Everyone loves a hero: Bill Mazeroski hitting a home run to win the World Series; Jonny Wilkinson nailing a dying seconds drop goal to win the Rugby World Cup; Michael Jordan’s buzzer beater to win the NBA playoff series.

The financial equivalents are the early backers of entrepreneurs like Elon Musk and Brian Acton; founders who execute a great idea and “suddenly” make their investors (and themselves) rich when their company gets acquired or goes public.

Under the radar

Nobody talks about the journeymen performers like Julien Benneteau, who has made over USD$9,500,000 over the course of his 570 ATP tennis matches but has never won a tournament.

When people discuss the greatest Formula 1 drivers of all time, the name Alain Prost rarely comes up. Despite winning 4 world titles, Prost’s economical approach of reliably banking points in every race rather than gunning for the win, made for many forgettable races.

The thing is, for every defining Jordan-esque rockstar moment, there were thousands of times that the last gasp “death or glory” attempt misses altogether, leaving the player or investor to go home empty-handed.

Meanwhile “slow and steady” guys like Benneteau and Prost kept turning up, steadily banking points and prize money. They are no Roger Federer or Michael Schumacher, but they finished careers doing something they loved with a nice bank balance capable of supporting their families for the rest of their lives.

Apathetic investors sing the praises of low-cost index trackers, many professional investors do too. Critics argue you can’t get rich by blindly following the herd, to outperform the masses you must first do something different.

Low-cost index tracker investors will never have the heroic “I bought Amazon at $18” investment achievement to brag about, that just isn’t how they work. They do stand a pretty good chance of winning over the long term however, like Benneteau and Prost.

Everyone is a genius in a bull market

Mark Cuban once observed that “everyone is a genius in a bull market”.

The tech evangelists loved tech stocks during the dot-com bubble.

The self-aggrandising Bitcoin proponents worshipped cryptocurrencies at the start of 2018.

How many of them strategically took profits on the way up?

Perhaps a better question is: how many lost their “on paper” profits (and possibly much more) on the way back down?

Rebalance

Personal finance geeks extoll the virtues of periodic rebalancing, many wealth managers do too. Critics argue this throws good money after bad, channelling the profits made by backing winners into an ever larger holding of losers, in the hope that should the losers come good someday they will be riding the wave.

Investors using low-cost index trackers often apply the concept of rebalancing to align their portfolio weightings back towards their target allocations.

