I walked past the newsstand in the station. Headlines shouted things like “House asking prices hit record levels across Great Britain” and “House Prices rise at the fastest rate in 17 years”.

A couple of hours later a series of estate agents filed through one of my buy-to-let properties, conducting marketing appraisals.

Centrally located in a trendy neighbourhood that has been in high rental demand for as long as I have lived in London. The sort of place young couples or flat sharers working in their first professional jobs out of university rent together. A short commute to work. Staggering distance home, after a night out on the town.

The sharp suits and slicked-back hair worn by the estate agents were familiar. However, something was missing. The oozing overconfidence and brash manner. Those smug boasts about the vast numbers of properties they had sold in the last month.

Instead, they were reticent. Almost sombre. Too much stock. Too little selling. A real buyer’s market. The likes of which the youngest of the agents had not previously experienced.

The first agent lamented that the last time his firm had sold a property for me, his local office had a team of eight negotiators working out of it. Today there were only two. The herd ruthlessly culled as business steadily declined. The firm’s “neighbourhood expert” sales team approach had been abandoned in favour of a leaner single centralised team. His beat now covering a large chunk of the city. His local knowledge barely matching that of a keen buyer researching properties on Rightmove.

The second agent complained that he had a book containing over 80 active listings, yet there was little sales activity. He was conducting more appraisals than property viewings. Delusional vendors reading headlines about the national booming market. Failing to recognise that those figures were a composite of thousands of individual local markets, each experiencing very different conditions.

Difficulties conducting in-person viewings due to COVID had created an unusual environment, where well-informed buyers were being led by heads rather than hearts. Careful research. Targeting properties based on price per square footage metrics. Proximity to schools, shops, and services factored in. Offers resembling carefully targeted sniping than the traditional shotgun and pray approach.

The third agent was the youngest. Anxious. Flighty. Fearful for his job, after rumours his firm was attempting to negotiate an early exit from their office lease. Remarkably frank for an estate agent, stating neighbourhood prices had plateaued back in 2015, with no real growth experienced since.

Excess supply flooded the market, as long-delayed new-build apartments and office conversions came online.

He was at a loss to explain who was going to buy them all?

The numbers no longer worked for buy-to-let investors. Travel restrictions were keeping overseas buyers away. Remote working had, temporarily at least, eliminated the demand for inner-city shag pads for masters of the universe with families living out in soulless commuter villages.

All of them hoped that the “Boris beats COVID” narrative works out better than the whole “Boris does Brexit” debacle had done. Rescuing the economy. Breathing some life into their local property market. The second half of the year would be better. It had to be.

As he was leaving, the third agent confessed he was looking into going back to school and retraining. Commissions were proving to be a tough way to make a living during a down market.

That evening, the marketing proposals trickled in.

All three agents recommended the same asking price. The language in the proposals was fascinating.

One agent expressed “confidence” they would sell the property. Eventually.

Another highlighted, twice, the challenging market conditions and glut of supply.

They would normally value a property then whack on 20% to secure the listing. Subsequently dropping the asking price a couple of weeks into the marketing campaign, due to weak interest from prospective buyers. They professed that a newfound honesty was the order of the day in the current market, seeking to manage vendor expectations from the outset rather than trapping them into an exclusive marketing contracts that left owners feeling like they had been conned and lied to.

The final appraisal appeared reluctant to take on the listing at all. Not a great time to be selling. Difficult to foresee when (if?) market conditions were likely to improve.

All three strongly recommended doing whatever was necessary to keep the existing tenants in place. There were even fewer prospective tenants in the market than prospective buyers, so should the property fail to sell, vendors faced lengthy void periods between tenancies.

A contrary view

A couple of days later, I was speaking to one of the imaginary internet friends I have gotten to know a little through writing this blog. Their day job? A buyer’s agent. Finding properties for the indecisive, remotely located, or time-poor. Helping negotiate the price and secure the purchase. Like a good mortgage broker, more than paying for themselves by obtaining hard to find attractively priced deals.

