The incompetent project manager raced around with her hair on fire. Her eyes held a wild-eyed look of desperation. In her head, klaxons sounded. Flashing lights strobed. “All hands to panic stations”.

An independent observer could be forgiven for concluding that the end of the world was nigh. That the game being played had life or death consequences.

Not appreciating that the deadline the project manager was bullying her team to hit was arbitrary.

Chosen at random during a long-forgotten committee meeting held many months ago.

Well before any detailed analysis of size and scope of the work had been conducted.

An uninformed guess made up on the spot then. Ensuring future disappointment and likely failure later.

A process not engineered to succeed. In fact, a process designed to fail.

The deadline provided a target. Motivation. A means of measuring success or failure. Influencing behaviours, as “success” became inexorably linked with meeting the deadline, rather than achieving the desired project outcomes.

Compromise.

Corner cutting.

Short-termist decision making.

Doing anything and everything just to hit that arbitrary date.

But here is the thing. No one would live as a consequence of the deadline being met. Nor die, should it be missed.

Nobody outside the firm was even aware it existed at all. In truth, the deadline mattered little today. In six months, nobody would remember there had been a deadline at all.

Yet the consequences and ripple effects of all those short-sighted decisions will be felt for years.

Such is the project lifecycle within a megacorp.

As the unfortunate project manager performed a decent impression of a headless chicken, I idly wondered what would happen if we planned out our lives as badly as we plan projects at work?

My inner saboteur gave an evil chuckle: “oh, but we do!”

Arc

Many of us make similar types of mistakes as those corporate project sponsors. Starting with ill-informed and unrealistic expectations. Rushing in without doing the thinking, analysis, or planning. Concentrating on the easy wins and immediate gratification, often at the expense of the less glamorous activities which will yield big dividends over a longer timeframe.

Many of us start out by viewing life as nice a straight line. Simple. Easy to understand. No surprises.

One end contains the past, stretching back to the day we were born. The past is full of facts. Certainty. Known outcomes. The wisdom of hindsight. A sunk cost, nothing we may do can change it.

At the other end resides the future. A story as yet unwritten. Full of hopes and dreams. Constructed out of assumptions. Expectations. Predictions. Uncertainty. Informed by our past, but not defined by it.

Standing somewhere along that line is us. Today. At the only point we have any real control over: now. Making decisions or avoiding them. Influencing the outcome or surrendering to fate.

It is worth observing that the line is not infinite. Our journey will come to an end at some point. A troubling, if unavoidable, fact that creates scarcity and makes time a precious commodity.

This perception of a nice single straight line is faulty.

In part, because real life more closely resembles a game of snakes and ladders. Our path somewhat haphazard and random as “life happens” events and evolving priorities alter our course.

In part, because not all years have equal value.

Our early years of life find us entirely dependent upon the generosity and goodwill of others for our survival. Drooling all over ourselves. Eating baby food. Staring into space. Wearing nappies.

In an ironic display of the symmetry, many of those fortunate enough to avoid an untimely end, via accident or illness, will endure a similar experience at the tail end of their elder years. Gradually losing their independence, mobility, and marbles.