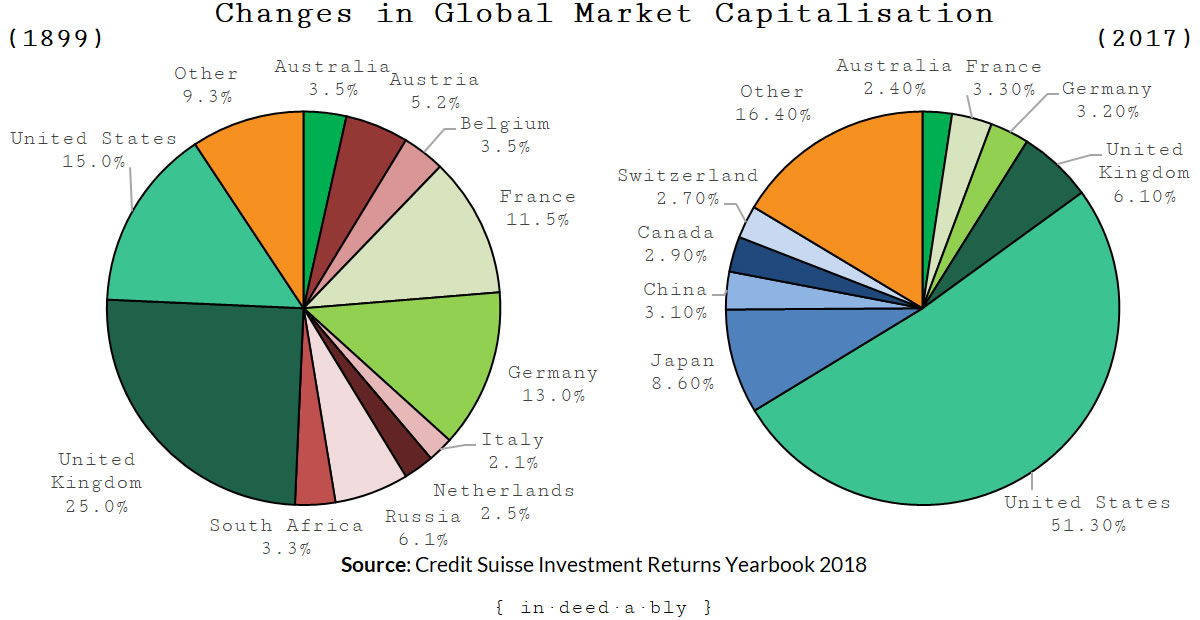

Why is this important? Well, things change, markets move, and so on. Consider the chart below that illustrates how that World Bank market capitalisation view by country has changed over time.

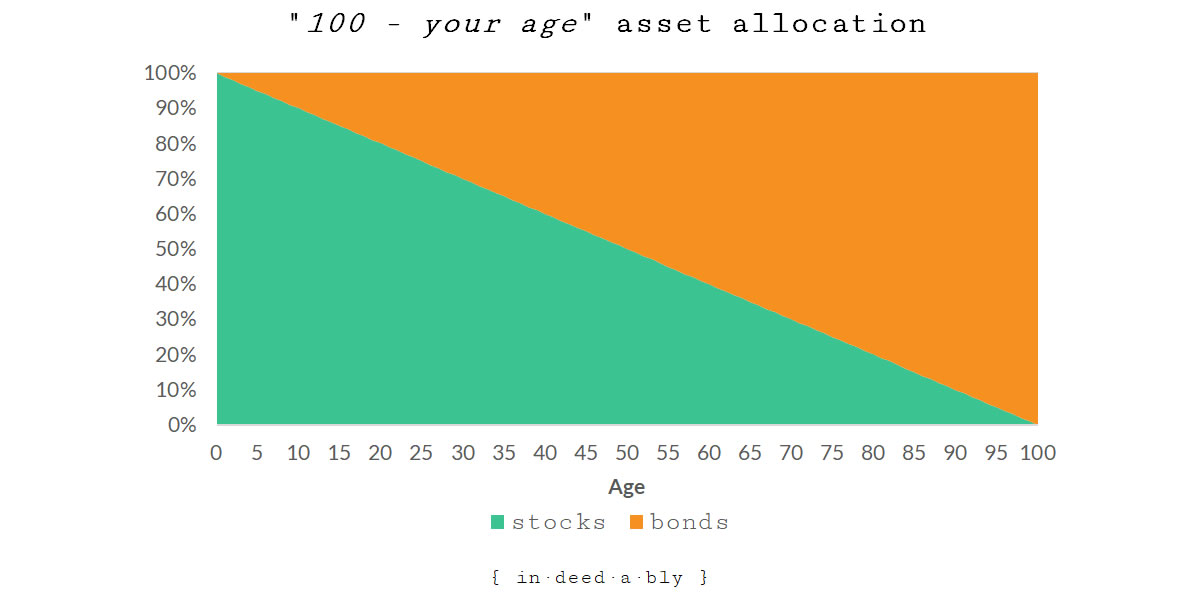

For some this involves adjusting their split between stocks and bonds, perhaps they apply the “100 – your age” rule of thumb to calculate their target allocation of stocks.

