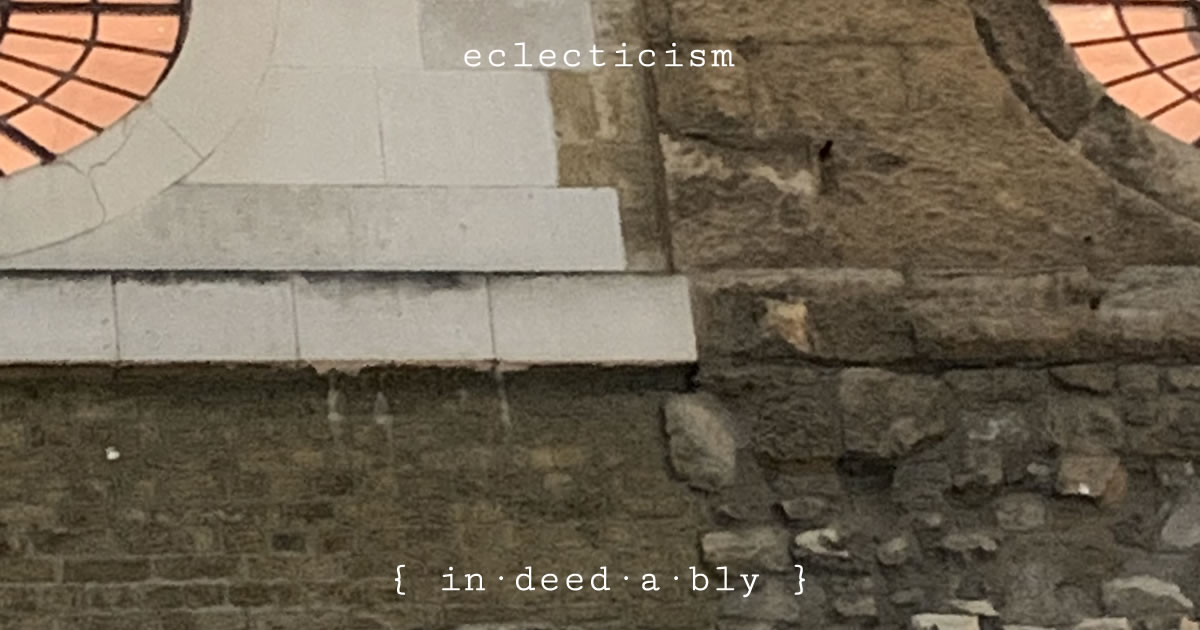

On my commute sits an old church. Once grand. Important. Impressive. Dominating its surroundings. Today, not so much. Located on a side street. Encircled by much taller buildings. Granted only briefest glimpses of sunlight each day.

A location only the keen would seek out, or the most ardent of explorers might stumble across.

The site had originally been a Roman temple. As with many aspects of popular culture, fads and fashions changed over time. Good parts co-opted, the rest conveniently forgotten. The names of the deities changed, as did the rituals for worshipping them, but the important dates and celebrations persisted. New narrative replacing the old. History is written by the storytellers.

Throughout my groundhog day like professional career, I must have walked past that church a thousand times without ever really seeing it.

Mornings spent grudgingly trudging past, resigned to selling off yet another day of my life performing well-remunerated yet meaningless tasks at organisations that benefit nobody but themselves.

The reverse course in the evenings always felt lighter, walking downhill with the weight of the world temporarily lifted from my shoulders. Attention span exhausted. Brain fried. Eternally busy yet rarely fulfilled. Grateful it was over, the furthest point in the day from lining up to do it all again tomorrow.

One day, for no particular reason, I happened to look up at the moment the sun slipped between two neighbouring buildings. For a brief moment, the side of the church was basked in sunlight.

I wish I could tell you that I witnessed a jaw-dropping illumination of a majestic stained glass window. Or experienced one of those Blues Brothers style “I have seen the light” transformational moments. Alas, that would be a lie.

No, what the sunlight illuminated from beneath decades worth of accumulated soot, grime, and pollution was a point where four distinct building styles from across the ages intersected in a single section of wall. A revealing exposé of changing times, methods, knowledge, fashion, and approach.

It was a stark reminder that nothing is forever. Over the centuries since the church was originally built, it had been extended, renovated, and repaired. Subjected to all manner of unexpected externalities. Ranging from dramatically unforeseen disasters, such as the Blitz and the Great Fire of London, to the mundane everyday events like burst water mains and careless construction crews.

