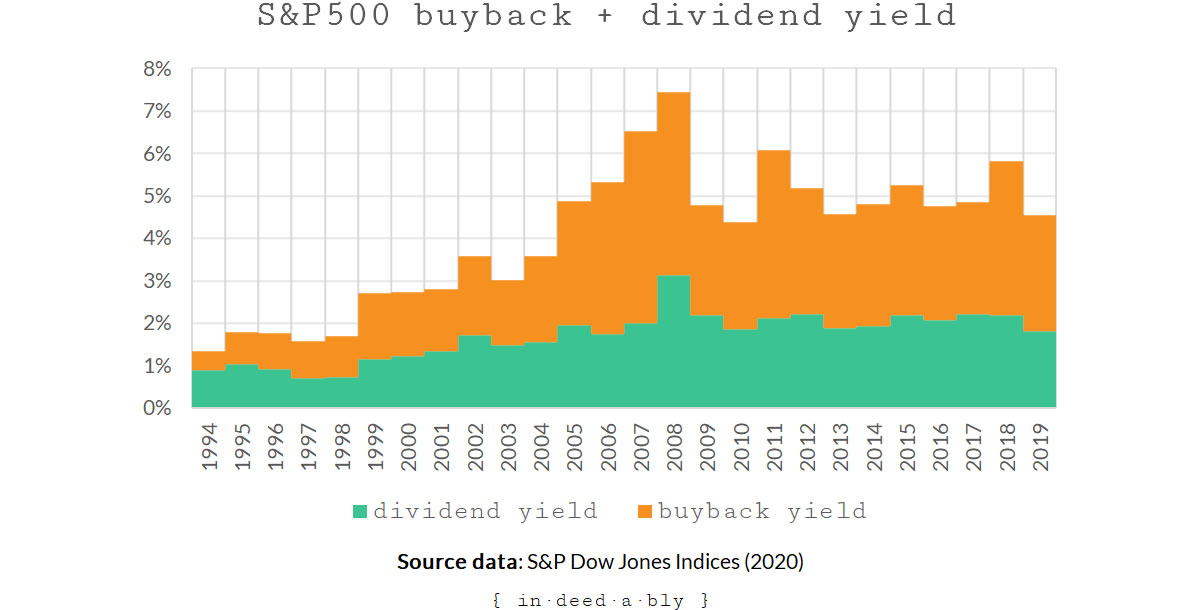

Much has been written about the merits or evils of share buybacks. An alternative means for companies to return excess capital to shareholders, often involving a more favourable tax treatment.

I trawled the internet for historical S&P500 share buyback data. This seems to be a scarce commodity. My Google-fu struggled to find datasets going back more than a couple of market cycles, and all those I looked at contained some fairly significant caveats and health warnings.

Since 1996, companies in the S&P500 appear to prefer buybacks over dividends. When the two methods are combined, the rate at which capital is returned to shareholders remains much closer to those halcyon days of natural yields in the 5-6% range.