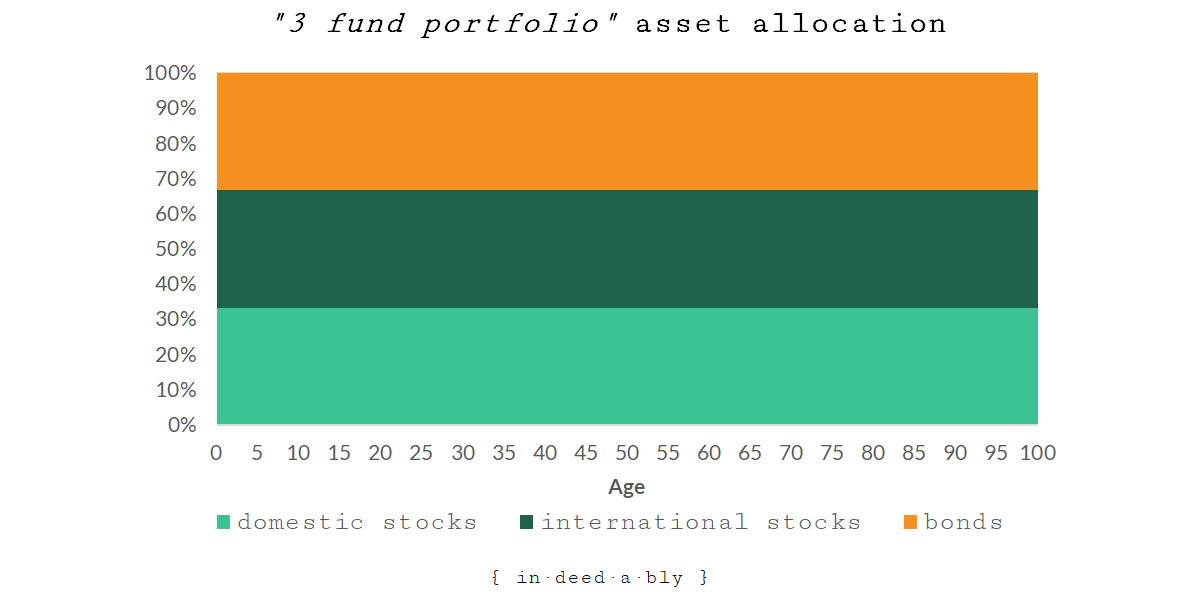

Others may follow the three-fund portfolio discussed by the Bogleheads, with an even three-way split between domestic shares, international shares, and bonds.

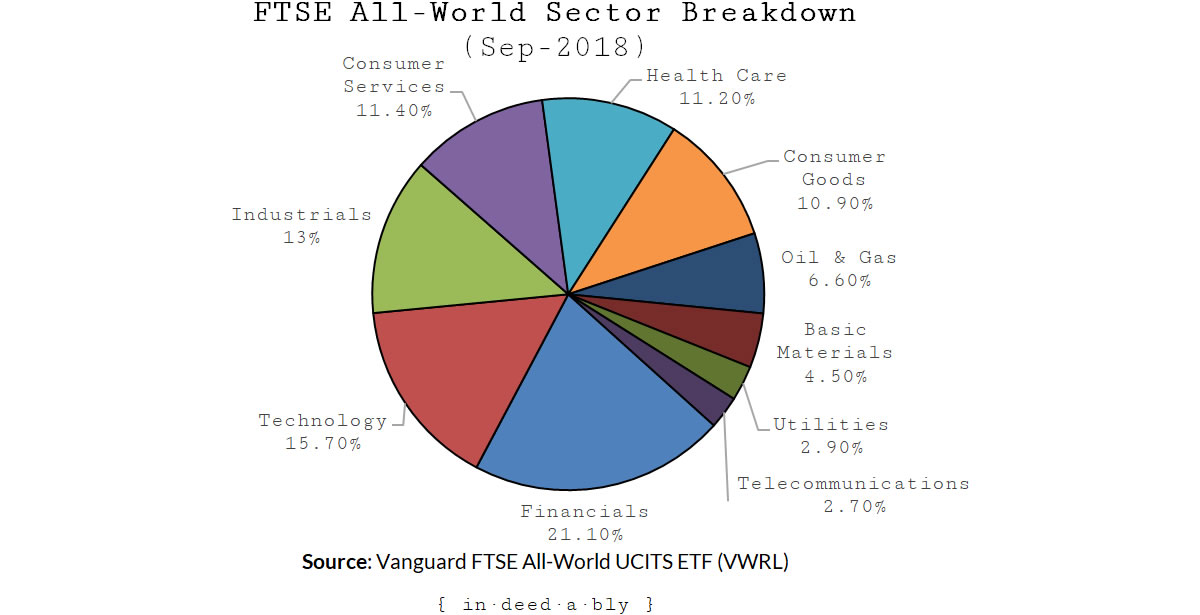

Maybe you hand roll your own global index tracker, using a handful of low-cost regional ETFs, to save a tiny bit on management fees. Periodically you realign your allocations mirror the FTSE All-World or MSCI ACWI Index weightings.

