A lazy Springtime Saturday morning.

Early morning sunshine crept over the rooftops. Illuminating the cat silently stalking sparrows amongst the random bunches of flowers that had mysteriously bloomed on the back lawn.

Inexplicably, she doesn’t kill the little birds when she catches one.

Instead, she gently carries them through the cat door, then releases them to fly freely around the inside of a house sized cage.

Convincing the birds to fly back outside again is harder than you may think. Seldom an ideal way to cap off a typically frustrating day at a client site, especially on a cold rainy evening!

Dualing screens at the breakfast table.

Younger son watching a Teen Titans Go cartoon. Fart jokes. Catchy songs with witty lyrics. Doing a surprisingly credible job of explaining the economics of becoming a private landlord.

Elder son watching some annoying YouTuber who publishes a seemingly endless stream of videos showing him playing computer games with his imaginary friends on the internet. Fart jokes. Begging for likes and subscribers. The influencer fallacy in action.

My screen displayed the week’s news from back home.

Bushfires forgotten.

Fear and attention seamlessly transitioning to the next crisis. This time a mystery virus from overseas.

A video of three fat women fighting over the last pack of toilet paper in a supermarket dominates the front pages. Barely a mention that the local women’s cricket team had made it to the World Cup final.

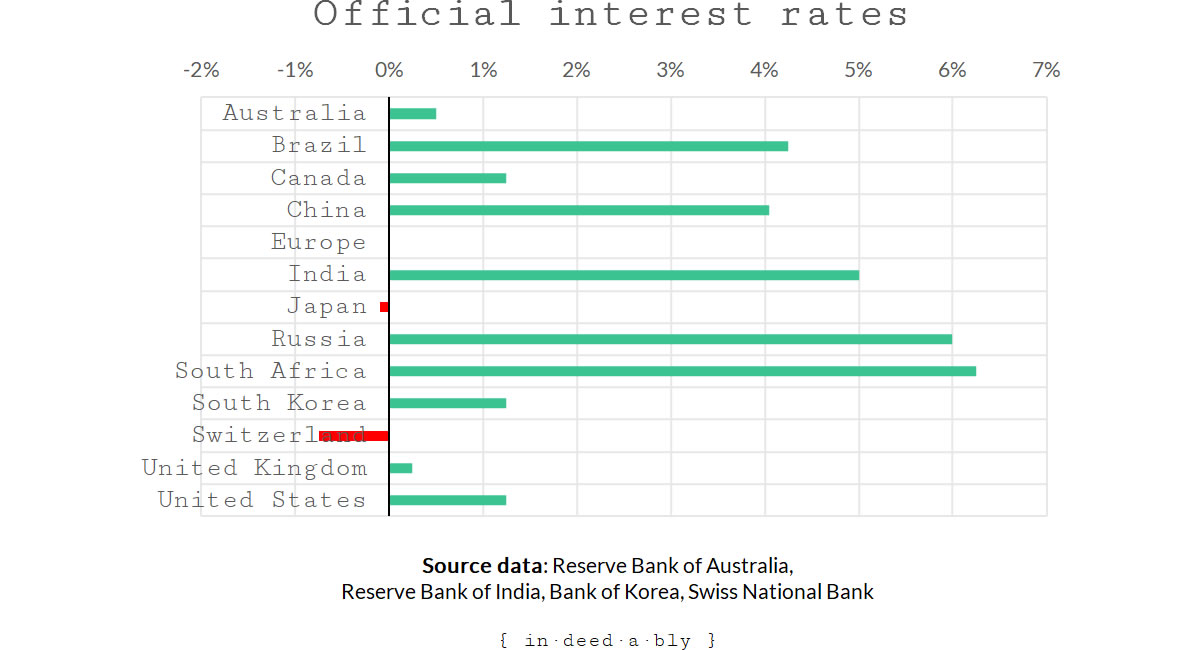

Local interest rates had been cut.

The excuse being one-off events like virus fears and bush fires. The reality, a stalled economy heading for its first recession in nearly 30 years. A remarkable run, especially given the many clown car governments and Game of Thrones leadership changes they’ve endured throughout.

Not to be outdone, the Americans followed suit by cutting their interest rates.