They declared that the current booming market was largely artificial.

A government-induced fairy tale. The temporary reduction in stamp duty taxes on real estate purchases merely providing state aid for rent-seeking estate agents and property developers.

He reported an alarming number of purchases were falling through at the valuation stage, as uncharacteristically cautious lenders questioned the inflated offers that aspirational homeowners were making for their next abode. The gulf between rose-coloured lifestyle dreams and cold hard numeric realities tripping more than a few loan-to-valuation thresholds.

The popular narrative was the stamp duty holiday had uncorked vast amounts of pent up demand. Transactions frustrated by COVID restrictions, as those living in cities fled to rural villages in search of the good life. Flats dwellers seeking additional room and outdoor space to escape their nearest and dearest after a year of close quarters living during lockdown confinement.

The buyer’s agent had a different view. The breathless headlines were mostly citing year-on-year comparisons. A deceptive take, given last year the market had effectively been shut down by COVID restrictions. Any activity would look bullish by comparison.

That said, the number of transactions completed were the highest they had been since just before the Global Financial Crisis.

The agent believed the stamp duty holiday had simply pulled forward 3-4 years worth of transactions into an artificially constrained window. They predicted the property market would fall in a hole as the tax breaks concluded and normalcy returned.

The buyer agent’s primary source of business had historically been overseas purchasers, who viewed the United Kingdom property market as a safe store of value in which to park their excess riyals, rubles, rupees, and yuan.

While some clients sought to minimise their holding costs by letting their investments out, many didn’t bother, concluding the low yields on offer didn’t warrant the hassle.

Other clients purchased properties for their offspring to occupy while studying at some of England’s finest universities. Offering more comfortable accommodations than the traditional student residences or new breed of well-appointed commercial digs.

Brexit uncertainties had apparently led their more honest clients to seek alternative jurisdictions for their investments. Australia, Canada, and New Zealand all proving popular destinations offering a strong rule of law and favourable tax treatment for property investors. A willingness to ask few questions and look the other way meant the UK remained a popular destination of choice for funds with more dubious origins.

Like the young real estate agent, the buyer’s agent was also considering a career change away from what they expected to be a stagnant property market over the medium term.

Was their assessment correct? Pessimism warranted? I have no idea. All will be revealed in time.