Each event requiring adjustment and evolution. Accommodating change. Learning from past failures. Applying accumulated skills and experience to determine the best way to approach the problem.

In truth, the building resembled a living thing. A constant work in progress. Never fully complete.

Superficially impressive. Confident. Considered. The fruition of a well-executed plan.

Dig a little deeper however, and a different story emerges. The outward appearance is a façade.

A long history of compromise and rough edges. Ambitions inconsistent with financial realities.

Lots of activity driven by tactical short-term decision making.

Little evidence of strategic long term planning. The thinking required upfront, necessary to ensure all those little steps are heading in the right direction, helping to accomplish the ultimate goal.

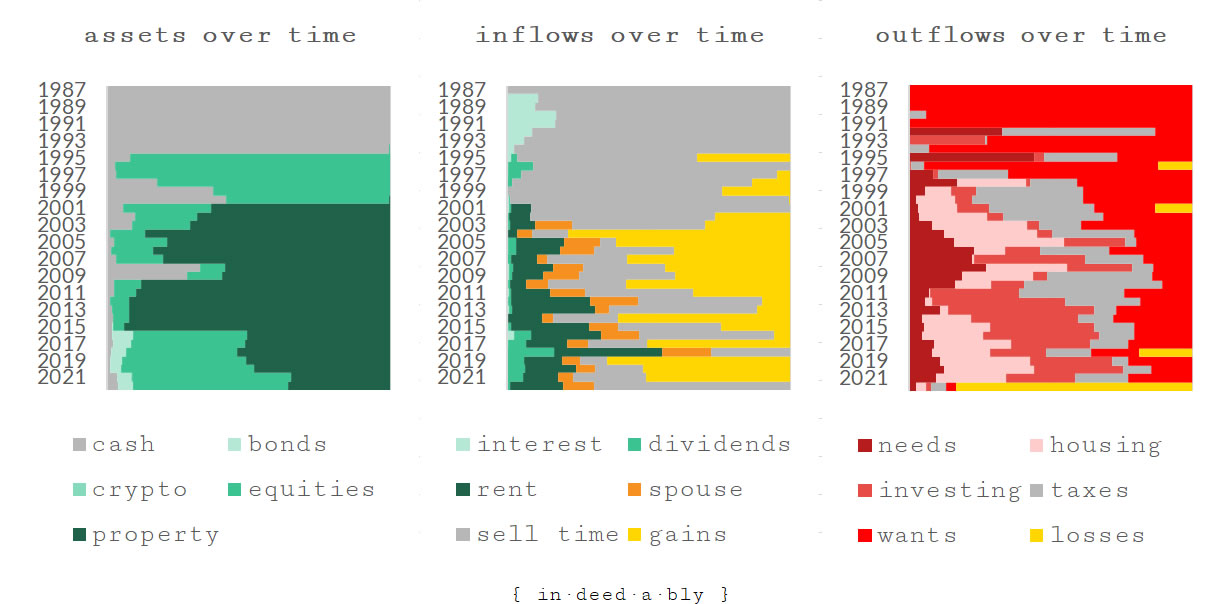

The segmented wall of the church wall resembled some charts I originally produced long ago. Displaying asset allocation, income source, or the drivers of change in wealth over time.

Telling mildly interesting stories when viewed in absolute numbers.

Illuminating when viewed as a sequence of evolutionary steps, displayed as proportions of the whole. Each segment forming bricks in a row. Each row representing a year in my life. Collectively building a wall charting my progress as investing horizons broadened. Knowledge grew. Appetites changed.

First all cash.

Then stock-picking individual shares.

Add some real estate. At first a little, later a lot.

Learning to evaluate risk versus reward. Effort versus outcome. Cashflow versus capital growth.

Understanding the difference between gambling and investing. Luck plays a part, but isn’t a plan.

Objectively evaluating what worked, and what did not. Turns out I’m not as smart as I thought I was!

Gradually drifting from active equity investments to passive index trackers. Losing the chance of hitting a home run. Gaining slow and steady relentless compounding. Reclaiming my time from the endless reading and research into the prospects of companies and sectors I had little interest in and no control over.

Adjusting strategy to the ever-changing rules of the game. Age and tax efficiency making pensions start to seem attractive. Tax and social policy reducing domestic real estate to an investment of dubious merit and uncertain outcome.

When viewed over a 20+ year time horizon, the effect was jarring. I would learn a little about something and get swept up in it. Over a few years, I would learn more and temper my enthusiasm. Eventually, my interests wandered and I would stumble onto the next shiny thing. Only for history to repeat. Difficult to observe while living it. Hard to refute when so dramatically illustrated.