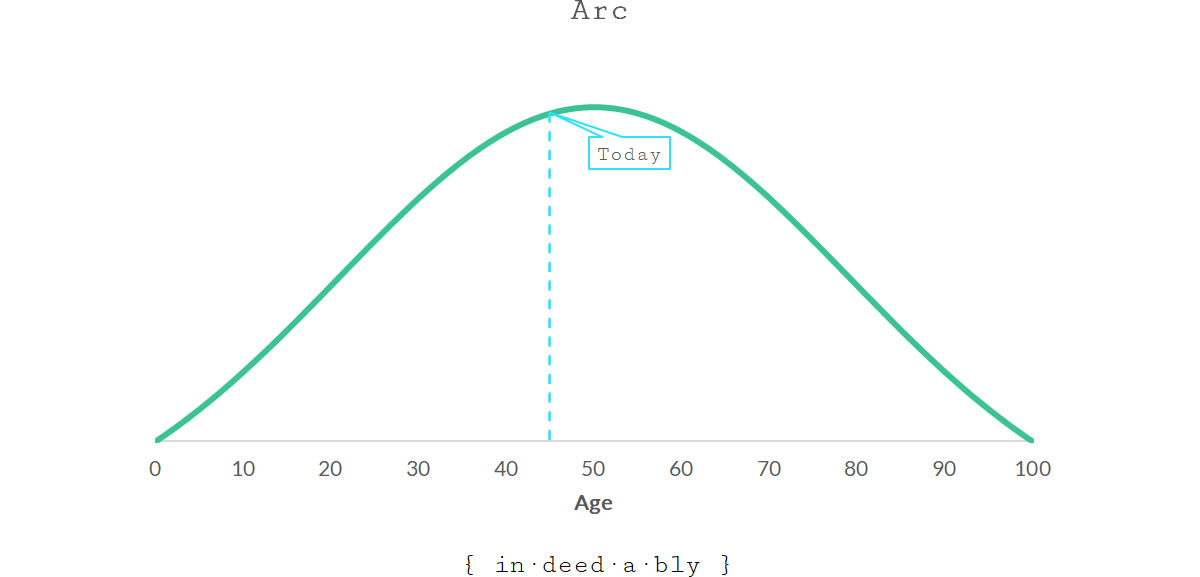

In between, there is an arc of sorts.

Rising out of childhood as we develop and mature.

Gaining confidence. Experience. Financial means. Knowledge. Marketable skills. Self-awareness.

At some point, this arc plateaus as age starts to catch up with us.

From that peak a decline commences. Gradual at first, then steadily gaining speed with the approach of old age. One by one we are no longer able to perform feats we once could. Closer to the end than the beginning.

But to think there is a single arc at work is overly simplistic. Reminiscent of those business sponsors who pull dates out of their air, without any understanding of the effort required to achieve their desired outcomes.

In practice, there are multiple arcs.

Operating concurrently, yet largely independently.

Providing windows of opportunity. Informing a logical sequence of events, that if understood can make our journey infinitely easier. Providing a strong tailwind at our backs, rather than having us constantly swimming against the tide.

Physical

On the way up, we are young. Physically capable. Contentedly broke, Not yet knowing any different.

Our physical prowess is something we take for granted. Only noticeable in its absence or decline. Fast metabolism. Musculature. Natural good looks. Rapid healing. Sex appeal. Stamina. Strength.

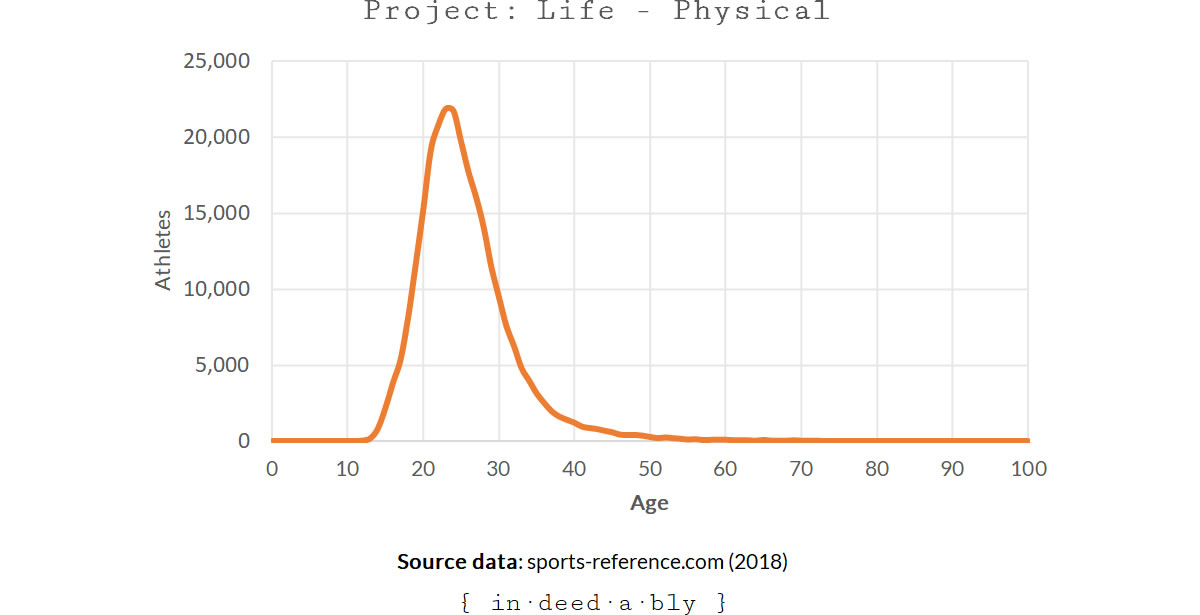

To illustrate, consider all athletes who have participated in a modern Olympic games. A population of more than 250,000 individuals. Representing the peak of human physical performance. Ranging in age from 10 to 83.