Interest

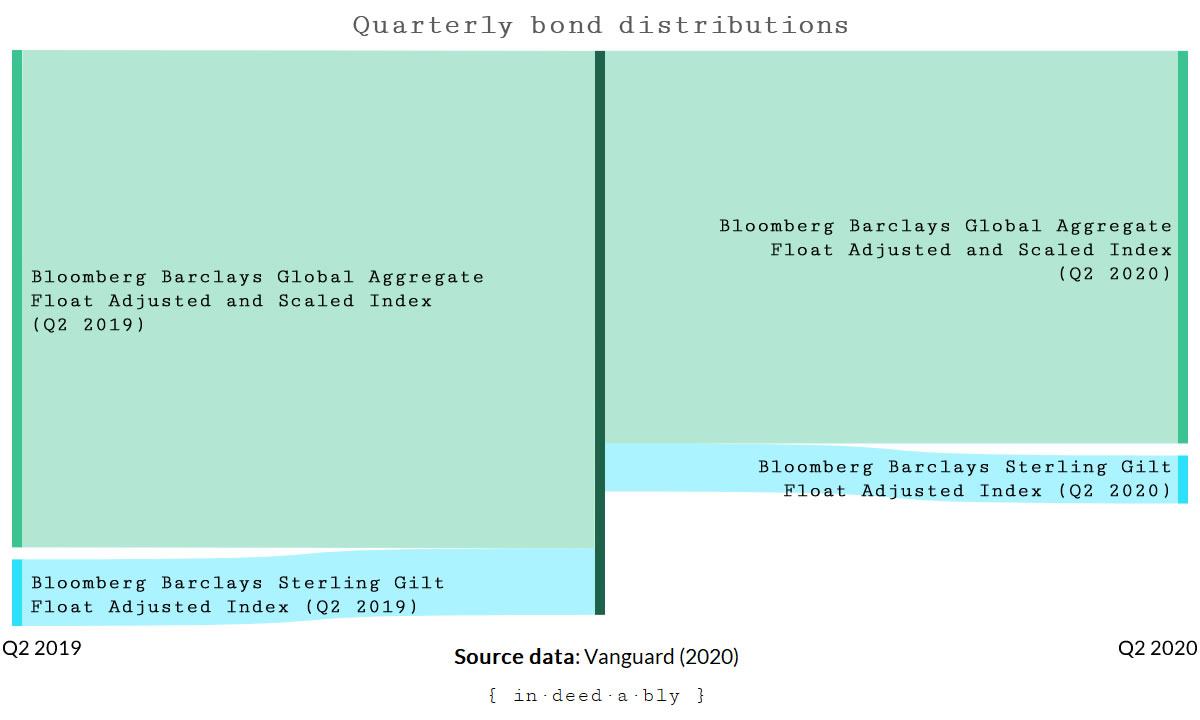

Next, I switched my attention to my bond income.

Bonds are a reluctant feature of my investment portfolio, playing the role of matrimonial peacekeeping device. They perform their traditional function in portfolio construction, serving to smooth out the occasionally bumpy ride. The difference in my case is that the turbulence they insulate against has little to do with the stock market.

Once again, second quarter distributions were down compared to a year ago. Just over 20% lower for global bonds, unsurprising in a world of lower interest rates and widespread quantitative easing. That drop was closer to 30% for the United Kingdom flavour.

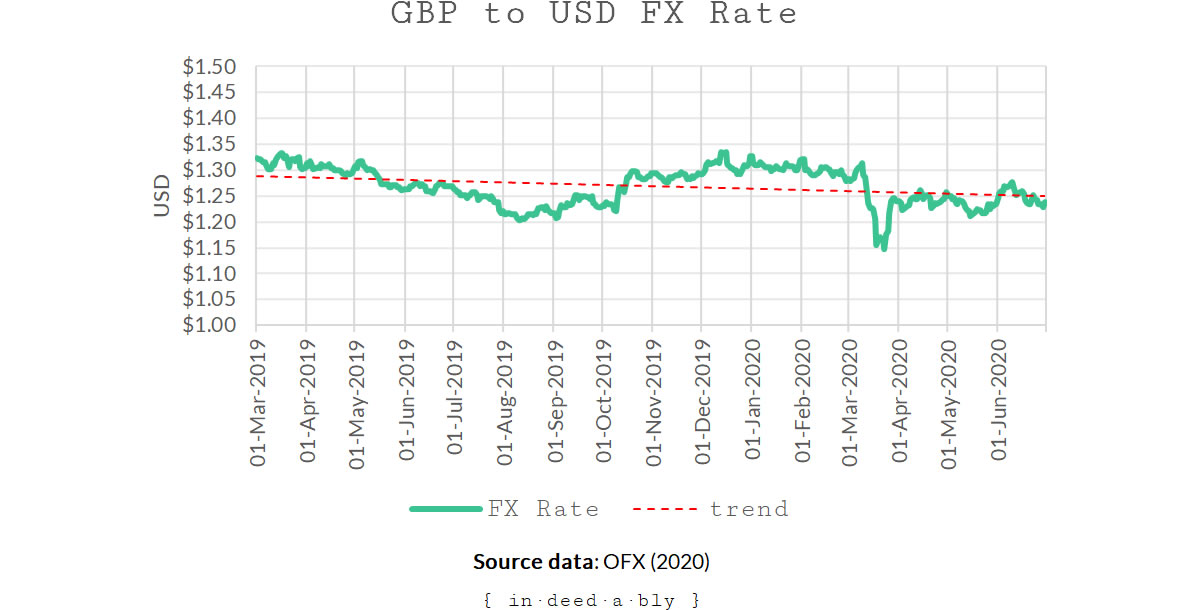

I wondered about Britain’s underperformance. First dividends, now bond interest. Could it be explained by movements in exchange rates?