Their move defied logic. An apparent attempt to shore up the re-election prospects of a President who uses the Dow Jones Industrial Average as a proxy for his administration’s economic performance.

The United Kingdom’s rates are negligible.

Europe’s non-existent.

Japan’s negative.

Groundhog day

As predictable as the arrival of the daffodils is the Springtime resumption of hostilities about the merits of homeownership in a high cost of living neighbourhood versus living a semi-retired lifestyle while renting.

Two intractable forces of nature.

Inexorably coming together like speeding freight trains playing a game of chicken.

On the one hand, a fear of missing out and a desire to keep up with those troublesome Joneses.

On the other, reasoning that can be distilled down to: “just because we can, doesn’t mean we should”.

Sure enough, my lady wife appeared mid-morning. Battling a cold. Nursing a hangover after a girls night out that started with tequila on an empty stomach and ended with shopping spree in Selfridges.

A comment here.

One of her single friends is planning to downsize and move into the centre of town. Walking distance from work. Removing the need for a car.

The kids glanced uneasily at each other.

An observation there.

“Several new property listings have hit the market in our neighbourhood this week“.

Younger son rolled his eyes. The atmosphere in the family room noticeably chilled.

A warning shot across the bow.

“Interest rates are so low that borrowing is essentially free”.

This is true.

Elder son mouths “good luck” as he scooped up the iPads and bolted for the exit.

A ranging shot.

“Mortgage payments would be less than we currently pay in rent“.

This is partially true. The interest component of a mortgage payment would be less than our current rent.

Younger son scarpers upstairs after his brother.

Target acquired.

Another of her friends has just apparently completed their final renovation project. A guest cottage/teenager retreat. Credit where it is due, they have a beautiful home.

The cat poked her head through the cat flap, carrying yet another sparrow. Glanced at my lady wife. Froze. Glared at me. Dropped the bird inside, sprinted across the yard, and leapt over the back fence.

Engage.

“Why is it that all my friends have nice things, decorate their homes however they like, but I can’t?”

I mentally donned a helmet, hunkered down inside my foxhole, and kept my mouth firmly closed.

Incoming!

The disorientated sparrow lurched into the air.

The conversation paused as we watched it fly across the family room like a punch drunk boxer.

It emptied its bowels as it passed over my computer, before crash landing on top of the fridge.

Sigh. Some days I’m the seagull, some days I’m the statue.

Today it appears I am to be shat upon from a great height. Both literally and metaphorically.

Springtime has arrived once more.

Mission impossible

When it comes to owner-occupied real estate my lady wife knows exactly what she wants.

Essentially it is the house we currently rent.

Same size.

Same layout.

Same location.

There is just one problem: it isn’t for sale.

Selling up would see my landlord incur a capital gains tax bill in the region of half a million pounds. A problem she plans to leave to the beneficiaries of her will, along with their inheritance.

Nor are any of the handful of comparable houses in the neighbourhood for sale.

A few months ago we had a false start with one comparable property down the street.

Delusionally overpriced.

A seller who pined for the days before Brexit.

Before financing costs ceased being tax-deductible.

Before stamp duty surcharges for owners of multiple properties.

Before the once “outstanding” rated local school toppled from its pedestal.

A machiavellian buyer played them at their own game. Outbidding everyone else to clear the board. Dragging out the conveyancing process while the seller mentally spent the proceeds. Then gazundering them, repeatedly, once the seller had financially committed themselves elsewhere.

According to the land registry, the eventual sale price was £50,000 less than houses on the street were selling for five years ago.

Prison of my own making

As appears to have established itself as an annual tradition, Springtime finds me challenging some of my premises and preconceived ideas.

Validating whether or not my preferences make sense.

Can my beliefs withstand rigorous scrutiny?

Am I fighting the last war? Dated and irrelevant.

Or worse, a religious war? Ill-informed and misguided.

I am very conscious that many of us are trapped in prisons of our own making. Myself included.

Biases, past choices, and preferences blind us to opportunities and blinker us to potential options.

Setting aside my lady wife’s very prescriptive wants, I decided to test my own thoughts on property.

What assumptions and conditions have I constructed my prison from? Do they still hold true?