Looking at the numbers, with a vanishingly few exceptions, by the time an athlete reaches their mid-to-late 30s, they can no longer compete at the same level they had once achieved. Their place taken by somebody younger, stronger, and fitter than they now are.

Of course, that doesn’t mean somebody in their 60s can no longer enjoy themselves physically. Oscar Swahn won Olympic gold aged 64. Just that their ability to perform is constrained and compromised by the inevitabilities of age.

Earnings

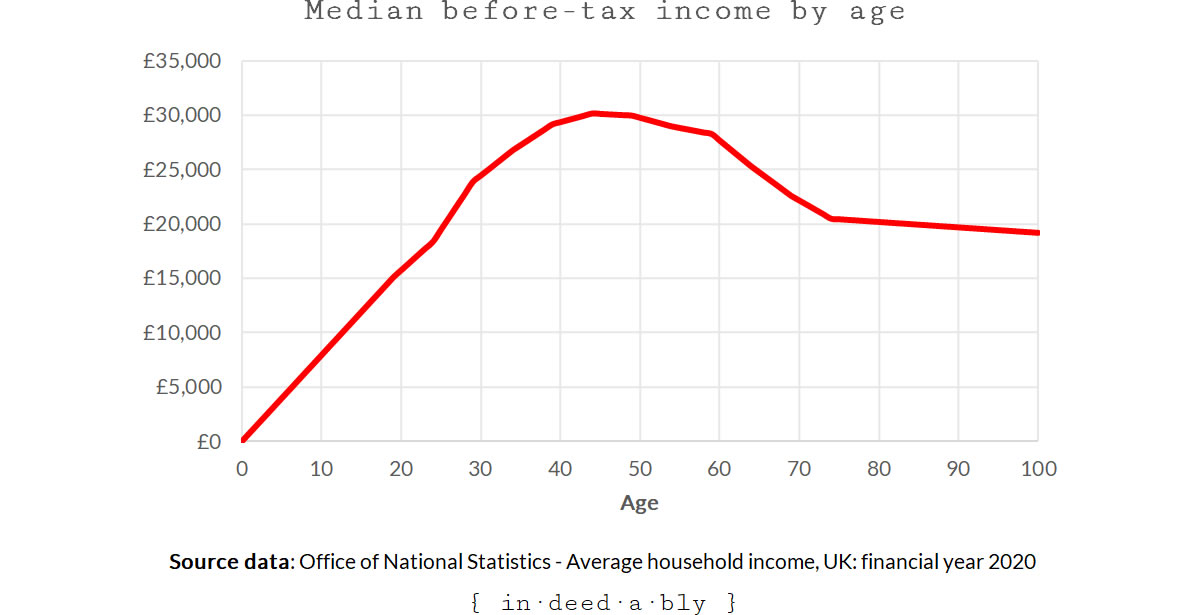

Our income-earning abilities usually take a little longer to develop, as illustrated by the United Kingdom median before-tax income by age.

Many of us emerge from childhood performing lowly paid jobs and laden with student debt.

As we gain experience, the marketable value of our skills rises throughout our 20s and 30s.

Eventually, our earning potential peaks. Our careers top out. We reach the limits of our competence.

From our 50s onwards, our earnings are more likely to decline than increase.

Age discrimination.

Changing priorities.

Family commitments.

Health issues.

Retirement, where pension income is often just a fraction of our former wages.