Herding cats

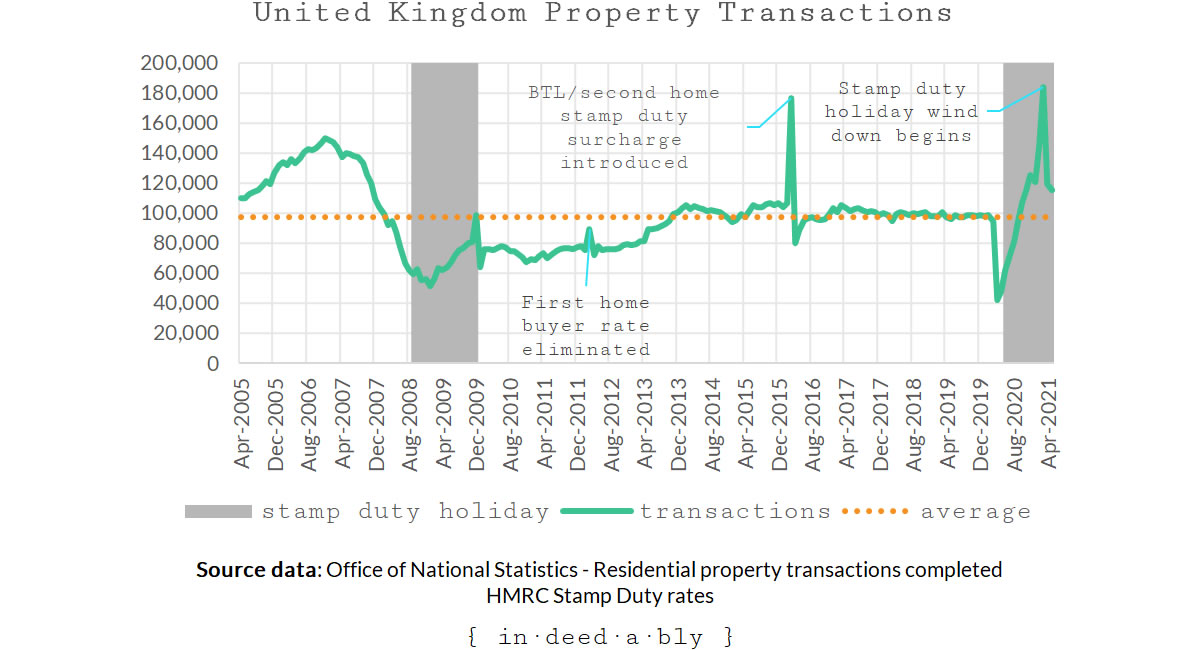

Out of curiosity, I did some research into what had happened the last couple of times major stamp duty changes had occurred.

Predictably, there was a run-up in transaction volumes as the change deadlines approached, followed by a noticeable lull in their aftermath.

In 2016, transaction volumes had returned to average levels within six months.

2012’s small spike was followed by a lull lasting just three months.

Back in 2009, the recovery took 4 years, as the economy struggled with its GFC hangover.

But recover they did.

It reminded me of the old joke about funeral parlours being great investments because people never stopped dying. Creating an endless sales funnel of grieving families to guilt into purchasing overpriced coffins, hearse rentals, and remembrance merchandise.

In a similar vein, life happens events never stop happening. People are always going to be moving homes due to changes in their circumstances. Education. Employment. Family size. Relationship status.

That said, transaction costs introduce friction and influence the behaviour of buyers.

The greater the friction, the less likely the buyer is to complete a purchase.

Back in the heady property boom of the late 1980s, most property purchases incurred a stamp duty charge of 0%. It was no coincidence that the average homeowner at the time moved house once every 8.63 years.

In the days immediately before COVID, property purchases incurred an eye-watering levels of stamp duty. Transaction costs of up to 2% on median-priced homes in England, 5% for median-priced homes in London, and up to 12% for those wishing to live on millionaire’s row. Add on another 3% for anyone who owns multiple properties in their own name, and pursuing the Monopoly approach to getting rich starts to look like a very expensive endeavour.

Unsurprisingly, by 2019 the average tenure for homeowners had more than doubled to 20.8 years.

Fairy tales

The contrast between the media headlines and my property’s local market is jarring. It is always worthwhile doing our own research into the numbers, and drawing our own conclusions rather than blindly accepting whatever the bloviating talking heads and spin doctors would have us to believe.

Even within a local market, there can be very different trends concurrently occurring for different types of property. Single-family houses in great demand, but apartments you might struggle to give away.

I’m undecided on what course of action I will take with this investment property.

I share the agents’ collective curiosity about where the next generation of buyers will come from?

Who will be the greater fools that step in to rescue harassed landlords and overstretched owners, once quantitative easing winds down and interest rates begin to climb to see off the dark clouds of inflation gathering on the horizon?

I also wonder about the long term prospects for London residential property as an investment class.

An increasingly hostile regulatory environment, combined with embarrassingly low yields, make many investment properties pure capital gain plays. Wherever the investor is not actively creating value via extension, rezoning, subdivision, or title consolidation this approach relies largely on educated guesses and hope. Not the typical foundations upon which a sound financial plan are based!

I will be watching the migration statistics with interest over the next year or two, to see if the world’s ambitious entrepreneurs, financiers, students, and technologists continue to seek out experience and fortune in London. Or whether the City loses its lustre, reduced to mere sales office outposts for organisations who make all their important decisions elsewhere.