Marriage

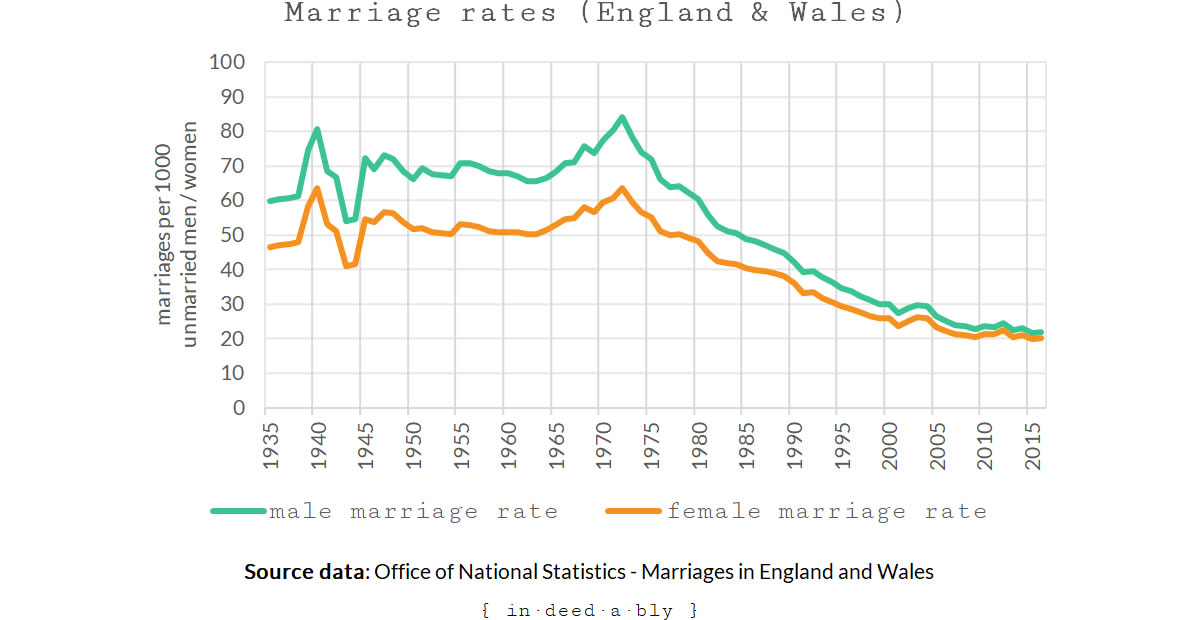

Marriage is an interesting nexus of life choices, legal protections, and unanticipated consequences.

An institution in decline.