Wealth

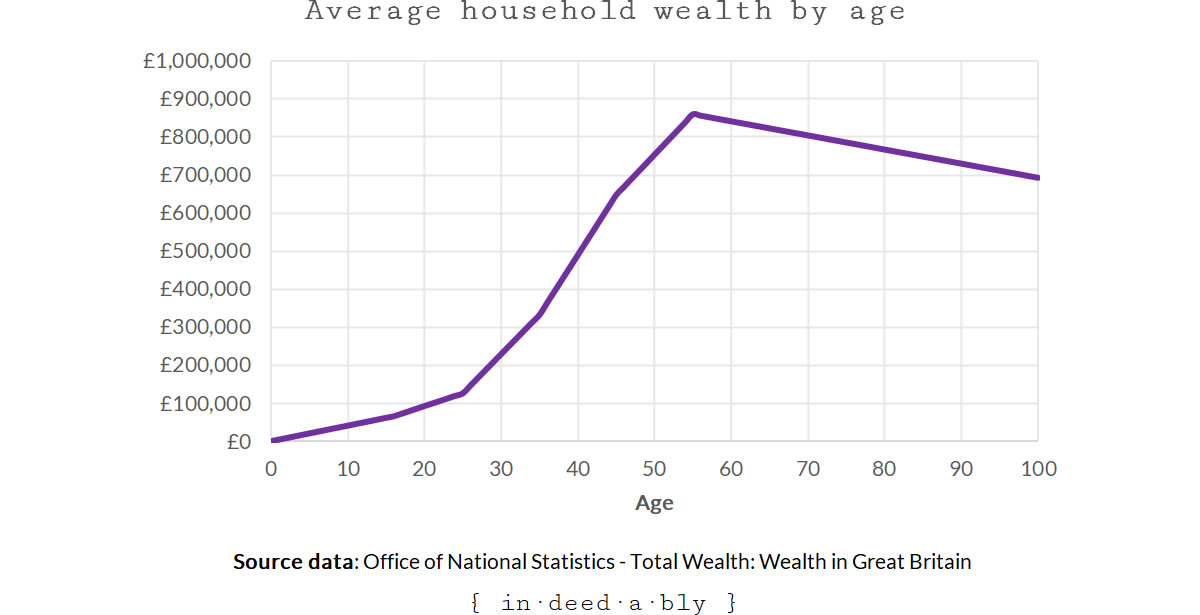

Later developing still is our net worth. This time the tale is told by average household wealth by age. The figures here are a bit more open to interpretation, as averages mask a multitude of individual stories, and the age is that of the “main” householder defined by responsibility, income, or longevity.

Wealth is one of those things that tends to sneak up on us later in life.

Good luck, good management, and the power of compounding combine to create a wealth-generating snowball effect. For a time, at least.

This aspect of our journey can feel painfully slow to get started.

Early in our careers, we earn little.

Consequently, much of our income is consumed by lifestyle costs.

What savings we do manage to squirrel away are also likely to be small. An inconvenient truth of low earning power, no matter how impressive our savings rate. Nobody ever saved their way to riches!

Over time our incomes increase. Yet as they do so, many of us will progress from being single to part of a couple, then starting a family. These major life events tend to result in major financial outgoings, for a time at least. Childcare costs. School fees. Mortgage payments. All tag-teaming to empty our wallets and slow our wealth generation.

Eventually, many of us will outgrow those expensive years.

Our mortgage (may) gradually be paid off, significantly reducing our living costs.

Our children grow up, and (may) leave home, reducing those costs even further.

Our workplace pension contributions (may) start to add up, becoming non-trivial in size.

The marketable value of our skills continues to rise as we gain experience and seniority.

Meanwhile, enough time has passed for the magic of compounding to start turning those small savings from the early days into something much more impressive.