Both the church wall and my charts created a patchwork effect. Reminding me of the hand-me-down charity store school trousers of my youth. Endlessly patched and repaired, as they endured the rough and tumble adventures of generations of free-range children climbing trees, crashing bikes, getting into fights, and playing contact sports. Resilient, yet suboptimal.

There is no perfect approach or one true path. Truth is, we all stumble along, making it up as we go. Sometimes we win. Sometimes we don’t. But while we remain open to new ideas, we are always learning.

Perhaps what we build will be fit for purpose and stand the test of time, as that patchwork church had done.

Perhaps it won’t. Demolished, then forgotten. As experienced by successive generations of buildings neighbouring the church.

One thing the charting exercise highlighted was the value in zooming out every now and again.

Casting a critical objective eye over where we find ourselves and how we came to be there.

How many of our actions today are taking us closer to achieving our goals of tomorrow?

Of those that aren’t, why are we doing them?

Those that make us happy or we derive value from may be understandable, suggesting a potential misalignment between actions and stated outcomes. Do we really want the goals that we say we do? Or were they things we had seen or heard about then copied, striving for other people’s goals because they sounded impressive or attractive?

Those behaviours that do neither are contrary to our interests. Counterproductive. Examples of us standing in our own way.

The exercise also highlighted the importance of validating that goals set long ago remain relevant.

Are our desires really unchanged?

Or have we stubbornly been constructing a monument to the past? Pride and ego demanding we continue along a journey towards a destination we no longer wish to go. A situation all too common amongst those racing towards early retirement, when all they really wanted was greater control over their time investment decisions.

As foolish as empty nesters buying trophy family homes long after their kids have grown up and moved out. Or the mid-life crisis sufferers purchasing little red sports cars, while their balding heads and expanding waistlines actively repel the sort of attention and envy that such trophy owners seek to inspire.

Producing a historical remnant not unlike the patchwork church.

Overshadowed. Ignored. Irrelevant. All but forgotten.

Nick @ TotalBalance.blog 21 March 2022

What the hell happened in 2021?! :-p

I like your stories – but I love your charts!

Also, what made you “switch” from 90% real estate to now ~50%? Just curious 🙂

I’m sensing a great disturbance in the force! What’s going on? 😛

{in·deed·a·bly} 21 March 2022 — Post author

Thanks Nick.

The second and third charts show where wealth came from and where it went. A gain meant I finished the year with more than I started. A loss was a loss. In 2021 somebody close to me needed the money far more than I did. Things are looking promising for them now, so with a bit of luck I should see the bulk of it returned later this year. If that happens, happy days. If not, then I’m comfortable that helping out was the right thing to do.

There were a few aspects to this. For many years I had played the long game, property investing with capital gains in mind. Providing a property was self financing, I didn’t worry too much about the cash flow aspects because my business more than covered my family’s lifestyle costs. Then a health scare and some introspection led to some questioning of priorities and re-evaluation of how I invested my time. One outcome of that was switching to my preferred semi-retired seasonal working pattern. Another was the recognition that if I wanted more control over my time, I needed more passive income cash flows to pay for it.

A second aspect was a change the UK government made to how they taxed private landlords. Once, the taxation basis was profits. After the change, it shifted to more of a turnover basis, meaning landlords potentially faced a tax bill while operating loss making properties in expensive markets with low rental yields. As ever, there were some potential loopholes around this, but the long term viability of any investment strategy dependent upon a loophole is questionable.

A third aspect was the grudging acceptance that I was unlikely to return to my homeland. After a couple of decades, “one more year” had been my mantra for so many years it had become a standing joke. With that recognition came questions about whether it made strategic sense to continue building my portfolio on the other side of the world.

Combine the three, and I have gradually unwound my direct exposure to real estate. Opportunistically selling some properties when the time was right. Shifting the proceeds into diversified equities. I do miss using other people’s money to increase my net worth, but am now at an age where lenders start asking uncomfortable questions about how I would pay them back before retirement.

John Smith 22 March 2022

I saw few wage-dependent workers, trapped in a 20-25 years work with the same company, but still 8-10 years until state pension (obsolesce). As Jacob Lund Fisker from ERE said it: specialization is for ants (not for humans). Patch-work means evolution, learning as our body/mind adapts to a changing world.

I enjoyed your assay, as always.

{in·deed·a·bly} 23 March 2022 — Post author

Thanks John Smith, wise words indeed.