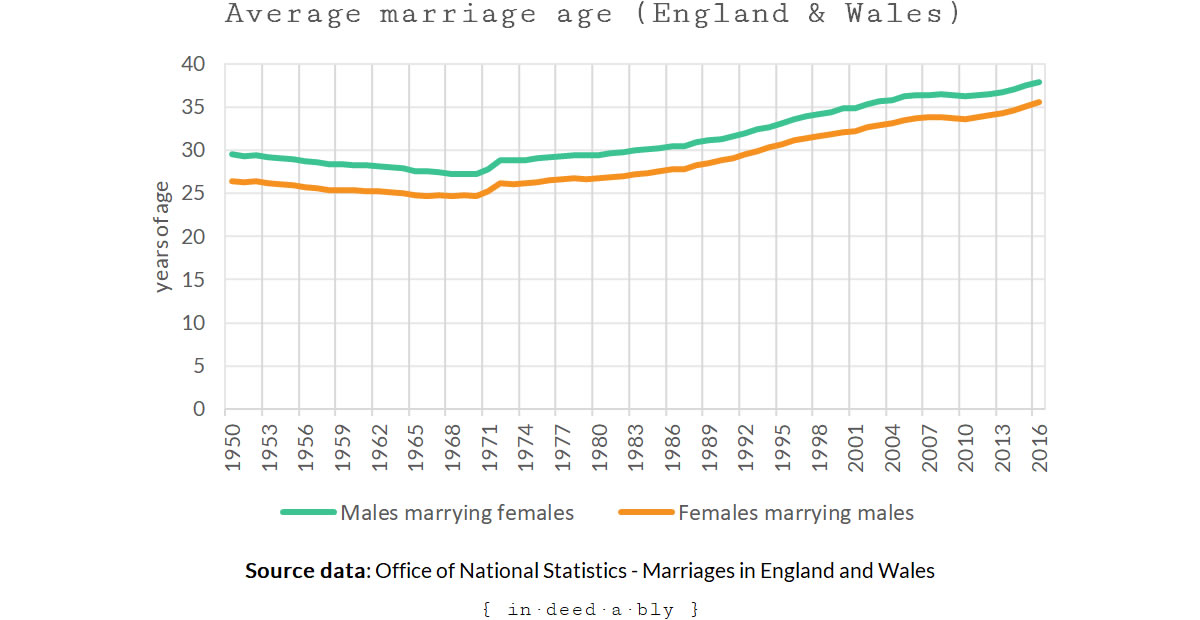

Fewer people are getting married.

When they do, it is at an older age.

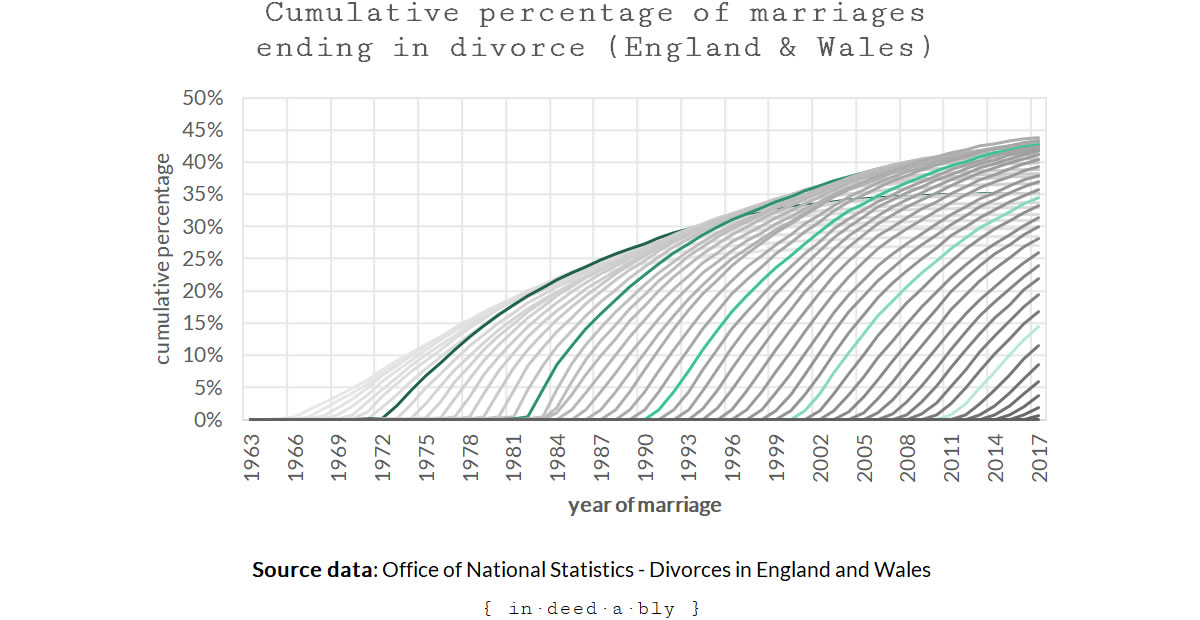

Once married, nearly half of them fail.

For those folks, marriage proves to be one of the most costly financial decisions a person can make.

As I’ve gotten older I’ve observed that the things that people want, and those make them happy, change. Some relationships evolve along with these changing hopes and desires. Many do not.

Add a bit of “life happens” randomness and things can become interesting.

Some couples grow apart, heading in different directions. Other times one partner outgrows the other.

Some remain unhappily ever after. Afraid of being alone. Financially constrained. For the kids.

A fortunate few grow closer the longer they are together. These are a rare breed if my peer group is anything to go by!

My first working assumption is that I wish to stay married and remain cohabitating with my family.

This assumption imposes some constraints.