Happiness

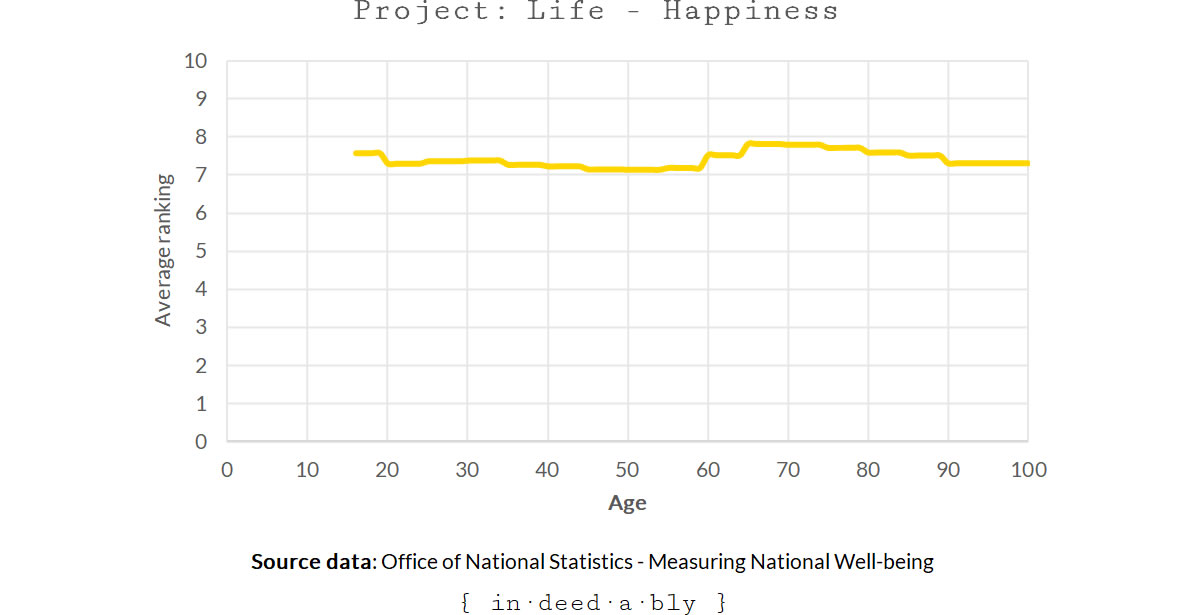

Happiness is a moving target. Ephemeral. Fleeting. Hard to quantify. We know it when we see it.

Research into happiness has reported some intriguing findings.

Starting from a relatively high point in our late teens, happiness declines throughout our adulthood, to a trough during our 40s and early 50s. Then an interesting thing happens. It starts to climb. Passing those teenage highs in our early 60s and continuing to new heights until the frailties of age start to clip our wings and compromise our abilities to do the things we enjoy.

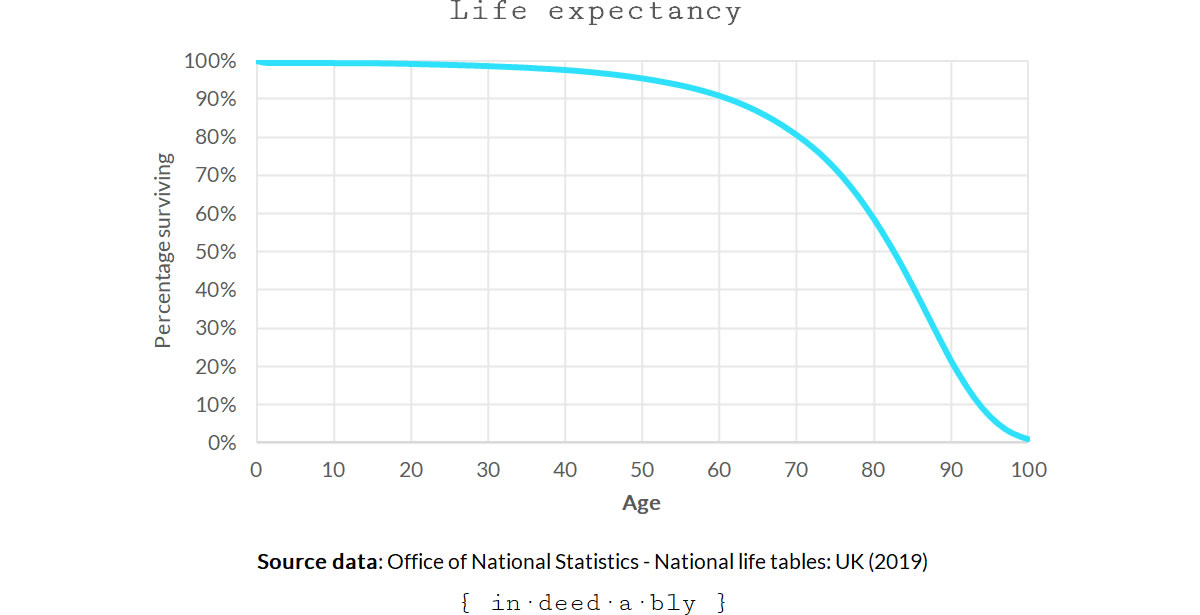

Life expectancy

So far we have looked at a host of different arcs. Interacting. Peaking over different time horizons.