A quick chart of the FX rates throughout the period in question does reveal a weakening in the value of the Pound compared to the US Dollar.

However, that currency decline alone does not appear to fully account for the relative underperformance.

Rent

Finally, I looked at my rental statements. I already knew this was going to be a shit show, having had tenants lose their livelihoods and plead hardship during the lockdown. We reached an agreement about what they could afford to pay, and agreed to review the situation again in a few months time.

The extent of those losses were offset somewhat by the fact that the lease where I currently live came up for renewal during the lockdown period. Market forces had shifted the balance of power from landlord to tenant this time around, so we were able to negotiate a material discount in rent.

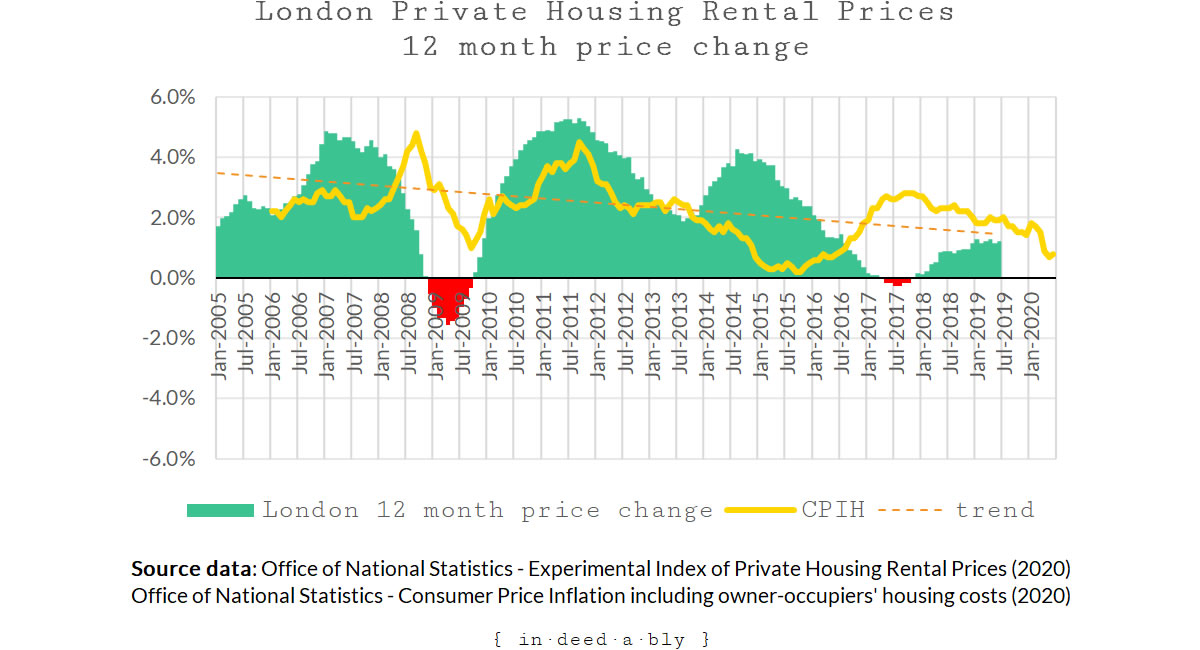

The Office of National Statistics publishes an experimental private housing rental price index. I called up the rolling 12 month price change numbers for London. For additional context, I overlaid the CPIH inflation rate using the same rolling 12 month change period.

This chart tells an interesting story. It illustrates a couple of laps through the property boom and bust cycles that occur roughly every seven or eight years. The overall downward trend, together with the anaemic growth rates, partially tell the story of a property market where it is difficult to make property cashflow numbers work for private landlords.