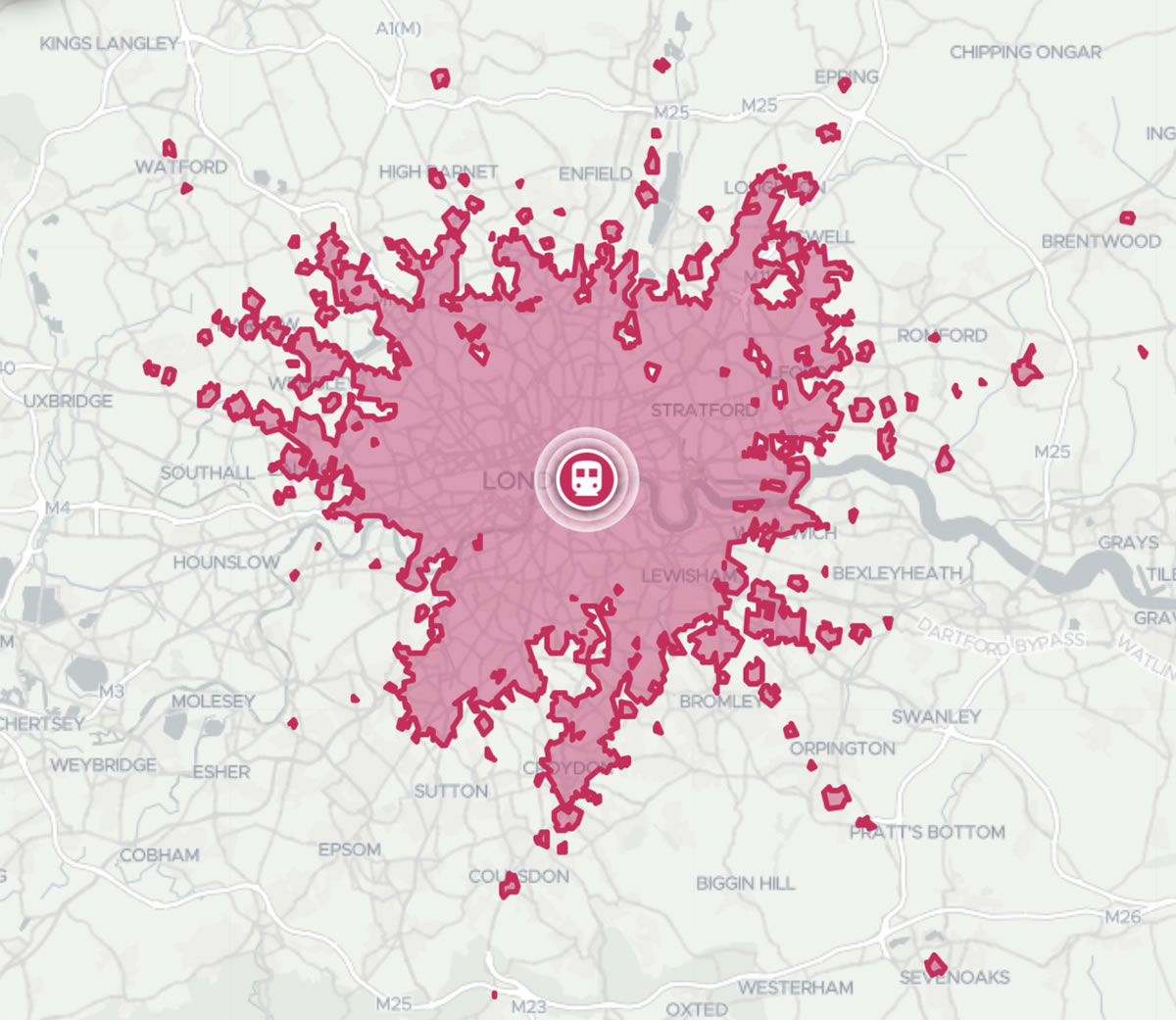

A whole world of potential property options shrinks considerably, limited to London.

Any owner-occupied home purchase would need to be a house, not an apartment.

That house would require at least 4 bedrooms, 2 bathrooms, and some outside space.

While these constraints are onerous, they are also non-negotiable. The price of assumption #1.

They have been thoroughly probed and tested. Proving resolute and immovable. I have the scars to prove it.

Commute

The second working assumption is what constitutes a reasonable commute.

I am unwilling to regularly endure a daily door-to-door commute of longer than 45 minutes, each way.