Perhaps your target allocations are broken down by some or all of: asset class, currency, geography, and sector?

However you do it, it is important that you understand your target allocations, and why you set them where you did.

The “why?” question is key

What was it you were hoping to achieve?

What risks were you hoping to mitigate by your chosen approach?

An asset allocation example

The US stock market accounted for more than 54% of global stock market capitalisation, at the time of writing.

To provide an illustrated example, let’s say you wanted to allocate a portion of your stock investment portfolio to US-listed stocks. You wanted that allocation to be weighted such that it reflected the United States share of the global stock market.

Easy right? The answer is 54%, it said so just a couple of sentences ago!

Except according to the World Bank, the US markets accounted for around 41% of the global domestic stock market capitalisation at the end of 2017.

WTF?!?

Digging into the small print, the World Bank figure reflects the composition of the stock markets once “investment funds, unit trusts, and companies whose only business goal is to hold shares of other listed companies” have been excluded.

What does that mean?

- If Amazon issued 1 share to Indeedably Inc, then Amazon’s market capitalisation would include the value of that one share.

So far, so good.

- If Indeedably Inc was itself listed on the stock market, the value of that Amazon share would be effectively accounted for twice: once in Amazon’s market cap and then again in Indeedably Inc’s market cap.

- These types of investment companies should typically trade at around their Net Tangible Assets value, as the vast majority of their worth is essentially the sum of their holdings.

That explains the difference between the 54% and 41%, the World Bank has attempted to remove this double counting.

So when you said “reflected the United States share of the global stock market” which measure actually reflected the target allocation goal you were trying to achieve?

If your portfolio contains 54% exposure to US stocks, then depending on what your allocation goal actually means, you would need to either do nothing or rebalance by selling down some of your US position.

Tracking your net worth… honestly

Tracking your net worth is a very useful tool to monitor how your lifestyle costs impact your financial well being. Acting upon that information leads towards a more considered and conscious consumption spending pattern.

Many financial writers recommend including the value of owner-occupied housing in those net worth calculations. Critics, such as Robert Kiyosaki of “Rich Dad, Poor Dad” fame, argue against this because owner-occupied property is not an investment in the sense that it (generally) fails to generate excess cash flow.

I believe that a conservative valuation of owner-occupied property should be included in the net worth calculation, offset by the current value of any mortgage liability that may encumber the property.

My reasoning is that an owner-occupier residence is likely to contain accumulated equity. This equity could be accessed via refinancing or through the sale of the property should the owner so desire. Failing to include this accumulated equity in net worth calculations would be painting an incomplete financial picture.

Home ownership and asset allocation

What relevance does the inclusion of owner-occupied property (or not) have on a discussion about low-cost index investing and portfolio allocations?

Plenty!

Consider the case of an investor who had decided to limit their exposure to property, wanting that asset class to have a maximum portfolio weighting of 25%.

Those low-cost index trackers will likely include some listed Real Estate Investment Trusts (REITs), their core business is property.

That investment property the investor directly owns, perhaps the result of becoming an “accidental landlord” after moving in with their partner or spouse, would also be included in the 25%.

But what about your own your own home? It is property after all, and housing costs consume a material portion of most people’s income.

If you include it, you will likely find your current asset allocation is hugely skewed towards property. The fewer investments you hold, the greater the weighting property will account for.

Now consider the case of an investor who wishes to limit their home market bias, or their exposure to the British Pound, because of concerns over Brexit’s potential impact on the future prospects the UK economy.