Not a topic I’m well-informed enough about to hold an opinion on currently. Yet the long term prospects of my local property holdings are directly linked to the answer of that question.

References

- BBC (2021), ‘House prices rise at fastest pace in 17 years‘

- BBC (2021), ‘Stamp duty holiday: How much do I have to pay now?‘

- Burridge, D. (2021), ‘New-build home development hits 21-year high’, Zoopla

- Gov.uk (2021), ‘Stamp Duty Land Tax‘

- Gov.uk (2021), ‘Table 104: by tenure, England (historical series)‘

- Jolly, J. (2021), ‘House asking prices hit record levels across Great Britain’, The Guardian

- Lewis, W. (2019), ‘On Average, how often do we move home?’, Property Reporter

- Office of National Statistics (2016), ‘The effect of stamp duty changes on housing market activity: April 2016‘

- Office of National Statistics (2021), ‘Families and households‘

- Office of National Statistics (2021), ‘UK monthly property transactions tables‘

- Property Reporter (2021), ‘Residential property transactions see busiest April since 2007‘

- StampDutyRates (2021), ‘History of Stamp Duty Taxes‘

- White, D. (2017), ‘How often do we move house in Britain?’, Zoopla

GentlemansFamilyFinances 11 July 2021

Great post.

Volumes or market depth matter more than price – especially in such an illiquid market as property.

Here in an unloved Scottish city, the market is going bonkers. I keep an occasional eye out and like the £/M2 metric.

Flats half the size of ours, similar location, similar condition selling for a fraction of what we paid for ours 5 years ago yet the housing price index says ours is not gone up by much.

Something doesn’t add up…

We might need to wait a few months to see just what’s going on.

It’s just a shame that you can’t eat equity.

{in·deed·a·bly} 11 July 2021 — Post author

Thanks GFF.

Markets within markets. Doesn’t make for good click-bait headlines or vote buying, but describes the reality on the ground.

Home equity line of credit, offset mortgage, or a predatory reverse mortgage are about as close as you can get while still retaining the property.

Donna 11 July 2021

I have optimistically decided to list my house last autumn, took a bit of time to get a buyer who offered the asking price, but longer to find a property at a price I was prepared to pay vs the increased space. Back in March, I entered a painful property chain, with morally dubious people. Nevertheless, this was largely complete early May and all legal processes were done by mid June. All except the person at the top of the chain, who despite saying all along she wanted a quick sale, had decided to relist her house for more money. Something I found out accidentally as estate agents were quite content to keep the chain in the dark. Have been trying to find another house since, but prices are ridiculous for detached houses now vs what I agreed in March. I have found this mentally exhausting and really hope prices will l start to drop. I always thought the hard part was to have sufficient money to buy my next house with a minimal mortgage, but there is no accounting for people’s conduct and estate agents’ practices!

{in·deed·a·bly} 11 July 2021 — Post author

Thanks Donna.

Sorry to hear about your stressful ordeal, I can only imagine the uncertainty around when (if?) you’ll be able to move. People can certainly be savages, especially when money is involved.

I wish you a swift resolution and a happy life living in your new home.

Jimbo 12 July 2021

Timely article , as we currently debate whether to buy our landlords house at 8% more, than I am happy paying or do we rent elsewhere and play the waiting game for a little longer.

Sadly there is always someone else willing to pay more and stretch themselves beyond sensibility when it comes to houses!

{in·deed·a·bly} 12 July 2021 — Post author

Thanks Jimbo. I hope you find a satisfactory outcome to the dilemma.

For what it is worth, “falls” in property values are more often relative than literal. In other words, one area might stagnate or underperform relative those nearby. Another type of “fall” is in real terms, where the nominal price remains unchanged but after inflation the cost in terms of purchasing power has reduced.