Life is too short.

Commuting is lost time. Non-billable. Seldom doing the things I enjoy. Time away from my kids.

My clients are generally based in the City. Therefore my commuting circle is centred on Bank station.

Schools

The third working assumption is that my children will complete their secondary school education at the high school my elder son currently attends.

I have some issues with the school’s priorities, but there is no arguing with their track record of students receiving offers to excellent universities. By way of comparison, many of the other state high schools in my part of the world do not provide a viable pathway to any university at all.

Another key factor here is that my son actually enjoys going to school.

He has made friends with a nice bunch of kids who seem to compete with one another to be the best academically. Getting into the school was an expensive sunk cost, so it is great to see him making the most of the opportunity.

Commuting is no more fun for him than me, so I drew another commuting circle on the map centred on the high school.

The result was a Venn diagram that looked like it had been drawn by a sugared-up toddler suffering from early-onset Parkinson’s disease. The overlapping segments defined the boundaries of the universe of candidate properties that meet all three working assumptions.

Money

According to the past sale statistics, the average sale price for an appropriately sized house within that universe was… a lot.

Large enough that anything but the top prize in this week’s Lotto draw simply wouldn’t get the job done.

A sum that if invested, the natural yield would comfortably out-earn the nation’s median household disposable income.

2.5x the price of a beachfront house where I would live, were I to return to Australia.

2x the price of a comparable house with ocean views in a nice part of Cornwall.

1.5x the price of a well-located apartment by the sea in the South of France.

An amount slightly smaller than the Gross Domestic Product of the Federated States of Micronesia.

Prevarication aside, that average sale price achieved in the last 12 months was also larger than the properties in my neighbourhood have been selling for. Which doesn’t make them cheap by any measure, but it could certainly be worse.

If the Coronavirus mortality rate projections amongst the elderly prove to be even slightly accurate, then over the next few months there will be quite a few properties in my neighbourhood hitting the market. Their current occupants will unfortunately no longer need them.

If the mooted tax penalties for non-resident buyers prove to be more than an exploratory test balloon, then the competition for those properties will be greatly reduced.

If the approaching economic storms that are visible on the horizon end up being as turbulent as they appear, then the herd of potential buyers may thin out considerably.

That said, if wishing made things so then my lady wife would already own a beautiful house the envy of her friends, and I would be living by the ocean somewhere sunny and warm.

Balance

Which brings me to my fourth working assumption, that I wish to remain semi-retired.

Trading a sizeable sum of investments for a paid-off house appeals to my lady wife. Depending on the purchase price, it would potentially also be a cash flow positive move.

Indeed, the historically low interest rates potentially provide the ability to get the best of both worlds. Leverage is always a risk, but a calculated one.

Financially at least, this decision should be a no brainer.

And yet I hesitate.

Freedom

Eventually, my lady wife grew frustrated and stormed back to her eyrie in the loft.

I opened wide the skylights in the family room, hoping the fearful sparrow would return outdoors.

Experience has taught me to give plenty of time and space, it is best not to rush these things. Rushing doesn’t achieve the desired outcome any faster, yet inevitably stresses out all the participants.

While I waited, I pondered why I was gun shy about buying an owner-occupied house.

It wasn’t a religious objection. On several occasions I have purchased a home to live in. We just haven’t tended to live in them for very long.

It wasn’t the money, silly though the numbers most certainly are. My existing property portfolio is worth more in aggregate than the asking price for a typical house that ticks my assumption boxes.

In part, I am wary of the endless renovation and redecorating projects that would undoubtedly follow.

In part, I fear being trapped in a prison of my own making, turning into an old man living in London.

My inner saboteur believes that buying a home intended to house my children through to the end of their childhoods would be conceding that my dream of living by the ocean was just that. A dream.

It may be right.

The sparrow finally emerged from above the fridge. After glancing furtively around for the cat, it took flight and escaped through the skylight to freedom outside.

That gave me pause. Why the recurring theme of incarceration?

Connotations of deprivation of liberty.

Absence of choice.

Denial of freedom.

Lack of control.

All things that are done to a person. Yet always as a consequence of their own actions and choices.

Food for thought. We are each only as trapped as we choose to be.