A final arc worth considering is that of life expectancy. Happiness and wealth may peak later in life, but an ever-increasing proportion of us may not be around to reap the benefits.

Crimes against charts

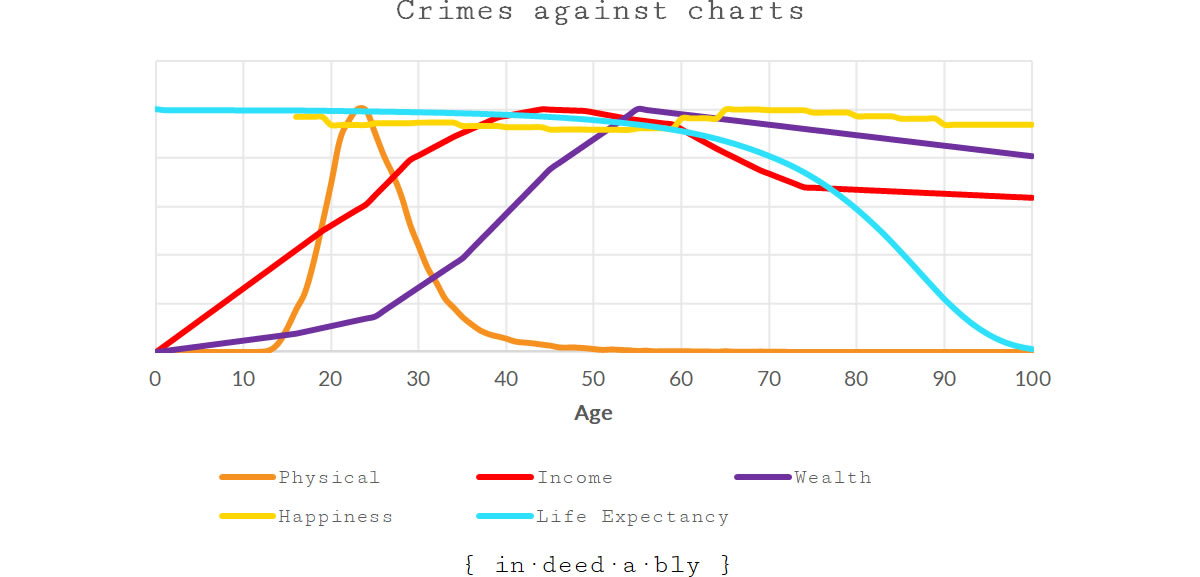

Now just for fun, let’s mash those charts together to see a single image of how those arcs overlap.

Comparing money to happiness survey results to life expectancies produces a serious crime against charts. Yet the resulting picture is fascinating in terms of where we may sit on each arc at a given age.

A person much wiser than I once said that the secret to happiness was maintaining low expectations. The result is regularly being pleasantly surprised on the upside, yet retaining a realistic outlook on life.

Successful project management involves adopting a similar approach.

Conducting a realistic assessment of what is possible versus what is pure fantasy.

Performing an honest appraisal of progress versus hope or self-delusion. Adapting plans or resetting expectations as required.

At the very beginning, developing an appreciation of where the real value can be found in terms of aligning activities to strategic outcomes. Ensuring effort is concentrated on those valuable activities. The alternative is focussing on tempting low-hanging fruit, quick wins, and shiny distractions that just aren’t going to get the job done.

Our financial plans could benefit from applying similar lessons. Including maintaining a grounded assessment of what is realistic at a given age, and what should be prioritised today as nothing lasts forever.