It is much less common for nominal prices to drop like a stone, though it does happen occasionally but rarely when we want it too, and it takes a brave soul to swim against the tide of panic and angst to pull the trigger on a purchase in a plummeting market.

BTL investor 12 July 2021

Interesting article. Do you mind me asking roughly where your btl is located? I have a few BTL on outskirts of London nearing heathrow and capital values have fallen back to 2015 levels and rental values are flat although they remain easy enough to rent. I can confirm that in my home town out in the sticks, prices have appreciated a solid 10 – 20%. This is rather annoying as one plan I had was to sell the BTL and move to the sticks. I can’t help but feel though that the govt / society will seek to get London ‘moving’ again and in five years time things will look markedly different to now but that’s an opinion only Good luck selling – sounds as if you should perhaps keep trying to let them?

{in·deed·a·bly} 12 July 2021 — Post author

Thanks BTL investor. Sorry to hear your escape plan may need adjusting, hope you find an alternative path to achieving your goal.

I’ve not yet decided what to do with it. I’m conscious of sunk cost fallacy, so looking at anticipated future returns rather than basking in the glory days long ago when it increased in value by 50% over the first two years I owned it. I’m also watching interest rates, as while it is comfortably self funding today that may not remain the case when it comes time to refinance.

This property is on the edge of zone 1.

BTL investor 12 July 2021

ok interesting. Yes i would think this is worst time to sell it at the moment. Still uncertain what’s happening with return to work, brexit affect etc. Hard to see in two years time all things being equal that outskirts of zone 1 is in a worse place. Sure if interest rates increase substantially all bets are off but that applies to everything. Otherwise can’t help but feel holding on is better if you can.

{in·deed·a·bly} 12 July 2021 — Post author

Thanks for sharing your thoughts, BTL investor.

For mine, the worst time to sell would be in a panic or as a distressed seller (as the previous owner of the property had been when I purchased it). I find myself in the fortunate position where I enjoy the luxury of choice, able to either retain or sell. The default option is always apathy/”no change“, which in this case is renewing the existing tenancy and retaining the property.

I agree, unless a major infrastructure or employment change has been announced, two years would usually be too short a period to measurably assess whether a change was a permanent structural adjustment or a transient change in fashion. Hence my interest in the skilled migration data, as this is a potential leading indicator of skilled professionals’ perspective on the prospects of post-Brexit London. Essentially using Heathrow as a polling mechanism, how are these skilled professionals voting with their feet?

David Andrews 12 July 2021

The market for city centre flats is going to struggle, especially any that have potential cladding issues. Houses with gardens will fare better as working from home demands extra space, both indoors and outdoors. My partner has a rental flat in the city centre and I’ve found it best not to mention it for the past few years. New boilers, leaks, cladding, waking watches and other maintenance costs have been causing “issues”

In the vicinity of my family and rental homes I’ve seen properties go from for sale to sold in less than a week. A few have been returned to the market recently, presumably due to a collapsing chain and the end of the stamp duty holiday.

The consent to let on my rental property ends soon and I’ll need to finally make a decision on its future. Issuing a section 21, keeping the property empty and retaining the keenly priced offset interest only mortgage may be the best outcome for me but I suspect the tenant will not see it that way.

Our properties are technically debt free which takes a lot of stress out of market watching.

{in·deed·a·bly} 12 July 2021 — Post author

Thanks David.

It will be interesting to see how the city centre market plays out. It will come down to a trade off between bonus chasing cost savings by reducing corporate rent bills versus insecure managers wishing to big themselves up by being able to survey their empire of minions looking busy at their hot desks.

I suspect human nature will gradually reassert itself, probably faster than we expect, and many of those folks who escaped to the countryside will come to regret their now lengthy commutes. Hopefully not though, as I prefer remote working to sitting in an office all day!

Good luck with your decision, sounds like you have several viable options to choose from for your rental place.