References

- Bank of Korea (2020), ‘Base Rate‘

- O’Brien, G. (2019), ’27 years and counting since Australia’s last recession’, Parliament of Australia

- Office of National Statistics (2020), ‘Average household income, UK: financial year ending 2019‘

- Office of National Statistics (2019), ‘Divorces in England and Wales: 2018‘

- Office of National Statistics (2019), ‘Marriages in England and Wales: 2016‘

- Reserve Bank of India (2020), ‘Bank Rate‘

- Swiss National Bank (2020), ‘Current interest rates and exchange rates‘

- The Economist (2017), ‘How Australia broke the record for economic growth‘

- Travel Time Platform (2020), ‘Travel Time Platform‘

- Whitbourn, M., Fitzsimmons, C. and Drevikovsky, J. (2020), ‘”It’s not Mad Max”: Fight in Sydney Woolworths as tensions flare over toilet paper’, Sydney Morning Herald

- Zoopla (2020), ‘Property value data/graphs‘

Mr. RIP 11 March 2020

I feel your pain, sparrow brother.

Exerting freedom is becoming increasingly more difficult. Maybe it’s age? Commitments? The realization that freedom is hard and it guarantees no happiness? Are dreams better in picture than reality? Better to stick with herd behavior? Desire to be liked, and not alone? But what about future regrets? One day everything will be clear in hindsight, sadly too late to act upon it.

A virtual hug.

{in·deed·a·bly} 11 March 2020 — Post author

Thanks Mr RIP, much appreciated.

This morning the Bank of England announced they were slashing interest rates by another half a percent, making the official rate 0.25%.

Meanwhile, the flights to my Easter beach holiday have been cancelled.

It’s a conspiracy!

The rational part of my brain needs to punch my inner saboteur in the face and go buy a house while the financing is free.

Mr. RIP 11 March 2020

Don’t give for granted that “it’s rational to buy a house”.

If interest rates raise again, house pricing could drop by a lot. Housing market, especially in large cities, is an efficient market. No free lunch.

Buying a house is by no means a “no-brainer”. It’s always a personal/family decision.

{in·deed·a·bly} 11 March 2020 — Post author

You’re absolutely correct.

There are a few inescapable facts to consider.

We need to live somewhere, whether we continue to rent or decide to buy.

That somewhere is more likely than not in London, for the next 11 years or so. Unless the bottom falls out of the UK job market because of Brexit, which is possible, but I suspect it will be a measured and relative decline by being left behind rather than a more dramatic falling off a cliff.

If mortgage rates fall in line with the official bank rate then the difference on cash flows would be material. My winter working hibernations could become less frequent, nearing the point of being optional.

When rates do rise, I have the means to pay off the mortgage entirely. In this case the borrowing represents an arbitrage opportunity, borrowing “free” money so that I can leave my capital invested in higher returning assets elsewhere.

The rational part of my brain makes a strong argument. Of course the downside would be my lady wife would be well within her rights to do the “I told you so” dance!

Nick @ TotalBalance.blog 11 March 2020

I feel your pain, mate!

Since you’re older and more experienced than I am, I might not be in a position to give you marital advice. I can however relay a message that I once received from a realtor, back when we were house-hunting (I was looking at this particular property alone): “Unless you’re aiming for a divorce, you’ll let your wife pick the house you’re going to live in”

Of course I know that he said this because women are more prone to make decisions with their emotions, where as men (like yourself) tend to gravitate towards using logic to make the decisions (I say this knowing the risk of being flamed by your female followers…).

This is why we now live in a very non-FIRE friendly old (done-up) house in one of the more expensive areas of the country….(because I wasn’t aiming for a divorce :P).

I (we) didn’t discover the concept of FIRE until about 1 year after we moved in to this house. We’ve since talked about leaving it in favor of a more FIRE-friendly option. However, recently we’ve both come to accept the sacrifices (in terms of FIRE) that we are making, by living in this house. We both like to live there, and the cost of selling/buying/moving would take years to recover, even if we moved into a half that was half the price of our current one. So it did feel a bit like a prison to begin with, but now it feels more like home (and that is a feeling that you can’t really put a price-tag on) 🙂

It might be a bit presumptuous of me, but if I were to make a prediction about your current predicament, it would be that you’re gonna end up buying that house (that you wife wants), and you’re also gonna end up over-paying (we did).