References

- Griffin, R. (2018), ‘120 years of Olympic history: athletes and results‘

- Office of National Statistics (2016), ‘Measuring National Well-being: At what age is Personal Well-being the highest?‘

- Office of National Statistics (2020), ‘Average household income, UK: financial year 2020‘

- Office of National Statistics (2020), ‘National life tables: UK‘

- Office of National Statistics (2020), ‘Total wealth in Great Britain: April 2016 to March 2018‘

GentlemansFamilyFinances 31 October 2021

Great post – it made me think a lot.

There’s a simplicity to what you’ve presented and for me personally, I feel that I’ve reached a personal finance milestone in the last year or so and was no motivated by it and now have what I would consider financial independence but haven’t chucked in the towel on the (WFH) 9-5.

Am I missing out? Am i happy in my own mediocrity? Or is this is – half way through my life with all the.things I needed to do (£££) done and all of the things that I want to still do laying ahead?

{in·deed·a·bly} 1 November 2021 — Post author

Congratulations on your financial achievements GFF, and thanks for the kind words.

I think what you have done is commendable, buying yourself sufficient control and financial cushion to enjoy the choice of how you invest your time. Our kids are only young once, and only actively wish to hang around with us for even less of that time. You have put yourself in a position to maximise that window, should you so choose.

The important thing now is to think about what comes next? Past achievements make for fond memories, but now the finances are conquered they will soon lose their appeal as a focus for our interests.

Fulltimefinance 1 November 2021

As someone who’s spent most of his career running projects I have to say ninety percent of the time the executive sets the date and basically tells you you have to hit the goal. Which means like you noted you can only adjust features or resources. Since most of the time in corporate you get a handful of useful resources and the rest don’t help, it’s features that get dropped if you are a good project manager and you realize you have to play the game to survive. It’s all about realizing minimal viable, for better or worse. In my personal life I’d never accept that…

{in·deed·a·bly} 1 November 2021 — Post author

Thanks FullTimeFinance.

You paint a familiar picture. “Minimal Viable Product” is a euphemism capable of masking a multitude of ills!

I think to some extent we all accept that approach in our personal lives. Seldom is anything perfect, little even approaches it. Instead we are a constant work in progress, tinkering with and improved as time, interest, and resources allow.

The early retirement end of the FIRE movement in particular involves a huge trade-off between good and “good enough“. Most early retirement plans involve a large element of minimal viable product in their lifestyle design. Thinking about it, they also involve arbitrary dates and a certain amount of aspirational decision making!

FullTimeFinance 1 November 2021

To some degree definitely. But in the corporate world I sometimes feel it’s closer to go to the casino and bet a pot on black. Your hapless project manager as an example. Perfect is the enemy of the good, but rushing things can lead to disaster as well. It’s all about the middle ground.

{in·deed·a·bly} 1 November 2021 — Post author

Absolutely. For the personal finance equivalent, we need look no further than cryptocurrencies and NFTs.

Fire And Wide 1 November 2021

Ha ha ha….how I don’t miss those kind of projects…..I remember MVP’s et al all so very clearly. Funnily enough one of my fav roles was playing the devil’s advocate ( aka business manager.. ). I took a lot of stick up front for insisting the IT crew stick to only delivering the basics. Not promising everything whizzy and shiny that the execs wanted purely to get funded – before inevitably introducing a ‘staged’ delivery. One to declare ‘success’ and then handing over to the much beleaguered business as usual team to actually make it work….

If curious, it ended up one of the most successful project ever in that department and gained a lot of kudos afterwards. Simply by setting reasonable/realistic expectations. Much like FIRE and early retirement indeed….

Love the graph mismash – now if you add one where you combine them you end up with about 5 years in the middle of truly golden years. Sobering or inspiring??

{in·deed·a·bly} 1 November 2021 — Post author

Thanks Michelle.

At least when you have the basics in place, you have something functional and that stands a fighting chance of succeeding! Well done on a successful delivery, that puts you are amongst the rare breed of project manager to go live and not end up with a BAU assigned hit squad stalking them forever more.

My take on the combined chart was a little different. Make sure we have fun while we are young, fit, and attractive… while also putting the foundation pieces in place for the wealth accumulation snowball later.

In the middle years concentrate on the marketable value of our skills, while keeping lifestyle inflation under control.

Then, providing we haven’t messed it up along the way, from around private pension accessibility age we should be free to enjoy 15-20 golden years before we starting slowing down and wearing out.