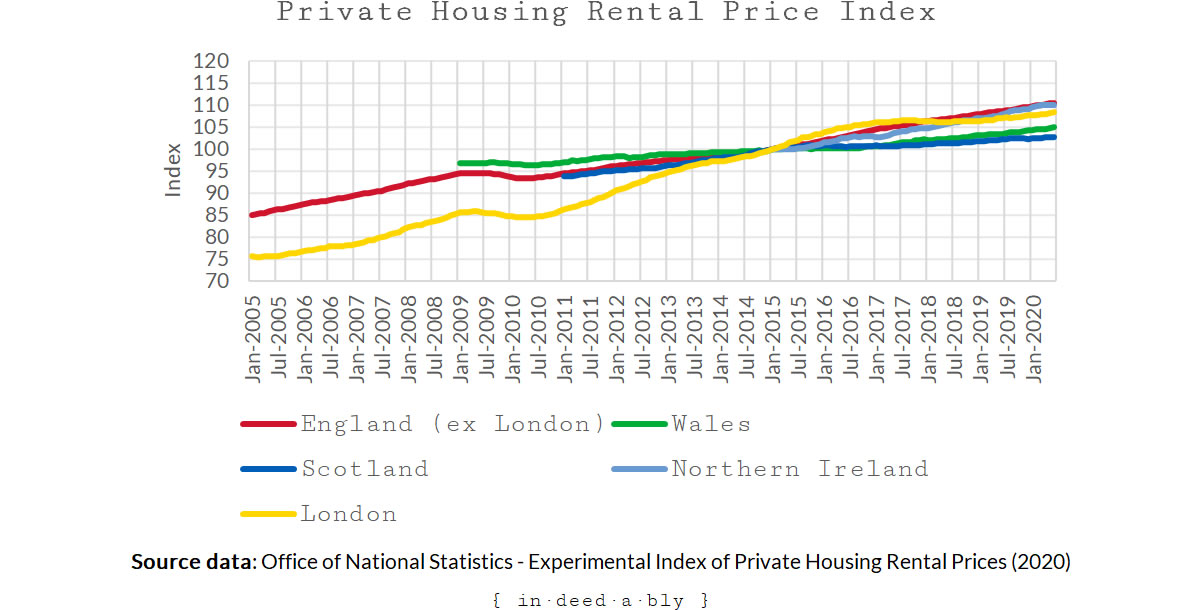

Zooming out a bit, I plotted the private housing rental price index values by nation. Out of curiosity, I broke out London from the remainder of England, as in many ways the two exist in entirely separate worlds.

Northern Ireland’s performance since the Brexit referendum result was interesting. It seems more than a few people have acted upon the arbitrage opportunity presented by the land border with Europe.

The remainder of England’s outperformance of London over the last couple of years is the flip side of that same coin. Fear, uncertainty, and a raising drawbridge combining to reduce demand and competition for the overpriced property in the capital.

As this is a lagging indicator, is a bit early for the full impact of the pandemic to show up just yet in the rental price index.

How safe is your castle?

Folks who rely upon passive income streams or natural yield to support their lifestyles will likely be feeling somewhat uncomfortable at the moment. Simultaneous hits have occurred to their three most common forms of “unearned” income: dividends, interest, and rent.