The inclusion of their owner-occupied property will paint an honest, though (depending on their politics) potentially alarming picture of their exposure to each of these asset allocation factors.

What does all this mean?

For any investor, it is important for them to understand the implications of their investment choices.

To be successful over the long term, rather than just getting lucky occasionally, the investor needs to understand why they wish to buy, hold, or sell their investment assets.

- Is it part of a well thought out strategic plan?

- Is it taking advantage of a short-term arbitrage opportunity?

- Or is it just blindly following the herd, the advice of a bloviating talking head on one of the stock market gossip cable channels, or a “hot tip” from a bloke at the pub who is (probably) no better informed than you are?

They also need to understand why they have adopted a given target portfolio allocation across asset classes, markets, geographies, sectors, and currencies.

- What is the goal of that target allocation?

- What is it helping to achieve, or avoid?

These allocation rules and investment choices are deeply personal, the right answer for one person will not necessarily be the same as for another.

Therefore it is vital for the investor to understand the rationale and reasoning behind their own approach, to ensure each individual decision aligns with their strategy and will help achieve their goals.

References

- Dimson, E., Marsh, P., Staunton, M. (2018), ‘Credit Suisse Global Investment Returns Yearbook 2018‘

- Moore, L. (2014), “World Financial Markets 1900-1925”

- Vanguard (2018), ‘FTSE All-World UCITS ETF (VWRL)‘

- World Bank (2018), ‘Market capitalization of listed domestic companies (current US$)‘

The Transoceanic Teller 18 October 2018

Thank you for your refreshing words and unique perspectives/story telling about personal finance and FIRE. I recently started following your page, and I’m really excited each time there’s a new post, because I know it won’t be the same recycled stuff as usual. I also really appreciate the beautiful graphics/plots you make! Keep it up!

{in·deed·a·bly} 18 October 2018 — Post author

Thanks for reading Transoceanic Tellar, and for the kind words. I’m glad you enjoyed it!

earlyretirement 18 October 2018

This is very educational! A few days ago I published a post about whether or not to diversify my own portfolio. I own one stock only. My company’s (obtained via an ESPP program). I know (or rather I think) I need to diversify, but diversifying just for the sake of it doesn’t seem right to me. I want to understand the why. Your post suggests I am asking myself the right questions. It doesn’t guarantee I make the right choices of course…but it’s a start 😉

{in·deed·a·bly} 18 October 2018 — Post author

Glad you learned something Marc.

The circumstances you describe contain what we used to call, back in my days as a hairy smelly techie, a “single point of failure“.

In the unfortunate event that your employer were to go broke, then not only would you lose your job but you would also lose your only share investment. That is a concentration of risk that is worth giving some thought to, a bit of diversification may be prudent.

earlyretirement 18 October 2018

I do have a mortgage free home, so my portfolio isn’t entirely concentrated around one stock. But you raise a valid point.

youngfiguy 18 October 2018

Very thoughtful post Indeedably (as ever)!

The cross-holdings thing is also a particular issue for the FTSE All Share / FTSE 250 due to the listed Investment Trusts.

Your last paragraph is spot on.

youngfiguy 18 October 2018

Also any post that name drops Julien Benneteau is good in my book.

{in·deed·a·bly} 18 October 2018 — Post author

You have to respect the way Benneteau keeps turning up year after year, hoping for a Steven Bradbury moment.

I really hope he manages to win a tournament before he hangs up his racquet, 18 years is a long time to wait.

youngfiguy 18 October 2018

If he won a title he’ll probably do what Gilles Muller did (who had to wait ages for his first title over Evans) and get a career high ranking then retire!

Steven Bradbury! Now there is an all-time sporting classic. I remember reading a long-form piece about that victory. There was some people who thought it was a bit of joke. But I read about how he had had two near death accidents, told he’d never skate again, then ended up winning Olympic gold. If that ain’t what the Olympics is about, I don’t know what is!

{in·deed·a·bly} 18 October 2018 — Post author

Thanks YoungFIGuy.