Which ironically enough is essentially the traditional life script many of us follow by default, albeit not consciously.

weenie 3 November 2021

The graph is somewhat skewed as I’d argue that some (most) of us don’t have the short fitness lifespans of Olympians or reach those dizzy heights! The up and down in fitness and strength is much more gradual for normal folk I suspect. For me, my peak would have been early to mid 30s (during my martial arts days) and then slowly starting to drop from early 40s. However, I work hard at the gym to stop it from being a cliff edge drop but am aware that there’s only so much I can do to stop the ravages of time, it’ll get me in the end!

But great overall post – although still with years to go on my journey, I’m at the tail end so need to start thinking more about what I want in my life.

{in·deed·a·bly} 3 November 2021 — Post author

Thanks Weenie.

The choice of Olympians was to illustrate that our physical capabilities diminish with age. Eventually our excuses become reasons! What was (potentially) possible when we were younger becomes physically impossible as we get older. That isn’t the same thing as whether we actually used that potential, but rather that the potential no longer remains a choice.

I’ll use myself as an example. At school I was ok at swimming, making representative teams and so on. Today, even with all the training and nutrition and performance enhancing drugs in the world, there is no way I could realistically achieve the same times I once did.

I agree that physical activity doesn’t magically stop at age 40. Indeed, most of the long distance runners I know hadn’t taken up running until they reached mid-life crisis age. They may achieve personal bests today, which is fantastic for them, but those times will always be slower than what they might have achieved had they been active runners at a much younger age.

David Andrews 5 November 2021

“The important thing now is to think about what comes next.” That’s absolutely the challenge once the financial imperative has been removed.

Right now I’m not sure what’s next so I continue to be afflicted by one more year syndrome. The financial numbers generally continue their upwards trajectory and mostly cease to be an everyday concern. Over the past month my modest investments have made a larger net return than renting out my “spare” property for the past year with none of the associated tenant based issues.

Most days I feel like walking away from my employer but I’m not sure what I’d be walking towards at this point.

{in·deed·a·bly} 5 November 2021 — Post author

Have you considered taking a trial retirement? A sabbatical or similar.

Long enough to escape that initial holiday mode feeling, and have a new sense normal routine emerge. Perhaps to discover if you would get bored. Maybe thrive on new social interactions, or become aware of any dependence you have on work based socialisation. Assess if having a lot more time with your partner helps or harms your relationship, when escaping to the office no longer provides a circuit breaker or acceptable excuse to be elsewhere.

Just a thought. Is the knowledge my seasonal semi-retirements provided me, which made future decisions well informed ones rather a leap of faith into the total unknown.

David Andrews 5 November 2021

Back in 2012 I had a trial retirement ( 6 month sabbatical ) as my partner got offered a job in Sydney. It was a bit of a wasted opportunity as I was generally tied to the local area and couldn’t travel to much as she was working. I also ended up getting a job after a couple of months.

However, there are much worse places to spend 6 summer months than Sydney and the Northern beaches (Manly specifically).

Presently I’m a bit restricted by the schooling demands of my 7 year old, not much travelling to be done between drop off an pick up times. That time restriction means that continuing to work a little longer makes logical sense.

{in·deed·a·bly} 5 November 2021 — Post author

Manly is a lovely spot to find yourself marooned for half a year!

That school observation is well made, will be your reality for another ~4 years before your kid may not need escorting to/from, and even after that you’re still somewhat restricted to outside term times for travel opportunities.

Which is a good thing in a way, as you wouldn’t then make the mistake many early retirees do by conflating holidays with retirement. Eventually holidays come to an end, and the retiree finds themselves at home alone on a rainy Tuesday morning watching unemployment television and struggling to remember why taking up day drinking is considered to be a bad thing!

BeardyBillionaireBloke 6 November 2021

Or the limits of what the company does with your competence … like putting you in a role a school-leaver could do.

That’s certainly ignoring one book about money and other subjects.

Matthew 6:19-21, Luke 16:11, 1 Peter 1:4

{in·deed·a·bly} 6 November 2021 — Post author

Thanks BeardyBillionaireBloke. Those limits could be internally exposed or externally applied. The latter being an arrangement with greater longevity I suspect!