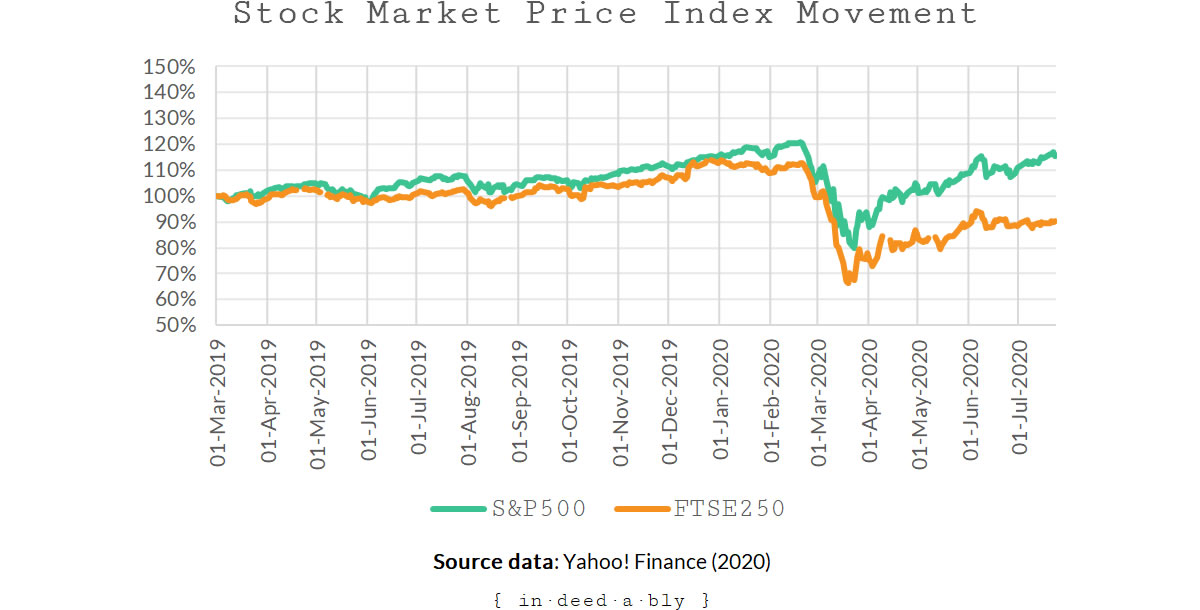

Those who focus on total return when measuring their portfolio performance have cause to feel slightly more optimistic.

The S&P500 is bubbling along at near-record highs. Looking behind the headlines, the recent gains have largely been driven by a handful of large technology companies, Their collective operations benefiting greatly from the pandemic lockdown.

The performance of the United Kingdom market has been underwhelming by comparison, stumbling along at valuations 10% lower than this time last year.

Thunderclouds are gathering on the horizon however, as the Chancellor has called for a review of Capital Gains tax. One potential outcome may be that capital gains are taxed in a manner consistent with earned income.

This would undoubtedly upset a lot of folks. Yet doing so would remove some of the glaring tax avoidance arbitrage opportunities that are built into the system today.

For mine, all people and all forms of income (including capital gains) should be subject to the same rates of tax.

Easier to administer.

Simpler to understand.

Harder to evade.

Hopefully, you have managed to weather the pandemic induced economic storm without much in the way of lasting damage. Cheerleaders of the fabled “V” shaped recovery will point to the retail sales figures and flash PMI reports with unabashed optimism that the eventful first half of 2020 will soon be a distant memory.

Pessimists are left scratching their head in bewilderment. Pointing at eye-watering unemployment rates, second wave lockdowns, and a stock market that seems divorced from the uncertain medium term future.

Realists understand that until uncertainty will prevail until a COVID-19 vaccine (that is free from side effects) has successfully been discovered, tested, manufactured, distributed, and widely embraced by the global population.

Until then we will exist in a world of disruption and inconvenience. Schools and workplaces will randomly find themselves ordered to shut down, and their occupants asked to self-isolate or quarantine as COVID-19 outbreaks ebb and flow throughout the population.

What that means for our passive income streams remains to be seen. The charts above illustrate that disruption adversely impacts earnings. With that disruption likely to continue for at least another 12-18 months while a vaccine is worked on, it could be some time before we see passive incomes returning to the levels we had previously taken for granted.

References

- Chee, F. Y. (2020), ‘Ban on dividends, share buybacks for bailed-out EU firms’, Reuters

- Damodaran, A. (2019), ‘January 2019 Data Update 8: Dividends and Buybacks – Fact and Fiction’, Musings on Markets

- Federal Reserve Economic Data (2020), ‘Unemployment Rate‘

- IHS Markit (2020), ‘IHS Markit / CIPS Flash UK Composite PMI‘

- Inman, P. (2020), ‘Rishi Sunak’s capital gains tax review may usher in higher taxes on wealthy’, The Guardian

- Office of National Statistics (2020), ‘Consumer Prices Index including owner occupiers’ housing costs (CPIH)‘

- Office of National Statistics (2020), ‘Experimental Index of Private Housing Rental Prices‘

- Office of National Statistics (2020), ‘Retail sales, Great Britain: June 2020‘

- OFX (2020), ‘Historical Exchange Rates‘

- SankeyMATIC (2020), ‘Build a Sankey Diagram‘

- Shiller, R. (2020), ‘U.S. Stock Markets 1871-Present and CAPE Ratio‘

- Silverblatt, H. (2020), ‘S&P 500 Q1 2020 buyback and related data’, S&P Dow Jones Indices

- Vanguard (2020), ‘Exchange Traded Funds‘

- Yahoo! Finance (2020), ‘FTSE 250 Historical Data‘

- Yahoo! Finance (2020), ‘S&P 500 Historical Data‘

- Zeng, L. and Luk, P. (2020), ‘Examining Share Repurchasing and the S&P Buyback Indices in the U.S. Market’, S&P Dow Jones Indices

Gentleman's Family Fiances 24 July 2020

I keep an eye on my future income/dividends from all non pension sources.