But that’s OK, because you know just as well as I do that a Happy Wife = Happy Life 😉

There’s a trend growing here in Denmark, where people have started to take 30-year interest-only mortgages in their houses, once they reach an LTV of 60%. I don’t know whether that’s an option in the UK, but at these interest rates it doesn’t seem like that crazy of an idea.

I was brought up with the notion that you should make yourself debt free as fast as possible, so that has always been my goal. But I’ve now come to realize that it doesn’t make sense to not have debt (low-interest mortgage) in the current economical environment. Yes, it’s a question of risk tolerance, but I honestly can’t imagine the interest to ever return to former levels (but perhaps I’m crazy to think that). The way the banks are printing money, it was inevitable that credit was eventually gonna become (essentially) free. I still hold onto my gold though! Just in case 😛

But as you say yourself – as long as you hold somewhat liquid assets to become mortgage neutral, the risk of higher interest rates is limited to the risk of decreases real estate prices. Which is always a risk regardsless…

{in·deed·a·bly} 11 March 2020 — Post author

Thanks Nick, it is almost as if you can see into my future!

The Rhino 11 March 2020

Rousseau had it about right, “Man is born free and everywhere is in chains.”

There are a lot of damaging social narratives out there, if you’re UK based, most of them emanate in London and disperse outward, lessening as they go. Worth bearing in mind.

All things considered, I’d buy the house and be done with it.

Thanks for the schadenfreude, its cheered me up

{in·deed·a·bly} 11 March 2020 — Post author

Thanks Rhino (I think), happy to be have been of service.

SG 13 March 2020

I will resist the temptation to suggest a course of action other than to imagine yourself in your ideal scenario, completely happy with everything you want (not what your family wants but what you want for your family).

Work backwards asking why several times, see what you find and think about how you can get there….

Thanks for the blog posts.

{in·deed·a·bly} 13 March 2020 — Post author

Thanks SG. Your approach is sound, the breaking of a seemingly insurmountable large problem down into a series of manageable smaller ones is an approach I use often.

There are many options. Some more palatable than others. All with consequences attached.

andyB 17 March 2020

I echo SG – work backwards from the ideal and work out why are you not there already. once you’ve bought you won’t have the maddening issues of ‘do I buy now’ aka market timing from equity

A last point (having hired buyer’s agents in multiple cities and countries and not been able to convince myself to buy for a myriad of reasons) – is that if all imputed rent and capital gains are tax free; and it’s the lowest risk investment you can make (and incidentally creates a very cheap borrowing source)

p.s. I live in Australia (having worked in UK for a long time) and can say that if you were looking for a house in Melb or Syd by the ocean, that wherever you are looking must be incredibly expensive, because most truely decent places (i.e. wife acceptance factor) are around $4-6m in Melb and $5-8m in Syd… Ok the AUD has dropped below 2 again, but you must be looking in deepest Surrey or Chelsea for that…

{in·deed·a·bly} 17 March 2020 — Post author

Thanks AndyB. Valid points all.

You’ve made an assumption there that has led you to an much larger number than is actually the case: that the place I’d live in Australia would be beach front Sydney or Melbourne. Rose Bay or St Kilda would indeed be lovely places to live, but my aspirations are far more modest. The “wife acceptance factor” (I like that phrase) would also make them either a solo endeavour or a pipe dream.

Divide those prices in half and you would be much closer to the mark!

Andyb 17 March 2020

I can’t claim any originality. I think I read it from a stereo magazine talking about the size of loudspeakers that would be acceptable in the house… perhaps it wouldn’t just be your wife who would find things to put on the walls and make the house a home…?! 🙂

Bernie 2 June 2020

I have spent some time reading through all your blog posts. It has been thoroughly enjoyable. This one was probably the most poignant for me. The realisation that a lot of pressure and stress I experience is self inflicted, my own worry about what I feel is expected of me. Liberating to recognise!

Thank you for your excellent writing. Your thoughts and analysis are insightful.

{in·deed·a·bly} 2 June 2020 — Post author

Thanks for the kind words Bernie. Glad you have found some enjoyment in my ramblings.