The World Bank data perspective made for a fascinating chart, kind of like looking at those world maps that use the Gall-Peters projection to display the countries/continents correctly by their relative sizes.

Image credit: WikiCommons.

I would have posted it, but the absence of UK market data in the last time period would have caused more trouble than it was worth.

The Obvious Investor 20 October 2018

Love this article! Thank you.

Very similar to my strategies, Stocks, Bonds, REITs but also Gold. This is how it backtests for many years.

Just found your site. Enjoying it immensely so far.

Thanks again,

Mark

https://obviousinvestor.com

{in·deed·a·bly} 20 October 2018 — Post author

Thanks for the kind words Mark.

I must confess I never bought into gold as a stand alone asset class. I figured one day a smart scientist somewhere would come up with a way to make gold in a lab, much like they did with diamonds. Once that happened the scarcity would be gone and I’d be left holding a shiny ornament.

Of course it hasn’t happened (yet?), but I prefer to focus on asset classes that will throw off cash flow and in doing so help support my lifestyle.

The Obvious Investor 20 October 2018

Thanks for your reply!

Funny enough, gold can be make in a lab (particle accelerator)! Only problem is; it costs about 10 times as much as regular gold, so kind of misses the point 🙂

For me, gold is an insurance policy, rather than type the whole diatribe I hope you don’t mind me just posting a link.

To point, if you go to a chart and look at the date October 11th just gone. Look at the Dow, and then at gold. When the markets panic, big money goes into gold. That day right there should show that. Dow off 800 points, gold up $30 in 1 day.

For me, I just like having 25% of my overall portfolio in gold. No dividends, but it saves from the big drawdowns.

Still reading your site. Really good 🙂

Mark

https://obviousinvestor.com

PendleWitch 20 October 2018

Hi Indeedably.

But…but…it’s not so easy! I have an overall net worth allocation target (cash / house / equities), heavy-ish on cash since we’re not overly young. But since we’re using salary sacrifice into company DC pensions, we (1) only get to choose from a small number of approved funds (‘global’ for me=30% UK and 60% other developed countries (mainly US)); and (2) can’t actually increase the cash % due to the DC pension contribs being larger. The house part is slowly decreasing though…

Perhaps “good enough” is that I thought about it, even though it can’t be perfect?

Btw, you’re writing a lot – are you not going back to work this winter? 😉

{in·deed·a·bly} 20 October 2018 — Post author

Thanks PendleWitch.

I’ll challenge your premise a little bit, as things only as complicated as we choose to make them!

The constraints of the pension wrapper and limited fund selections are self imposed. They are driven by other choices you have made, such as your jobs and retirement funding strategies. Whether those limitations are acceptable or unnecessarily restrictive is a question only you can answer.

Whenever I’m feeling trapped or constrained I often find it helps to step back and look at how and why I have arrived in that circumstance. More often than I would like to admit, the trap is of my own making, created by failing to consider all the options available.

Lol! Have you been talking to my wife?

It would be fair to say there is a masterful display of procrastination going on. I am in talks with a few potential clients for my winter office hibernation, but fears over Brexit uncertainty seem to have put the brakes on much of their decision making. There is progress, but compared to previous years it is at a glacial pace.

In the meantime I am supposed to be finishing off my last university unit, but having called me out on my blogging verbosity, it wouldn’t come as a surprise to hear that I’m not really feeling it at the moment. Will need to knuckle down soon, or I’ll have too many balls in the air come the winter!

PendleWitch 22 October 2018

You’re right. I was making excuses and being lazy! Looking just now, the DC pension choices also include a “cash fund”. Fact sheets are quite impenetrable. Benchmark is 7-day LBID for that one, and yearly numbers don’t look great. Off to Google again… Plus I’m also waiting to see what SIPP comes out of Vanguard (promised for many months but not yet delivered)

Alain Prost won the only Grand Prix I ever went to (Montreal ’93). Atmosphere great, but viewing rubbish. Wouldn’t be spending money on that kind of thing these days, obviously 🙂

Good luck with all your winter plans!