Things aren’t good but Bizarrely, my venture capitalist trust haven’t been affected as much as my own shares / etfs this year – they are remarkably placid. They account for about 25%, my side hustle investments about the same.

One investment area of mine / side hustle has been booming.

{in·deed·a·bly} 24 July 2020 — Post author

Thanks GFF.

That is interesting about your VCTs. Do you think that is because they are counter cyclical, or is it more likely just a timing thing where the impact of the slowdown has not yet worked its way through the portfolio company books?

weenie 24 July 2020

I’d like to think that I looked as cool as the person in your pic when I went snowboarding but alas, my family said I looked like a ‘mini Lego character’!

Not got all the data for my end of month update just yet but I already know there will be a massive drop in my dividend income, in what should be the month where I normally receive the most income.

Good to have experienced/witnessed this drop now for the first time, while I’m still accumulating and not when I’ve pulled the FIRE plug!

{in·deed·a·bly} 24 July 2020 — Post author

Thanks weenie.

I’m told the one time I tried snowboarding, I resembled one of those old Looney Tunes cartoon characters tumbling down the slopes in the middle of an ever growing snowball that looked to the onlookers below like an oncoming avalanche!

Agree with your sentiment that having a diversified mix of earned and passive income streams is a win at the moment.

Bernie 24 July 2020

I couldn’t agree more. What I think will be interesting is how big the immediate general public uptake will be for a vaccine. How many will prefer to sit things out with social distancing / enhanced hygiene until longer term safety data is available vs opt for the vaccine immediately in the hope of a quick return to life the way it used to be.

{in·deed·a·bly} 24 July 2020 — Post author

Thanks Bernie.

That is an interesting question. Particularly with all the propaganda and misinformation that spreads so rapidly via social media. It doesn’t take much imagination to foresee one country or group attempting to gain an advantage over others by spreading rumours or planting fear of a Thalidomide like tragedy in the making.

We need only look at the false autism association with the MMR vaccine as an example, persisting years after the study reporting the alleged findings was proven fraudulent and its author struck off for professional misconduct.

Fire And Wide 25 July 2020

As someone in the UK, I’ve always tried to avoid increasing further my UK-based exposure, especially with all the Brexit stuff. Whilst I understand why people may be patriotic, I find that difficult without a good reason to be.

Given we’re on the withdrawal side of the FIRE camp, it’s been interesting for sure and I’m very glad at the amount of contingency we built in. A few more years of work seem well worth the peace of mind now!

I’m pretty much firmly in the realist camp on the virus front – though still think we should never underestimate just how fast everyone will get used to this new level of risk. It will be interesting in Winter with less economic wriggle room as to how the balancing game plays out from the propaganda/newspapers perspective.

{in·deed·a·bly} 25 July 2020 — Post author

Thanks Fire and Wide.

I think having a home market bias is reasonable when it is a well informed conscious choice, rather than just blindly following the herd or taking the default easy option.

Someone from the United States with a home market bias would have cause to feel pretty good about themselves over the last 30 year years. A Brit over the last five years, or a Hong Kong native over the last two, not so much.

The last few months have been an eye-opening reminder that boredom, impatience, and inconvenience will triumph over risk avoidance and self-preservation more often than not.

Natural selection is the theory of the survival of the fittest. It is seldom commented upon just how many of the “unfit” failed to survive long enough to reproduce. I suspect it is a sizeable proportion, with oversized risk tolerance playing a significant part in determining that outcome.

Malcolm 25 July 2020

For interest-a World Equities Index Tracker Fund and a World Bond Index Tracker Fund hedged to the Pound -my Retirement Portfolio -has returned to Feb levels-no action carried out

UK investor

As I am retired (74-17 years rtd) I have a conservative 30/70 asset allocation

Much thanks to John Bogle of Vanguard

What happens going forward-who knows?

{in·deed·a·bly} 25 July 2020 — Post author

Thanks for reading Malcolm. It is great to hear your fund values have returned to their pre-pandemic levels. Hopefully the Pound strengthens, to also restore the purchasing power of your portfolio balance. It currently sits around 5% lower than the levels seen at the end of February.

How have the distributions from your investments fared over the pandemic period?

Imon Kearns 10 June 2021

Sankey diagram is a very useful visualization to show the flow of data. Can you shed light which tools are best and easy to use to draw Sankey diagram.

{in·deed·a·bly} 11 June 2021 — Post author

This was produced using a free web based tool called SankeyMATIC.