David Andrews 15 July 2021

Thanks for your response. Following some “heated discussions” after I issued a section 21 rent increase last month, the tenant has announced his intention to move out and purchase a property. This is probably the least problematic outcome as it means I shouldn’t have to go through the hassle of issuing a section 21 in order to take back possession and retain my cheap residential mortgage on the “rental” property.

I’ll keep the property empty for a couple of months and use the time for some renovation work. I’ll also enquire how long it needs to be back in my possession before the consent to let period resets.

Continuing to rent it out on the previous heavily discounted rate was no longer economically viable. Increasing the rent to market rates wasn’t agreeable to the tenant. Once renovated it might go back on the market for rental again but at market rates.

{in·deed·a·bly} 15 July 2021 — Post author

Best of luck with it, David.

ijustwantacat 18 July 2021

Really interesting post, thank you! I’m close to buying my first home (close by some metrics, probably looking in April to July next year, an eternity away) and have been searching the market endlessly over the last 8 months.

During the most recent lockdown I moved from London to Manchester because my rent in zone 4 was close to £1500 and I live alone—couldn’t justify paying that while struggling to save for a deposit, and knowing I’d never afford to buy in London anyway. I miss the city and everyone I know dearly but I don’t miss the creeping dread of knowing I was on a treadmill I’d never be able to jump off! Since moving I’ve turned around my financial health rapidly. But I don’t know Manchester housing market, hence the property searches even though I won’t be eligible to buy until ~April.

As I’m into gardening and work from home, the properties I’m looking at are what everyone else now wants! A few months ago was the worst of it. Houses were going to best and final offers and sealed bids the day they were listed and people were paying 5-10% over asking. I’d do my searches just to find out what was so awfully wrong with the properties that came up. One crazy cat place is still imprinted in my mind and might be forever. The headlines say 15% price growth in the northwest and I don’t think they’re far wrong. The poor folks with city centre flats are stuck or even slightly decreasing, but 3-bed garden semis or 2-bed semi rural detached places are soaring up out of my price bracket now.

Even though my budget is well below the current 0% threshold, the market is starting to even out post-stamp duty deadline and there are non-scarring places showing up. The price history gadget shows people who were trying to be cheeky putting their asking price down, sometimes repeatedly. People have wised up here too. But the average suitable property is creeping further out and/or coming with more reno work than it did this time last year, so I can see the price growth happening in listings. It’s maddening!

Is Manchester and the northwest going to steal the spotlight from London? I guess we’ll find out in the rear view mirror 🙂

{in·deed·a·bly} 18 July 2021 — Post author

Thanks for sharing your story, ijustwantacat. I hope your home ownership quest is ultimately successful, and you enjoy many years happily occupying your newfound dream house.

Weenie has also been describing how hot the Manchester market is running at the moment, it sounds like a good time to be a seller there currently!

ijustwantacat 19 July 2021

Thank you! I’m sure things will fall into place at the right moment 🙂 I’ve gone over to investigate Weenie’s blog too! I hoover up any and all input and opinions on where we’re heading, if only so that in a few years’ time I can groan at my own fairy tales 😉

Q-FI 27 July 2021

Hahaha. This is exactly what it feels like to me… “I was speaking to one of the imaginary internet friends I have gotten to know a little through writing this blog.” Great way of summing it up. I question if the online personalities I interact with are even real sometimes.

For the ignorant American here, the stamp duty tax is a one time transaction fee, correct? Basically like closing costs, it’s not ongoing like property taxes.

{in·deed·a·bly} 27 July 2021 — Post author

Thanks Q-FI. It is amazing how life like those AI chatbots have gotten, offering up compliments, quotes, and even existentialist angst! ?

Stamp Duty is a value based transaction tax that is levied upon the purchase of certain asset classes, including property and (some) shares. My understanding is “closing costs” is a broader term, which in addition to this type of tax can also include things like legal fees, mortgage arrangement fees, brokerage, and insurance costs.